- IBIT saw record volume as the price of BTC fell.

- However, BTC saw record volume of over $100 billion.

The cryptocurrency market, including Bitcoin [BTC]has recently experienced a significant downturn, culminating in a sharp decline on August 5.

Despite this widespread market pullback, there was an intriguing contrast in the activity seen in the Blackrock Bitcoin ETF, which recorded one of the highest daily trading volumes on the same day.

Blackrock records record volume

The recent trading data of Mint glass indicates a notable increase in volume activity.

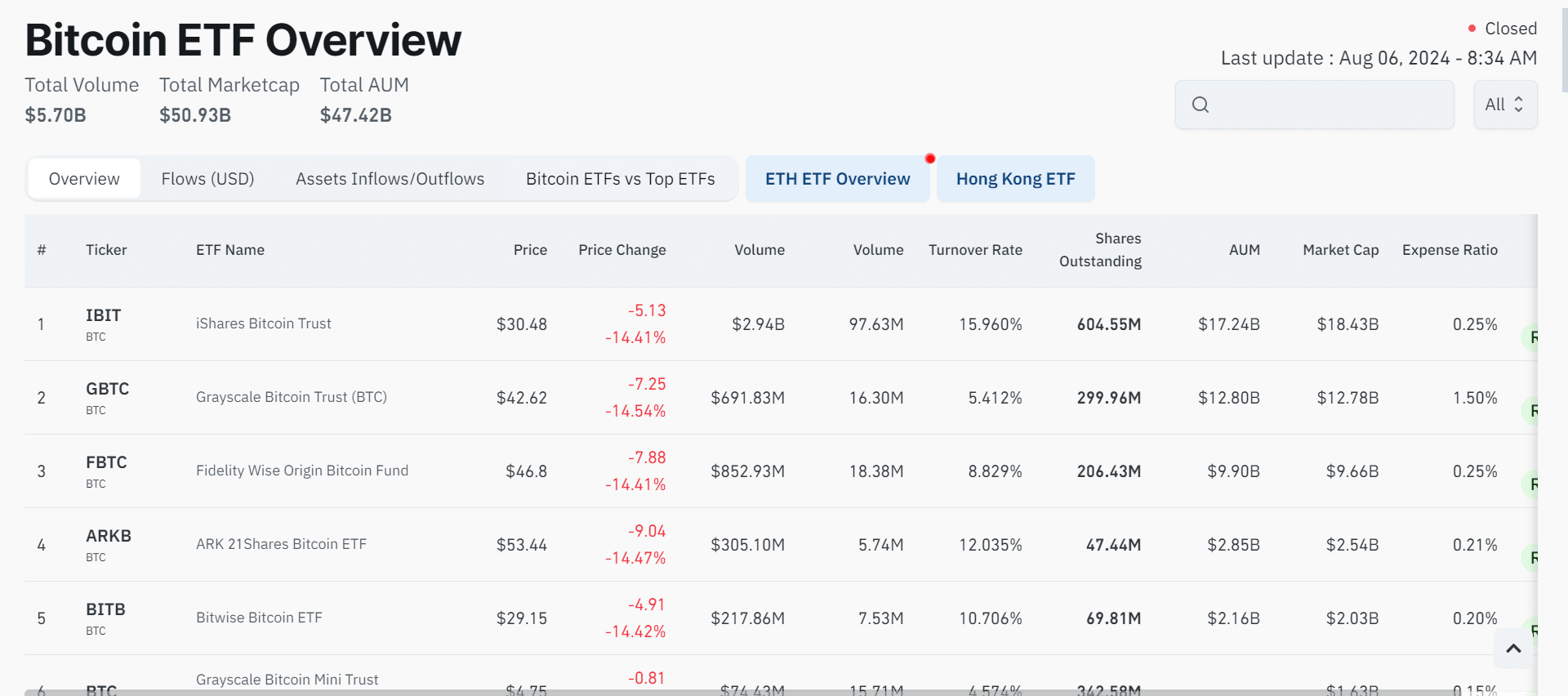

The BlackRock Bitcoin ETF (IBIT) recorded the highest volume on August 5. Analysis showed that this ETF’s trading volume soared throughout the day.

It started with an impressive $1.5 billion in the early trading hours and ended the day at almost $3 billion. This level of activity was significantly higher than any other ETF in the same category.

Source: Coinglass

This increase in trading volume during a broader market downturn is particularly notable. It suggests that while the overall cryptocurrency market was declining, many investors were actively involved in the BlackRock Bitcoin ETF.

This could indicate a range of strategic behaviors among investors. Some may have seen the recession as a buying opportunity, buying more shares at a lower price in anticipation of future gains.

Conversely, others might have sold their holdings to minimize losses amid falling prices.

Additionally, the exceptional volume in the ETF could reflect a broader shift in investor sentiment or strategy. Especially during heightened market volatility and uncertainty, investors often look for what they consider safer or more stable investment options.

Bitcoin regains consciousness amid BlackRock volume

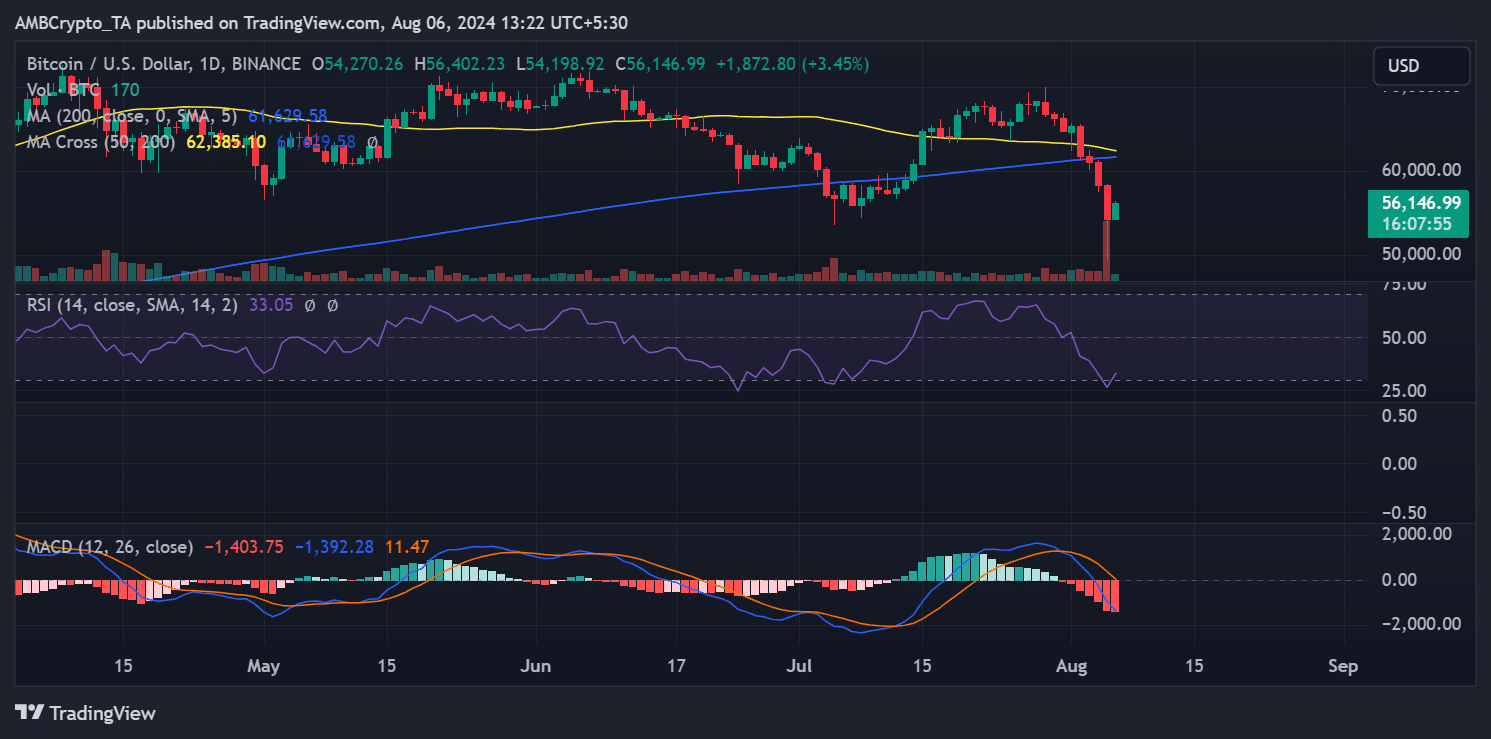

The recent analysis of Bitcoin’s price movements revealed a contrasting scenario. Despite a spike in trading volumes for the BlackRock Bitcoin ETF, BTC faced significant price struggles.

According to AMBCrypto’s analysis on a daily timeframe chart, the price of BTC experienced a sharp decline, reaching a low of $49,360.

Although the price recovered somewhat towards the end of the session, the price closed at around $54,274 – down from an opening price above $58,000, representing an overall drop of over 6%.

Source: TradingView

This decline pushed Bitcoin’s Relative Strength Index (RSI) further into oversold territory and below the critical threshold of 30.

Currently, Bitcoin is showing signs of a modest recovery, reaching over $56,000 and up over 3%. Accordingly, the RSI has improved slightly, to just above 30.

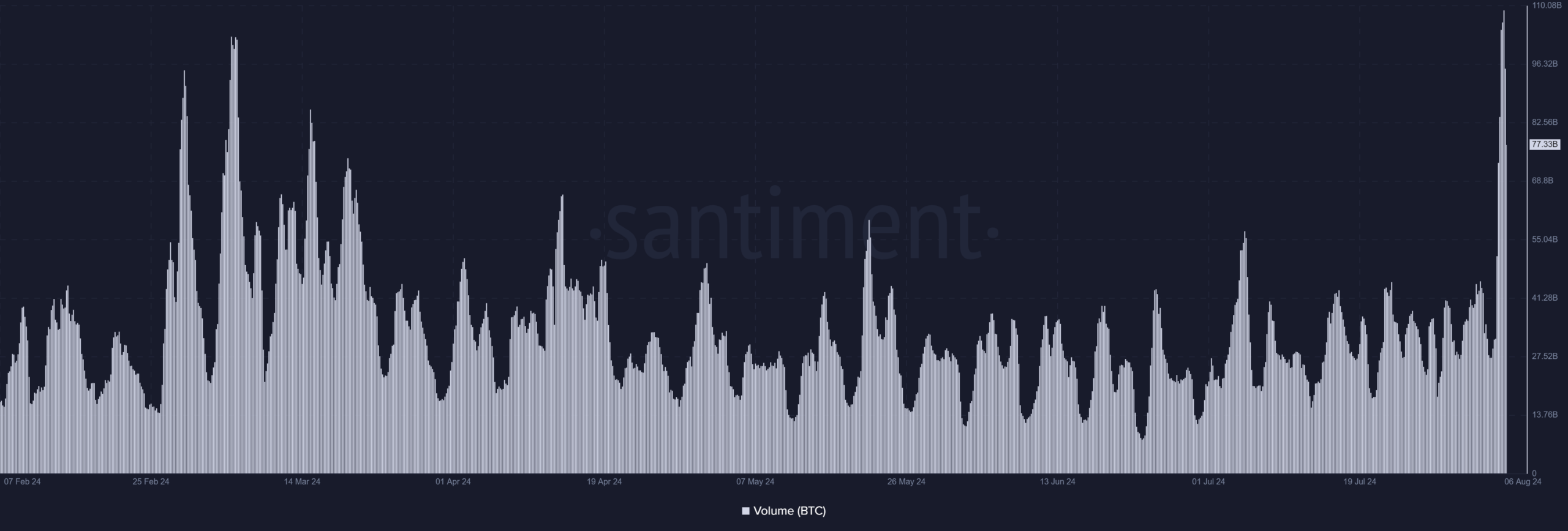

BTC itself is seeing a volume spike

Analysis of Bitcoin volume showed that, like BlackRock, it had its own peak. Santiment data showed a significant increase, with volumes reaching over $104 billion on August 5.

Source: Santiment

Is your portfolio green? Check the Bitcoin Profit Calculator

This spike in trading volume is particularly notable as it marks the first time the $100 billion threshold has been exceeded in more than five months.

The last example of such high volume was recorded on March 6, when it briefly reached $102 billion.