- The CVD showed that shorts outperformed longs, but could be great for the price.

- Declining Open Interest at this time and high volatility indicated caution.

Bitcoins [BTC] The jump from $60,731 to $63,049 has not deterred traders from opening short contracts, AMBCrypto confirmed. But historically, a large number of short positions could be good for BTC’s price.

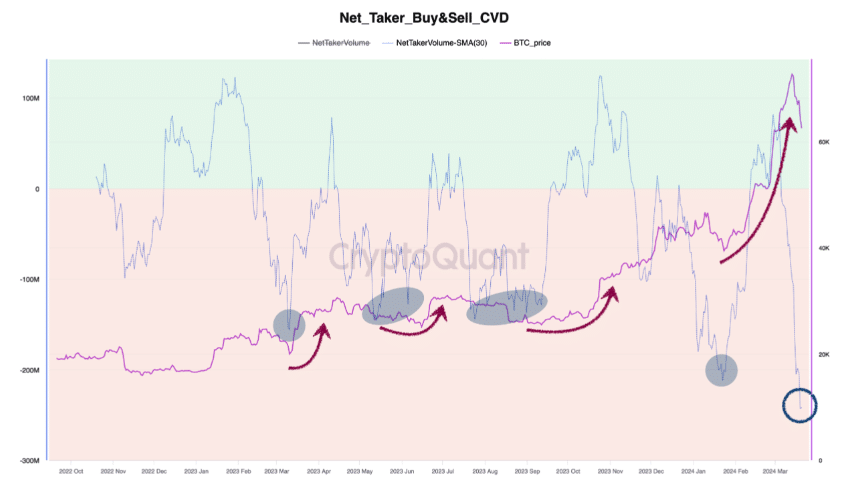

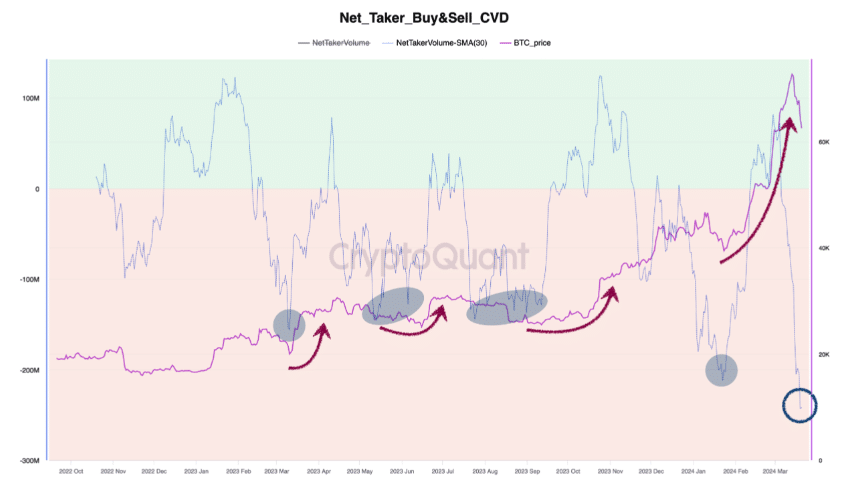

SignalQuant, an on-chain analyst, also joined our view. The analyst had Posted his thoughts on the matter on CryptoQuant. From the post, SignalQuant considered the Taker Buy/Sell Cumulative Volume Delta (CVD).

One says it’s recovery time

Unlike the spot CVD, the Taker Buy/Sell CVD follows activity on the derivatives market. For those unfamiliar, it shows the difference between long and short positions.

The green area (as shown below) indicates that the shorts have long been exceeded. But at the time of writing, the metric was in the reading range, indicating that shorts were dominant.

Source: CryptoQuant

The author concluded the analysis by noting that:

“However, the historical pattern shows that after a period of dominant market shortfalls, Bitcoin price moves sideways or recovers sharply.”

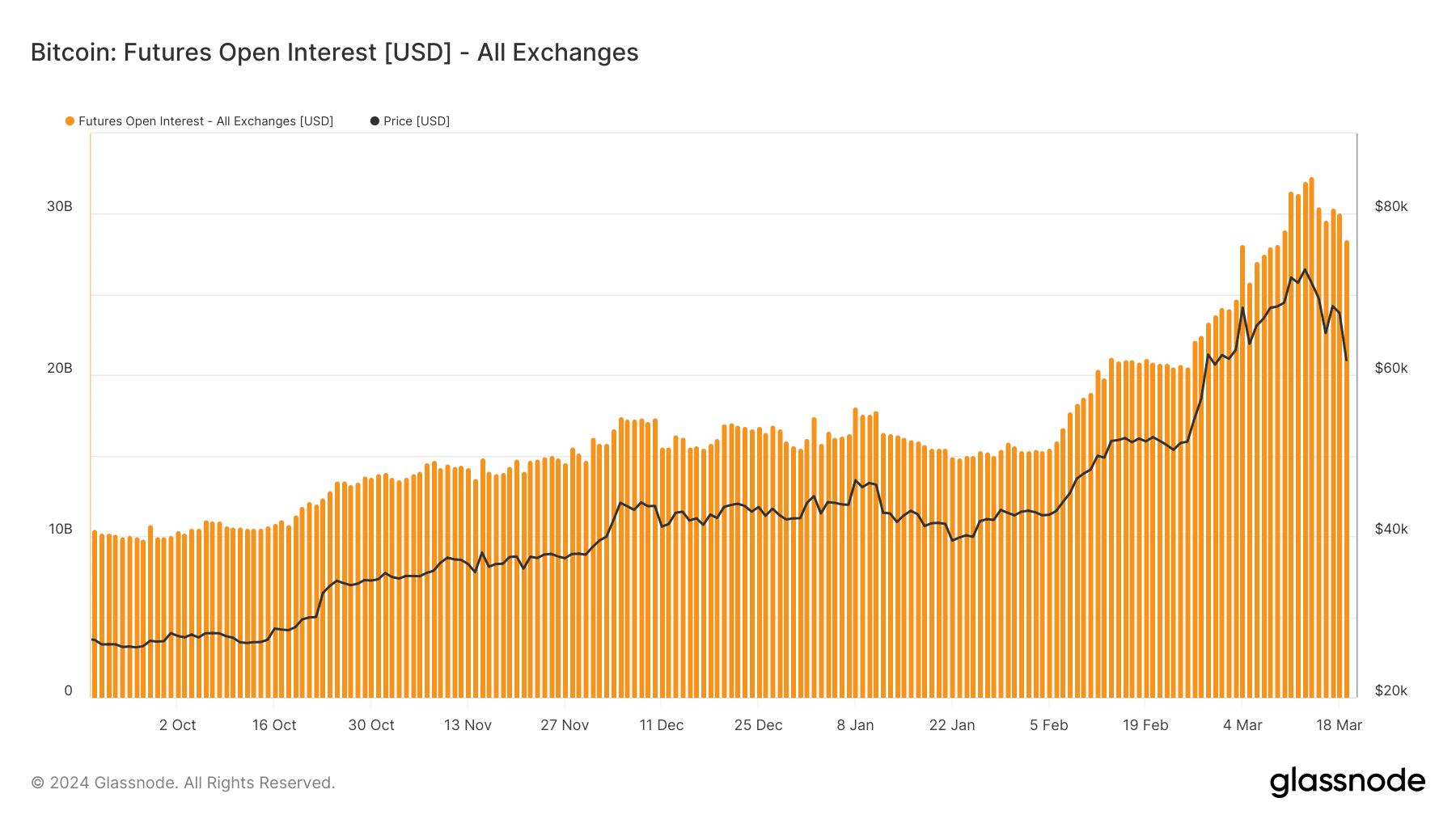

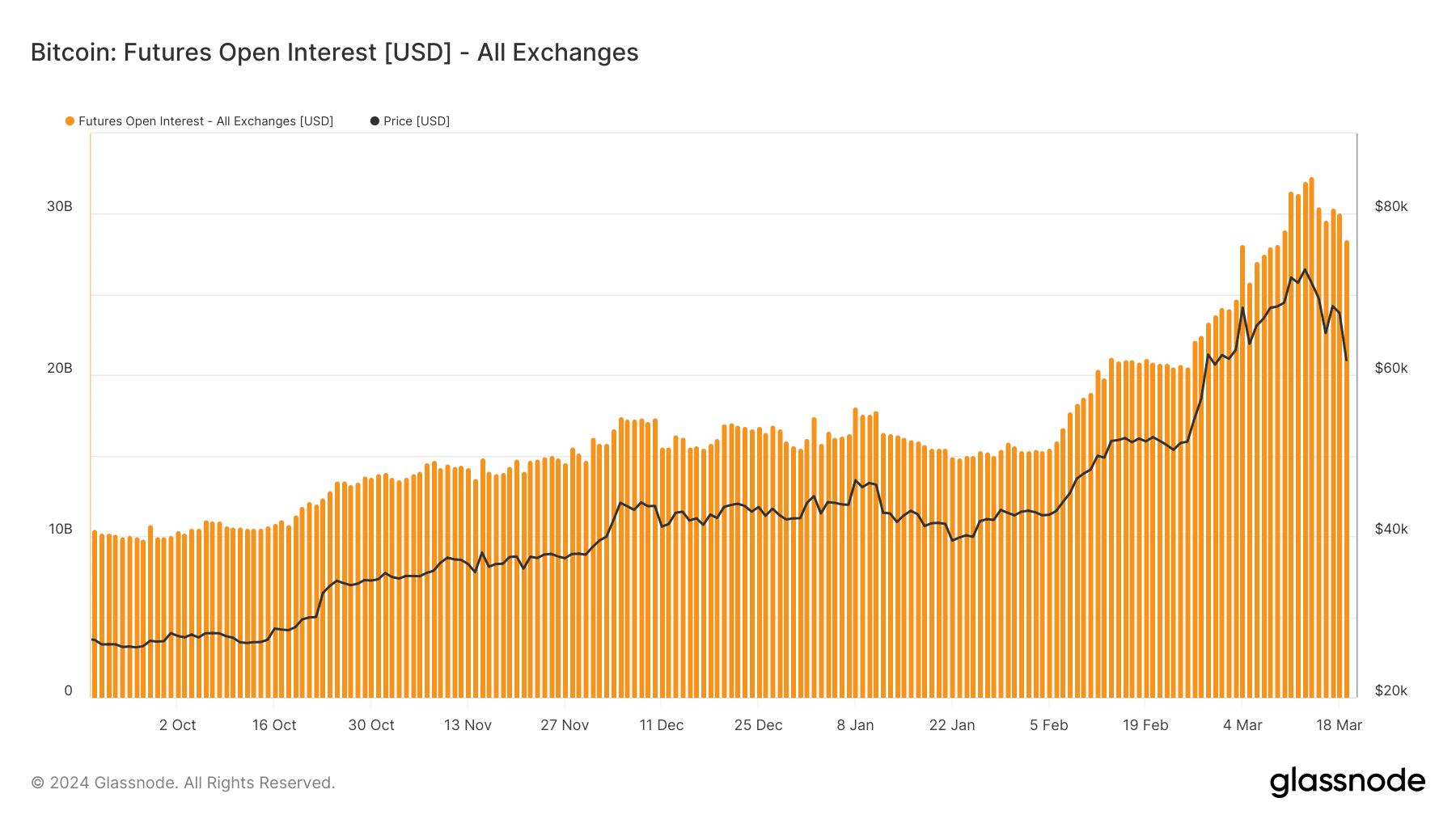

However, there was another twist to Bitcoin’s situation. This time it was about Open Interest (OI). OI is the number of outstanding contracts on the futures market.

Sometimes AMBCrypto reported how the OI was one of the main catalysts that caused BTC’s rise to $73,000. At press time, Glassnode data showed OI has declined.

This indicates that traders are closing their previously outstanding contracts. Assuming a similar situation to the 2021 bull cycle, Bitcoin’s correction may not be over yet.

Source: Glassnode

The other is against

If this is the case, Bitcoin’s price could drop to $58,000. Despite the recent decline, BTC’s Year-To-Date (YTD) performance was up 42.60%.

However, another nosedive from press time levels could see this number shortened. Should the price of Bitcoin fall, it may not take into account what the past cycles have been like.

For example, as the coin approached the 2016 halving, the uptrend it had at the time disappeared. A similar scenario occurred during the third halving in 2020.

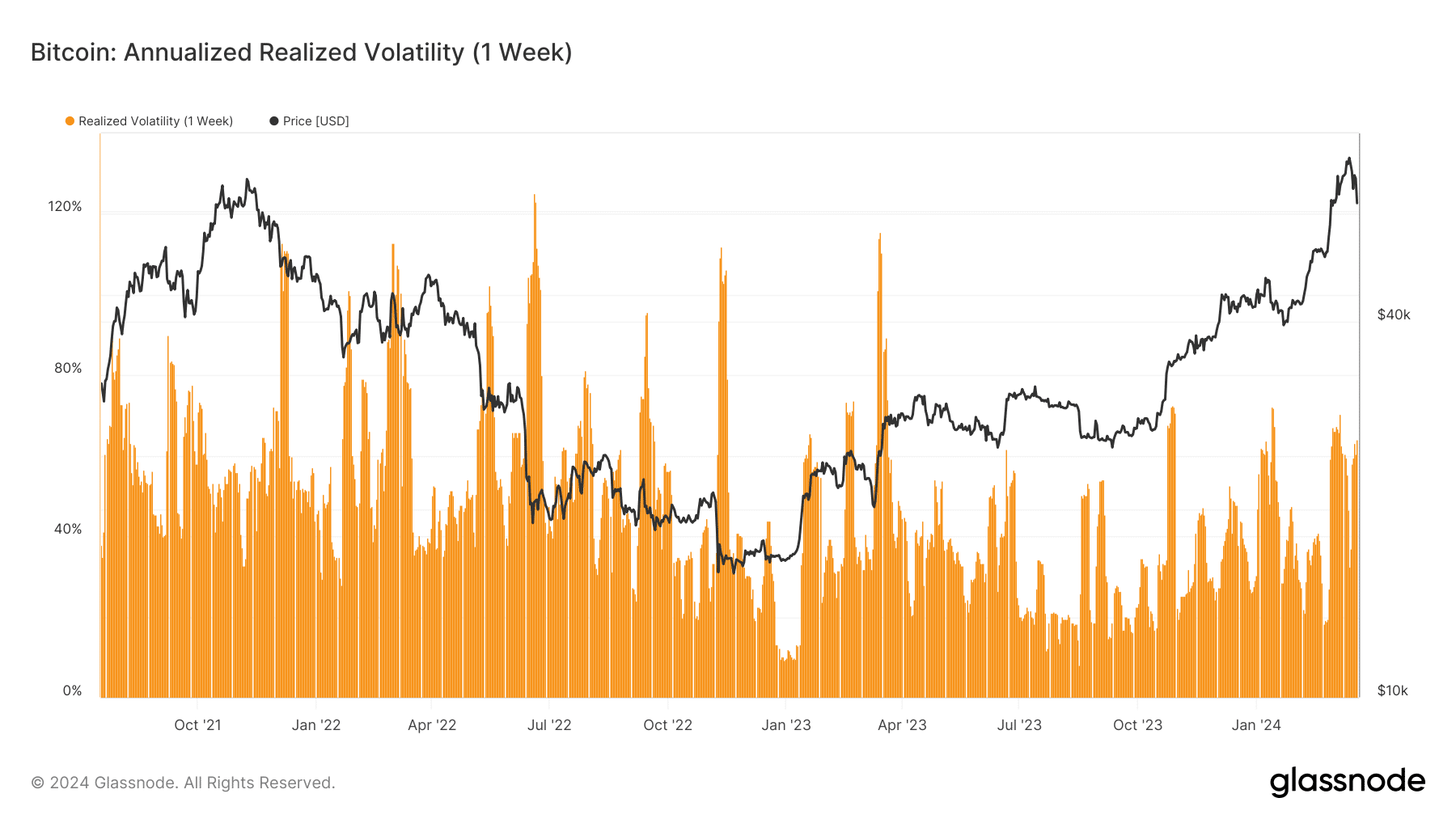

In addition, AMBCrypto assessed realized volatility. By definition, Realized Volatility looks at the returns a cycle has produced compared to what has happened in the past.

The result of this tells whether it is risky or not to trade BTC. Low values of realized volatility imply that it may not be risky to hold Bitcoin long or short.

Source: Glassnode

Realistic or not, here is the market cap of BTC in ETH terms

But at the time of writing, the one-week realized volatility was 60.6%, indicating a risky phase. Therefore, it may be better for traders not to open BTC contracts at this time.

As things stand now, prices can fluctuate in either direction, and highly leveraged bets could face massive liquidation. Furthermore, BTC’s value has more of a tendency to drop once more before making a notable recovery.