- Altcoin season follows the Dominance of Bitcoin – Capital shifts When BTC.D purchases

- Various factors can pose an important threat to Altcoin -Cycli

Bitcoin Dominance [BTC.D] is an important statistics to follow Altcoin seasons. When BTC.D drops, this usually means that investors go to Altcoins during periods of market volatility.

Even with macro -economic concerns such as the upcoming FOMC meeting and Trump’s 2 April ‘reciprocal’ rates, Bitcoin’s dominance remains strong. At the time of writing it had a lecture of 61.6%, still a bit under the peak of February of 64.3%.

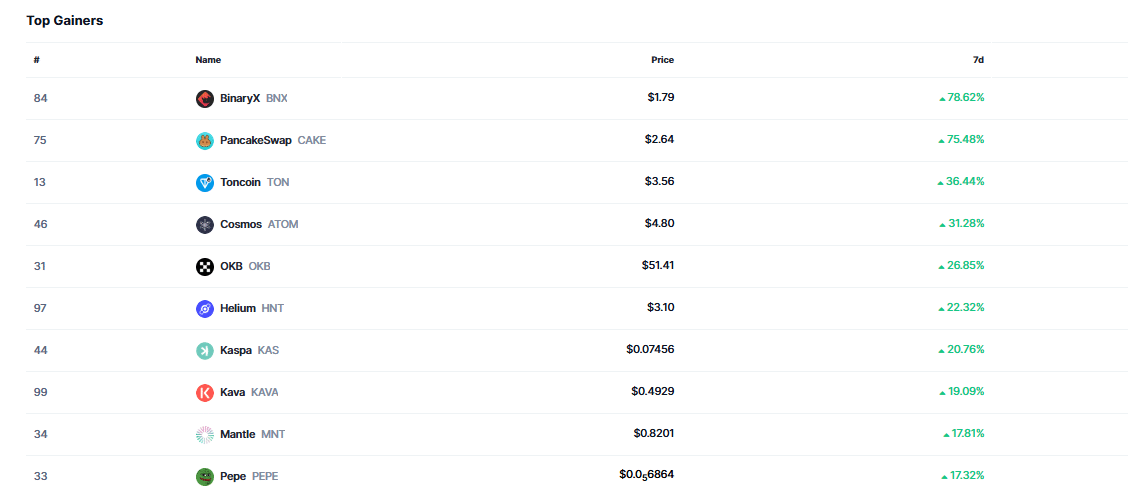

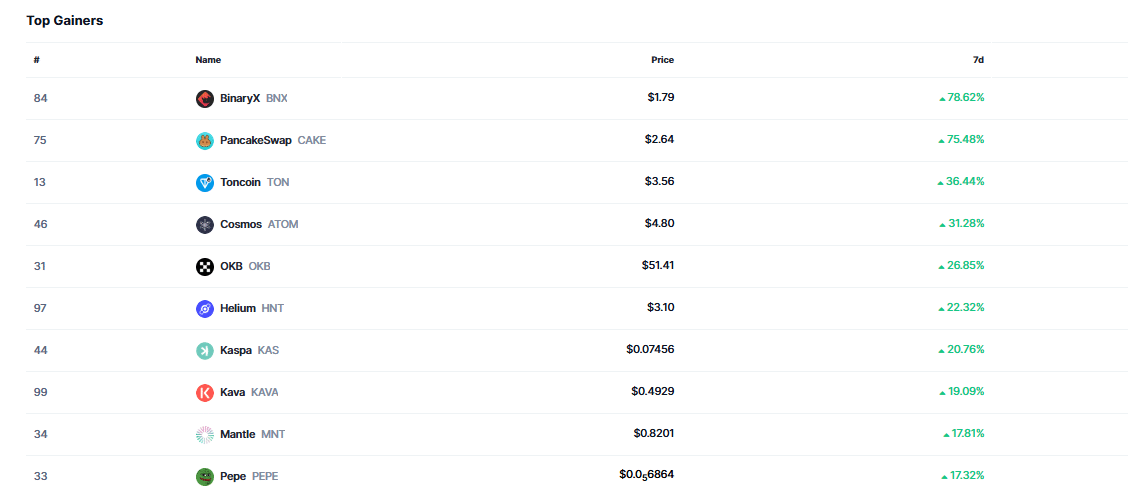

It is interesting that a further consideration of the weekly top win has shown that 4 were from the 5 central or low-cap altcoins. This shift suggests that investors have left coins with large caps in favor of cheaper, higher risk options.

Source: Coinmarketcap

Bitcoin’s resilience in the face of Altcoin -Over tax

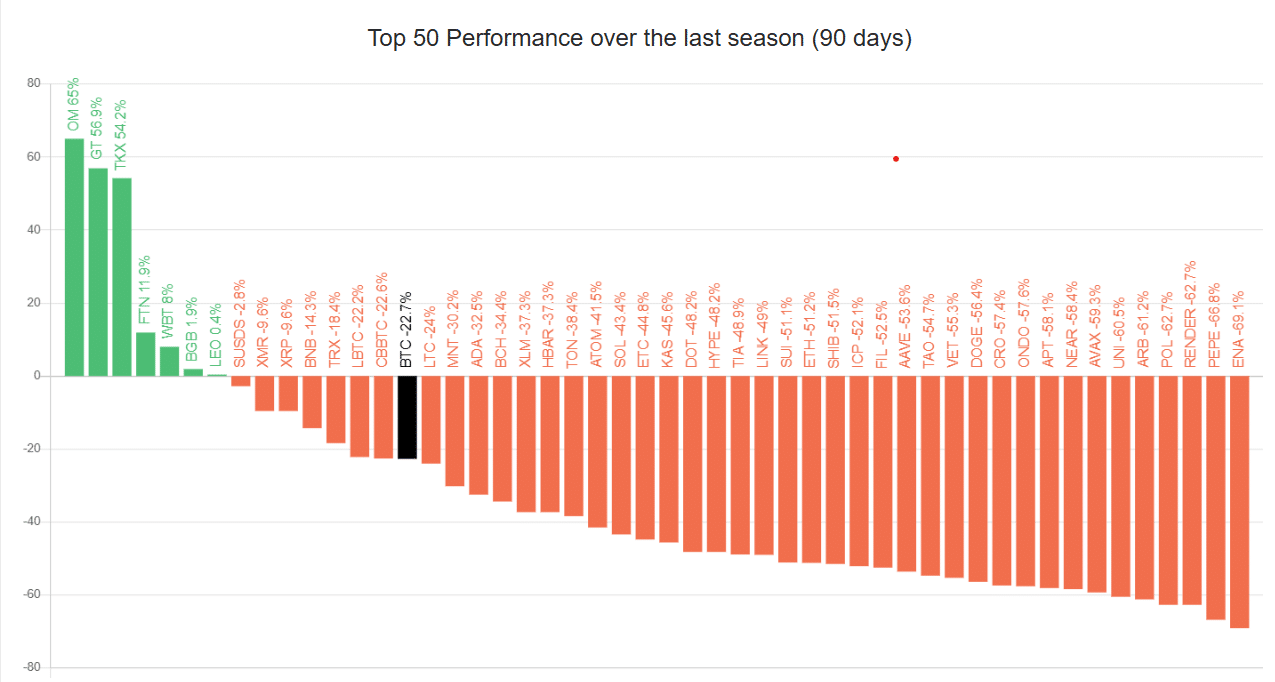

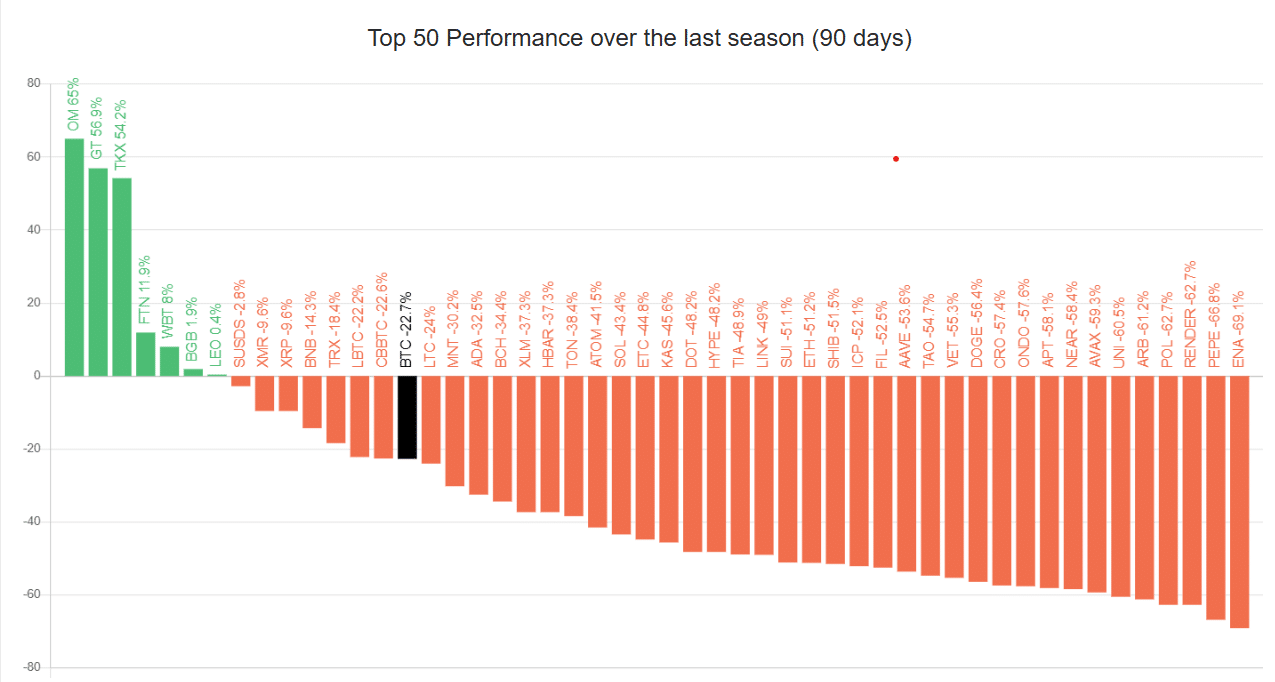

Historically, Bitcoin has served Dominance as an important meter for Altcoin seasons. When BTC.D rises, this usually indicates that investors move their funds to Bitcoin for safety. This time, however, things feel different. To begin with, the risk with Bitcoin is higher than normal. Q1 did not end as expected – Bitcoin is still below $ 100k, and disappointing many.

Moreover, no tariff reductions are expected until at least the end of the second quarter, so that the market is kept in a wait -and -see mode. Nevertheless, the Altcoin season is nowhere to be seen.

Even with Bitcoin holding, the Altcoin Season Index was at 29 at the time of the press, which means that 58% of the altcoins perform better than BTC. Especially the coins with low to middle cap.

However, this was still far below 75% threshold that was usually needed to start a real Altcoin season.

Source: blockchaincenter.net

An important factor behind this cycle is the rise of Bitcoin ETFs. Just a few days before Bitcoin struck his $ 109k high in January, Bitcoin ETFS saw $ 1,078 billion in inflow.

Since then, millions have been cast in these ETFs, which locks capital in BTC. This shift has delayed the typical Altcoin season, especially since the liquidity is limited.

The end of the Altcoin season?

From March 18 there were more than 12.88 million digital assets stated On Coinmarketcap, an increase of 11 million in February. This wave, mainly from memecoins and low cap-tokens, spreads the attention of investors thinly.

While Bitcoin Dominance has a strong possession and the Altcoin season slows down, investors turn into risky alternatives. Many tokens are now attached to market hoods between $ 10,000 and $ 100,000, which locks capital in short -term assets.

This puts pressure on the upper coins with a high cap. For example, ETH/BTC couple, once strong, has now fallen to a low-five-year low.

Source: TradingView (ETH/BTC)

In conclusion, Bitcoin’s dominance remains strong, with new tokens and the rise of ETFs that reform the market. The usual capital flow from Bitcoin to Altcoins also seems to fade, so that the cryptocurrency has a strong control.