- The percentage of BTC supply in profits has fallen 15% since March 5

- Coin’s Age Consumed and Network Realized Profit/Loss metrics refuted claims of a price floor

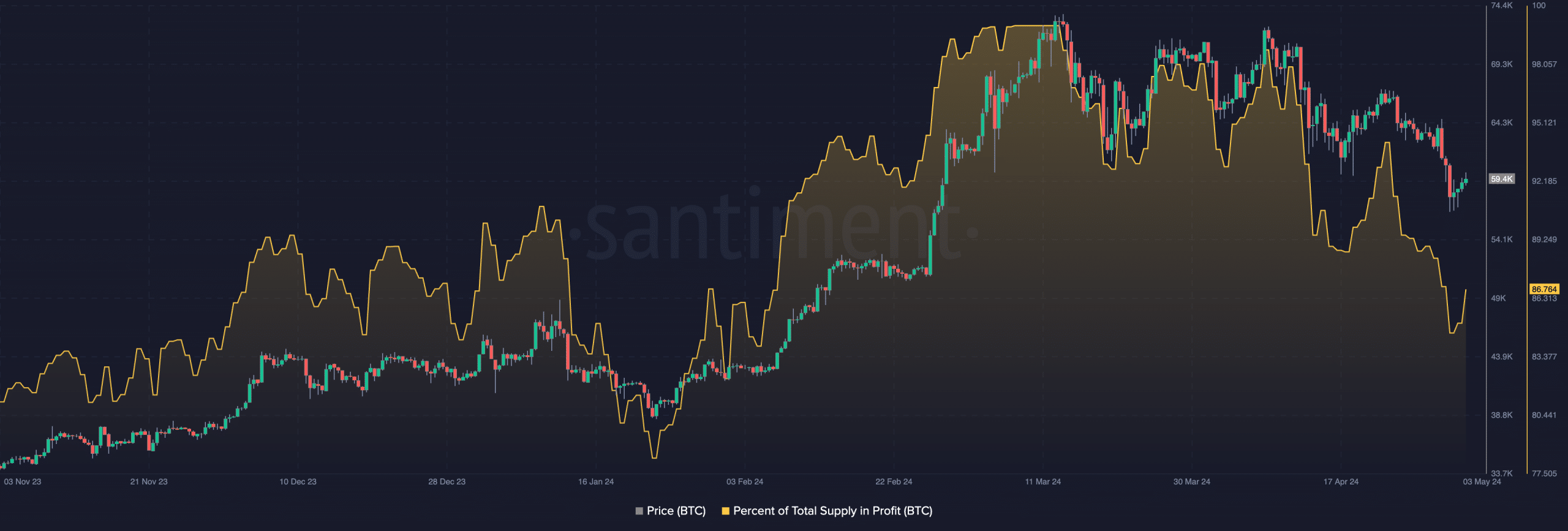

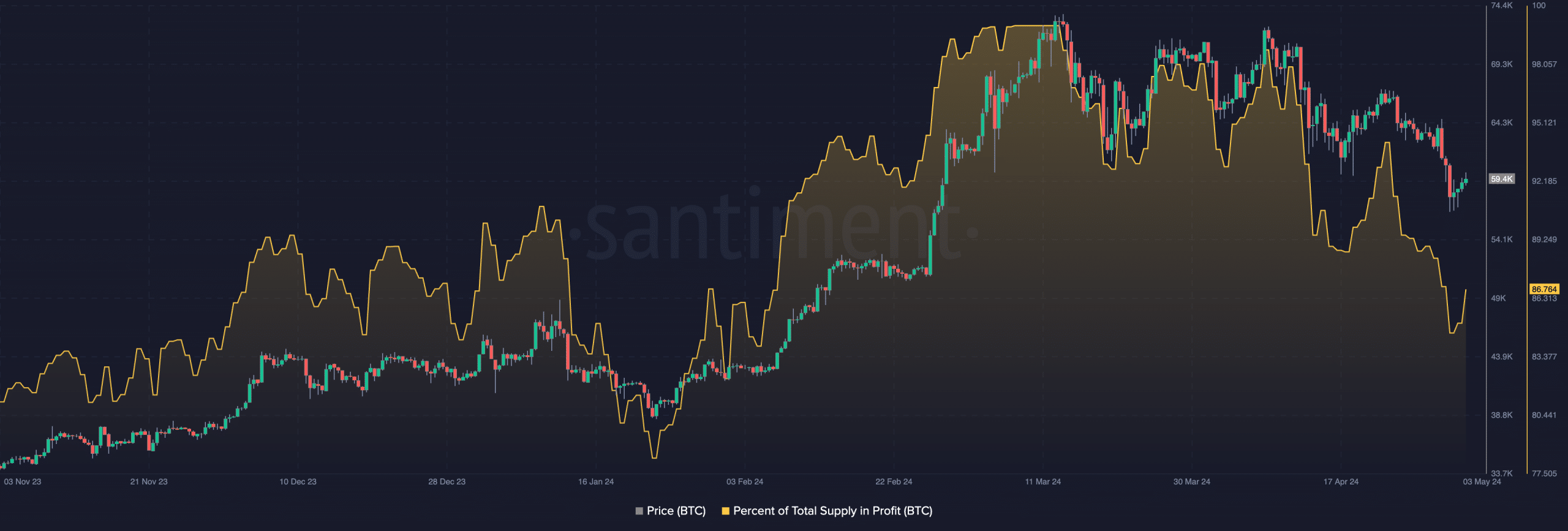

The percentage of Bitcoin [BTC] According to Santiment’s latest report, profit supply has fallen to a two-month low of 84.4% update on X (formerly known as Twitter).

In fact, according to the on-chain data provider, figures for the same rose to a peak of 99.93% year-to-date on March 5. However, it has since fallen down the charts.

Source: Santiment

When this ratio drops like this, it means that an increasing portion of BTC investors are holding their coins at a loss. This often happens when the price of BTC experiences a slight correction and short-term holders who have bought relatively recently at higher prices panic and start selling their holdings.

In its post, Santiment assessed the benchmark’s historical performance and concluded that “lower levels generally warrant more bullish conditions.”

This is because a low supply-to-profit ratio can be considered a contrarian indicator. When it falls, it indicates that weak/paper hands have been removed from the market and have made way for new demand in the market. A declining supply-to-profit ratio could indicate that an asset’s price is nearing its bottom because there are fewer sellers in the market.

Is the bottom in?

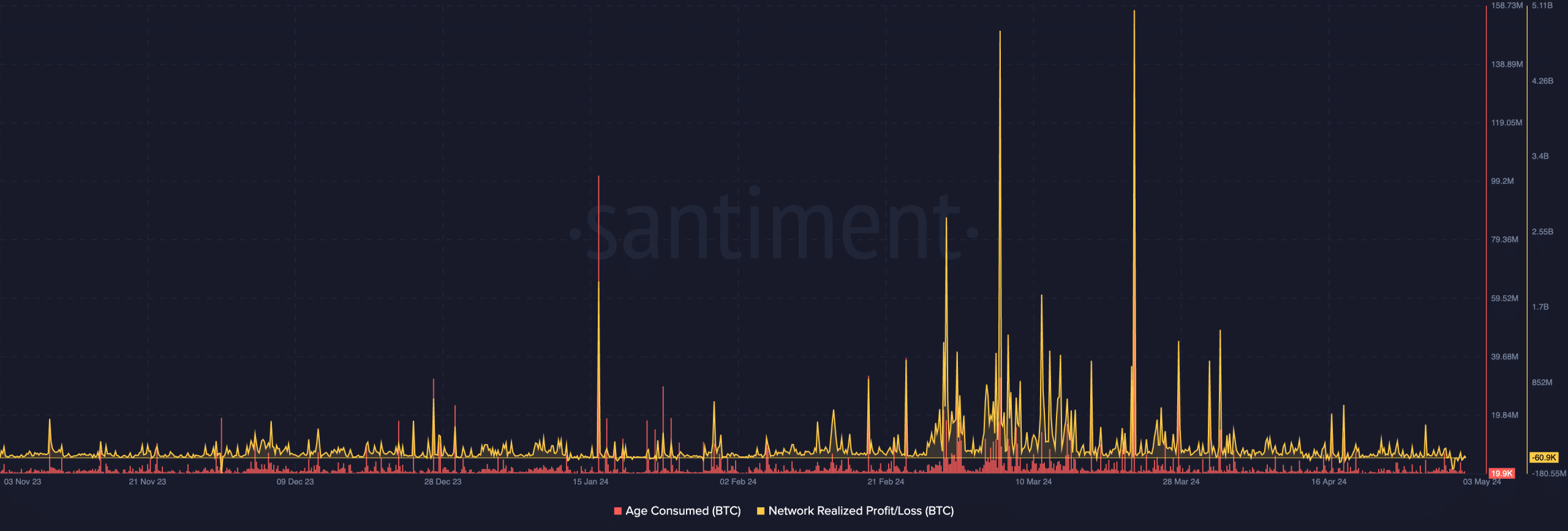

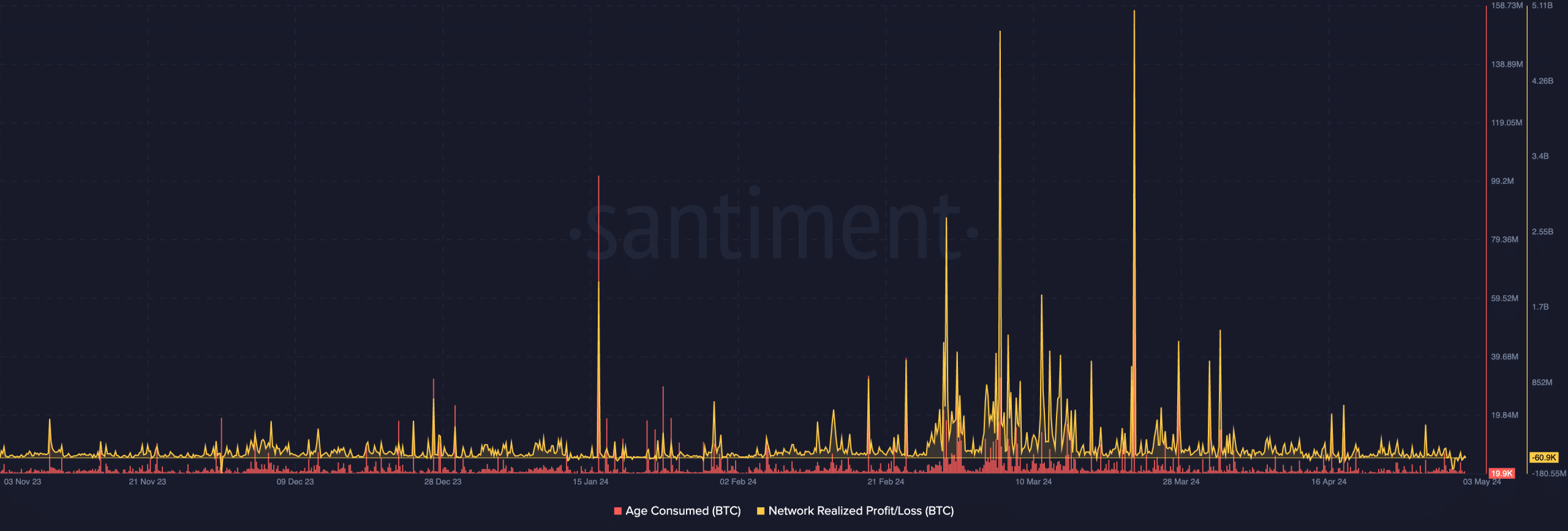

To assess whether the price of BTC has bottomed and whether a rally is underway, an important metric to consider is the coin’s Age Consumed. This statistic tracks the movement of the long-held inactive coins. This measure is considered a good indicator of local asset price tops and bottoms because long-term holders rarely move their dormant coins. It’s notable, then, that when this happens, it often results in major shifts in market trends.

When this value increases, it indicates that a significant number of previously inactive tokens have started to change addresses.

Is your portfolio green? Check out the BTC profit calculator

Conversely, this means that long-held coins remain at wallet addresses without being traded.

According to Santiment, BTC’s Age Consumed has been relatively flat since April 3, indicating there has been no significant movement of dormant coins, which could have marked a local low.

Another important metric to consider is BTC’s Network Realized Profit/Loss (NPL). It tracks the difference between the price at which coins last moved on the blockchain and their current market price. Historically, NPL declines are an indication of when an asset has reached a local low. This is because these dips are a sign of the short-term capitulation of ‘weak hands’ and the return of new money to the market.

There are no indications that a price bottom has yet been reached in the charts.

Source: Santiment