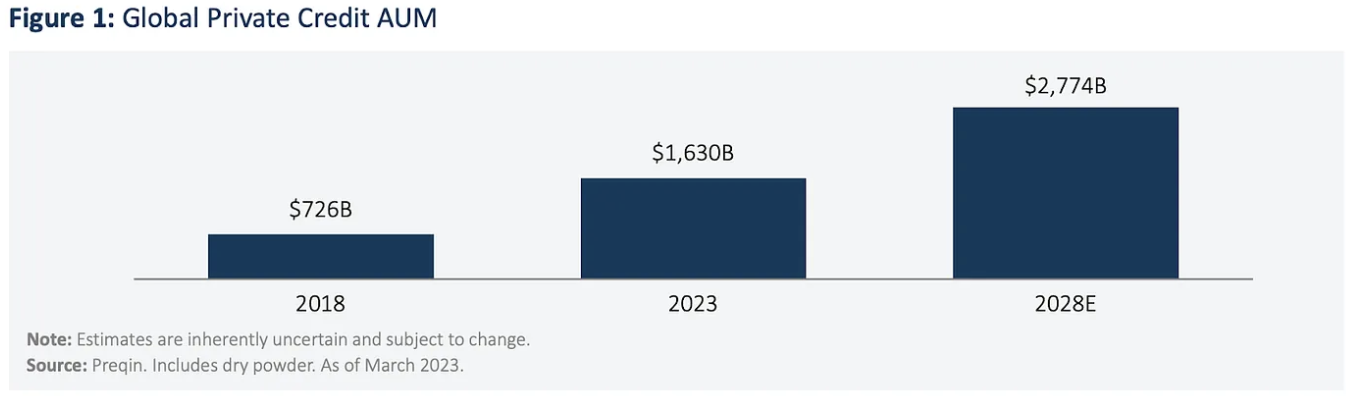

Since the Global Financial Crisis (GFC) in 2008, the growth of private credit has been a key theme within the alternative investment management sector. According to TPG Angelo Gordon, private credit strategies have grown from $726 billion in global assets under management in 2018 to ~$1.6 trillion in 2023. Surveys of market observers and participants show that a majority of lenders worldwide plan to increase their allocations to these to enlarge or significantly increase space. resulting in an expected $2.8 trillion in private credit assets under management by 2028:

Global private credit AUM

Source: TPG

What can this demonstrable growth be attributed to?

As a result of the global financial crisis, banks faced increased regulatory requirements and capital constraints, which dramatically reduced their lending capabilities. This has been especially the case for asset-backed financing (ABF) or specialty credit, which has historically been less standardized and relatively more complex to quantify or capture in terms of data history, assessments, etc.

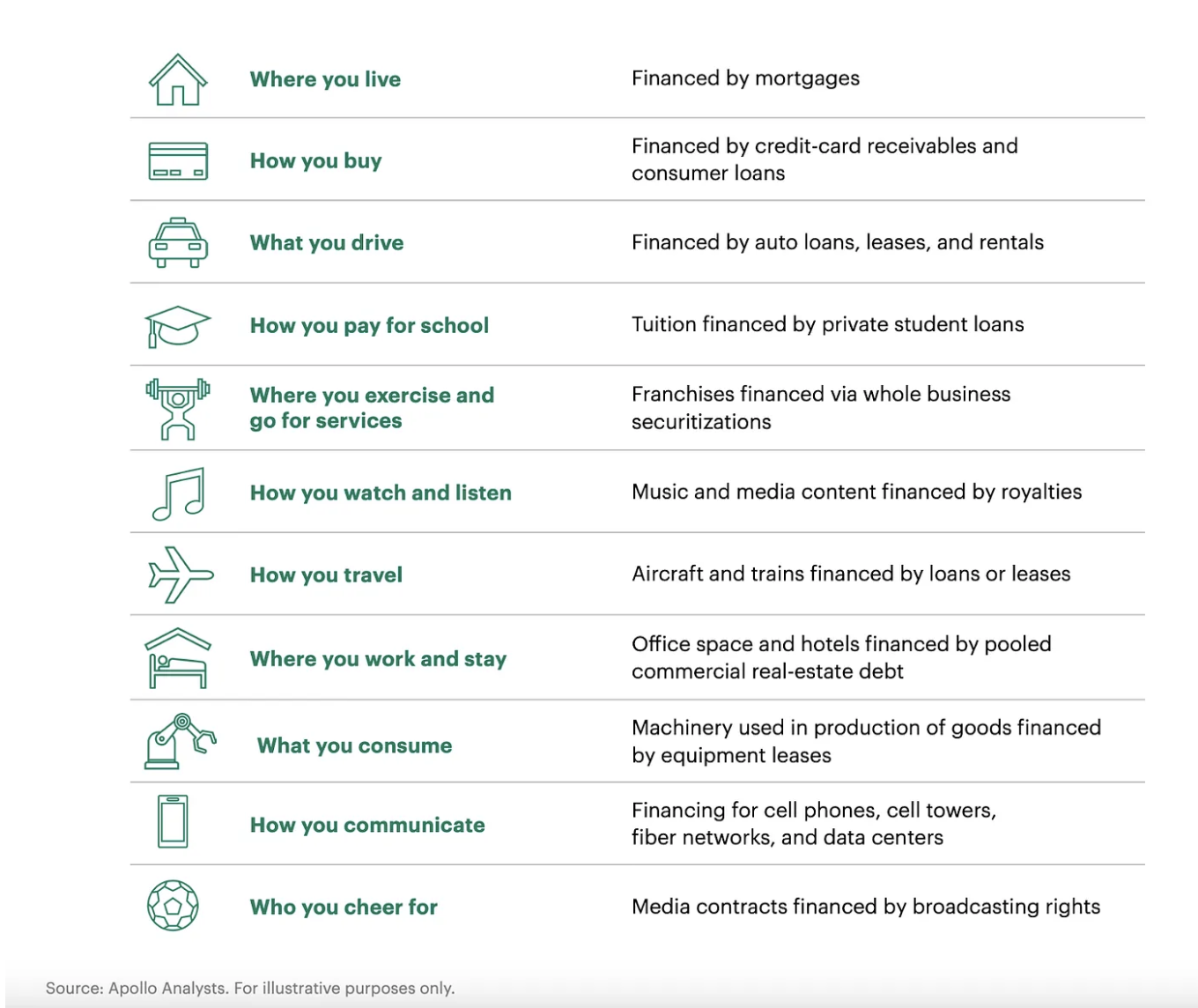

ABF sketches

Unlike corporate loans, ABF relies on more than just the full faith and credit of a borrowing company for repayment. Apollo Global Management (“Apollo”) defines ABF as “lending where a loan is supported first by the contractual cash flows of a pool of assets owned by a borrower with a limited purpose, and then by the liquidation of those assets themselves.” To this end, the ABF market is significantly larger than the corporate credit market and includes a range of credit types, including those described below:

ABF is hiding in plain sight.

While the contraction of bank lending was one of the direct consequences of the global financial crisis, eroded confidence in the traditional banking system was another consequence. At the same time, technological advances in mobile technology and cloud computing, increased venture capital funding, and the use of artificial intelligence (AI) and machine learning (ML) to evaluate alternative data collectively led to an increase in the number of financial technology (FinTech) companies . disrupting various credit markets. From LendingClub to SoFi, from Upstart to Credible, several successful FinTech companies have emerged over the past decade, which in turn have contributed to the growth of ABF and other private lending options.

Of the various ways to gain access to ABF, Apollo describes ownership and control of the promoters as one of the most important:

Owning and controlling the originators of ABF assets are powerful methods to gain exposure to ABF through direct access to proprietary deal flows. Participants who gain access to the market in this way can also acquire the right of first refusal on initiated loans or leases, as well as the right of first refusal on securitization debt, while at the same time participating in the growth of the platform originator. This entry point allows for potentially greater investment diversification, given the ability to go directly to the underlying borrower, reducing the involvement of intermediaries. Like private asset-backed lending, the combination of structuring expertise and broad asset knowledge allows an originator to design a flexible, risk-mitigated credit box. This further provides the opportunity to cross-sell and repeat existing activities and further reduce potential risk, given the ability to conduct direct due diligence and maintain control over credit documentation.

Through a combination of equity and debt financing, several alternative asset managers today are leveraging this model to grow and scale ABF originators while gaining exposure to the space.

As non-bank lenders and specialist finance companies have grown both in number and size, they have ultimately not only addressed the funding gap left by traditional bank lenders following the global financial crisis (and further exacerbated by recent bank failures and a ‘higher interest rate on the economy ‘), the longer interest rate environment), but also by leveraging their favorable mix of assets and liabilities, structuring expertise and technological capabilities to expand into new and emerging assets and markets historically underserved by the traditional banking system.

Blockchain innovation and opportunities in ABF

Among the technological innovations and developments in recent years, blockchain, smart contracts and tokenization have emerged as tools to further conquer the ABF addressable market.

“My ‘aha’ moment in appreciating the revolutionary capabilities of companies supporting blockchain, smart-contract and tokenization came from an article written by BlockTower Credit Head Kevin Miao,” said Morgan Krupetsky, Senior Director of BD Institutions and Capital Markets at Ava Labs. “In it, Kevin argues that these technologies can be leveraged to bypass the many unnecessary third-party service providers that are overloading the traditional $14 trillion securitization market, thereby delivering a lower cost of capital for borrowers. Whether it is lowering the cost of capital or systematically enabling access to credit across sectors, this enhanced technology stack and the various companies building on it deserve the attention of today’s ABF investors and capital providers.”

An example of this is Intain, a structured finance company whose platform has processed billions in loans through its on-chain administration platform. By combining the benefits of on-chain management and tokenization, Intain aims to facilitate efficient, cost-effective and transparent end-to-end asset issuance, investment, administration and trading. The company aims to dramatically improve the investor and issuer experience by bringing all stakeholders to a shared accountability platform that promotes a single source of truth by providing transparency, continuous alignment and an immutable audit trail.

On the investor side, the underlying blockchain technology can improve the experience by providing real-time transparency into every single loan that backs an investment and the ability to collect returns on a faster basis. On the issuer side, the use of automated smart contracts reduces issuance costs by an average of 50 to 100 basis points. The platform enables an 80% reduction in the number of days it takes to validate a loan pool, a 65% reduction in the number of days it takes to underwrite a deal, and a 90% reduction of the number of days required to complete the administration after closing.

Looking forward

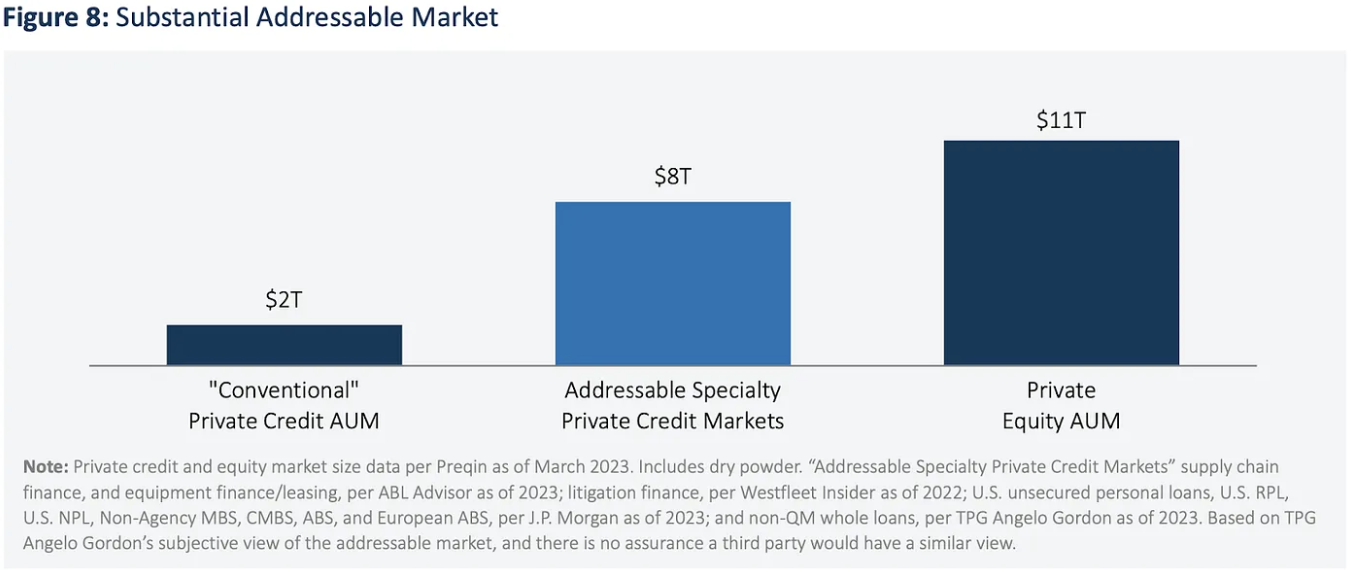

Today’s addressable private credit markets are $8 trillion.

Substantial addressable market

Many of the initiators building on blockchain today – in residential equity, reinsurance, receivables, commercial real estate and media/IP rights, to name a few – are bringing their industry expertise and embedded networks into the practice. They clearly understand the pain points in the sector they are looking for a solution for. They are building blockchain-enabled businesses and creating value propositions that either don’t exist or are substantially more expensive through traditional transaction, settlement and administration rails (due to economic or operational infeasibility). As these companies acquire debt financing facilities on a large scale, many of them can benefit from alternative asset managers’ structuring expertise and ability to grow with strategic equity partners. This combination of debt and equity exposure (plus the added benefit of potential upside from liquid tokens) could potentially provide an attractive return opportunity for investors.

About avalanche

Avalanche is a smart contract platform that is infinitely scalable and regularly completes transactions in less than one second. The new consensus protocol, subnet infrastructure, and HyperSDK toolkit make it easy for Web3 developers to launch powerful, custom blockchain solutions. Build anything you want, how you want, on the eco-friendly blockchain designed for Web3 developers.