- GSOL was rising towards all-time highs at the time of writing.

- Increased anticipation around SOL ETFs drove up GSOL prices.

Grayscale Solana Trust took advantage of the current market conditions as the crypto market recovered and institutional interest soared.

Over the past two months, increased debate over SOL ETFs has exposed institutional interest in them, even as prices for Solana fell after the May rally.

GSOL trades near ATH

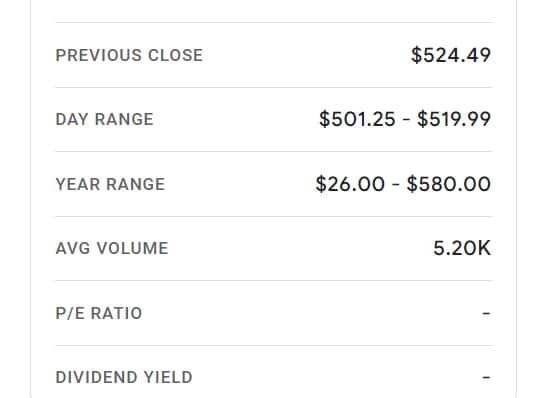

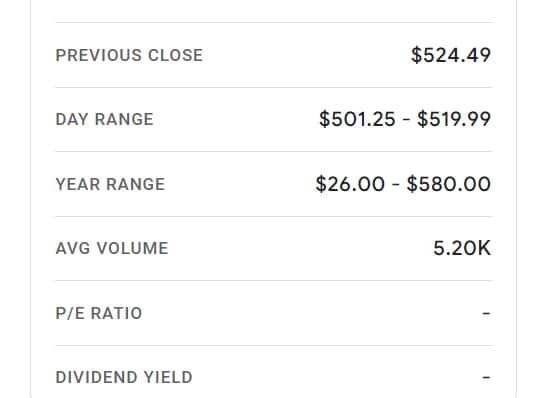

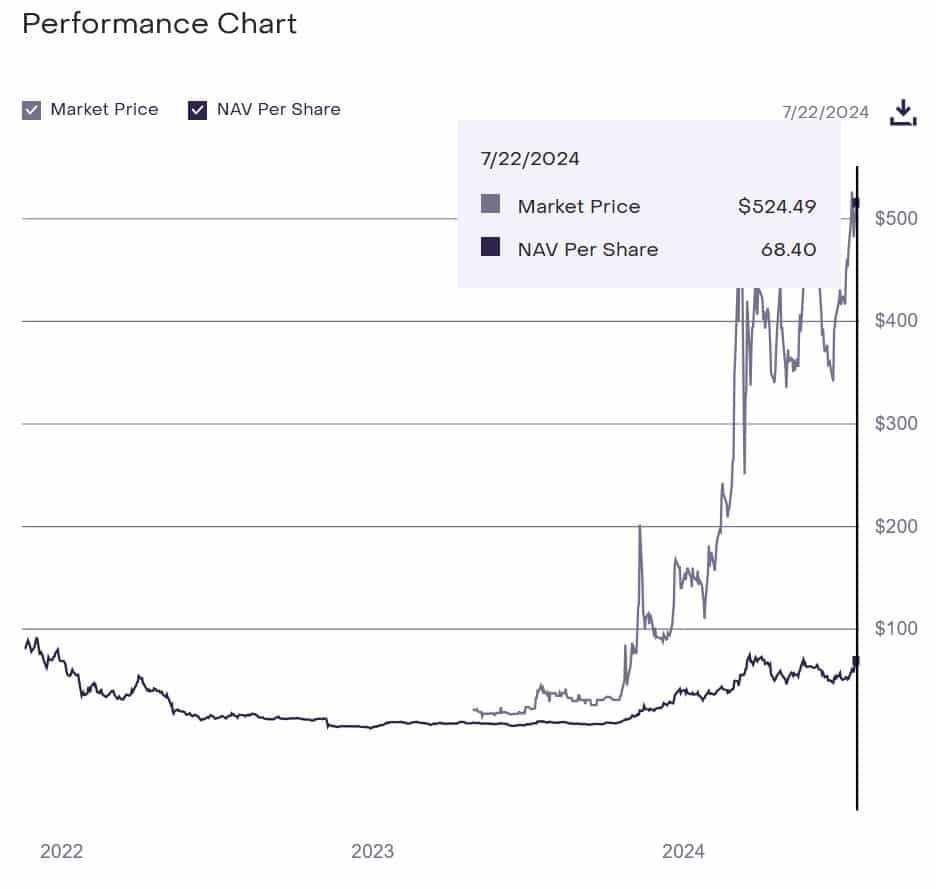

GSOL has benefited enormously from the favorable market conditions surrounding SOL. According to Google Finance, GSOL closed at $524 in the last two hours before publication time, which is near an all-time high.

Source: Google Finance

Over the past 30 days, GSOL has risen 48.45% to $507 at the time of writing, in addition to a 298.99% increase over the past six months.

Source: Google Finance

In particular, the recent surge has made analysts speculate and optimistic about GSOL’s future potential. For example, crypto analyst Nic is noted,

“The Grayscale GSOL trust is trading near record highs and at 7x NAV. These institutional buyers are willing to gain exposure to $SOL at an implied price above $1,300.”

Source:

His analysis assumed continued institutional interest in SOL. With increased investor inflows, these investors will be willing to pay higher premiums to gain exposure to SOL.

Eyes on SOL ETFs

Over the past two months, the crypto market has seen increased public debate over potential Solana exchange-traded funds (ETFs).

Last month, hopes for SOL rose significantly following applications from several companies for the funds. VanECK became the first asset manager to apply for Solana ETFs in the United States.

The filing was followed by 21Shares submitting their proposal to the SEC. Similarly, for QSOL, the Canadian company supplemented a Solana ETF to enable institutional investments.

These moves pushed GSOL stock to $408. Therefore, anticipation for Solana ETFs is the driving force behind GSOL’s recent rise and resilience as investors are bullish, especially after the adoption of Ethereum ETFs.

What the Solana price charts indicate

SOL was trading at $176.39 at the time of writing, after rising 8.21% on the weekly charts. Trading volume increased by 4.24% to $3 billion in the past 24 hours.

According to AMBCrypto’s analysis, the recent increase in SOL prices corresponded with the continued rise of GSOL, also a sign of favorable market conditions for the SOL ecosystem.

Source: TradingView

Is your portfolio green? View the SOL Profit Calculator

Solana was experiencing positive market sentiment at the time of writing, as Chaikin Money Flow (CMF) indicated. SOL’s CMF is positive at 0.31, indicating increased buying pressure.

The On Balance Volume (OBV) proved further. A rising OBV of $73.4 million showed increasing buying pressure at the time of writing, and a possible price increase.