Grayscale’s Bitcoin Trust (GBTC) has become a crucial tool in the cryptocurrency world since its launch by Grayscale Investments. As one of the pioneers in bridging the traditional investment landscape and the emerging cryptocurrency domain, GBTC allows investors to tap into the Bitcoin market without directly purchasing, storing or managing it. Monitoring GBTC’s price movements has become crucial, especially for analysts looking to gauge market sentiment.

Styled in the form of a traditional investment trust, GBTC’s unique proposition lies in the way Bitcoin is held. Instead of individual investors struggling with cryptographic keys and wallets, Grayscale centralizes the custody process, using high-security measures, including cold storage mechanisms, to ensure the safety of the assets.

GBTC shares, which represent ownership of a fraction of the trust’s underlying Bitcoin, trade on the OTCQX market. The OTCQX, or the Over-The-Counter QX, is a top-level regulated marketplace for stocks and securities that are not traded on conventional, large-scale exchanges. It provides companies with a platform to access US investors while adhering to high financial standards and disclosure practices.

A distinguishing feature of GBTC, which sets it apart from some ETFs (Exchange Traded Funds), is the lack of a redemption mechanism. Simply put, investors cannot directly exchange their GBTC shares for Bitcoin. Instead, they can only trade these stocks on the open market. This design choice helps ensure greater price stability, preventing large investors from abruptly cashing out, which significantly affects market dynamics.

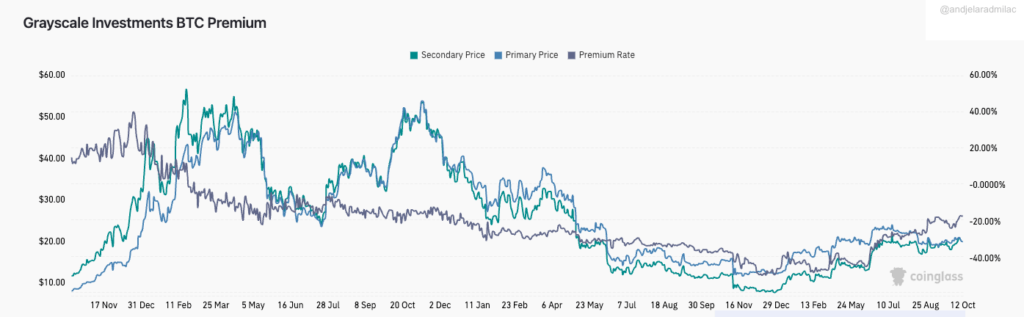

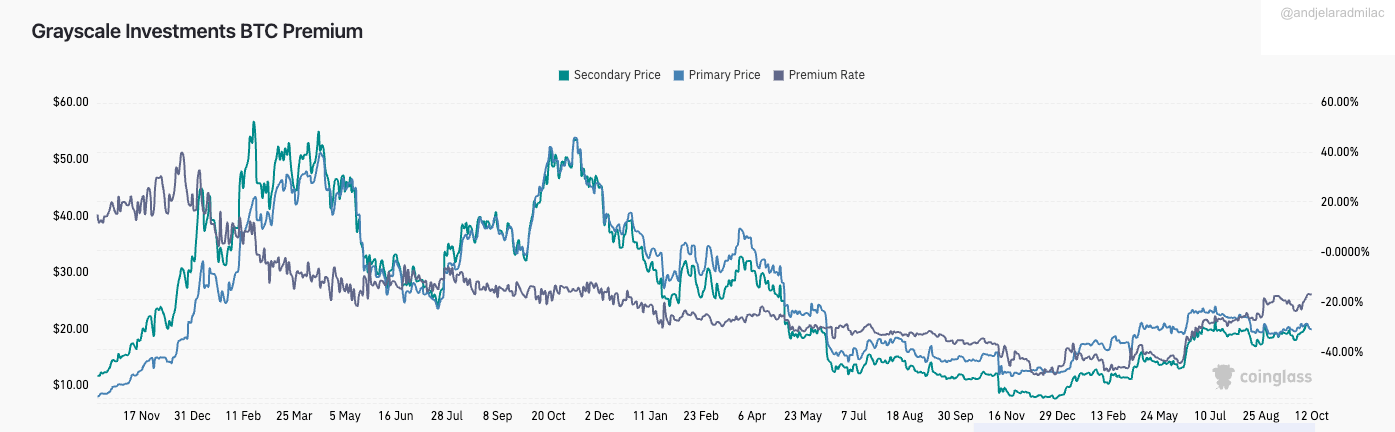

The uniqueness of GBTC lies in its premium, a term that indicates the difference between the market price of GBTC shares and the actual value of the Bitcoin it holds, known as the Net Asset Value (NAV).

This premium is caused by various factors. Initially, GBTC was one of the scarce channels for institutional players to access Bitcoin exposure, especially in limited jurisdictions. This exclusivity led to GBTC trading at a significant premium. Furthermore, GBTC’s liquidity and convenience added to its appeal, creating a wedge between the price and the true Bitcoin value. However, this premium is not static and can fluctuate based on market conditions and turn into a discount.

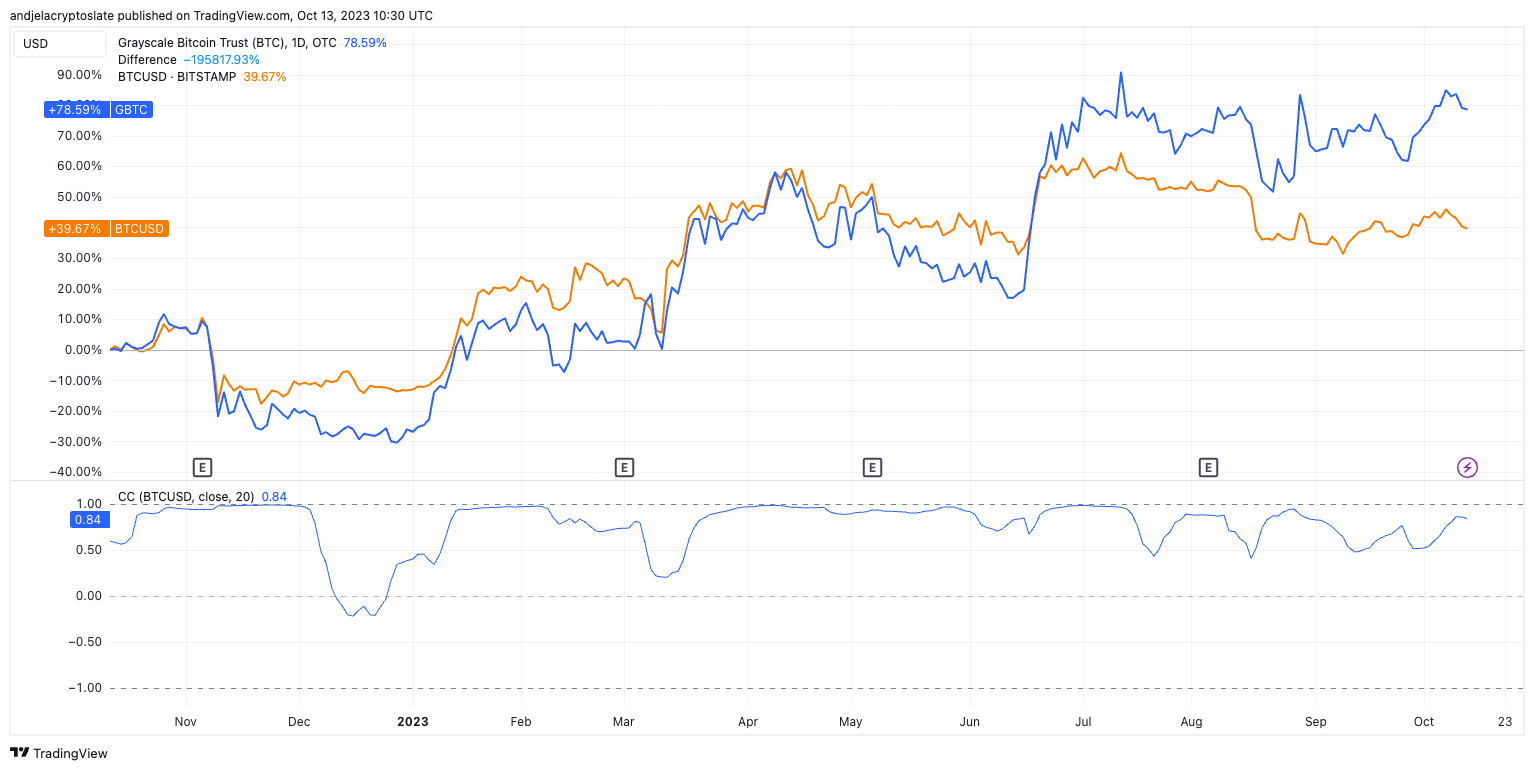

Historically, GBTC has shown a high degree of correlation with Bitcoin (BTC). This is expected as Bitcoin is GBTC’s main underlying asset. As BTC prices move, the value of the Bitcoin held by the trust also shifts, impacting GBTC’s NAV. However, the market price of GBTC, influenced by the dynamics of supply and demand for its shares, may deviate from this NAV, which may lead to the said premium or discount.

If regulations around cryptocurrency investment vehicles change, it could impact the attractiveness of GBTC to investors, which could lead to price movements that are independent of the price of Bitcoin. As more cryptocurrency investment vehicles emerge, especially those that offer features that GBTC does not (such as redemption features), this could reduce the demand for GBTC, which would affect its correlation with BTC.

One of those looming regulatory decisions is the possible approval of a Grayscale spot Bitcoin ETF. The market is abuzz with speculation, with many believing that Grayscale could be the frontrunner in gaining this approval. This transformation would address the long-standing premium/discount problem and serve as a monumental step in integrating cryptocurrencies into the mainstream financial sector.

The potential benefits are numerous. An ETF structure would streamline the trading process and potentially bring new inflows of institutional money. Moreover, it would further strengthen Bitcoin’s position as a legitimate and recognized asset class.

However, a Grayscale Bitcoin ETF could also introduce increased volatility, especially during the early days as the market adjusts to the new dynamics. And while the GBTC premium has historically been a driving factor in market sentiment, an ETF conversion could dilute the potential of this indicator.

The post Grayscale’s GBTC: Understanding Its Premium and Market Impact appeared first on CryptoSlate.