- Graysacal’s GBTC volume is starting to rise, signaling bullish sentiment in fiat markets.

- Whales are starting to show interest in Bitcoin as the number of addresses increases by more than 1 Bitcoin.

In the past month, Bitcoin[BTC] stagnated around the USD 30,000 and USD 31,000 levels, leading investors to worry about a possible price decline. The extended period of stability led to uncertainty about the cryptocurrency’s future performance, with investors closely monitoring market trends and indicators for signs of price movement.

Read the Bitcoin price forecast for 2023-2024

How does Grayscale come into the picture?

Despite the uncertainty surrounding Bitcoin, there was a huge amount of interest in Grayscale’s GBTC. For context, Grayscale Investments, a cryptocurrency asset management company, offers an investment product known as Grayscale Bitcoin Trust (GBTC). This trust functions by holding Bitcoin as the underlying asset. This allows investors to participate in Bitcoin’s price movements without directly owning the cryptocurrency.

Investors can acquire GBTC shares through brokerage accounts that provide indirect ownership of Bitcoin through the trust. GBTC’s primary purpose is to mirror the market price of Bitcoin and provide institutional and accredited investors with a conventional way to invest in Bitcoin within traditional investment accounts.

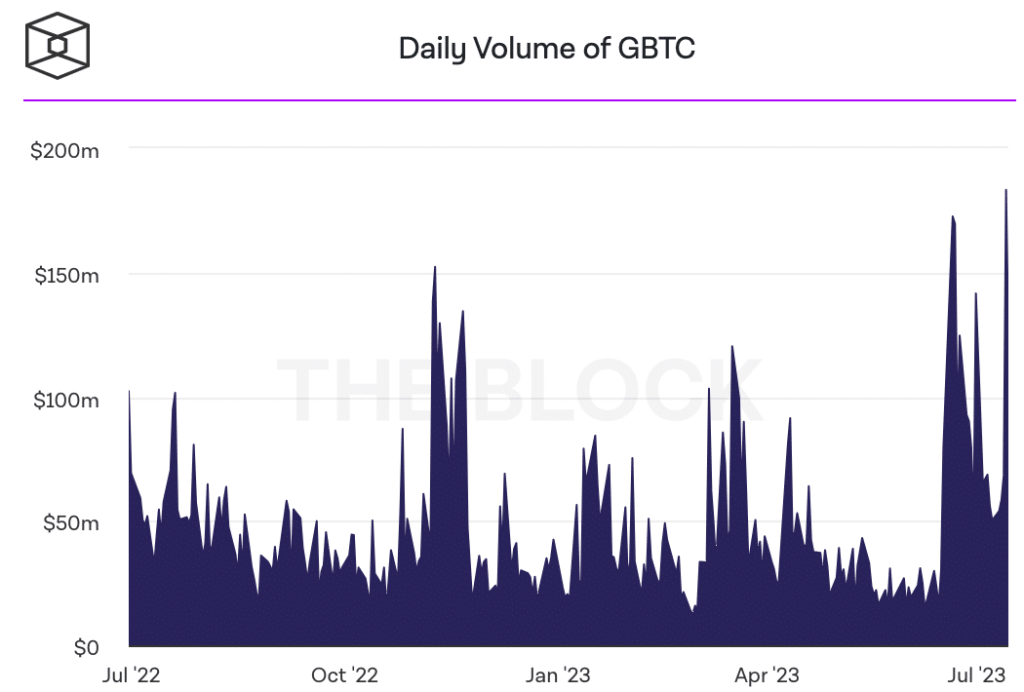

According to recent data, Grayscale’s GBTC experienced an increase in daily volumes, reaching the highest level of the year. This increase was attributed to an increase in the number of registered ETF deposits and a decrease in the net asset value discount.

Daily volumes for Grayscale’s largest fund product peaked at $183 million on July 13, following a previous high of $170 million on June 20. These figures indicated strong investor interest and activity in GBTC during these specific periods.

Source: The Block

The growing interest in GBTC indicates that investors in the fiat markets will also want to gain exposure to Bitcoin in the future. It indicates that investors in the fiat sector expect the price of BTC to rise even further in the future.

Is your wallet green? Check out the Bitcoin Profit Calculator

Whales come along for the ride

The hopeful approach was also shown by players in the cryptocurrency space. Glassnode’s data showed that the number of addresses with more than BTC coins hit an all-time high (ATH) of 1,009,850. This milestone indicated a remarkable increase in the number of large addresses with the king coin. This showed that whales were also starting to show an interest in Bitcoin.

Factors such as BTC’s ETF approval and SEC regulations could have played a huge role in determining BTC’s price going forward.

Source: glasnode