- Bitcoin trading activity was at an all-time low as the market ventured deeper into uncertainty.

- There may be a new wave of accumulation on the horizon.

It has been almost two weeks since Bitcoin’s sideways price action, indicating that the market is still in a state of uncertainty. This is because the market is waiting for a clear sign indicating the next market move.

Is your wallet green? Check out the BTC Profit Calculator

The magnitude of this market outcome is evident in Bitcoin’s stats. Network activity has slowed significantly in recent days and has been particularly pronounced in transaction volume. The latter is now at its lowest level in the past three years, according to Santiment’s latest analysis.

📉 #Bitcoin‘s #onchain Transaction volume has sunk to its lowest point in three years. This measures the amount of peer-to-peer payments, exchange deposits and withdrawals, and miner fees. A decrease in network activity is not necessarily the case #bearishbut certainly indicates a trader #FUD. https://t.co/0I48I4hMAJ pic.twitter.com/bTz8HgEUK4

— Santiment (@santimentfeed) August 28, 2023

Low volume translates into fewer trades/transactions; hence miner fees have dropped. While some may consider this a concern, it is quite common to see periods when the level of BTC trading activity falls, leading to sideways price action.

However, this is often followed by an increase in volume and a targeted price movement.

The accumulation of Bitcoin holders suggests that volatility is on its way

While the market remained in limbo at the time of writing, there was one specific metric that could provide insight into the next market move. The holder growth rate has historically been a reliable measure of Bitcoin cycles.

The same holder metric has recently retested the descending trendline and, at the time of writing, showed signs of slowing accumulation.

We are approaching the interesting part of the Bitcoin cycle.

“Hodler Growth Rate”, the 1-year growth rate of 2+ year old Bitcoin holders, has completed the bear market’s rapid growth phase and is leveling off.

See what happened every other cycle… pic.twitter.com/aUlB7LF7vP

— Charles Edwards (@caprioleio) August 28, 2023

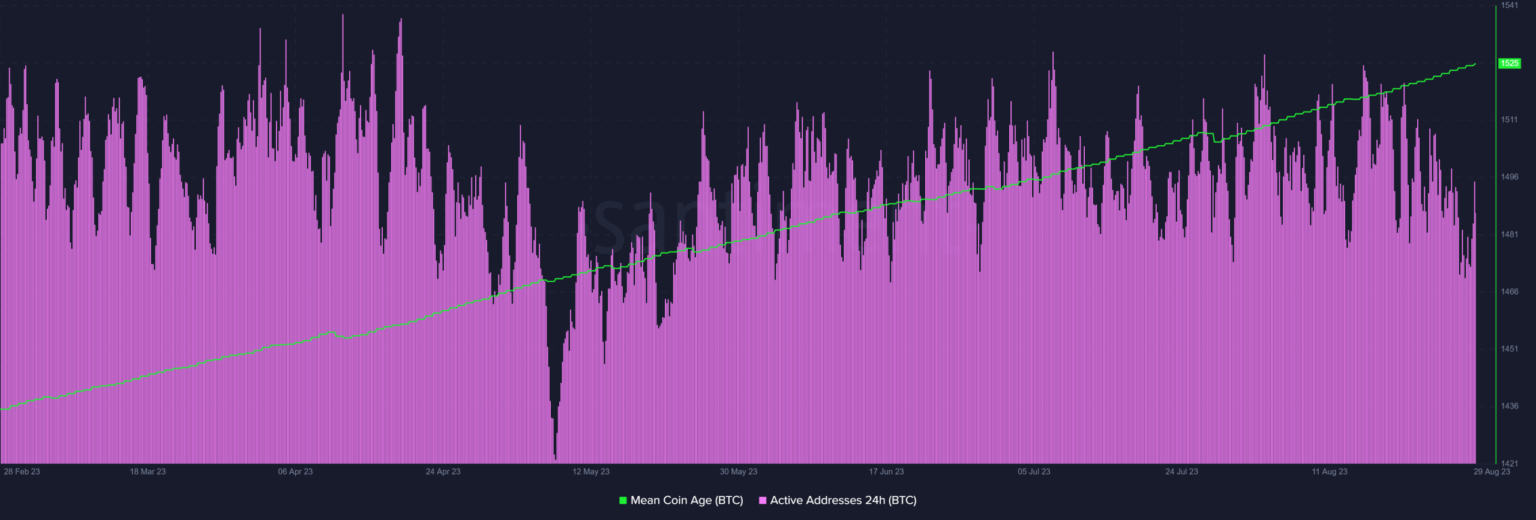

Speaking of accumulation, Bitcoin’s average coin age has been steadily rising and, at the time of publication, was at its highest point in six months. This confirmed that there was still prolonged hodling.

In the meantime. The number of 24-hour active addresses has fallen sharply since mid-August, in line with the aforementioned decline in trading activity.

Source: Sentiment

What should Bitcoin traders anticipate as August ends?

Bitcoin’s sideways price action is usually followed by a rebound in volatility. We could see that happening, especially in early August. However, the direction of that volatility remains a mystery.

Read Bitcoin’s [BTC] Price forecast 2023-2024

Nevertheless, Bitcoin was still oversold at the time of writing, suggesting the likelihood that traders would buy in anticipation of a recovery.

On the other hand, the market is not out of the woods, especially after the recent statement from the US suggesting that interest rates could be raised. This perfectly sums up the king coin stalemate and underscores the possibility of another crash.