- The DEX volume on the protocol is up 13x from what it was seven days ago.

- In addition, Fantom is slowly regaining market participants’ trust after recent unfortunate incidents.

Phantom [FTM] may have had to deal with the closure of one of its DEXs, but that didn’t stop the increase in DEX volume on the protocol. According to digital asset research firm ASXN, Fantom’s DEX volume has risen to $143.1 million in the past seven days.

Realistic or not, here it is The market cap of FTM in ETH terms

The increase was an incredible 1302.7%, compared to just $10.2 million a week ago. In addition, the volume increase suggested a notable increase in application utility within the Fantom ecosystem.

All thanks to SpookySwap and the rest

In an in-depth look at the protocol, SpookySwap was the key actor influencing turnout. SpookySwap is an Automated Market Maker (AMM) that provides traders with constant liquidity to trade against a liquidity pool.

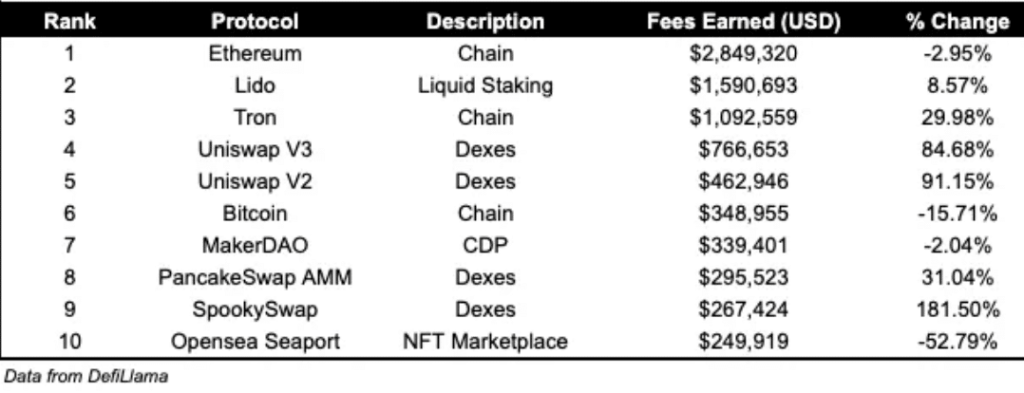

Data from DefiLlama shows that SpookySwap recorded a 181.50% increase in fees generated. This made the DEX the ninth highest fee earner in the DeFi landscape. This DEX volume increase shows some kind of stability in the Fantom protocol.

Source: DefiLlama

Just a few weeks ago, the project faced the forced shutdown from SpiritSwap, the former top DEX on Fantom. Around that time, the SpiritSwap team reported an inability to continuously cover operational costs and the Multichain Hack as the main reasons for leaving the sector.

While Fantom’s Total Value Locked (TVL) was also negatively impacted at the time, its value has been slightly improved in the past 30 days. At the time of writing, the TVL was $57.89 million – up 8.34% over the past month.

Source: DefiLlama

The TVL measures the value of assets locked or staked in a protocol. The higher the TVL, the more reliable the decentralized application (dApp) is perceived, and vice versa.

Therefore, Fantom’s mild TVL increase implies that the protocol regained market participants’ confidence. And this led to an increase in the number of unique deposits in chains operating under the protocol.

Skin in the game

As for the development activities, Santiment showed that Fantom was making moves in an upward direction. Development activity measures the number of public GitHub repositories associated with a project.

A decrease in development activity implies that code commits for a project are not very present. However, when the benchmark increases, it means that developers are committed to polishing up a network, as was the case with Fantom.

How many Worth 1,10,100 FTMs today?

In addition to development activities, FTM’s social dominance also increased. At the time of writing, social dominance was 0.226%.

Source: Sentiment

By looking at the percentage of discussions about one item compared to others, social dominance measures the hype and attention they’ve gained. The increase thus suggests that the eyes are slowly moving back towards Fantom.