- The number of Bitcoin wallets with a balance decreased.

- If the CLLD turns negative while the price of BTC falls, the coin could go up.

According to on-chain analytics provider Santiment, Bitcoin [BTC] holders want to own a stake in the recently approved ETFs. The company announced this on January 11 via X (formerly Twitter).

When the year started, there were approximately 52.64 million Bitcoin wallets with coins in them. However, AMBCrypto confirmed that this number had decreased.

Moreover, that was not the only thing. There is also a shortage of creating new addresses.

📊 With approval from #BitcoinETFSince yesterday, we may continue to see a slight decline in the number of active wallets #Bitcoin‘S #blockchain. While this is unlikely to impact the price, some traders could leave their existing platform $BTC portfolios in favor of #ETF exposure to

(Continued) 👇 pic.twitter.com/l5Q8OmOP5O

— Santiment (@santimentfeed) January 11, 2024

Traders take the volume of Bitcoin into the ETFs

Furthermore, it was worth noting that 40,000 wallets had liquidated all their BTC. So this can only mean one thing: exposure to the Bitcoin ETFs. Regardless of the movement, BTC price may not be affected.

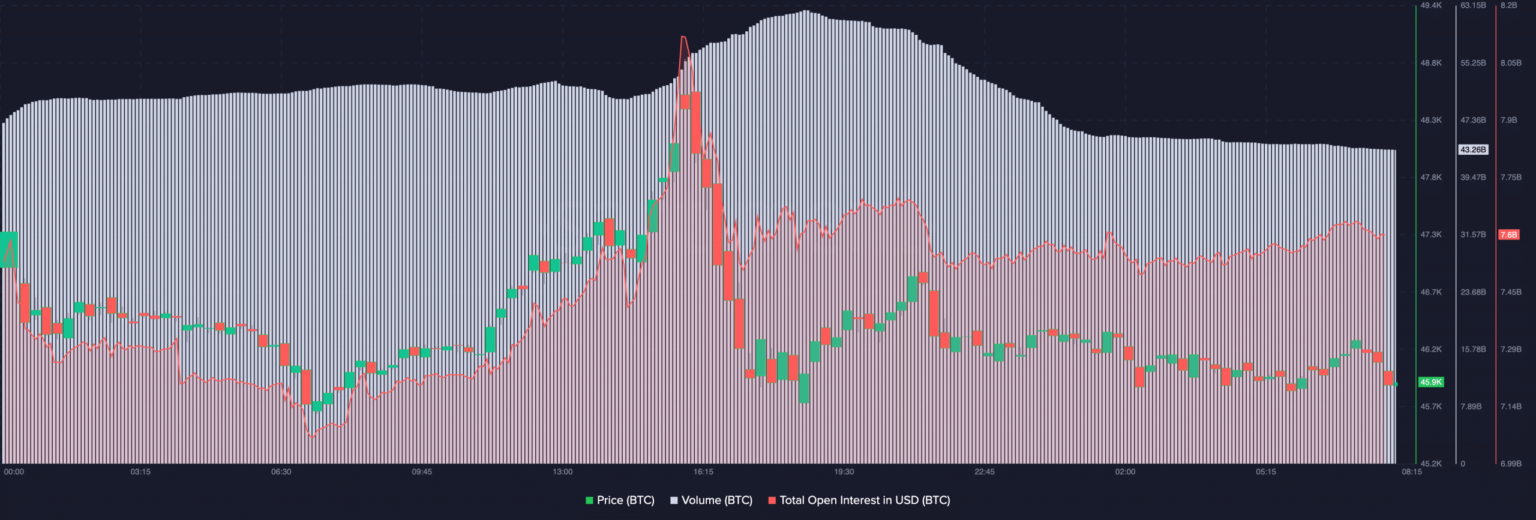

However, the ETFs’ first day of live trading took place on January 11. This brought with it an increase in volatility for BTC. Within the first hour, Bitcoin rose from $47,000 to $49,000.

But it didn’t take long for the coin to erase all its gains and fall below $46,000.

At the time of writing, Bitcoin’s price changed hands to $46,029, indicating that the initial storm has calmed. On the same day, AMBCrypto noticed that Bitcoin volume increased. At one point, data from the chain showed volume rising to $62.07 billion.

The volume shows the number of coins for all transactions on the network. This means that there was a lot of buying and selling in BTC during the period.

However, it didn’t take long for volume to drop below $50 billion. This indicates that interest waned within a short period of time. This idea was also confirmed by the Open Interest (OI) in BTC.

Source: Santiment

The shorts are wiped out and it could be the lung job

As for the price action, the reject in OI and volume implies that the downtrend became weak. If both metrics continue to decline along with Bitcoin price, a return to upside may be possible.

In this case, Bitcoin might not fade and return to $48,000 to start.

Moreover, a look at the liquidation levels showed that Bitcoin was heading towards the magnetic zones as it rose to $49,000. For context, liquidation levels are estimated price levels at which a liquidation event could occur.

Using Hyblock Capital’s data, we found that the price was moving in that direction due to the high liquidity there. Also, traders with short positions with high leverage would have activated their Stop Loss at that time.

Read Bitcoin’s [BTC] Price forecast 2024-2025

However, the bias has changed, as indicated by the Cumulative Liquidation Levels Delta (CLLD). At the time of writing, long positions with high leverage were at risk of liquidation.

Source: HyblockCapital

This was because the Bitcoin price had fully recovered and the CLLD had turned positive. But if the BTC price falls sharply and the CLLD moves in the negative direction, a return to the upside can be confirmed.