- Bitcoin’s halving in 2024 is currently dividing sentiment

- Anthony Scaramucci believes in the adoption curve and the potential of BTC as a mainstream asset

The D-day has finally arrived: Bitcoin’s [BTC] Halving in 2024. However, despite the excitement, the highly anticipated event has divided the public into two camps: those who expect major corrections and those who expect BTC to rise by +10x.

Sentiment around Bitcoin has been mostly divided over the past two weeks due to the crypto’s turbulent move up the charts. For example, at the time of writing, its value was estimated at just over $62,000. This happened within six hours of Bitcoin falling below $60,000 due to geopolitical tensions between Israel and Iran.

However, price movement aside, the question remains: is Bitcoin a safe haven?

Anthony Scaramucci’s Bullish View

Anthony Scaramucci, founder of SkyBridge Capital, sheds light on BTC’s atypical price movements in a recent interview with CNBC said:

“Bitco is on an adoption curve.”

He added,

“You won’t see this inflation hedge, or a mark-up of value as other experts say, until you have over a billion users. So right now it’s going to be a lot more volatile than people want.

With this perspective, Scaramucci then tried to suggest that people will view Bitcoin as a risk-on or risk-off asset until it reaches a certain level of acceptance.

Bitcoin supply and demand expectations

As expected, Bitcoin’s halving has led to conflicting expectations of a shift between supply and demand, which runs counter to recent trends. Instead of an increase in selling pressure, miners are reportedly reducing outflows. This unexpected development signals a potential near-term market boost, challenging conventional predictions and introducing a unique angle to the halving story.

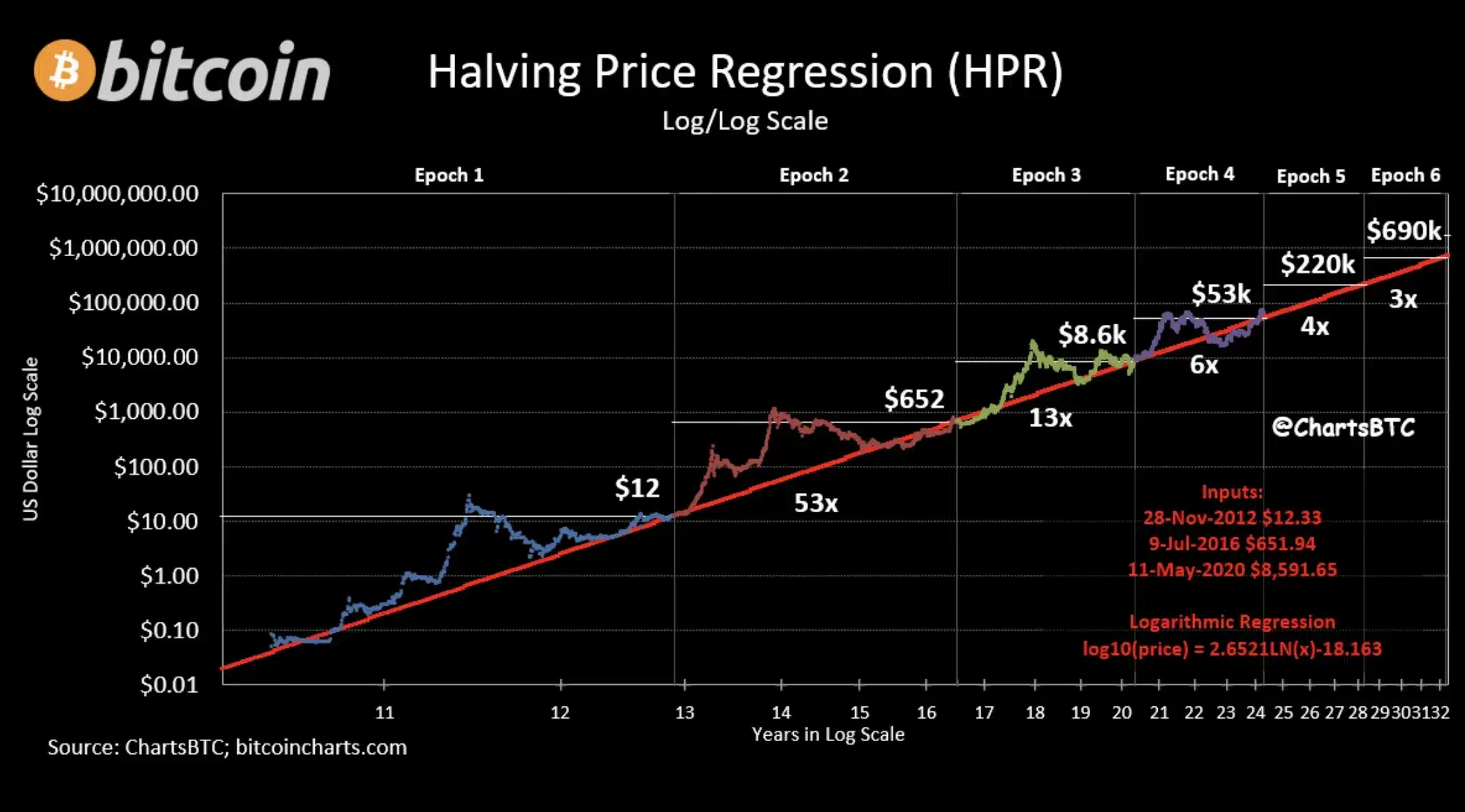

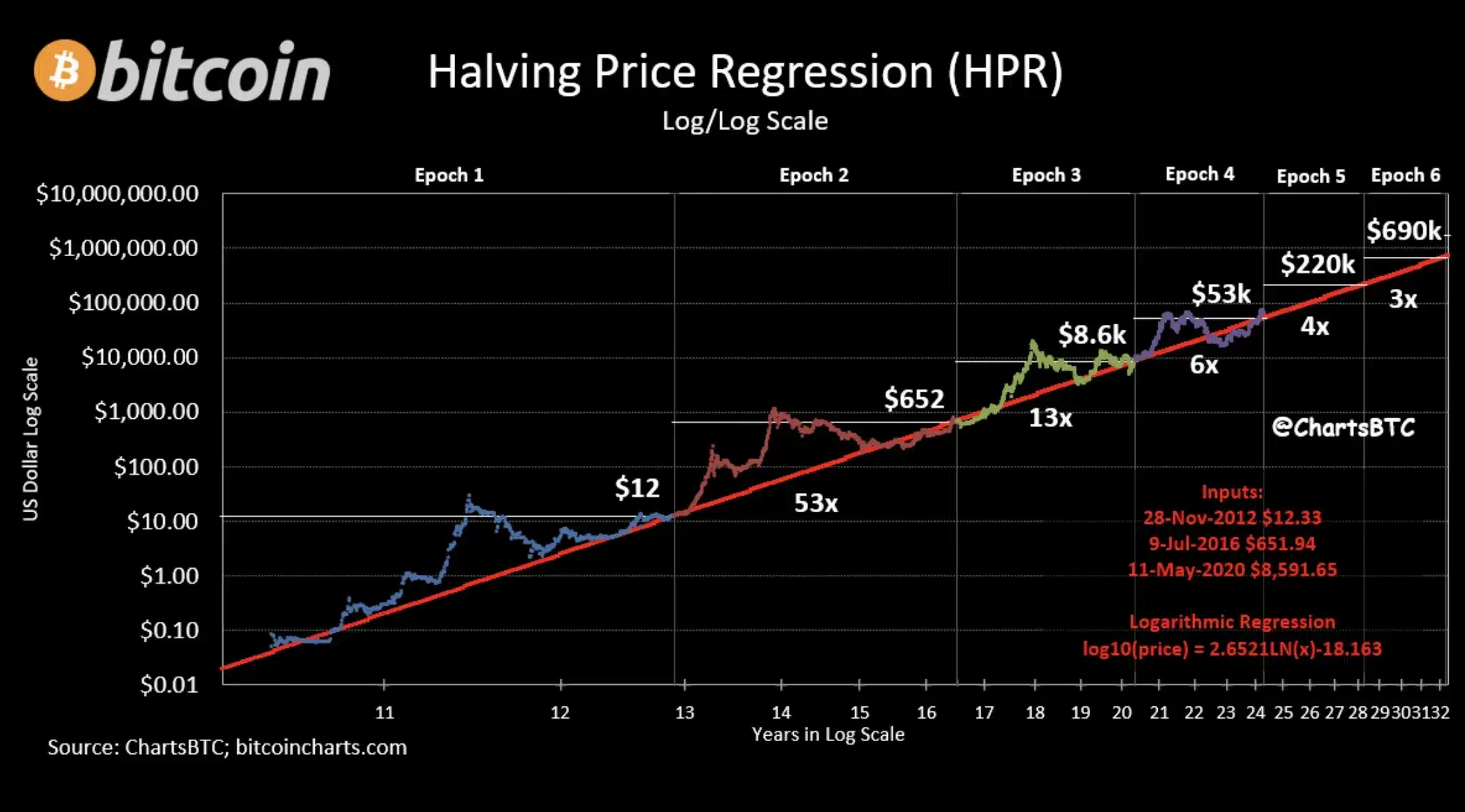

Historical data, as highlighted by @ChartBTCcan be used to demonstrate Bitcoin price increases following previous halving events.

Source: Twitter/ChartsBTC

Anthony Pompliano, founder and partner of Pomp Investments, says the same in a recent publication conversation with CNBC, claimed,

“Ignore the noise of short-term price movements.”

That said, Bitcoin can never go too far with positive sentiments critics as Peter Schiff believes,

“All week, Bitcoin pumpers were making excuses for Saturday’s Bitcoin sell-off. They claimed that Bitcoin was the only asset anyone could sell as all other markets were closed. Well, all the markets are trading now and Bitcoin is being killed again. Bitcoin pumpers have no more excuses.”

Bitcoin’s Future Prospects

In conclusion, despite concerns about Bitcoin, Scaramucci expects BTC to become a mainstream portfolio asset, potentially rivaling the market cap of gold.

Ergo, while he acknowledged short-term price fluctuations due to external factors such as wars, he maintained a long-term bullish perspective on BTC.

“The Bitcoin price could rise around $200,000.”