The second quarter in crypto was marked by Bitcoin (BTC) and Ethereum (ETH) downtrend, BTC miners selling off their reserves at a rapid pace and layer-2 blockchain activity surging four times, according to the “On -chain Insights” newsletter from IntoTheBlock. .

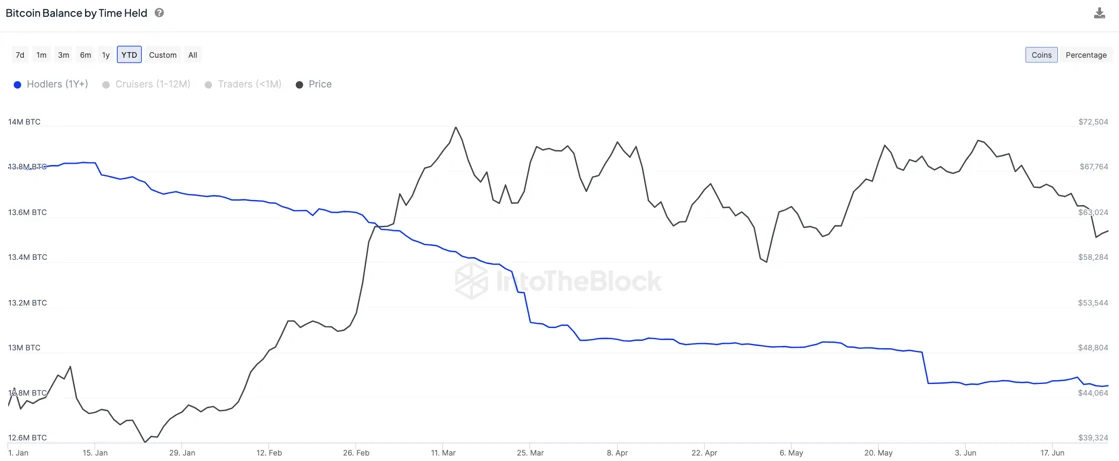

Bitcoin’s price fell 12.8% after the fourth halving on April 20, and an expected price increase due to a supply shock failed to materialize. IntoTheBlock analysts shared that this is likely due to long-term holders taking profits in 2024.

Moreover, in June alone, miners offloaded more than 30,000 BTC, amounting to almost $2 billion. Again, the halving could be related to this move, as profit margins for miners have declined since then.

In contrast, Ethereum saw a modest decline of 3.1%, a performance made possible by the adoption of spot ETH exchange-traded funds in the US, the analysts pointed out. This event increased the price of Ethereum by more than 10% as these investment products are expected to attract significant investments, mirroring the inflows seen in Bitcoin ETFs.

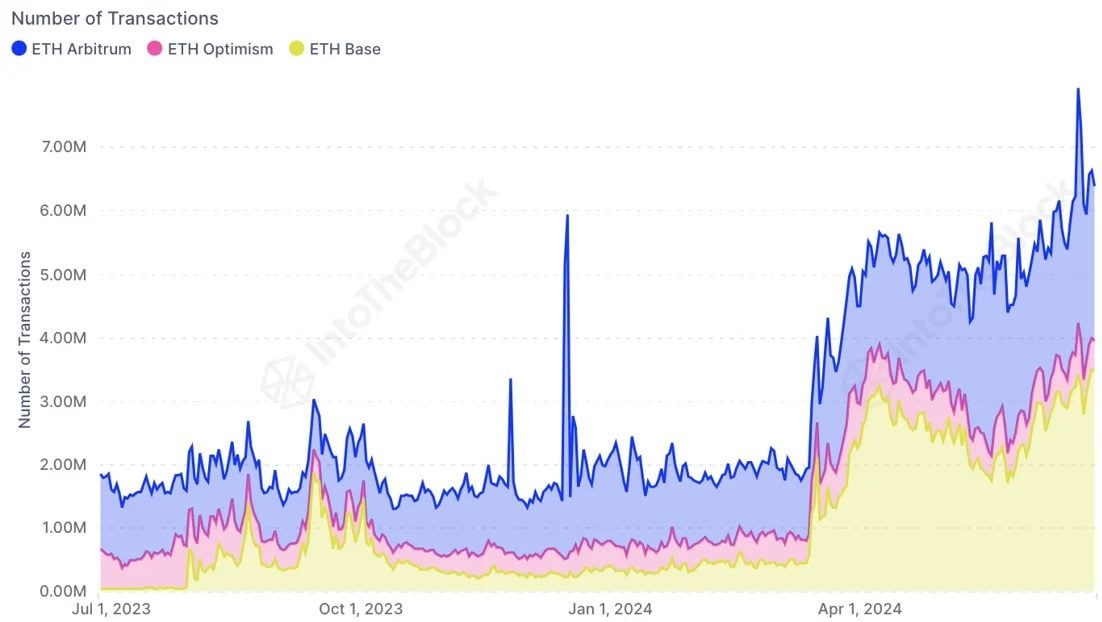

Furthermore, Ethereum’s landscape was noticeably different, with an increase in transactions on layer 2 blockchains such as Arbitrum, Base, and Optimism, following the integration of EIP-4844.

This development introduced the ‘blobs’, which significantly reduced transaction costs for layer 2 blockchains and encouraged greater on-chain activity. Therefore, this potential set the stage for long-term network benefits despite a short-term decline in fee revenue.