- Recently, $32 million worth of ETH was delisted from the Binance exchange.

- Whale trades increased as supply on the exchange fell.

Based on a recent analysis, an Ethereum [ETH] Whale transferred a significant amount of ETH from an exchange. In light of this recent transaction, what is the status of ETH’s supply on exchanges?

Read Ethereum’s [ETH] Price forecast 2023-24

Ethereum Whale Continues Withdrawal

A recent Lookonchain analysis found that an Ethereum whale has been actively removing ETH from the Binance exchange. According to data from Etherscanthis whale withdrew 8,968 ETH on November 4 and another 8,618 ETH on November 5.

This clever whale withdrew another 8,618 $ETH ($16 million) from #Binance 4 hours ago.

The whale dropped off 31.8 million people $USDT Unpleasant #Binance and withdrew 17,316 $ETHthe purchase price is ~$1,836.https://t.co/OLrmsm7kAi pic.twitter.com/WHvgeaR5At

— Lookonchain (@lookonchain) November 5, 2023

With these moves, the total withdrawal over the past two days amounted to 17,316 ETH. At the time of writing, the Whale’s total withdrawal from the stock market was almost $32 million.

Analyzing Ethereum Offers at trade fairs

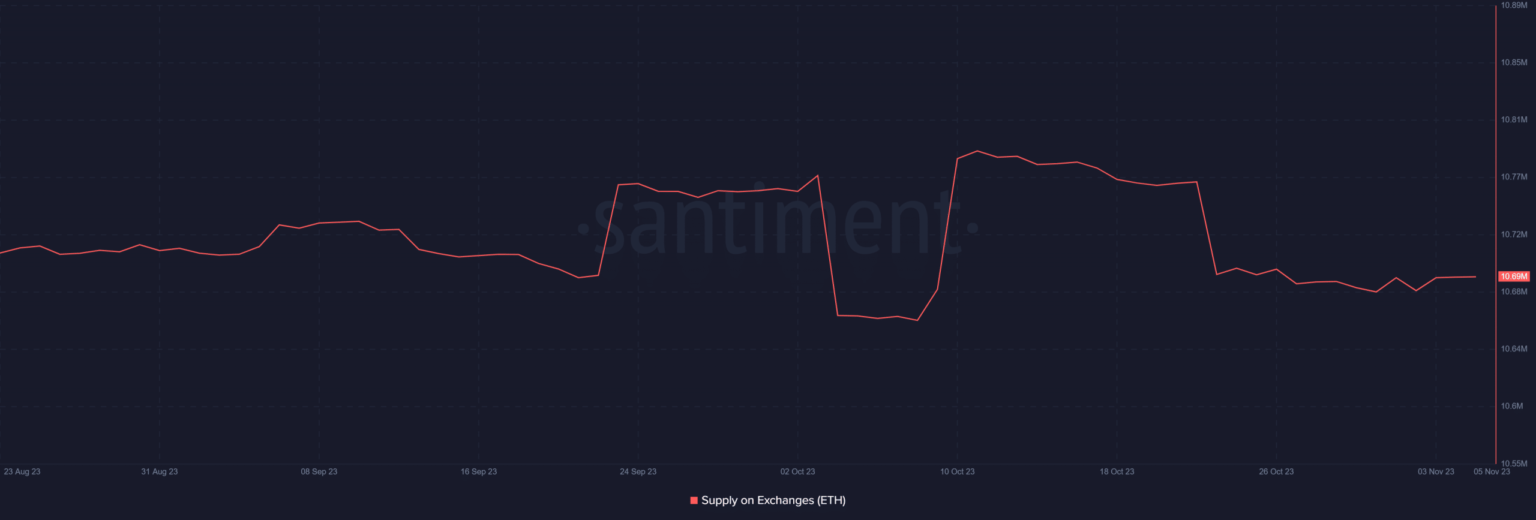

AMBCrypto’s analysis of Ethereum’s exchange offerings revealed a recent decline in the volume of assets held on exchanges. The chart indicated a notable decline that began around October 23rd.

During this period, the supply dropped from over 10.7 million to approximately 10.6 million ETH.

Furthermore, the drop suggested that more ETH was being withdrawn from the exchanges. What this could mean is greater confidence in continued price appreciation and the desire to accumulate shares.

Furthermore, the supply on the exchanges remained at approximately 10.6 million ETH at the time of writing. However, the graph also showed that it was approaching the 10.7 million mark.

Source: Santiment

Furthermore, AMBCrypto’s analysis of from Glassnode The Exchange Netflow chart revealed a consistent trend of outflows from exchanges. The chart showed that the volume of assets leaving stock exchanges had exceeded inflows in recent days.

This data underlined the magnitude of drawdowns that Ethereum has experienced across exchanges. It also showed a strong movement of ETH away from these platforms.

Whale transactions are increasing

Further analysis of Ethereum whale transactions exceeding $100,000 and $1 million on Santiment showed a notable increase in activity. When examining transactions over $100,000, the data shows a total of 179 such transactions.

Realistic or not, here is the market cap of ETH in terms of BTC

The numbers reflect a significant increase in this category of whale activity in recent times.

Source: Santiment

Additionally, the $1 million transaction category also sees a significant level of activity. At the time of writing, approximately 12 transactions have already been registered. These numbers suggested high levels of engagement and increased activity among Ethereum whales.