- ETH price volatility has fallen to its lowest point in a decade.

- The correlation with BTC can make the price stagnate for a while.

In its 10-year history, Ethereum’s [ETH] volatility has fallen to its lowest level, data from IntoTheBlock revealed. At the time of writing this was 16%.

Ethereum volatility is at a record low.

Throughout the history of ETH, a general trend of decreasing volatility can be observed as the asset grows in popularity. Nevertheless, the levels currently being experienced are quite extraordinary.Also note that volatility generally sees… pic.twitter.com/8gl5zKnKUT

— IntoTheBlock (@intotheblock) August 11, 2023

Read Ethereum’s [ETH] price forecast 2023-24

Like bitcoin [BTC], ETH is notorious for significant volatility in its price. However, there has been a noticeable compression of price volatility since November 2022. A closer look at price movements revealed that ETH has traded within the $1100 and $2000 price ranges since then.

An asset may witness volatility compression as it becomes more established and accepted by the mainstream. This can reduce volatility as investors gain confidence in the asset’s future.

When a crypto asset experiences a drop in volatility, the price is less likely to fluctuate wildly. It boosts investor confidence, meaning the risk of losing money on ETH investments is minimised.

ETH may have become more popular among investors due to increased activity on Layer 2 (L2) scaling solutions last year. Layer 2 adoption growth and mild monetary tightening have helped ETH overcome severe price volatility over the past 12 months.

where to now?

According to IntoTheBlock,

“Volatility generally spikes, both upwards and downwards, with periods of low volatility usually lasting no longer than a month.”

An assessment of ETH’s on-chain activity suggests that the altcoin is poised for an upward rally.

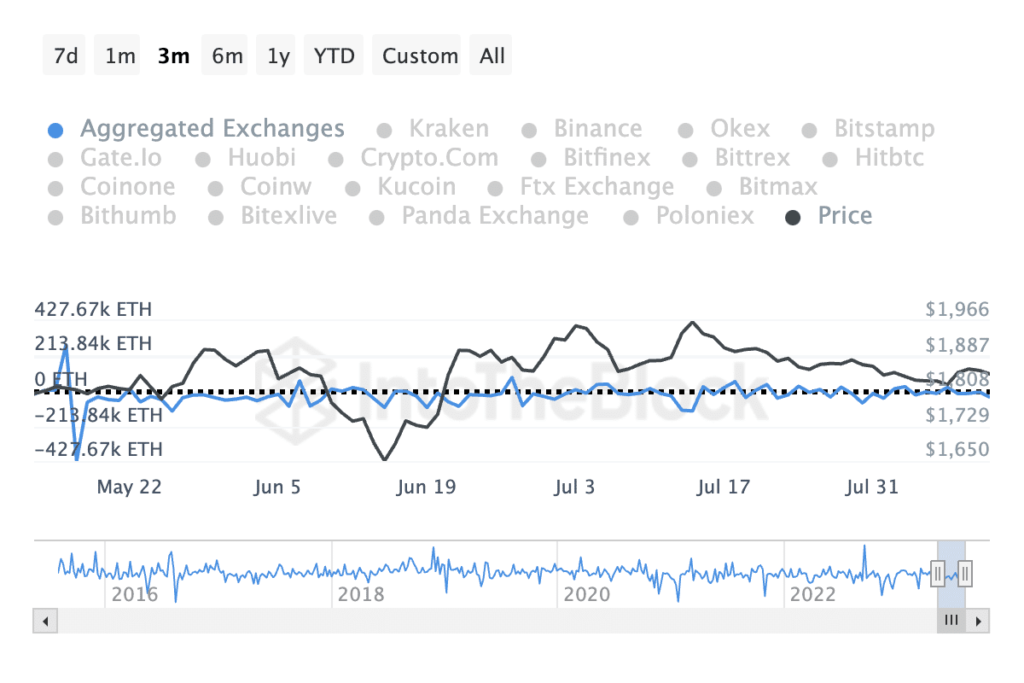

Despite limited price movement in recent months, ETH exchange activity revealed fewer sell-offs. This means that the coin’s investors had largely refused to sell their holdings and instead held on. Per data from IntoTheBlockETH’s net flow has been mostly negative for the past 90 days.

The net flows indicator tracks how traders move their coins in and out of cryptocurrency exchanges. When the net flows of an asset are positive, it means more assets are being sent to exchanges for further sale. Conversely, negative net flows indicate an increase in accumulation.

At the time of writing, net flows of ETH were -39,980 ETH.

Source: IntoTheBlock

The reduced selloff occurred despite ETH trades being significantly profitable over the past three months. According to Sanitationrevealed ETH’s ratio of daily trade volume in profit to loss assessed on a 200-day moving average that, for every trade that produced losses during that period, 1.27 trades ended in profit.

Source: Sentiment

Is your wallet green? Check out the ETH Profit Calculator

While the drop in volatility coupled with the increased accumulation of ETH are positive signs, the price of ETH’s statistically significant positive correlation to BTC may be fixed. Since April, the king coin has been trading within the $29,000 and $32,000 price ranges, with significant resistance at $30,000.

Market sentiment also needs to improve. According to Santiment, ETH’s weighted sentiment has been mostly negative over the past 90 days.

Source: Sentiment