- Stablecoin volume on Ethereum dropped to $40 billion, indicating the potential to push the cryptocurrency into a bear phase.

- The MVRV Long/Short difference and holder sentiment showed that the price of ETH could rise.

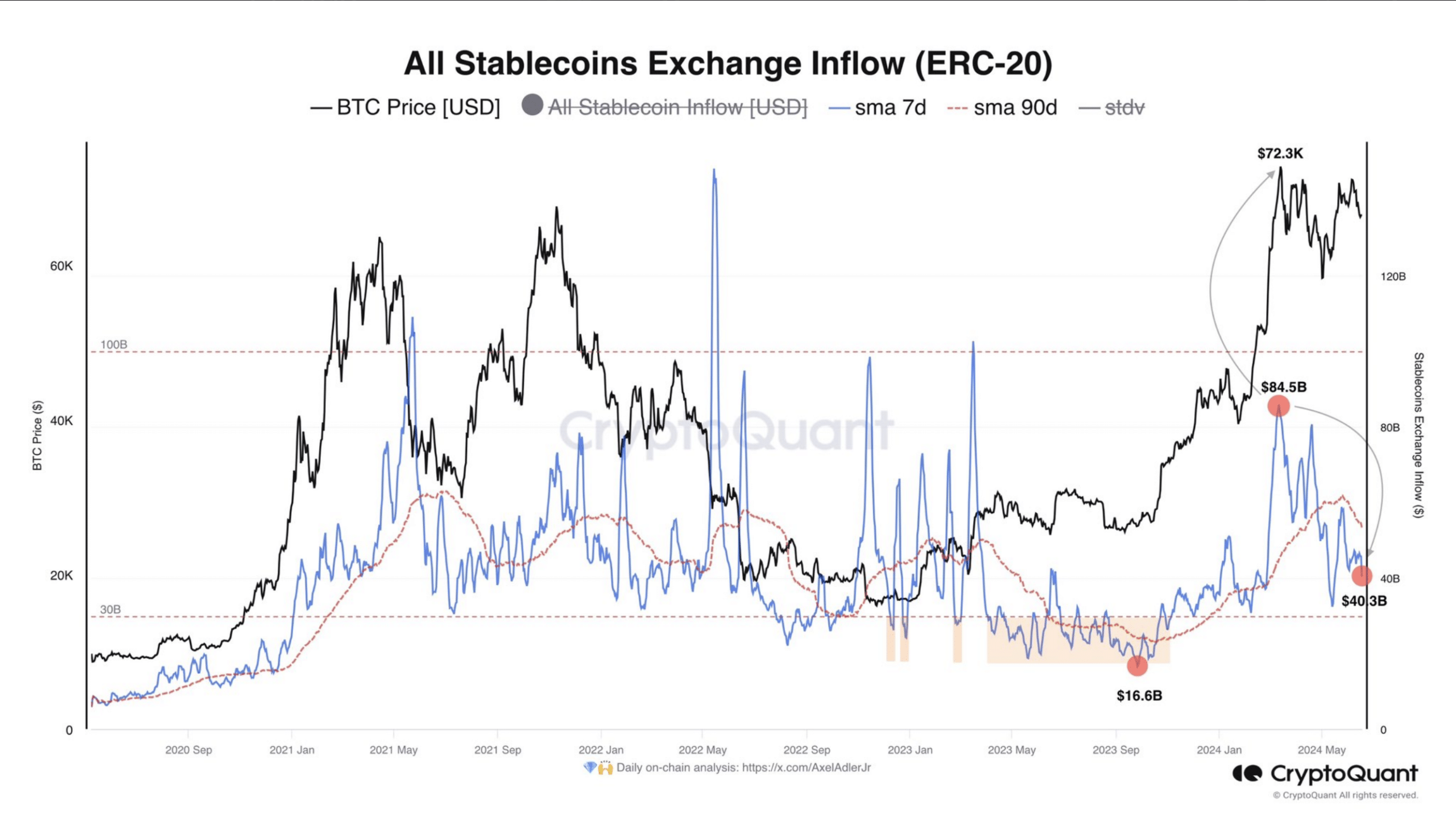

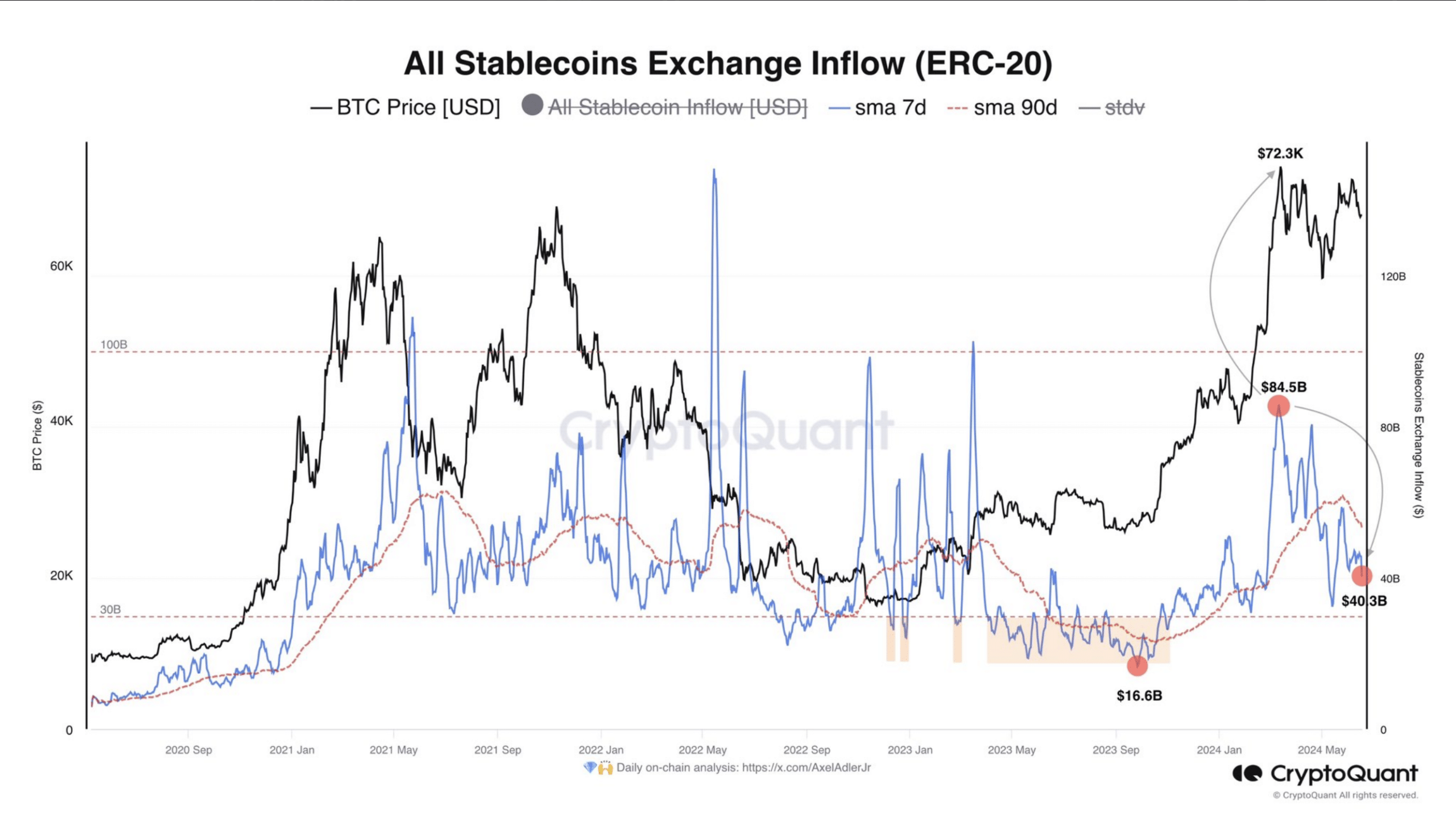

Stablecoin volume on the Ethereum [ETH] According to data from CryptoQuant, the blockchain has dropped from $84 billion to $40 billion. When the volume of stablecoins increases, it means that the demand for tokens on a blockchain can increase.

When this happens, it also strengthens the ecosystem’s native cryptocurrency. For Ethereum, the drop in volume indicates that most ERC-20 tokens are underperforming.

ETH holders don’t believe in bears

ERC-20 tokens refer to the fungible tokens created using the Ethereum blockchain. Historically, ETH falls into a bear market when stablecoin volume falls to $30 billion. So the risk was there.

Source: CryptoQuant

At the time of writing, the price of ETH was $3,517, marking a decline of 4.18% over the past seven days. While there have been predictions that the price would reach $4,000 again, that hasn’t happened in weeks.

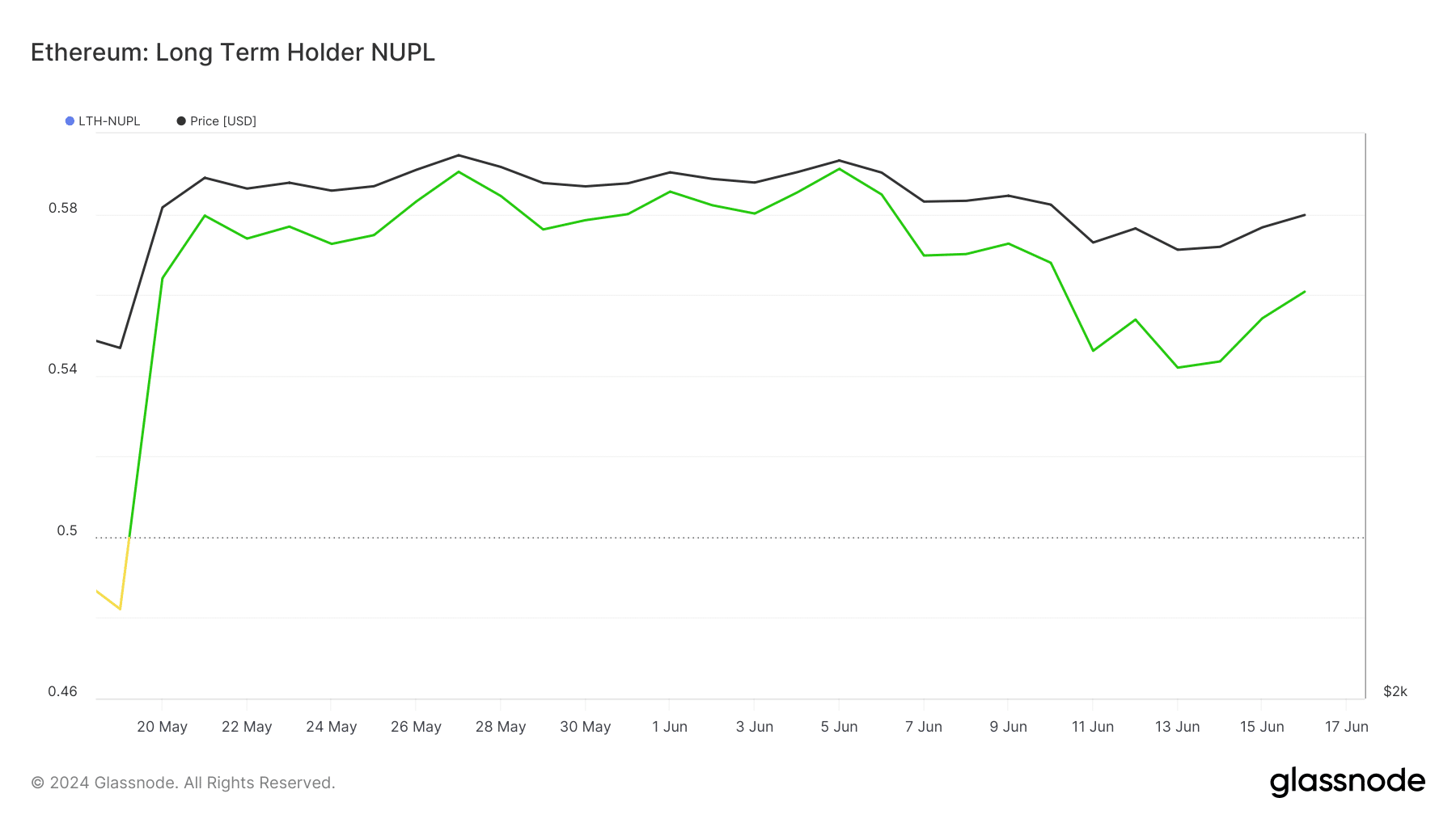

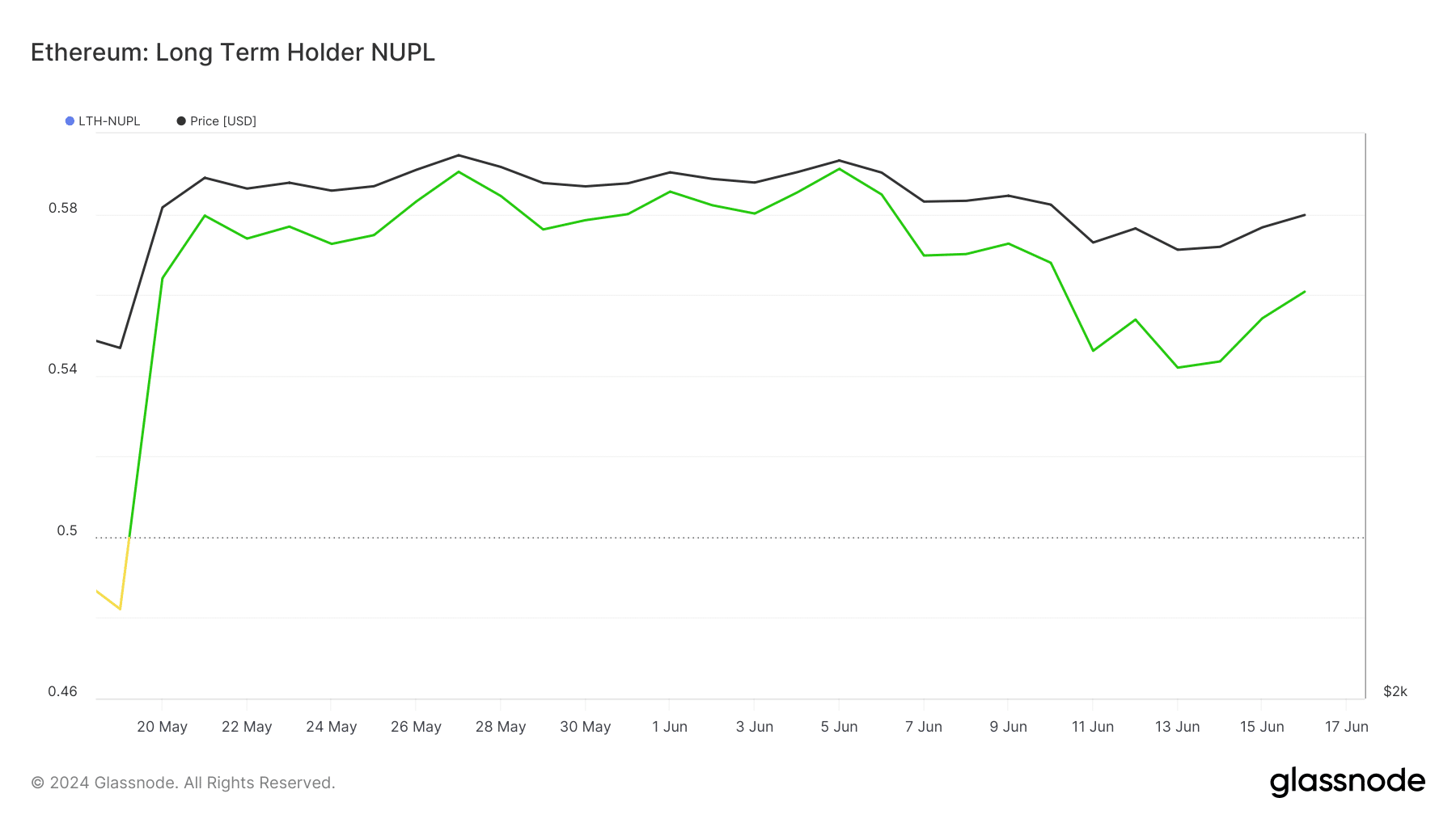

In addition, AMBCrypto looked at the LTH-NUPL. LTH-NUPL stands for Long-Term Holder-Net Unrealized Profit/Loss. This metric assesses the behavior of long-term owners.

Normally the statistic takes into account UTXOs with a lifespan of at least 155 days. According to Glassnode, Ethereum’s LTH-NUPL was in the belief zone (green).

This indicates that the holders of the token are convinced that the price could rise.

If this belief remains the same in the coming weeks, ETH may not enter a cycle. Instead, the token’s price, supported by demand, could reach a new all-time high.

Source: Glassnode

Will rising volatility cause the price to rise?

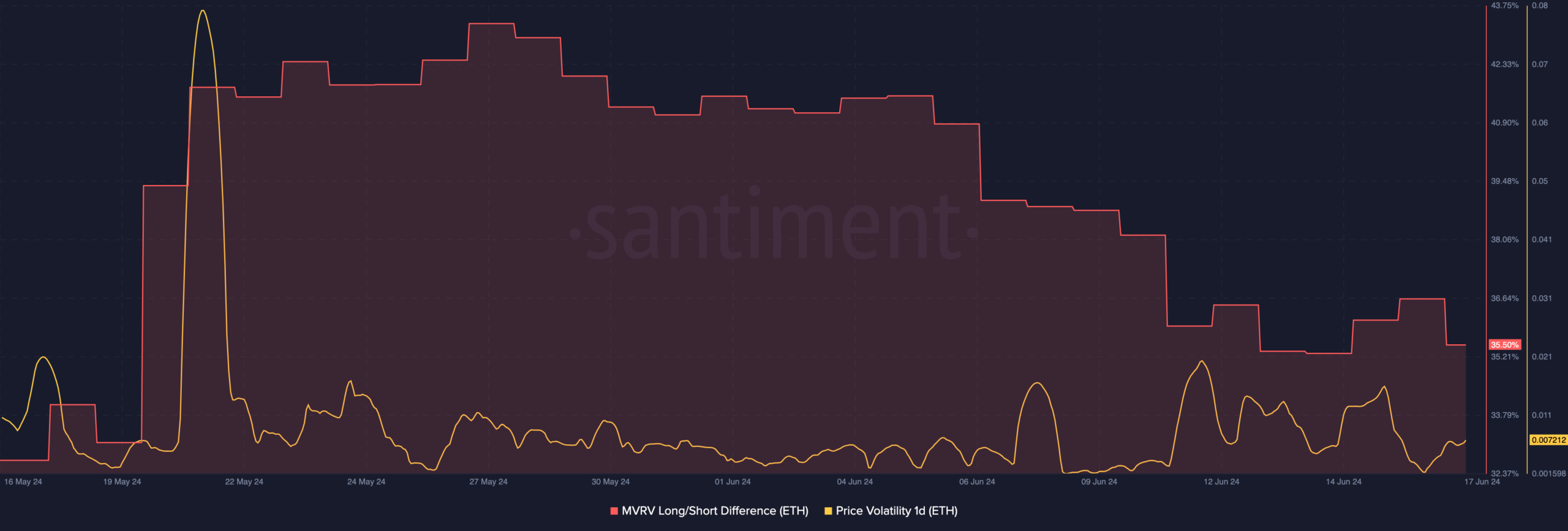

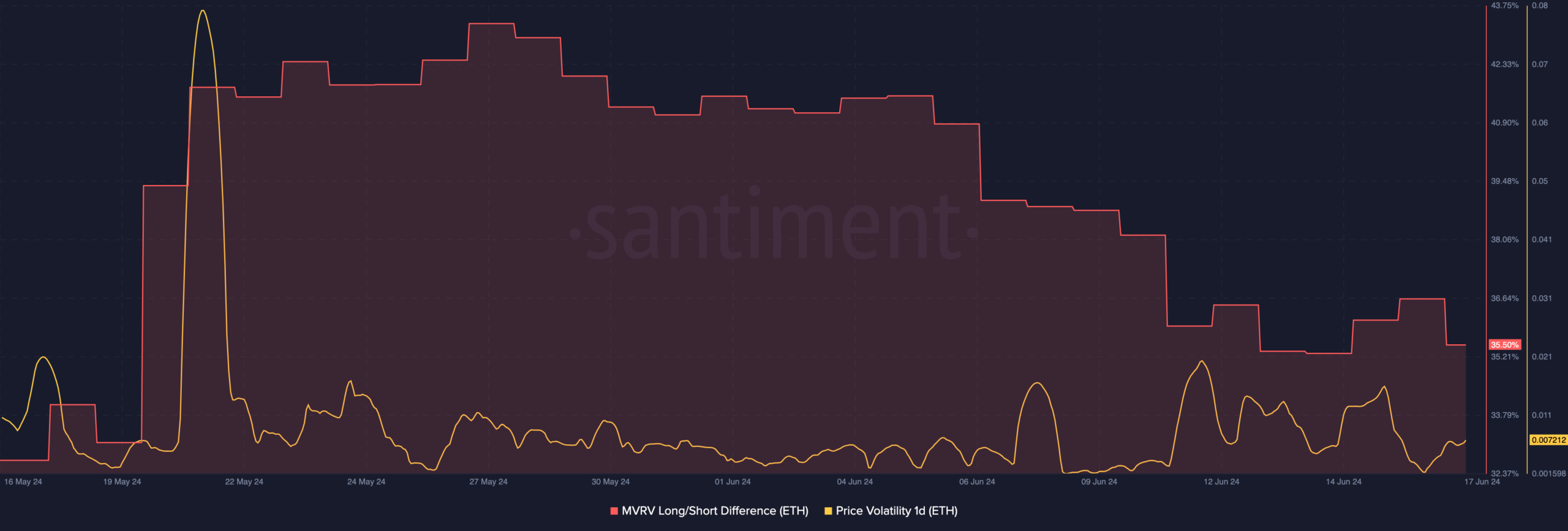

The long/short difference between market value and realized value (MVRV) is another metric that can reveal whether ETH is in a bear zone or not.

When the value of the metric falls into the negative territory, it means that a cryptocurrency may have fallen into the bear market.

But as long as the metric remains positive, the cryptocurrency is in a bull phase. At press time, AMBCrypto noted that the MVRV long/short difference was 35.50%.

While this was a decline from last month’s value, it was a sign that ETH has done just that did not succumb to the bear zone. However, you can’t deny that this implies that the price of ETH could fall.

But if it does, the cryptocurrency’s value is unlikely to fall below $3,000. If this remains the case, ETH may have a chance to retest $4,000 and above.

Meanwhile, one-day volatility is starting to increase. Volatility measures how quickly the price can move in different directions. When volatility increases due to buying pressure, the price can rise to incredible numbers.

Source: Santiment

Read Ethereum’s [ETH] Price forecast 2024-2025

On the other hand, high volatility and selling pressure will lead to correction. For ETH, it remains uncertain where the price will go.

However, something seemed almost certain: Holders might not give in to the bearish demand driving the price lower than expected.