Este Artículo También Está Disponible and Español.

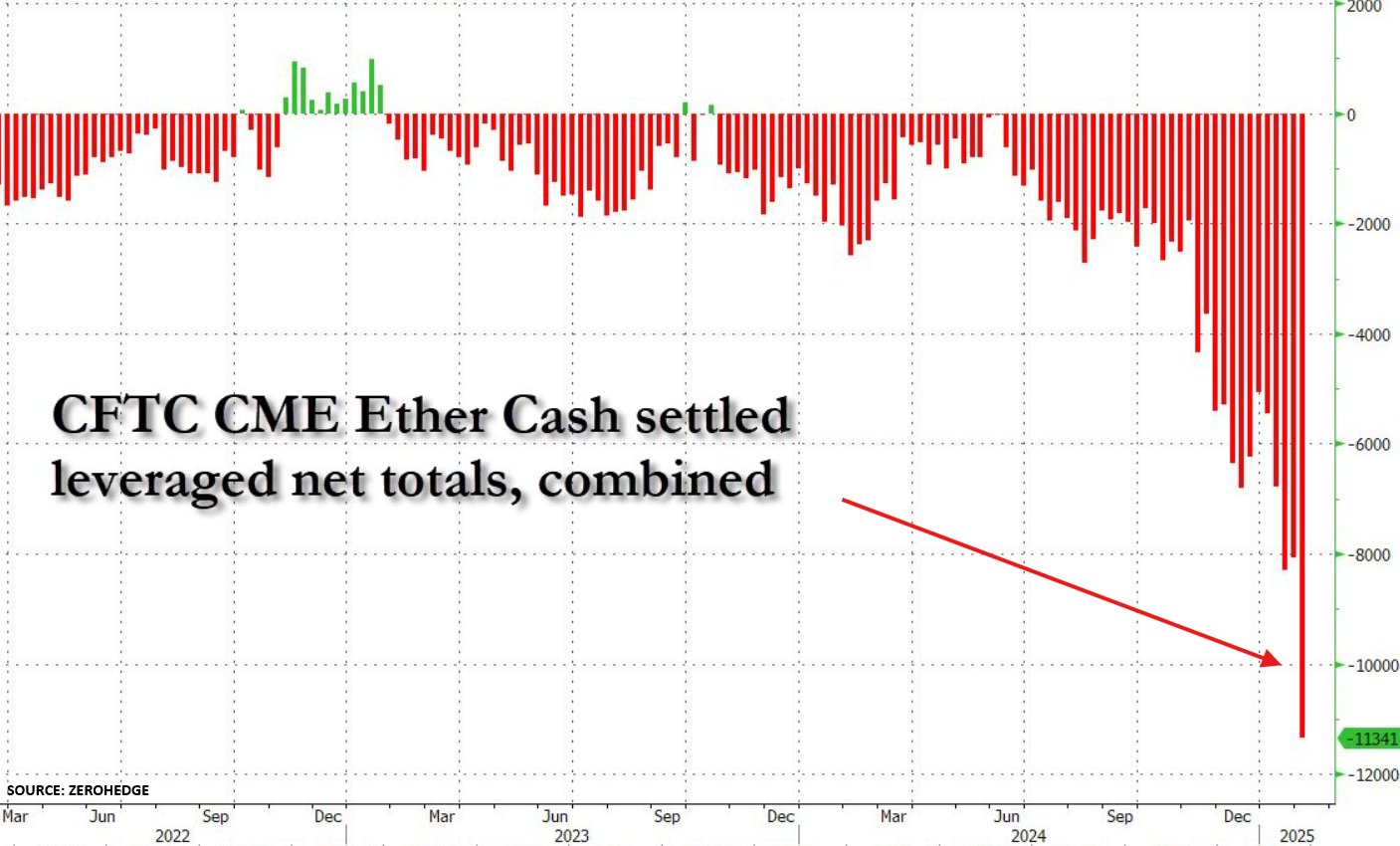

Ethereum (ETH), the second largest cryptocurrency of the reported market capitalization, is confronted with an unprecedented short selling of hedge funds. It is remarkable that short positions in ETH have risen by 500% since November 2024, which points to increased bearish sentiment to the digital active.

Institutional investors lose faith in Ethereum?

According to a recent after On X by the Kobeissi letter, the Ethereum price witnesses increasing challenges, because the short positioning in the cryptocurrency has recently been balloon. Eth -short positions in particular have risen by 40% in the past week, while they have risen by 500% in the last three months.

It is worth emphasizing that this is the highest level ever that Wall Street funds have been short Ethereum. Earlier this month, the cryptomarkt received an indication of this bearish ETH positioning, because the digital active in 60 hours crashed 37% in the midst of the proposed trading rates of Donald Trump on Canada, China and Mexico.

Related lecture

Interestingly, capital flows to Ethereum exchange-exchange funds (ETF) were considerably high in December 2024. In just 3 weeks, ETFs attracted More than $ 2 billion in new funds, with a record -breaking weekly inflow of $ 854 million.

However, the positioning of hedge funds on ETH suggests that they do not have very confidence in the price view of the cryptocurrency. Various factors can play for the decreasing importance of institutional investor in ETH.

For Instance, ETH is Currently Trading Almost 45% Below its Current All-Time High (ATH) or $ 4.878 Recorded Way Back in November 2021. In contrast, Bitcoin (BTC) HAS had A Stellar 2024, Hitting Multiple New Ath, and Commanding A market capitalization that is almost six times greater Then that of Eth.

The Kobeissi letter attributes ETH’s current matte price performance to potential “market manipulation, harmless crypto -hagen, to bearish prospects on Ethereum itself.” The market commentator, however, indicates that these excessive Bearish -by -views can set ETH for a short squeeze. They add:

This extreme positioning means that large swings as they occur more often on 3 February. Since the beginning of 2024, Bitcoin ~ 12 times as much has risen as Ethereum. Has a short squeeze been set to close this gap?

Eth Short Squeeze to initiate altea season?

A short squeeze on ETH could teleport The price up to $ 3,000, or even $ 4,000. However, according to For seasoned crypto analyst Ali Martinez, ETH has to defend the support level of $ 2,600 to climb higher.

Related lecture

Recent reports indicate that ETH is probably soilFreeing up the road for a trend removal to the benefit. Another report from Steno Research suggest BTC will probably perform better in 2025, with potential goals as high as $ 8,000.

That said, there are regular worries about the Ethereum Foundation dumping Eth. At the time of the press, ETH acts at $ 2,661, an increase of 0.1% in the last 24 hours.

Featured image of Unsplash, graphs from X and TradingView.com