- Sellers have adopted Ethereum’s price direction, suggesting the price could fall below $3,000.

- The one-day Realized Cap fell, indicating that the market could lose confidence if the trend continues.

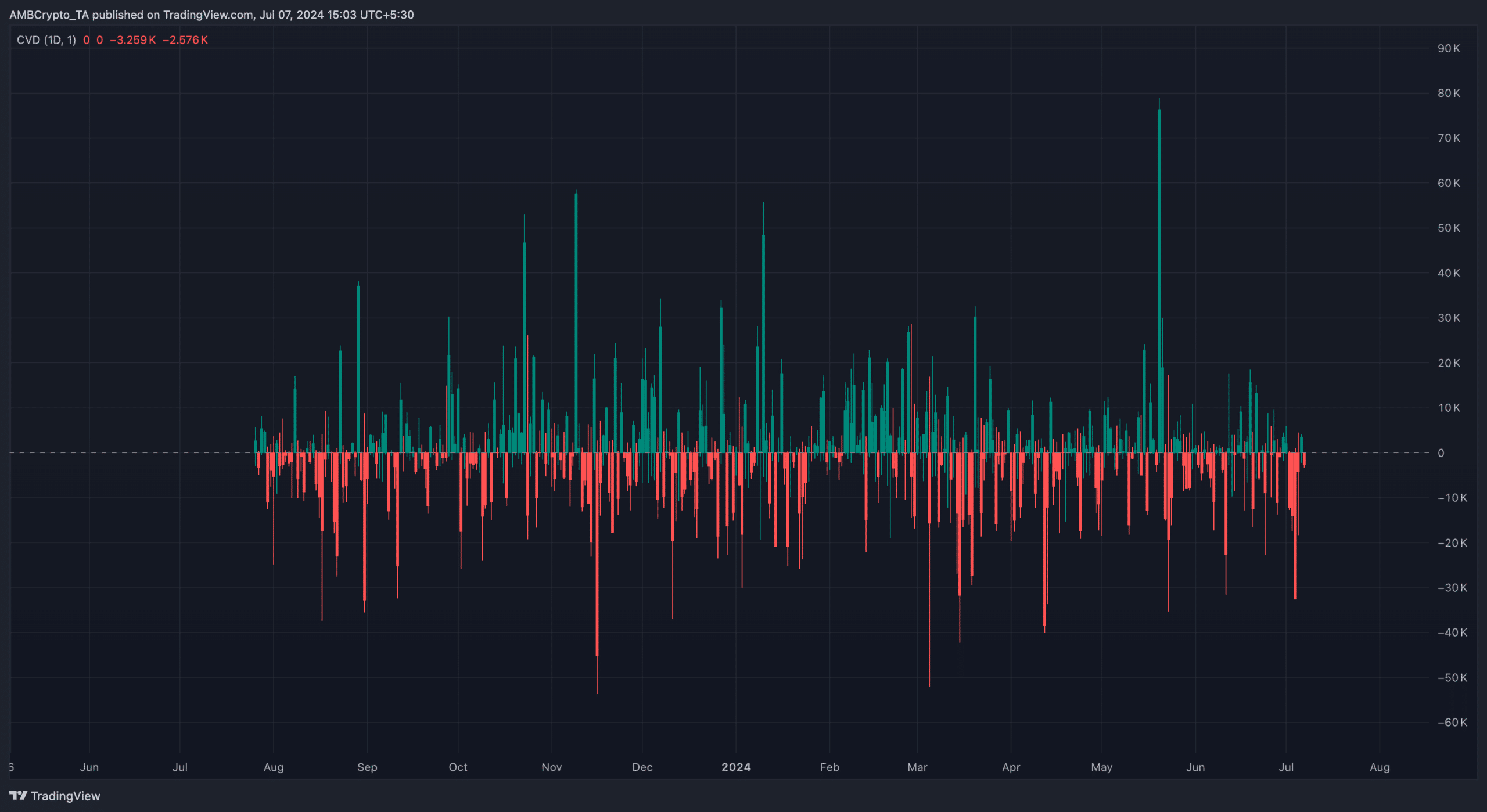

The price of ether [ETH] There is a risk that the price will fall below $3,000 for the second time in a few days. This was according to the data that AMBCrypto obtained from the Cumulative Volume Delta (CVD).

On the daily ETH/USD chart the spot had CVD dropped to the negative area. The CVD tracks the difference between the buying and selling volume of a cryptocurrency over time.

Buyers are struggling to keep up the pressure

When the value is positive, more holders buy than those who sell. If this is sustained, it means the cryptocurrency’s price could rise in the short term. However, if it is negative, it means that sellers are dominant.

Source: TradingView

In a situation like this, it becomes difficult to increase prices. At the time of writing, the price of the altcoin was $3,012. Previously, ETH had attempted to reverse $3,100, but the bears rejected the move.

However, aside from the CVD, other statistics showed that it may take some time for the cryptocurrency to fully recover.

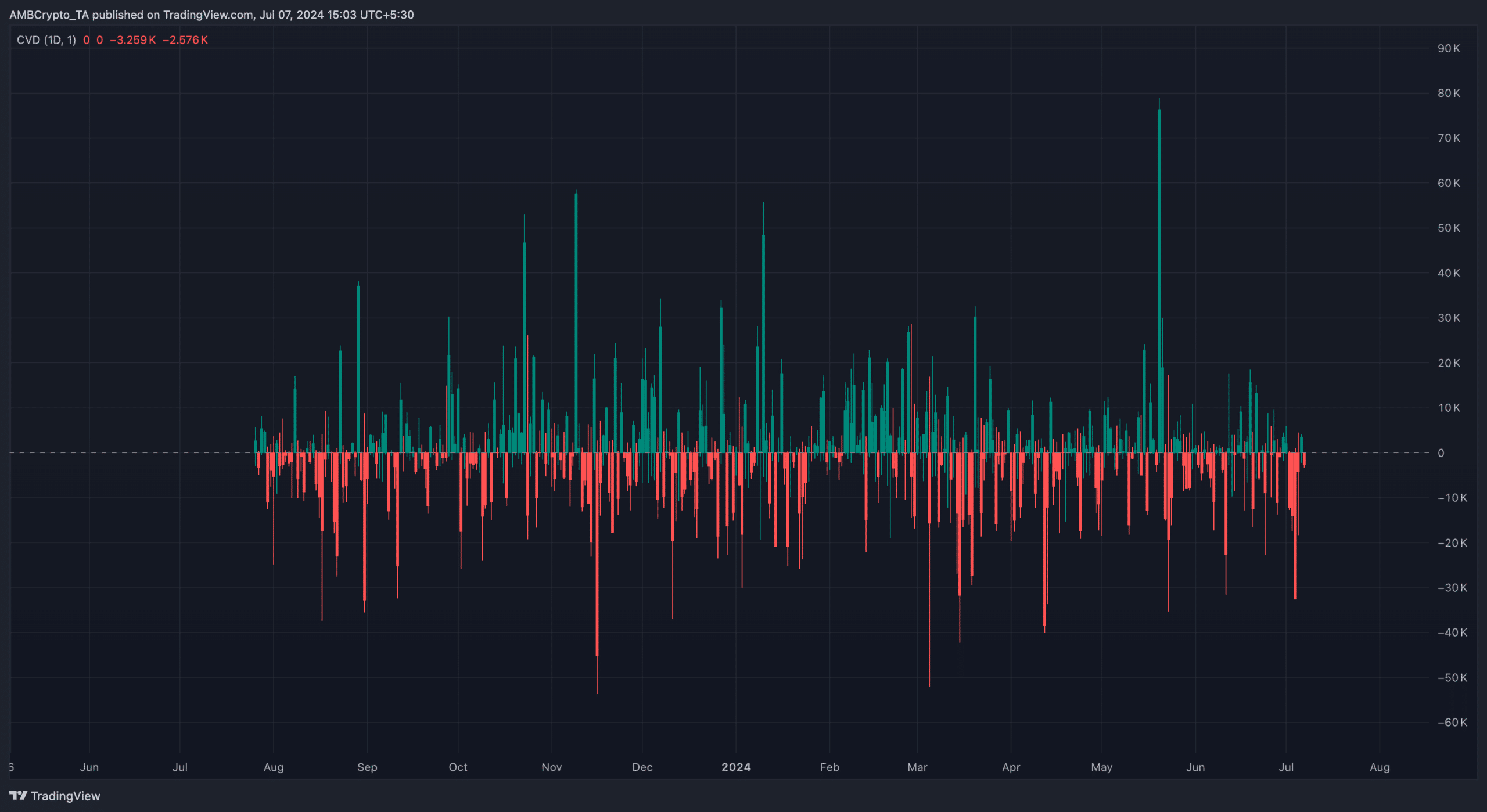

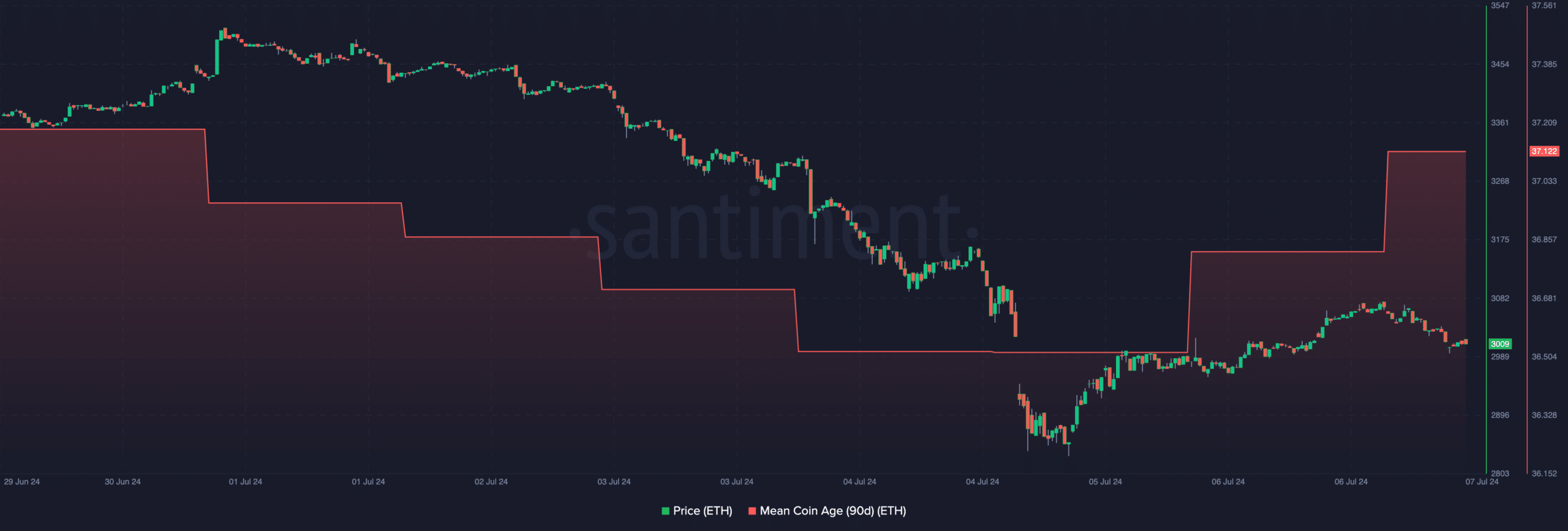

One such dataset is the Mean Coin Age (MCA). The MCA is the average age of coins on a blockchain. When it rises, it means old coins are coming back into circulation, increasing the likelihood of a sell-off.

But a decrease in coin age implies that holders will refrain from selling. Instead, they choose to keep their assets in non-custodial wallets.

More old coins, more problems

At the time of writing, ETH’s 90-day MCA had risen from 36.50 to 37.12. This increase implies a increase in trading activity involving the cryptocurrency.

Since the price fell from its July 6 value, this implies that most of the stock ended in a sell.

If this continues, the price of ETH could drop below $3,000. And if the buying pressure doesn’t match the rise, the price could fall to $2,881, just like on the 5th.

Source: Santiment

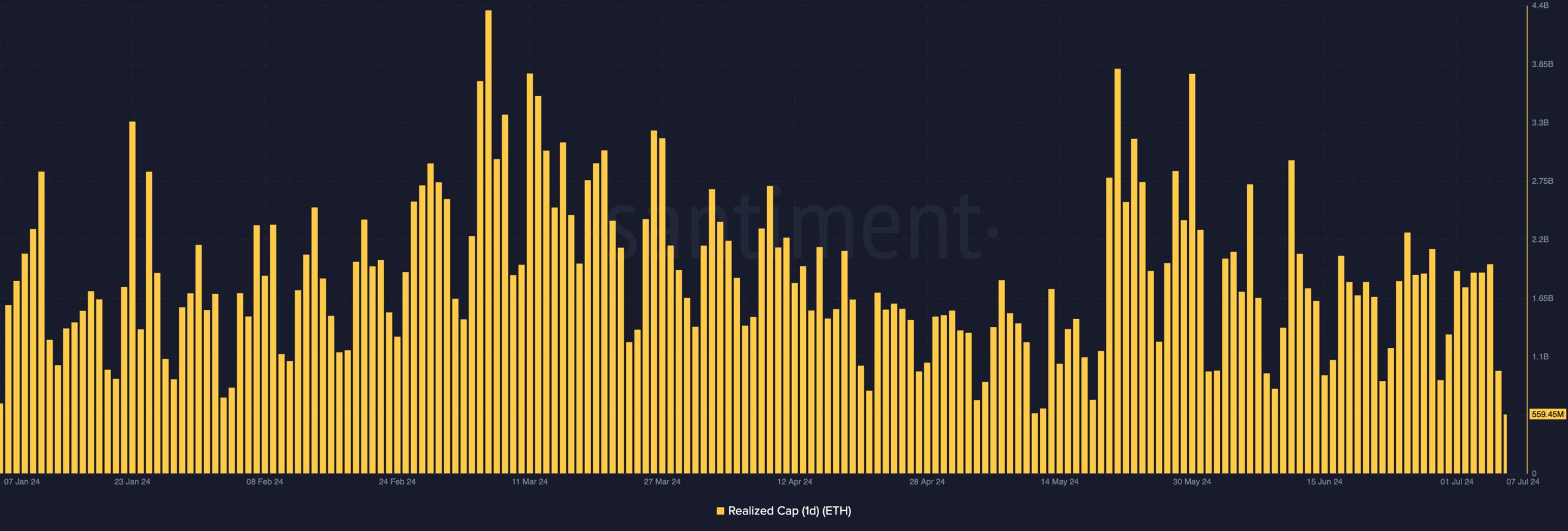

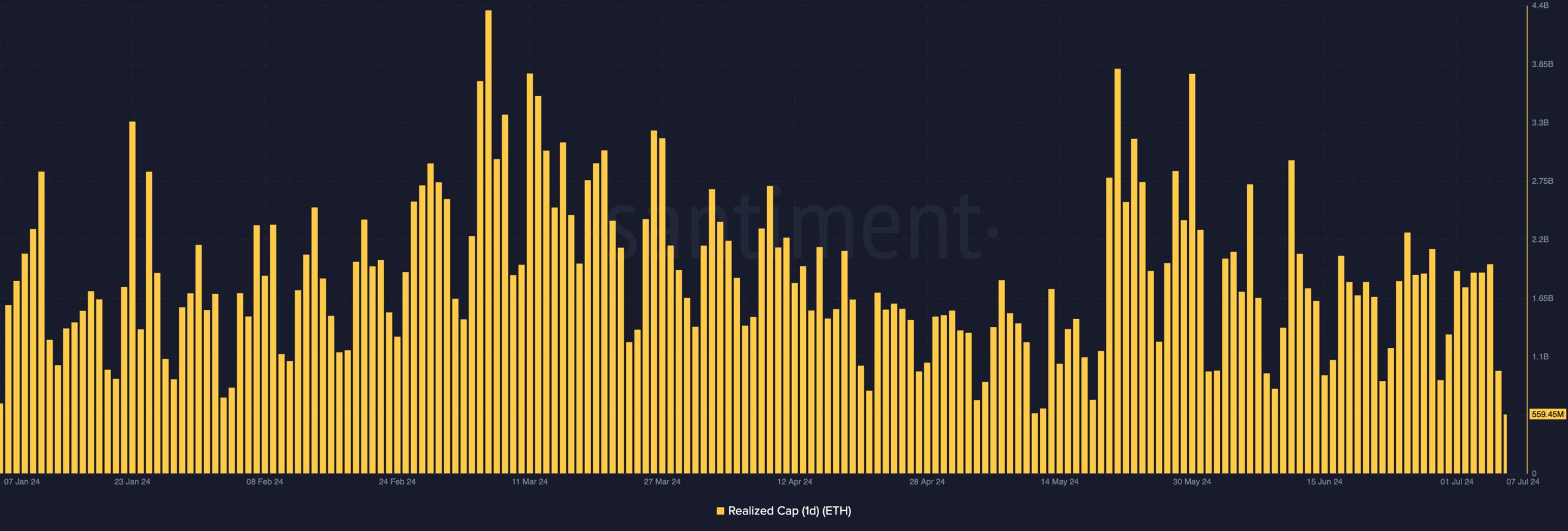

In addition to the above, the Realized Cap matched the forecast. Realized Cap indicates the value of each coin when it was last moved compared to its trading value.

As a measure of the collective cost base, the realized cap fell to $559.45 million in one day. This decrease implies that ETH had plunged some holders into unrealized losses.

If this continues, the broader market could lose confidence in Ethereum, potentially leading to low demand for the cryptocurrency. If this is the case, the price may drop as previously indicated.

Source: Santiment

Is your portfolio green? Check the Ethereum profit calculator

Interestingly, this decline also presents a buying opportunity as long as ETH remains in a bull market.

However, the fruits of this change may not be visible for a few days or weeks. But in the long term, it seems likely that the price of ETH will rise.