- Ethereum has just started monkeys of his 2021 pattern.

- Liquidity zones in the short term emerged at $ 2.8k $ 3k and $ 2.5k as the sales pressure in the Futuresmarkt decreased.

Ethereum’s [ETH] Graphs from 2021 and 2025 revealed a seductive story for possible future price action. In 2021, ETH experienced an explosive rise, climbing of sub-$ 500 levels to a peak around $ 4,500.

This meteorical rise was characterized by a significant outbreak after a consolidation period that started at the end of 2020.

Fast-Forward until 2025, and the pattern is similar, with ETH currently floating around $ 2,000 after a remarkable fall of higher levels.

The climb of 2021 started after ETH had supported $ 500, which led to an increase in purchasing pressure and bullish sentiment, which ultimately pushed the prices to new highlights.

In 2025, ETH demonstrated resilience at an important level of support above $ 2500, with the early stages of the 2021 route reflecting. If ETH follows a similar path, this could replicate from the past, which may achieve $ 26,000 by the end of 2026.

Source: X

Conversely, if Ethereum does not maintain the support of $ 2,000, this may indicate a weakening of the buyer’s momentum, possibly which leads to further decreases.

Investors must consider both the possibility of a bullish replication from 2021 and the potential for continuous decline that can prevent a similar result.

Permanent holders increase as sales pressure decreases

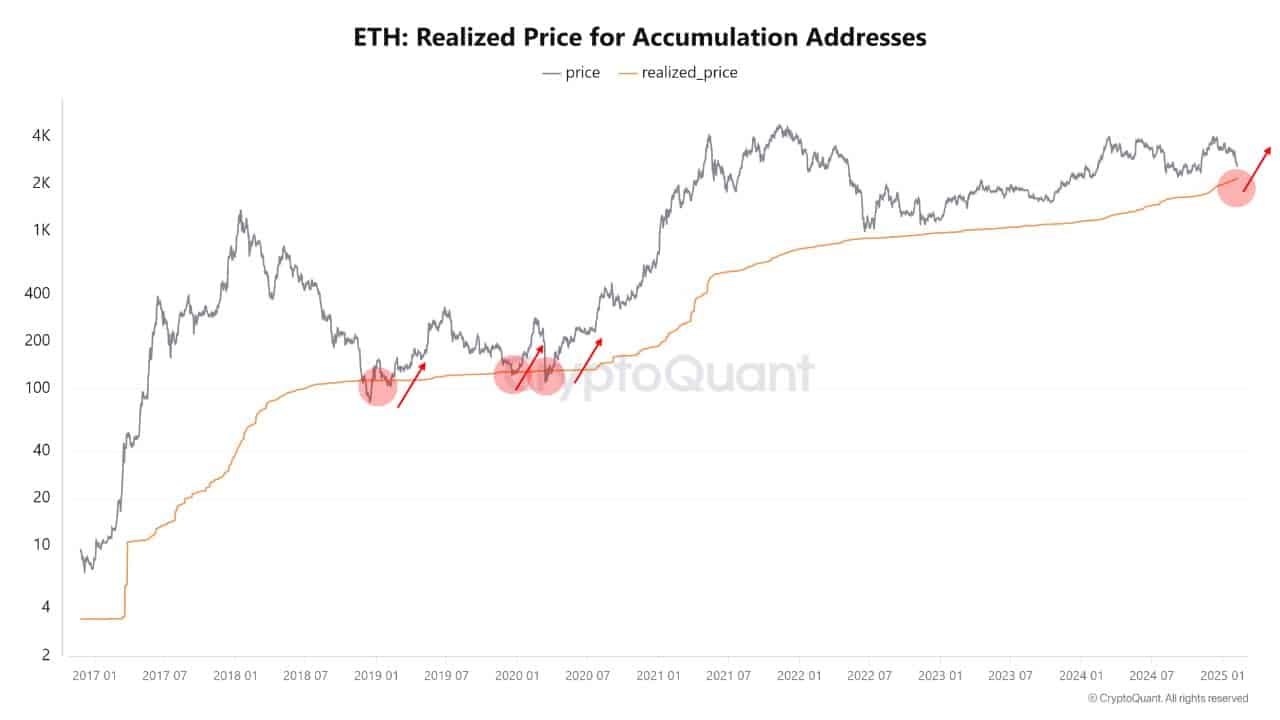

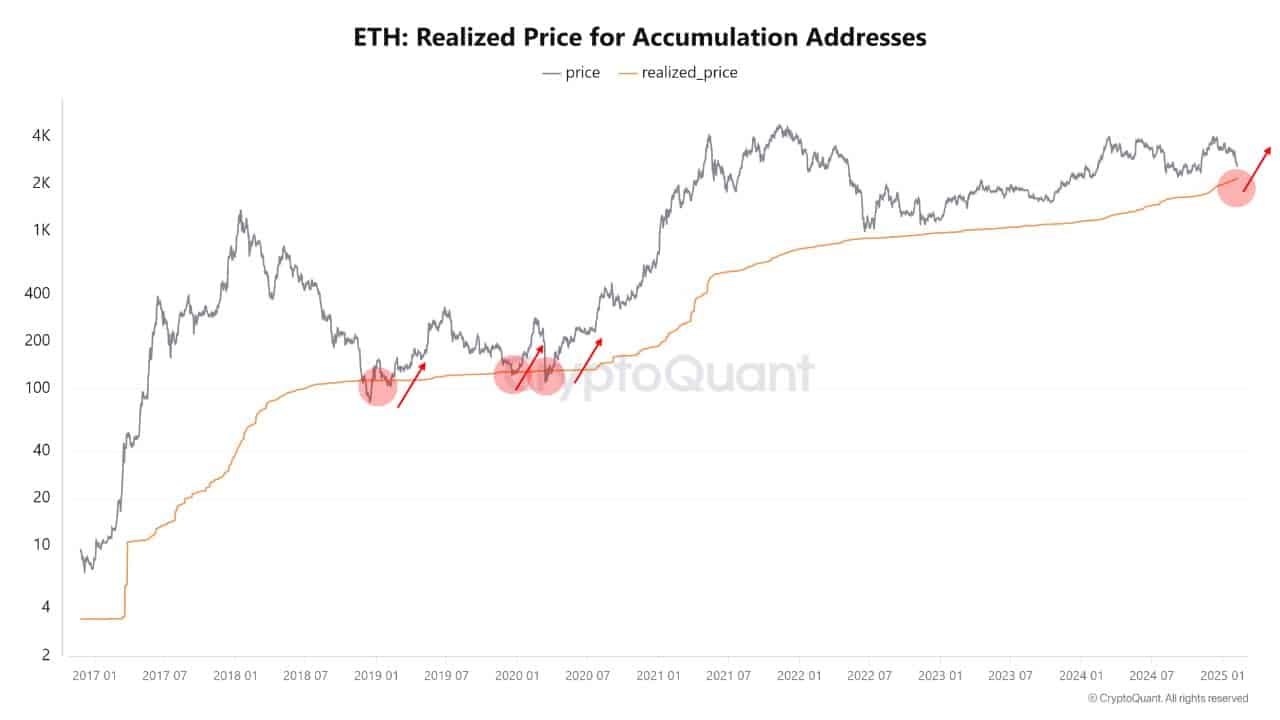

With the potential of ETH to replicate its 2021 wins, the realized price of $ 2.2k is far below the market price of $ 2.6k, indicating undervaluation with the realized price that acts as strong support.

The MVRV ratio slightly above 1 further emphasizes the potential for appreciation.

Growth in number of permanent holders who have bought and have never sold ETH, increases rapidly, The trends of Bitcoin reflect, which suggests that resilience against the sale of pressure from leaving whales.

Source: Cryptuquant

In addition, a reduced sales pressure in the Ethereum Futuresmarkt, compared to earlier highlights when EHH $ 4K reached, gave sustainable purchase interest despite price falls.

These jointly suggest that ETH could possibly reflect its increase in the past, although the results depend on the current market sentiment and stability.

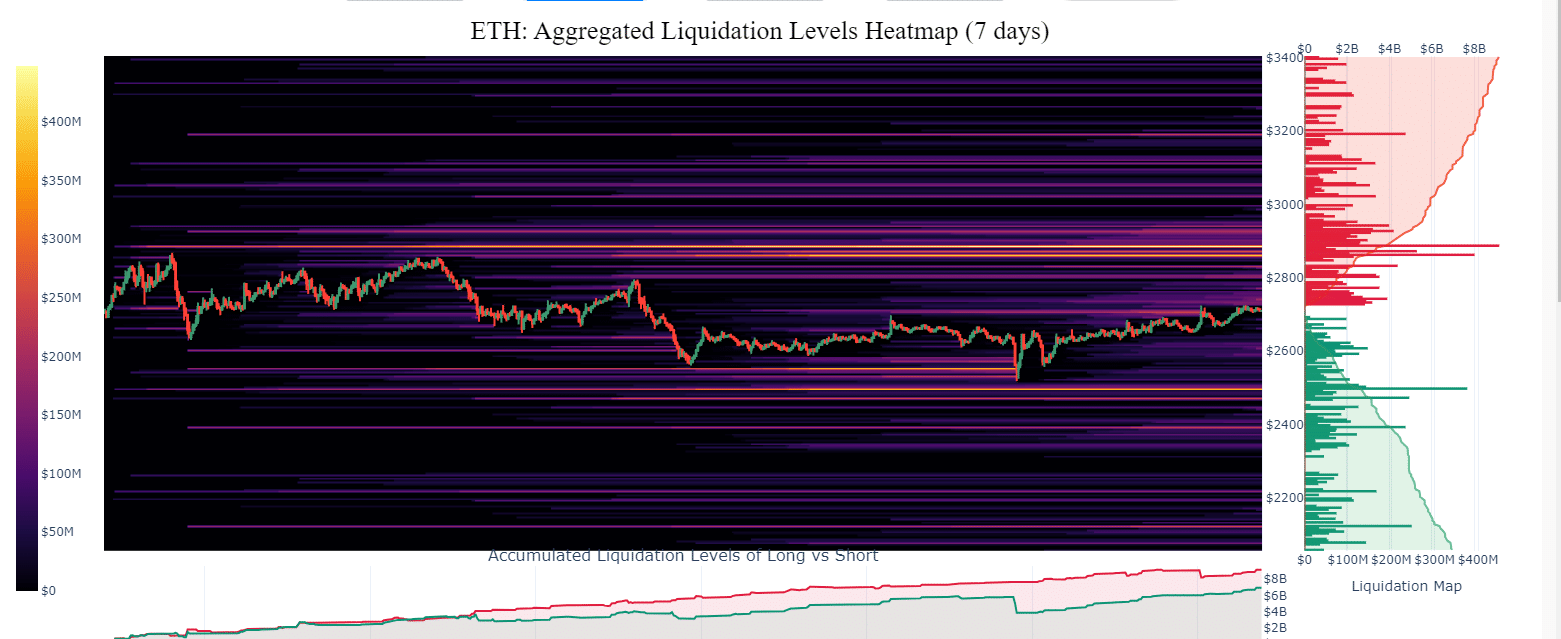

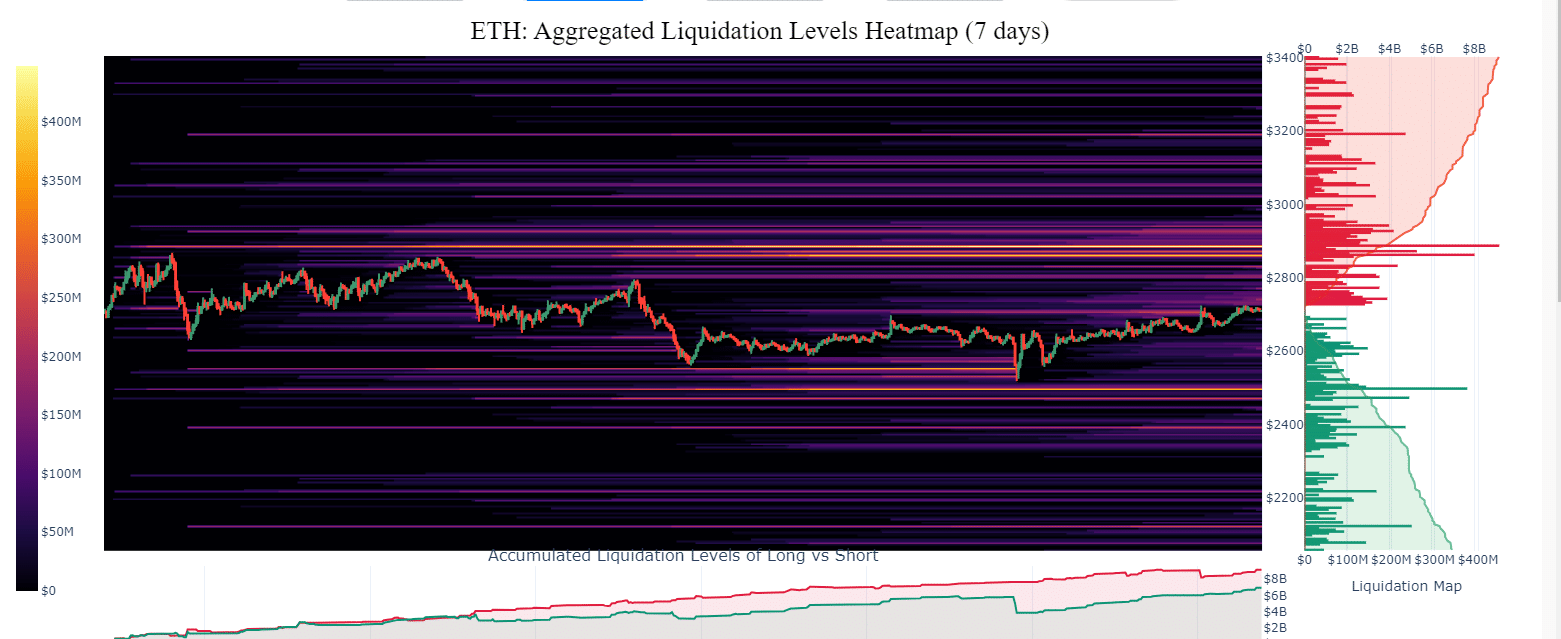

Ethereum’s short -term liquidity zones

The Ethereum Liquuidity Heatmap indicated that the $ 2.5k to $ 3K zones are crucial for both support and resistance.

Historically, these levels have either pushed up ETH with support or covered profits when acting as a resistance.

The concentration of liquidations between levels, $ 2800 to $ 3000, suggested that this reach was crucial for the short -term movements of ETH.

Source: X

A stable hold above $ 3K could reflect the 2021 increase, while falling from under $ 2.5k can undermine the bullish momentum.

This dynamic must be close monitoring because they can dictate the ability of Ethereum to mirror from the past or mirror them.