On-chain data shows that Ethereum sharks and whales have continued to sell for four months now, a sign that holdings may not recover anytime soon.

Ethereum may not be in the best situation right now

In a new insight afterOn-chain analytics company Santiment has been exploring what the various metrics related to Ethereum look like right now to get hints about the future outcome of the asset.

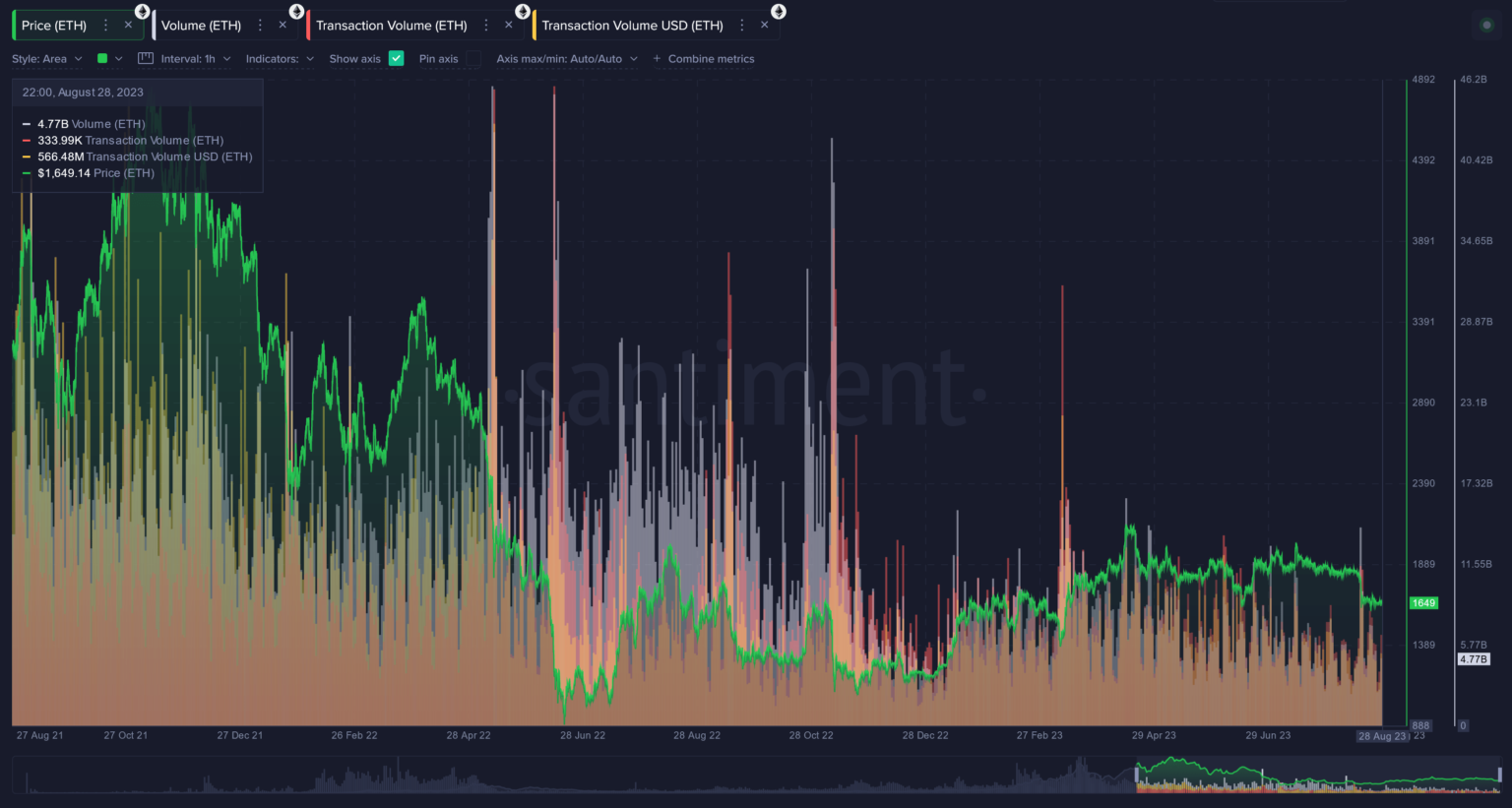

First, the analytics company discussed the asset’s “transaction volume,” i.e. the daily total number of tokens transferred over the network.

Here is a chart showing the trend in this indicator:

The value of the metric seems to have been low in recent days | Source: Santiment

As can be seen in the chart, Ethereum transaction volume has been declining lately and hitting low levels, suggesting that the network is not seeing much usage at the moment.

“While this is not necessarily an alarm signal for any asset, it is an indication that the public is simply showing disinterest at a time when many traders really can’t decide whether the $1,650 price level is overvalued or undervalued,” Santiment explained.

The company further notes that the USD 1,500 level has had quite a bit of psychological support, so if the cryptocurrency drops to this level, the volume could rebound.

While the volume can provide clues to interest among general investors, it does not necessarily reflect the sentiment of the largest holders. So, the second indicator that Santiment checked is the total number of assets held by investors who have between 10 and 10,000 ETH in their wallets.

Looks like the value of the indicator has been heading downhill since a while now | Source: Santiment

The investors with address balances in this range are the sharks and whales, entities that can exert some influence because of their large assets. The chart shows that these cohorts as a whole have been selling continuously since about four months ago when ETH peaked above $2,100.

Before then, these big investors had been accumulating, but it seems that these investors gave in to the appeal of profit-taking once ETH reached a high enough level. The sell-off has slowed down a bit lately, but these holders still continue to lose a net portion of their holdings.

“This continued decline in shark and whale supply is something we need to keep an eye on,” the analyst firm said. “Prices can still rise if they take profits, and their holdings are far from perfectly correlated. But when it comes to signaling an immediate return to $2,000 and above, this is certainly not perpetuated by whales.”

Finally, Santiment looked at the asset’s “development activity” to see how much work the developers put into the project’s public GitHub repository.

The trend in the development activity | Source: Santiment

In general, this metric can be one of the things you should look for to see whether a project has long-term potential or not. Since the Ethereum developers have not stopped working hard lately, it is safe to assume that they are still committed to ownership. So this is at least one of the indicators that are not gloomy for ETH right now.

ETH price

Ethereum has failed to pull out of its sideways movement lately as the price continues to trade near USD 1,600.

ETH has continued to be flat in the past few days | Source: ETHUSD on TradingView

Featured image of Sebastian Pena Lambarri on Unsplash.com, charts from TradingView.com, Santiment.net