- Pro Shares has announced a bearish Ethereum ETF.

- The price of ETH remains relatively stable; however, the chances of liquidation increased.

The cryptocurrency community is generally optimistic about ETF approvals. ProShares has now introduced a unique ETF focused on Ethereum [ETH]allowing investors to bet against its price.

Is your portfolio green? Check out the ETH profit calculator

Something for the bears

The ProShares Short Ether Strategy ETF seeks returns that are inversely correlated to Standard & Poor’s CME Ether Futures Index.

Simply put, if the index falls 1%, this ETF will try to gain 1%. Unlike direct investments in cryptocurrencies, this product is linked to futures contracts on Ethereum.

Spot Bitcoin ETFs, on the other hand, are still awaiting approval from the U.S. Securities and Exchange Commission.

The initial response to Ethereum ETFs in early October was not as successful as Bitcoin ETFs.

ProShares introduced three Ethereum-focused ETFs, and the largest of them has less than $10 million in assets.

Michael Sapir, CEO of ProShares, explained that this new inverse ETF allowed investors to take a bearish stance on Ethereum without the challenges and costs associated with direct short positions.

On the plus side, it could attract more investors to the market, potentially increasing ether’s liquidity. Additionally, it provides investors with a way to manage risk, making them more likely to invest in ether.

Conversely, the launch of such an ETF could lead to increased price volatility, as these bearish funds could cause rapid declines in the value of ETH.

It can also impact overall market sentiment. It has the potential to make some investors more bearish on Ethereum’s future.

Additionally, there is a possibility that some investors may be excessively shorting ether. This can lead to significant price fluctuations.

What will traders do?

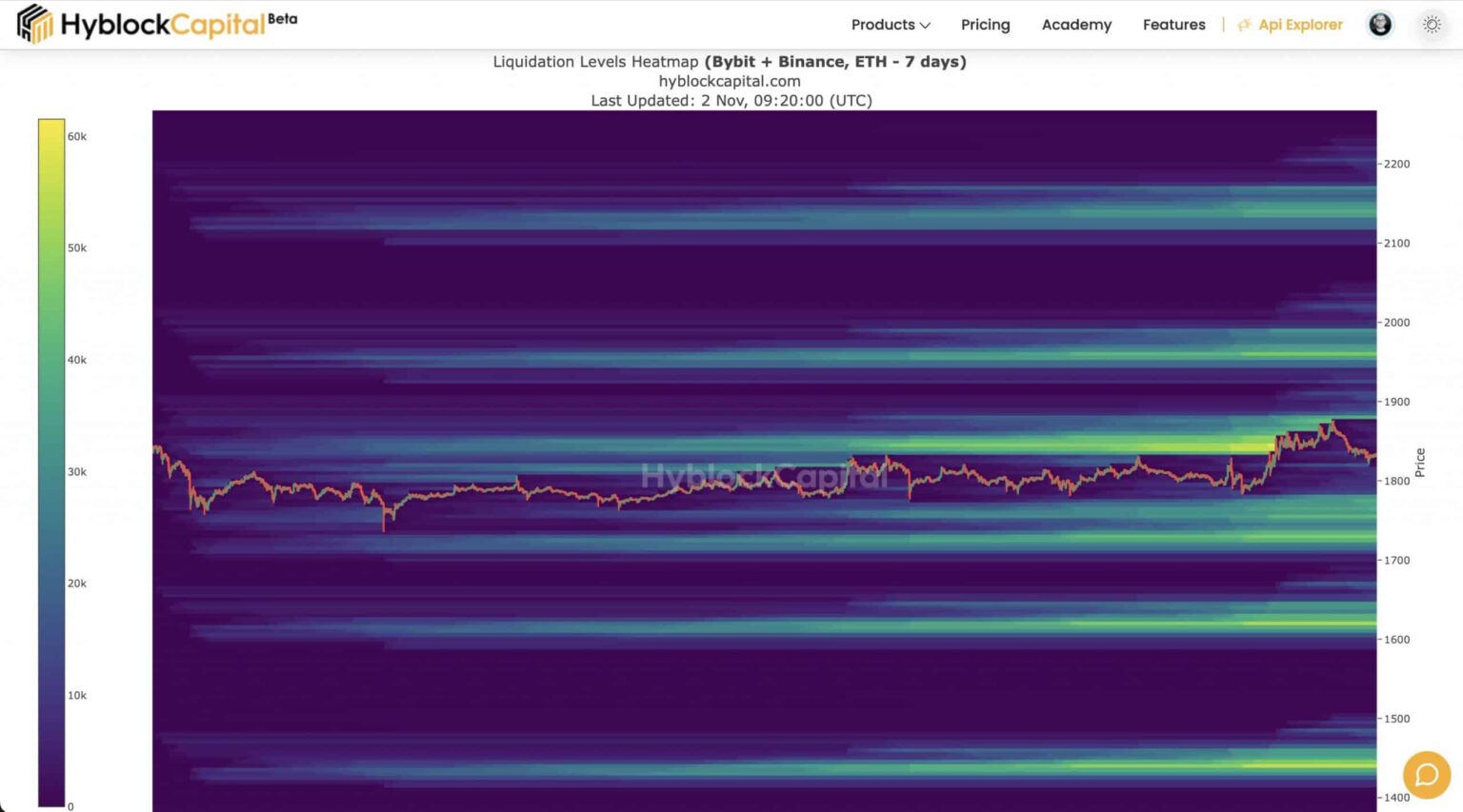

At the time of writing, the ETH Liquidation Heatmap indicated a risk zone for Ethereum between $1700 and $1800. The price of ETH was $1793, which is quite close to this risky range. This means that caution is needed when dealing with ETH in this price range.

Realistic or not, here is the market cap of ETH in BTC terms

Many traders could face liquidation if prices move against them, creating a potential sell-off.

Traders should keep a close eye on prices, use stop-loss orders or take other protective measures. This range is crucial for ETH, and price movements can be volatile.

Source: Hyblock