Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Ethereum (ETH) has been deposited 30% in the last two weeks and reflects wider weakness in the cryptomarket while the global economy reflects escalating tariff wars. Crypto analyst Ali Martinez warns that ETH could fall even further in the short term, making the level of $ 1,200 possible.

More pain for Ethereum, but a recovery is possible

Ethereum continues to struggle in the midst of global economic pressure. The second largest cryptocurrency in the world per market capitalization has fallen 8.3% in the last 24 hours and is currently being traded in the middle of $ 1,000.

Related lecture

In commentary on the recent price promotion, the experienced analyst Martinez emphasized that ETH could find important support at $ 1,200. He shared the following daily ETH graph and showed how digital active has broken several support levels since December 2024, when it was traded near $ 4,000.

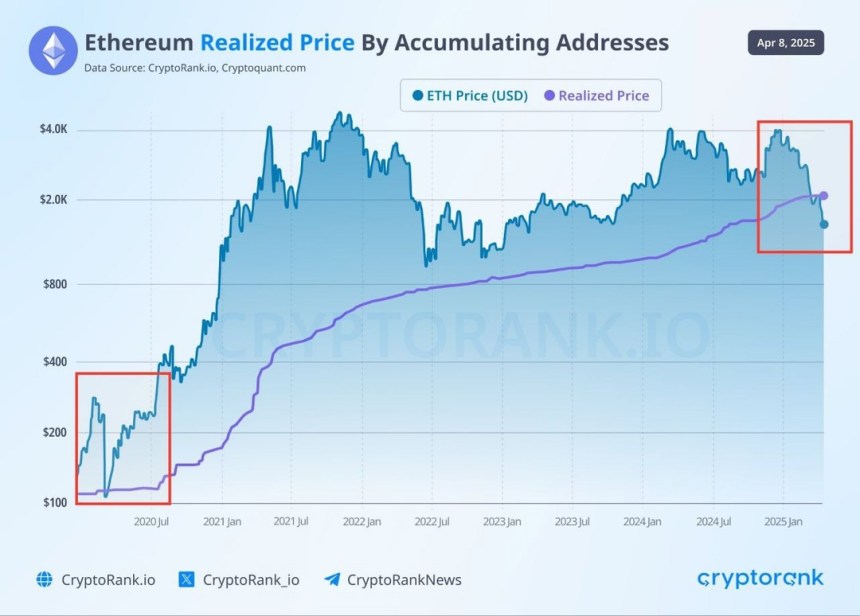

In the meantime, the famous analyst Carl Moon noted that ETH is currently trading under his realized price of $ 2,000. He pointed out that the last time this happened in March 2020 at the height of the COVID-19-Pandemie Eth had fallen from $ 289 to $ 109.

On a more optimistic note, Moon added that ETH quickly recovered after that steep decline. Based on historical trends, the current price level can offer a potential buying for long -term investors.

For those who are unknown, the realized price for accumulation addresses represents-as shown in the above cryptorank card-the average price with which holders have acquired ETH in the long term. This metric has historically seen as a strong support zone.

Is ETH about to surprise the market?

With the market sentiment that is approaching historic lows, the confidence in ETH seems to take. The Ethereum Fear & Greed Index currently Sits At 20, which indicates “extreme fear” among investors.

Related lecture

Despite the bearish mood, some statistics in the chain and historical patterns suggest that ETH could be about to overwhelming a strong bullish reversing option. Investors.

Crypto analyst Menter Crypto, for example, recently drawn a comparison between ETH’s current price action and from 2020, suggestion That Ethereum could start a price rally per quarter 2025.

Similarly, the market value of Ethereum for realized value (MVRV) Z-score indicates that ETH can be undervalued at the current price. The last time it was so undervalued – in October 2023 – the witness A sharp rally of 160%.

That said, not all indicators are bullish. Rise ETH Exchange reserves continue to express concern about potential sales pressure of holders. At the time of the press, the ETH is traded at $ 1,457, a decrease of 8.3% in the last 24 hours.

Featured image of Unsplash, graphs from X and TradingView.com