- Ethereum’s steady decline was partly due to lower transaction fees

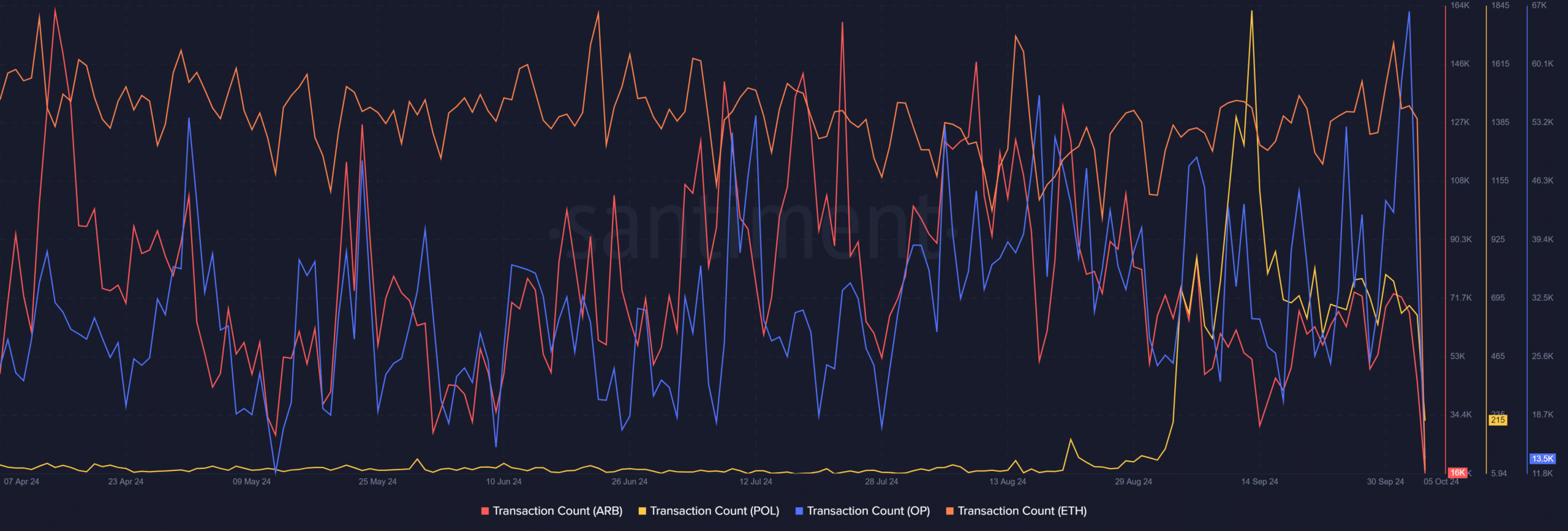

- Other leading L2s saw transactions increase, while ETH lost slightly

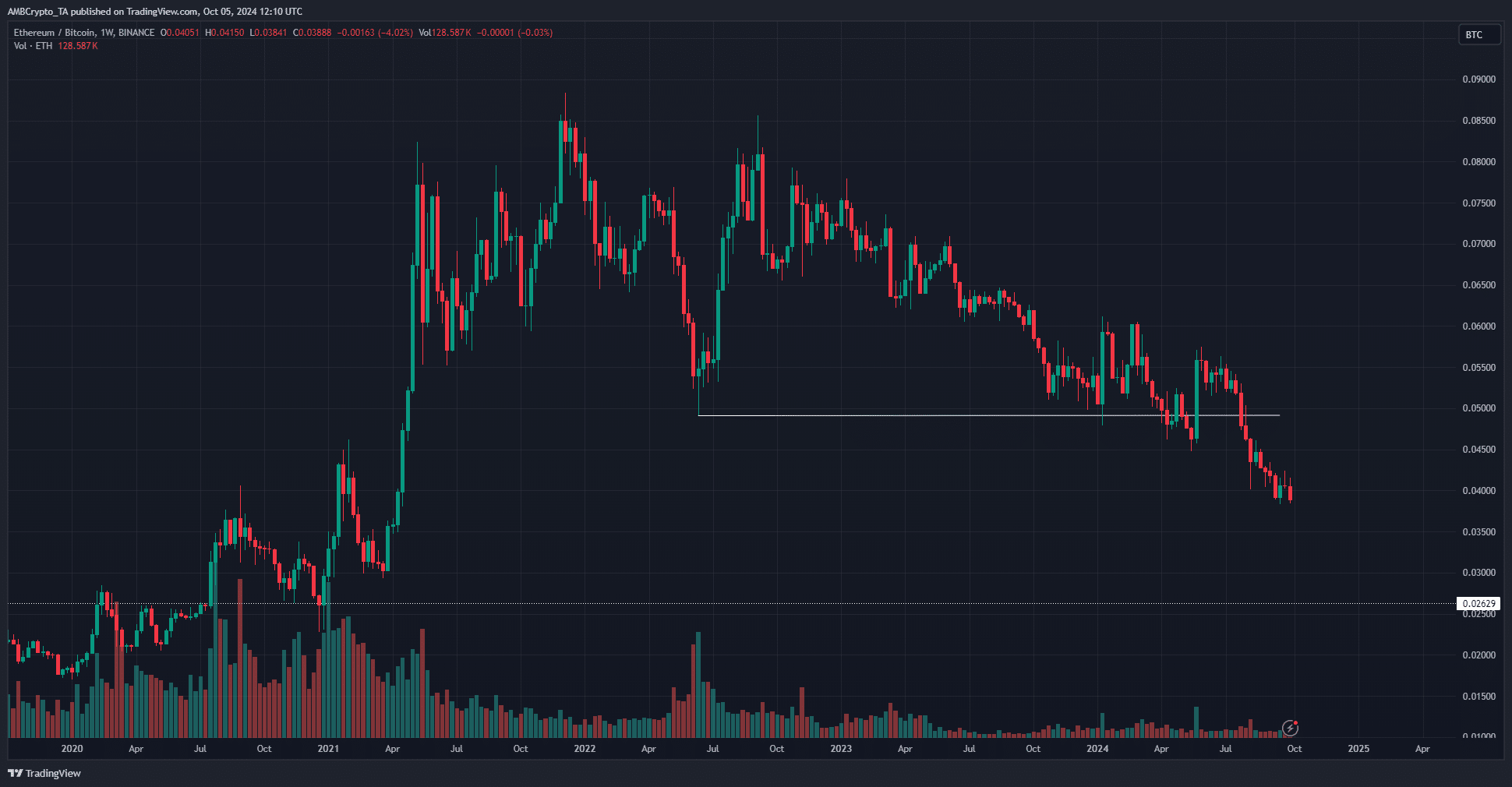

Ethereum [ETH] has been performing poorly since April, especially compared to Bitcoin [BTC]. As the leader of the altcoin market, some participants expect ETH to lead the altcoins’ bullish charge. However, as things stand now, the altcoin is struggling to keep up with the market.

Source: ETH/BTC on TradingView

The ETH/BTC chart has been on a clear downward trend since April 2023. Until April 2024, the June 2022 lows at 0.049 were defended, but the continued downtrend of the past six months took ETH/BTC to lows not seen since April 2021.

Reasons why Ethereum is losing value

Long-term investors in Ethereum would be concerned that Ethereum would lose ground to Bitcoin at such a rapid pace. One of the reasons why the token is losing is the inflation that has been present in the network since the Dencun upgrade in March 2024.

The Dencun upgrade introduced EIP 4844, which drastically reduced the transaction costs of L2 transactions. While this is good news for users, falling network fees meant less ETH was burned, making the token somewhat inflationary over the past six months.

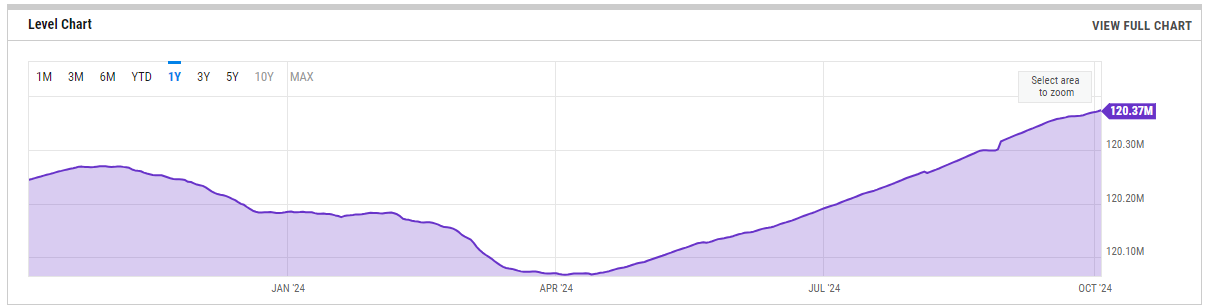

This could be seen in the rising ETH supply chart.

Optimism activity is clearly higher

Arbitration [ARB] and Polygon Ecosystem Token [POL] saw a higher number of transactions, but optimism [OP] was the clear leader. This showed that the L2s were growing in popularity.

In particular, Optimism outperforming the rest can likely be attributed to the rise in Coinbase’s Base L2 atop the Optimism Superchain.

Read Ethereum’s [ETH] Price forecast 2024-25

An inflationary ETH and its performance against Bitcoin challenge the idea that Ethereum is money. An uptick in activity could alleviate this problem, but the market’s lack of conviction in ETH can be illustrated by the ETH/BTC chart.