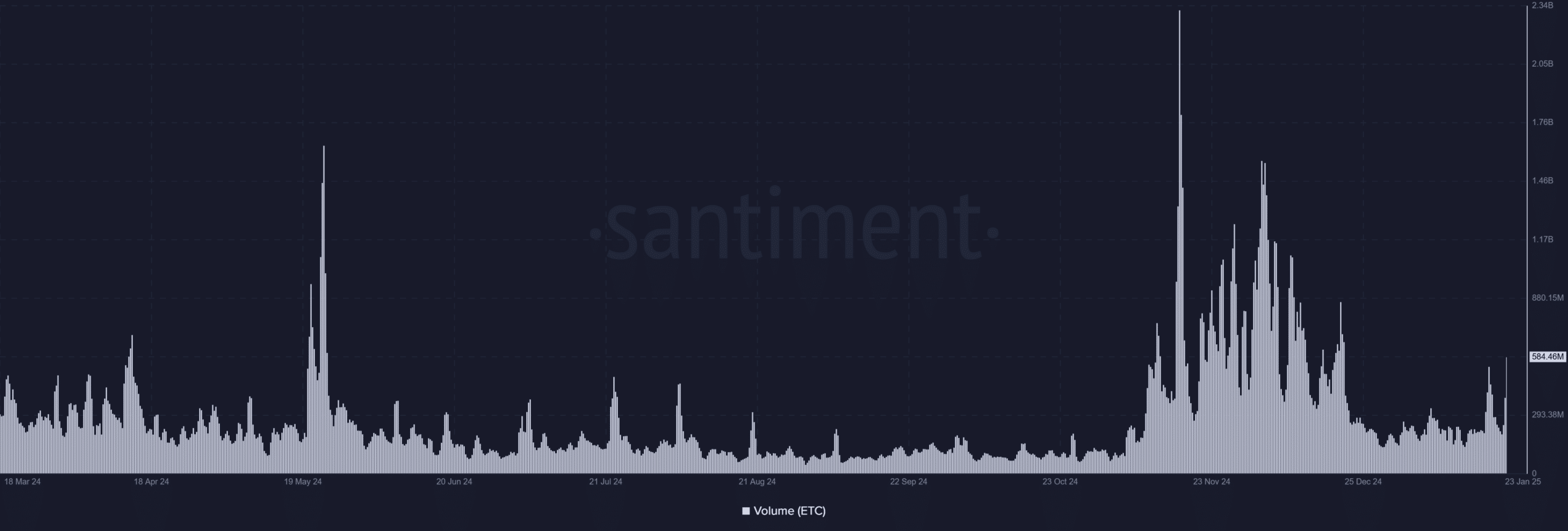

- The trade volume of Ethereum Classic rose to 584.46 million, indicating the rising investor’s interest in the midst of the falling power of ETH.

- ETC kept above the most important support of $ 22.50, while ETH struggled under its 50-day advancing average, which raised questions about market shifts.

Ethereum Classic [ETC] has seen a slightly better trend than Ethereum [ETH] Recently, which leads to speculation that it could absorb liquidity that loses the latter.

With both assets that show contrasting price movements and volume trends, investors wonder if ETC is on the rise as a feasible alternative to ETH.

Price promotion of Ethereum Classic: a mixed trend

Ethereum Classic traded at $ 24.54 at the time of the press, which reflects an intraday reduction of 1.72%.

The price diagram emphasized that ETC had entered into a consolidation phase after a strong rally, which was under its 50-day advancing average of $ 26.87 and higher than the 200-day advancing average of $ 23.15.

The fact that it remains above the 200-day MA suggests that etc. is still in a long-term upward trend despite bearish movements in the short term.

Source: TradingView

ETC’s recent price promotion is characterized by lower highlights, which could indicate decreasing bullish momentum. However, support at the level of $ 22.50 remains strong, which suggests that a leap can occur if the wider market stabilizes.

ETH’s loss, etc. profit?

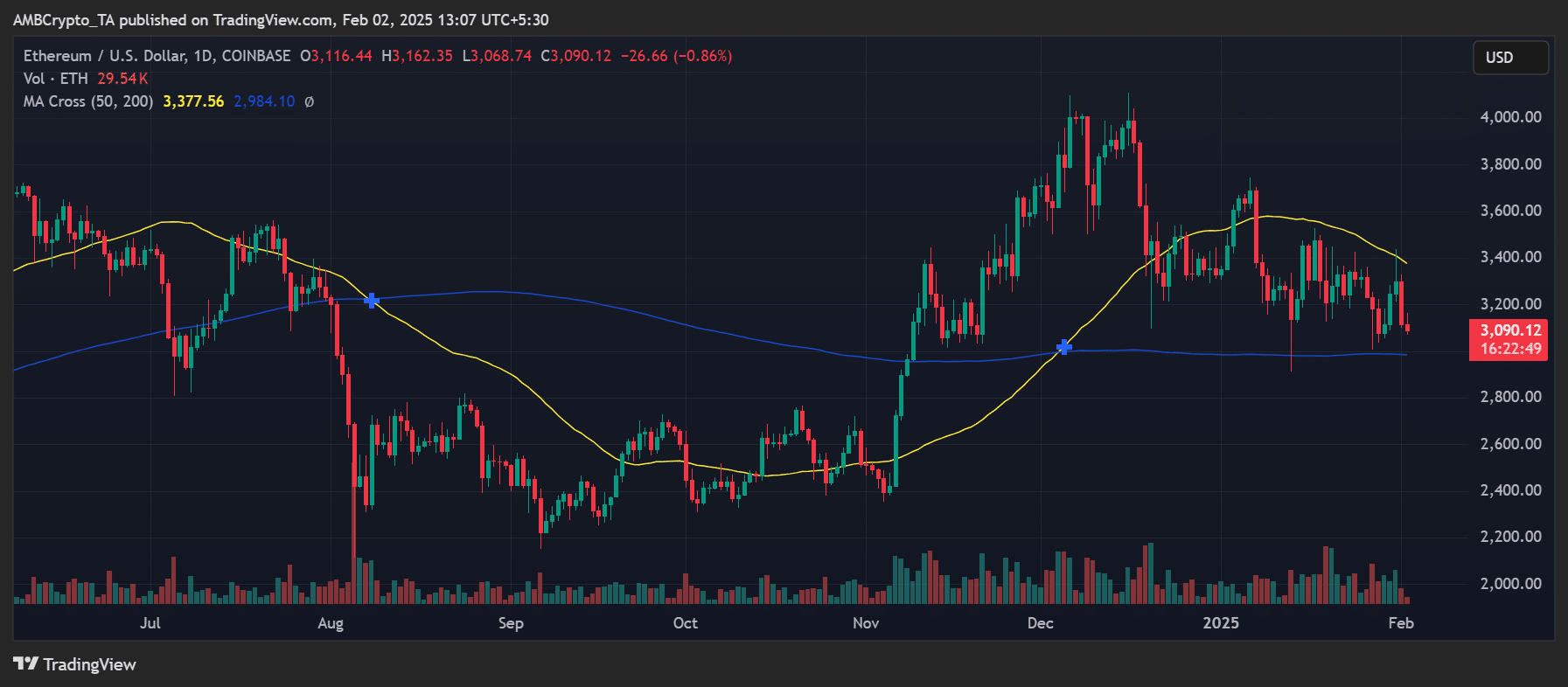

On the other hand, Ethereum traded at $ 3,090.12 at the time of writing, with a decrease of 0.86% for the day. While ETH remained in a wider upward trend, it had difficulty maintaining important support levels.

The progressive average of 50 days was $ 3,377.56, while the progressive average of 200 days was $ 2,984.10.

A infringement below the 50-day MA meant a potential loss of short-term momentum, making Ethereum vulnerable to further downward pressure.

Ethereum’s trade volume in particular has been demolished, in which the volume card of Santiment indicates that reduced participation of traders indicates.

This weakening interest could explain why some investors shift their focus to Ethereum Classic, which has demonstrated a higher relative strength.

Volumetrends: etc’s rising momentum

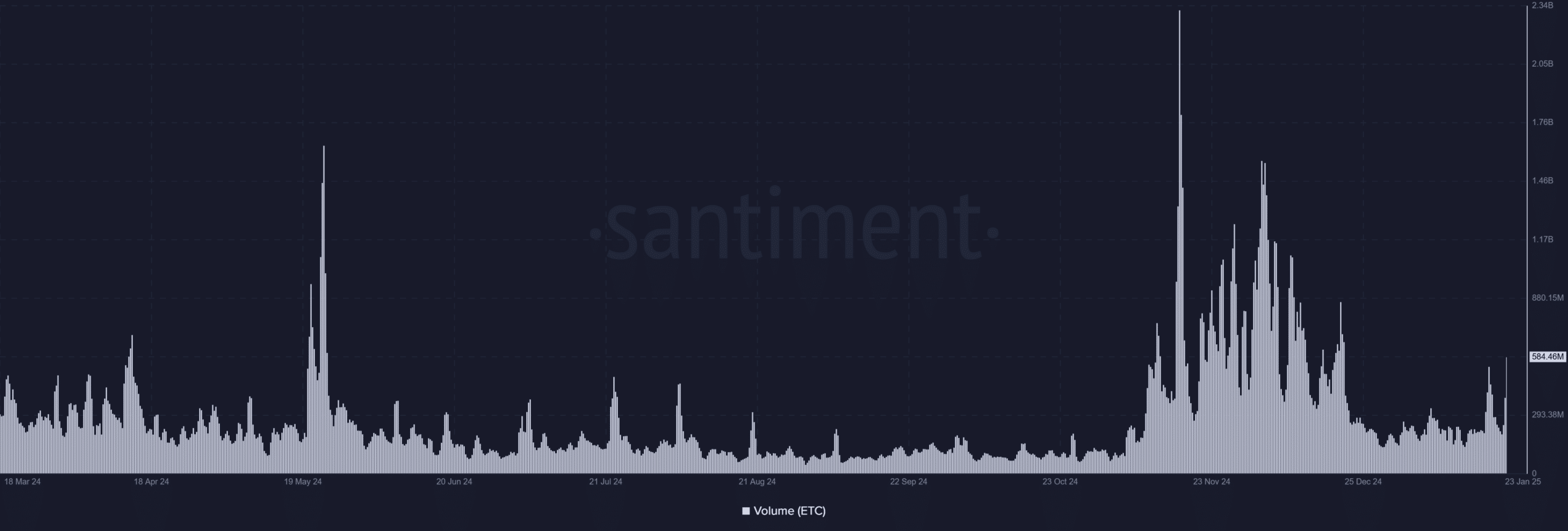

A further consideration of Santiment Volume card revealed that etc had experienced a steady increase in the trade volume, with a recent high point of 584.46 m.

This increase was a sign of renewed investor’s interests and growing faith in Ethereum Classic as an alternative to Ethereum.

In contrast to ETH, whose volume has decreased, the liquidity of etc. remained robust, which may indicate a transfer of market interest rate.

Source: Santiment

Volume peaks at the end of January 2025 tailored to price movements, which strengthens the idea that traders are actively working, etc.

This shift may be due to speculation that ETC offers a cover against the weakening momentum of Ethereum, or due to the expectations of network developments that can give preference, etc.

The next movement of Ethereum Classic

Looking ahead, etc. must retain its current trade volume and keep it above the $ 22.50 support zone to continue to position itself as a strong alternative to Ethereum.

If the weakness of Ethereum persists, there is potential for etc to get further grip. However, investors have to look forward to resistance near $ 27.50, where the sales pressure has previously covered profits.

Is your portfolio green? View the Ethereum Classic Profit Calculator

At the macro level, the correlation of Ethereum Classic with Ethereum means that wider crypto market trends will play a role in its process.

If ETH recovers, etc. can also benefit, although the independent volume wave suggests that traders are increasingly treating it as a self -contained instead of a derivative of Ethereum.