- The price of ENS has risen by more than 40% in the past seven days.

- There was a possibility of a decline as the ETF hype waned.

The Ethereum Name Service [ENS] token has seen a significant rally, rising more than 40% in the past seven days, according to data from CoinMarketCap.

The increase in value follows that of Ethereum [ETH] own impressive price rise, fueled by the recent approval of the highly anticipated Bitcoin ETF.

At the time of writing, ENS was exchanging hands at $26.21. According to data from CoinMarketCap, the altcoin’s value has risen 40.27% over the past week, earning its spot as the crypto asset with the most gains in the past seven days.

The demand for ENS is increasing

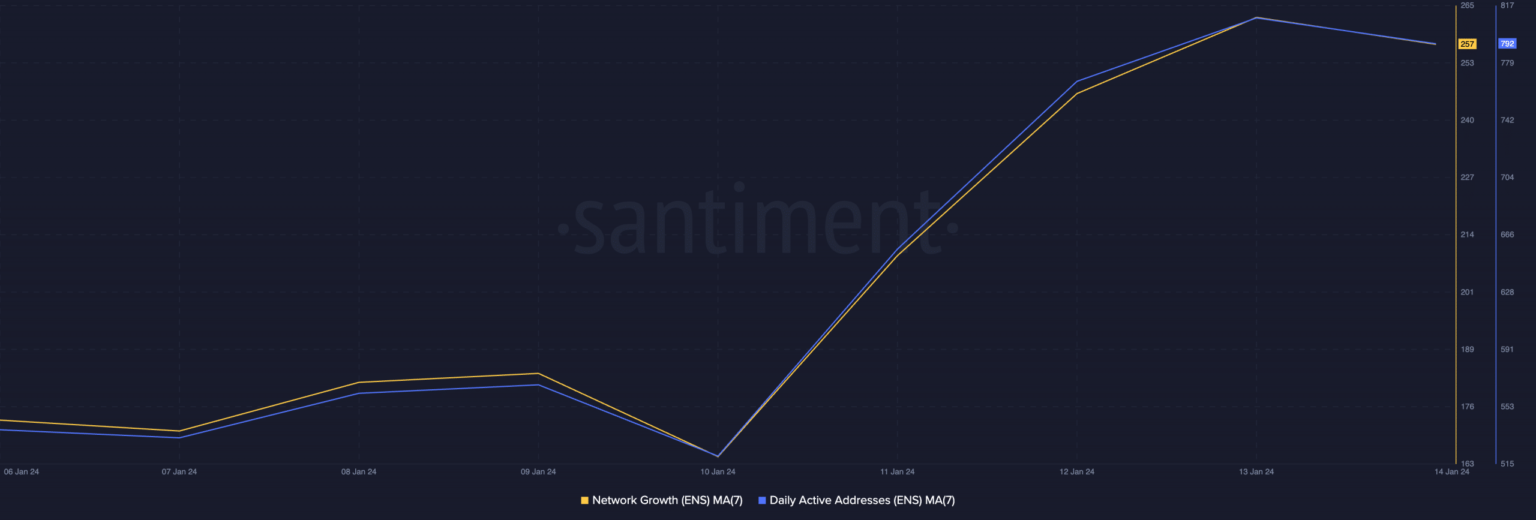

Influenced by the general rally in the altcoin market over the past week, ENS’s price increase has also been driven by real demand for its symbolic, on-chain data Santiment revealed.

According to the data provider, ENS’s daily active address count, measured on a seven-day moving average, has increased by 47% over the past week.

Likewise, the daily number of new addresses created to trade the altcoin has increased by 49% over the same period.

Source: Santiment

The positions of the main momentum indicators on a daily chart confirmed the high demand for ENS. For example, the Relative Strength Index (RSI) was 82.02, while the Money Flow Index (MFI) returned a value of 82.19.

At these values, these indicators showed that the accumulation of ENS significantly exceeded the sell-off among daily traders.

Showing the steady inflow of liquidity into the ENS market, the Chaikin Money Flow (CMF) maintained an uptrend and rested above the zero line at 0.27 at the time of writing.

A CMF value of 0.27 is a sign of strength in the market. This, and the large number of ENS trades executed over the past week, has reinforced the bullish sentiment in the market.

Furthermore, ENS’s Awesome Oscillator has returned mostly green, upward-pointing bars since the start of the year. This indicator is often used to track the momentum of the market. When the upward green bars return, it indicates bullish market conditions.

Many traders interpret this as a signal to go long, as they expect the price of the asset to rise further.

ENS’s Aroon Up Line (orange) confirms the strength of the bullish trend and was at 100% at the time of writing.

This indicator is used to identify the trend strength and potential trend reversal points in the price movement of a crypto asset.

When the Aroon Up line is close to 100, it indicates that the uptrend is strong and that the most recent high was reached relatively recently.

Source: ENS/USDT on TradingView

This is where the problem lies

While the indicators reviewed above confirmed ENS’s bullish cycle, others point to the possibility of a price correction.

The token’s 30-day MVRV ratio was 59.32% at the time of writing. An MVRV ratio of 59% means that holders who purchased the coin in the past month have seen their holdings increase in value by an average of 59%.

As the hype around the ETF begins to die down, traders may start to lock in these gains, putting downward pressure on the price of ENS.

Source: Santiment

The RSI and MFI of ENS were also at an overbought level at the time of writing. These levels are often marked by buyer exhaustion as bulls struggle to sustain further price growth.

With more than half of investors who bought ENS in the past month already making a profit, they may be incentivized to sell at this level.

A review of ENS’s bartering activities showed that profit taking has already begun. According to data from Santiment, there has been an increase in the supply of the alt on the exchanges since January 10. Since then it has risen 5%.

Is your portfolio green? View the ENS Profit Calculator

At the time of writing, there were 8.24 million ENS tokens on crypto exchanges. Conversely, off-exchange supply has fallen by 0.43% over the past three days.

Source: Santiment

The increase in ENS supply on exchanges shows that holders have started selling their tokens. As bullish sentiment plummets, profit-taking activity will gain momentum, pushing ENS’s value to new lows.