- Dogecoin continued to see a positive funding rate despite the decline.

- The price has fallen by almost 5% since this report.

Dogecoin’s recent price action has been dramatic, with the popular meme coin rising to one of its highest points over the past month before experiencing a sharp reversal. This volatility has investors wondering how low assets could fall if this bearish trend continues.

Analyzing DOGE’s price trend, NVT (Network Value to Transaction) ratio, and overall market sentiment provide some insight into the coin’s potential direction in the coming days.

Price trend signals a possible downtrend for Dogecoin

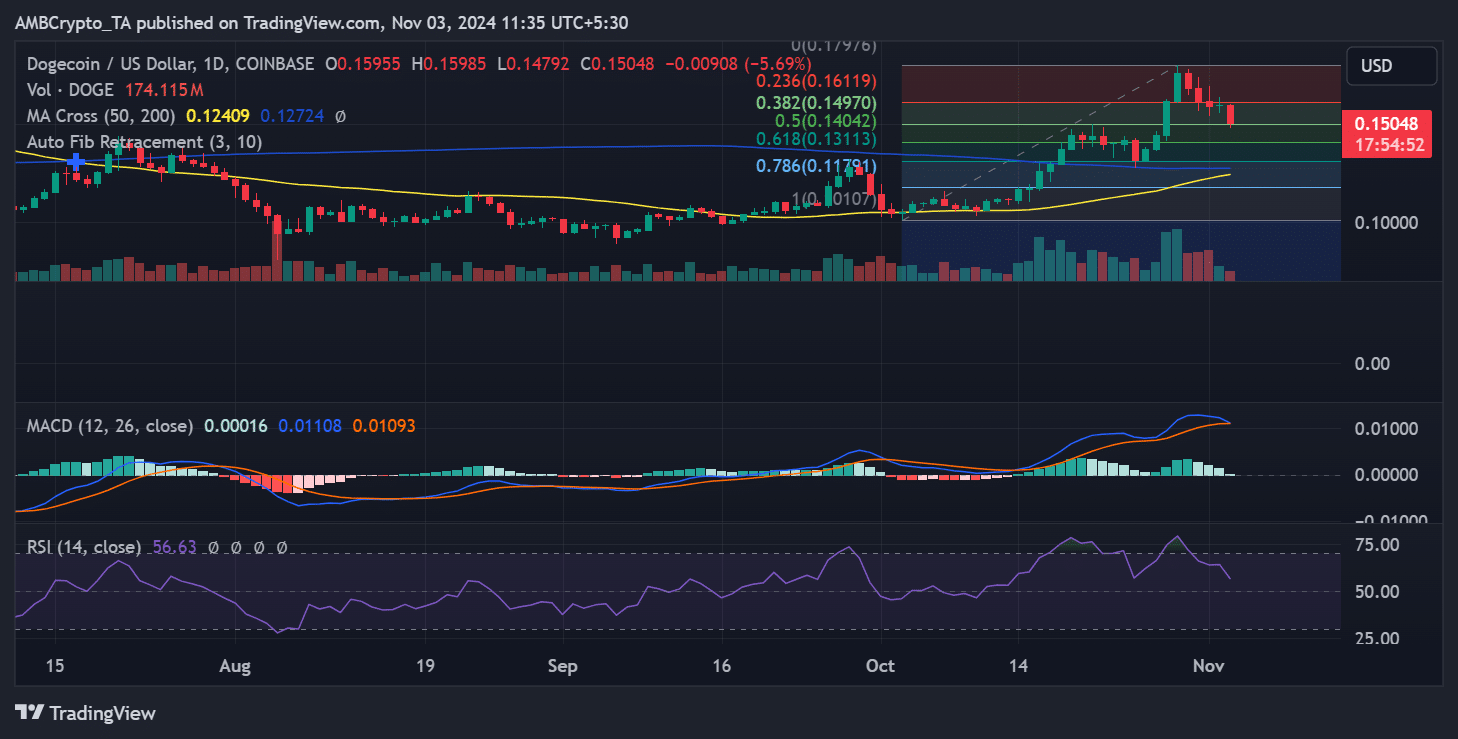

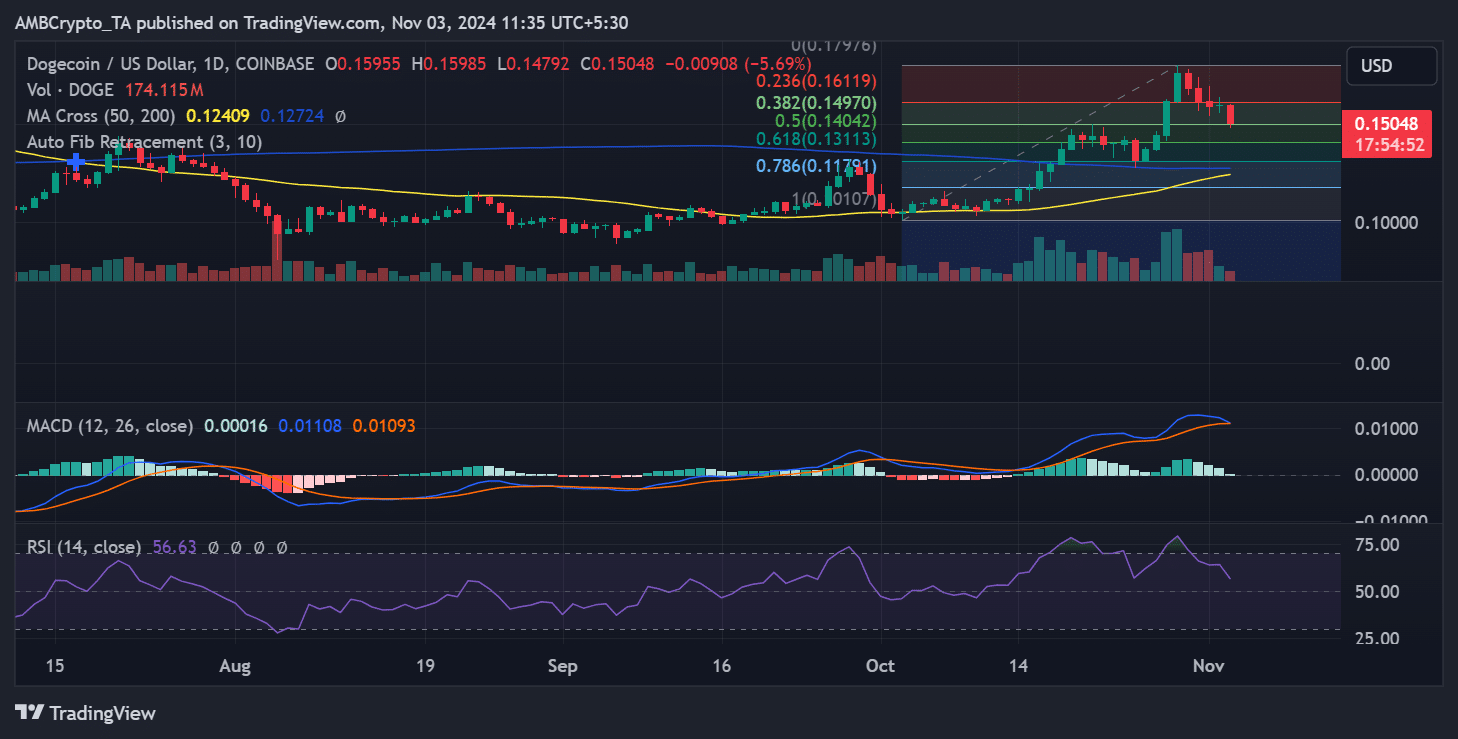

Dogecoin’s price chart shows a noticeable downward trend after the recent peak.

After the bullish run that pushed it to a high of $0.17976, the asset has fallen back and was trading around $0.15048 at the time of writing. This decline is accompanied by declining trading volume, indicating that buying momentum has weakened.

The MACD indicator, which recently showed bullish momentum, is starting to level off, signaling a possible shift to bearish dominance.

Source: TradingView

The RSI is also hovering around 56.63, shifting from the overbought level. If this trend continues, Dogecoin could test key support levels at the 0.382 ($0.14970) and 0.5 ($0.14042) Fibonacci retracement levels.

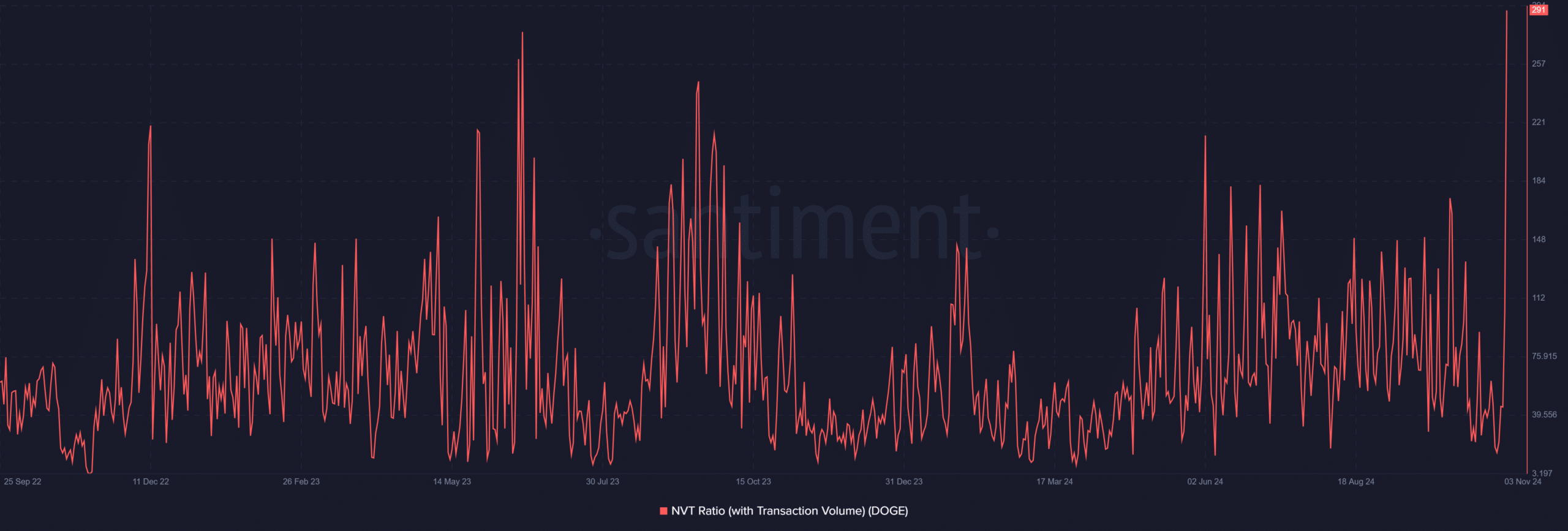

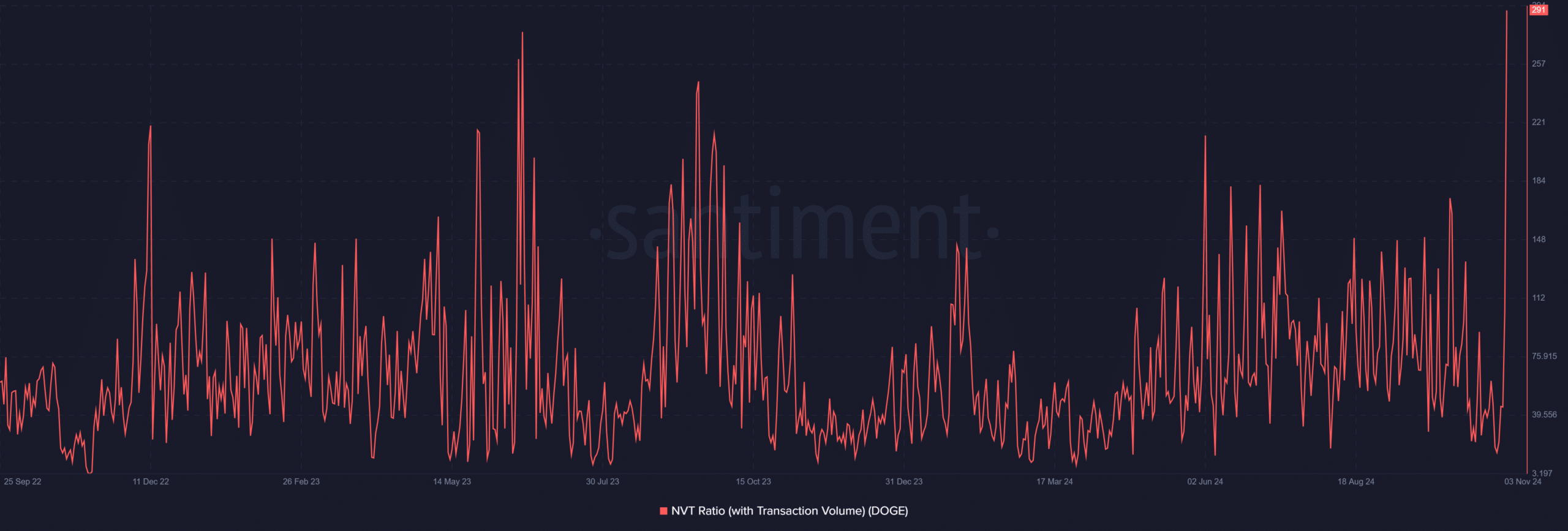

The rising NVT ratio indicates a potential overvaluation of Dogecoin

The Network value for transaction (NVT) ratio for Dogecoin was also a crucial metric to observe. Historically, Dogecoin’s NVT ratio has seen peaks and valleys, with higher peaks often correlating with market sell-offs.

Source: Santiment

The recent spike in the NVT ratio indicates a possible overvaluation compared to current transaction volume, which could signal a further price correction.

A high NVT ratio may reflect a higher valuation without a corresponding increase in transaction volume, potentially emphasizing investor speculation rather than organic network usage.

If this indicator continues to rise, it could indicate further downside risks for Dogecoin.

Key levels to watch amid bearish sentiment

In addition to the support levels mentioned, traders are likely to keep a close eye on the 50-day and 200-day moving averages for Dogecoin, which are around $0.12409 and $0.12724 respectively.

A breakdown below these averages could lead to additional selling pressure, pushing DOGE to move back into the $0.12 range. Conversely, if DOGE can stabilize around the $0.15 level, it could be a signal that the recent downtrend is nearing exhaustion.

Is your portfolio green? Check out the Dogecoin profit calculator

However, with current market sentiment and the elevated NVT ratio, the short-term downtrend seems more likely.

Dogecoin’s recent price movement and increased NVT ratio indicate a challenging road ahead. If bearish sentiment continues, Dogecoin may retest the lower support levels before finding a stable base.