- Dogecoin hasn’t yet seen a volume or momentum shift that would signal a price reversal.

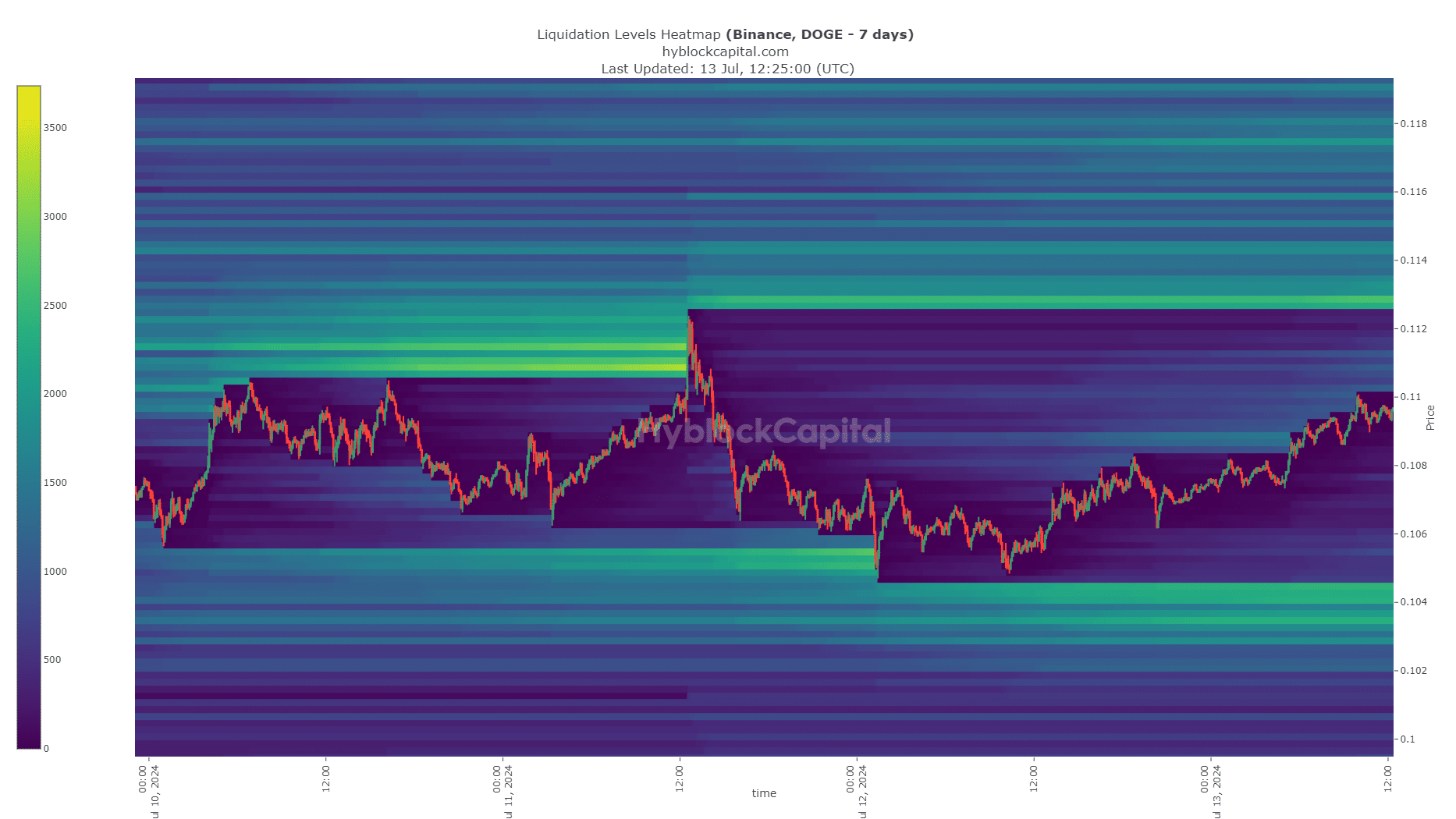

- The liquidation chart indicated that short-term range formation was possible.

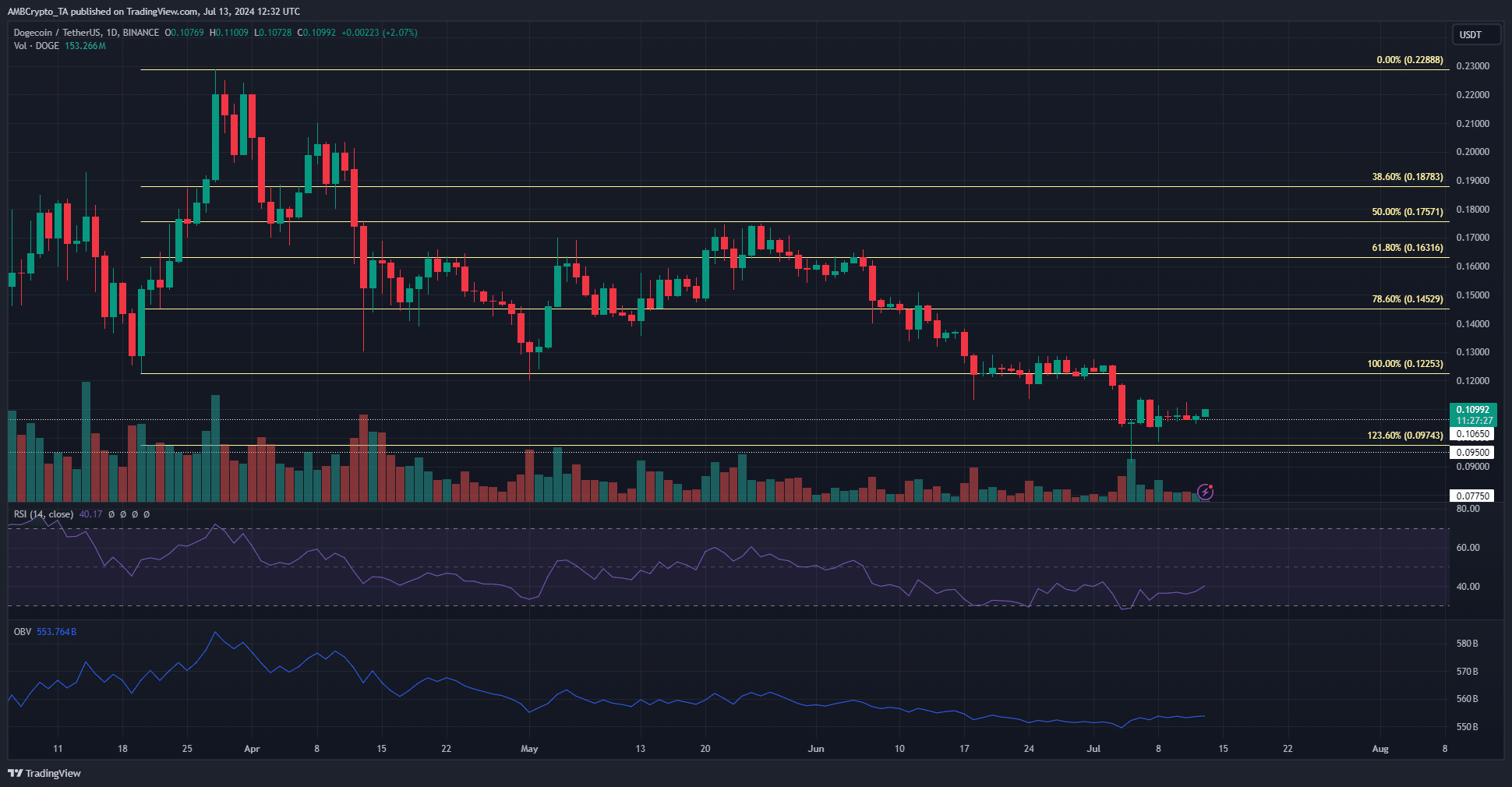

Dogecoin [DOGE] fell below the $0.123-$0.128 support zone that bulls have been defending since March. The bearish price structure on the daily chart was exacerbated by tepid buying pressure, which suggested demand was not good enough for a quick turnaround.

Source: DOGE/USDT on TradingView

The daily RSI was still below neutral 50 and the OBV has not changed noticeably after the recent decline. Together they indicated that bearish momentum was still dominant and that the bulls were thus far powerless to change the trend.

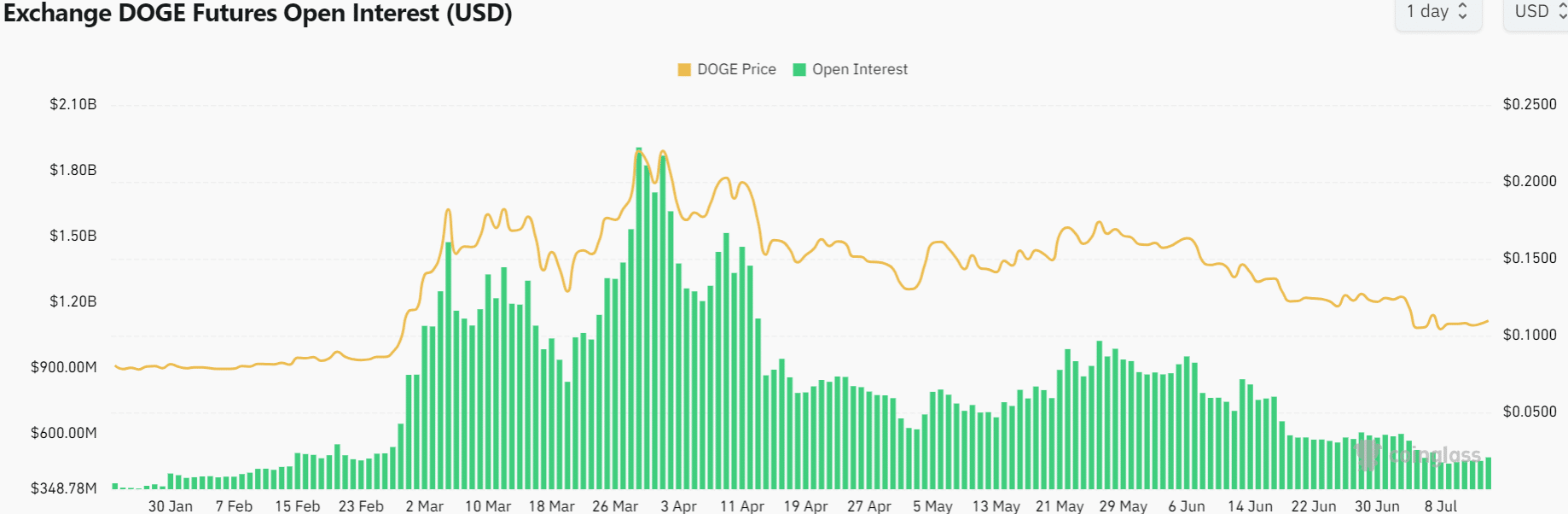

Open interest falls to pre-rally lows

Due to the huge price increase in late February and March, DOGE gained 176% in just over a month. At the beginning of the rally, Open Interest was $480 million, and by July 13 it was $478 million.

The substantial drop in OI over the past four months was a sign of declining confidence among futures traders. If and when the meme coin breaks through key resistance levels, the speculators could start flooding the market again.

With both the OBV and Open Interest maintaining their slumps, the conclusion is that buying pressure in the spot and futures markets was at multi-month lows. The on-chain metrics did not indicate that this could change anytime soon.

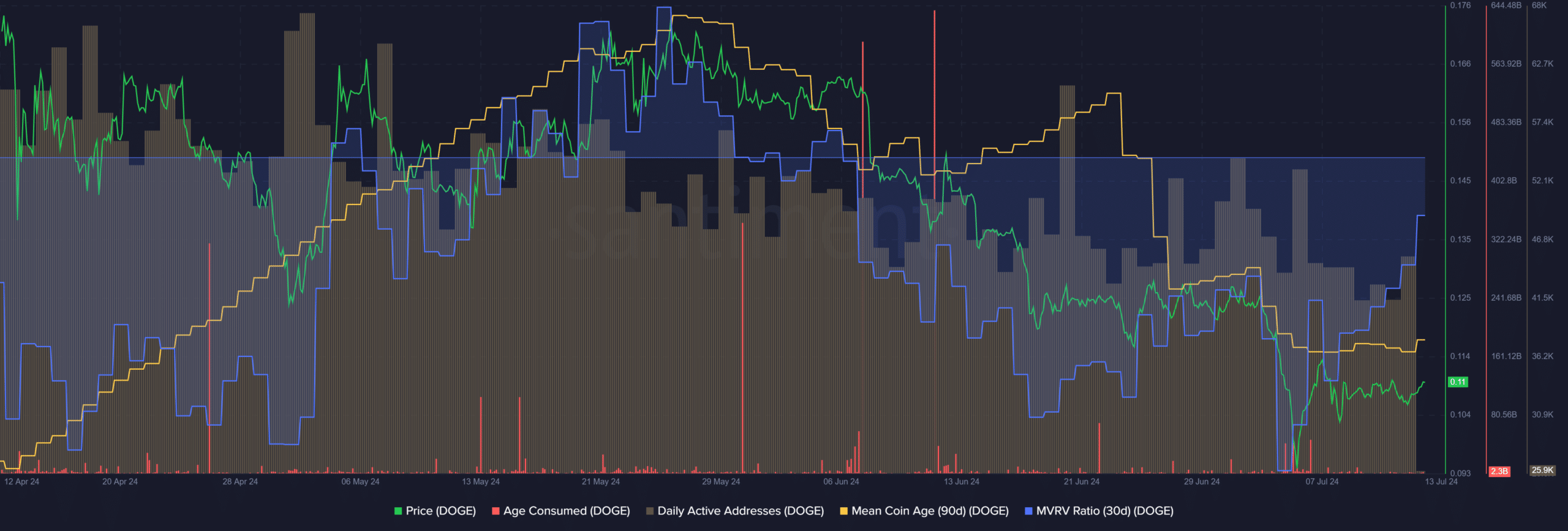

Dogecoin network statistics reflect token distribution

The 30-day MVRV ratio was negative last month, showing that short-term holders suffered losses. At the same time, the average coin age has also been on a downward trend since the end of May, although it rose for ten days in June.

This meant that it was not a good idea to buy DOGE despite the meme coin being undervalued, as the declining average coin age was a sign of distribution rather than accumulation. The age consumption statistic has been quiet since last week’s price drop.

Read Dogecoins [DOGE] Price forecast 2024-25

AMBCrypto found that the 7-day liquidation heatmap highlighted a potential short-term range formation between $0.104 and $0.1128.

After $0.113, the $0.13 and $0.135 levels are the next resistances to watch.