Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

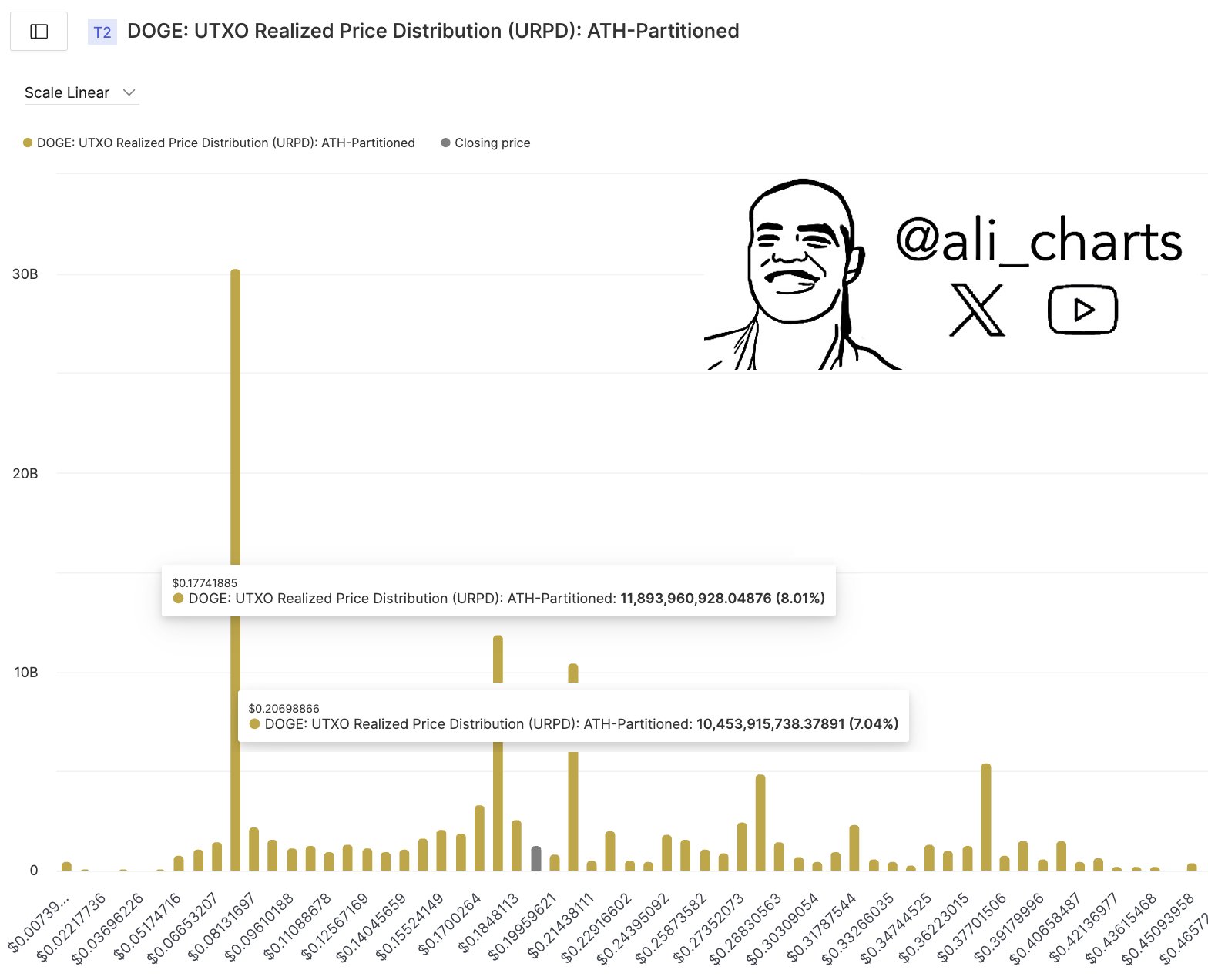

Crypto analyst Ali Martinez (@ali_charts) published a new UTXO realized price distribution (URPD) graph on X that offers a deep look at where large chunks of doge have last changed owner. This histogram shows various clusters of activities on the chain, which determines the most important price levels that could define the next large movement of the meme coin.

Martinez has specifically selected $ 0.177 as strong support and $ 0.207 as a remarkable resistance, which suggests that Dogecoin is effectively sandwiched between these two crucial price barriers. While $ 0.177 and $ 0.207 stand out for immediate trade decisions, the graph also reveals other striking price levels that justify closer inspection.

What this means for Dogecoin traders

The graph reveals the largest URPD cluster from Dogecoin around $ 0.177, accounting for around 8.01% of the total stock of doge (around 11.89 billion tokens). This concentration indicates that a large volume of coins are handled in that reach for the last time. Due to the large number of DOG holders with a cost basis around $ 0.177, analysts usually regard this level as an important support zone – where buyers can intervene to defend their positions.

Related lecture

Another remarkable cluster appears at $ 0.2069, which represents around 7.04% of the total offer (around 10.45 billion tokens). Martinez labels it as a key resistance and reflects an important group of holders who have acquired Doge against or near this price. If the market approaches $ 0.207, some participants can look to break or close small profits, causing possibly sales pressure.

One of the most striking observations is the big peak for $ 0.06653, where around 30 billion tokens were handled. This by far the highest bar dwares much of the smaller clusters on the graph, indicating that a huge volume of the Doge nutrition in the past shifted for that price.

Related lecture

Although the market is currently well above $ 0.06653, this level could be considerable if the prices ever correctly correct. It represents a considerable cost basis for a large part of the holders, making it possible a powerful area of support if Dogecoin experiences a deeper downward movement below $ 0.177.

At the top, the histogram emphasizes two important concentrations above current prices. About $ 0.2753, slightly lower than 5 billion tokens became transactive, and at $ 0.3622 exchanged slightly above 5 billion tokens. These high bars can act as important resistance nuisances such as Dogecoin can break above the shorter ceiling for $ 0.207.

As soon as Doge achieves a profit then $ 0.207, buyers can be looking for Momentum to carry it to $ 0.2753, where fresh resistance could appear. If bullish sentiment remains robust, the region can become the next important level to look at around $ 0.3622.

At the time of the press, DOGE traded at $ 0.196.

Featured image made with dall.e, graph of tradingview.com