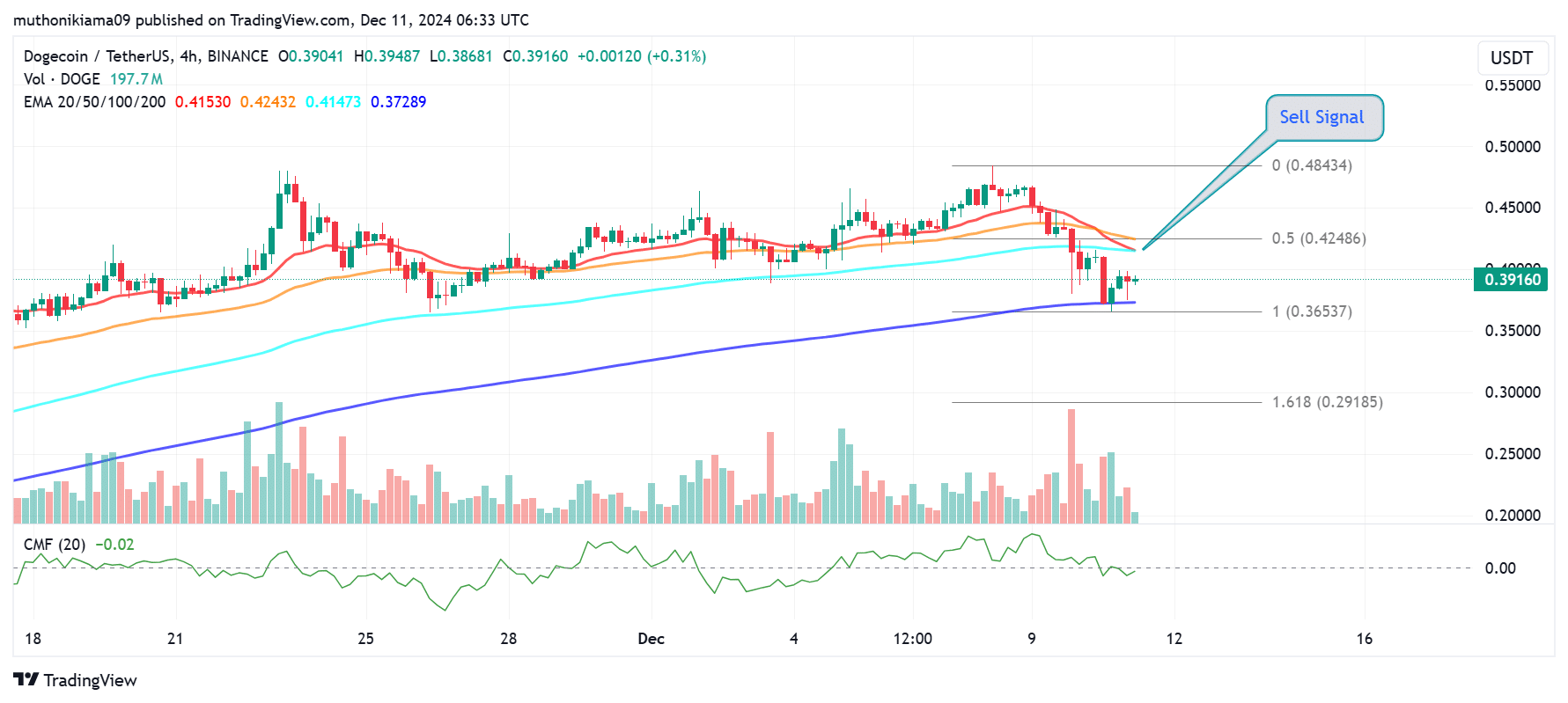

- Dogecoin formed a sell signal after the 20-day EMA converged with the 100-day EMA, showing a weakening short-term trend.

- Whales could also benefit after two major addresses moved $56 million worth of DOGE to Robinhood.

Dogecoin [DOGE] is facing a correction after its remarkable rally that saw it reach a multi-year high above $0.48. At the time of writing, the largest memecoin was trading at $0.39, having fallen 3.49% in 24 hours.

Dogecoin is facing more bearish trends as shown in the four-hour chart. DOGE is trading below the 20-day, 50-day, and 100-day Exponential Moving Averages (EMAs), indicating a bearish short-term trend.

A crucial support level is at the 200-day EMA ($0.34). If Dogecoin falls below this price, the long-term trend could also turn negative.

On this lower time frame, a sell signal emerged after the 20-day EMA converged with the 100-day EMA. If the 20-day EMA falls below $0.41 and moves below the longer-term moving average, it will confirm this sell signal and trigger a downturn.

Source: TradingView

The Chaikin Money Flow (CMF), with a negative value of -0.02, also showed that sellers were already active.

If Dogecoin’s trend continues to weaken as sellers dominate the market, it could fall to the Fibonacci level of 1.618 ($0.29).

Conversely, a crucial resistance level lies at the 0.5 Fib level of $0.42, which is also the 50-day EMA. If the dip attracts buyers, DOGE could reverse this level and resume its uptrend.

Are Dogecoin Whales Taking Profits?

Whale Alert data shows that two whale addresses transferred 146 million DOGE tokens, worth more than $56.42 million, to the Robinhood exchange on December 10. This transfer may indicate an intention to sell.

Source:

As AMBCrypto reported, Dogecoin is whaling fast accumulated the memecoin last month, which affected the short-term price action.

If these whales start selling at the same rate they bought, DOGE risks wiping out its recent gains.

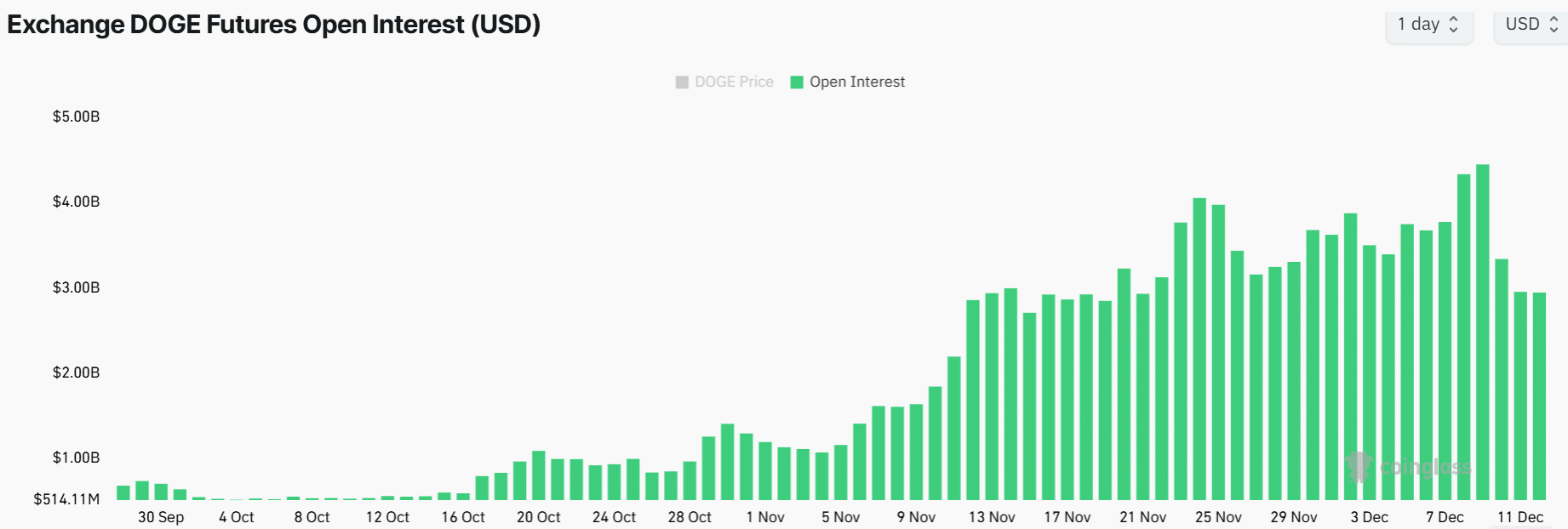

Speculative interest is waning

Dogecoin’s Open Interest (OI) hit an all-time high of $4.45 billion on December 9, after tripling in less than a month as speculative interest in the memecoin increased.

However, over the past two days, OI has fallen by more than $1.5 billion to $2.95 billion at the time of writing.

Source: Coinglass

Falling OI indicates that traders are closing their positions on Dogecoin. The reduced market participation is further reflected in derivatives trading volumes, which were down 34% to $14.23 billion at the time of writing. Mint glass.

The shift in sentiment in the derivatives market could reduce price volatility and force DOGE to consolidate.

Market sentiment is bearish

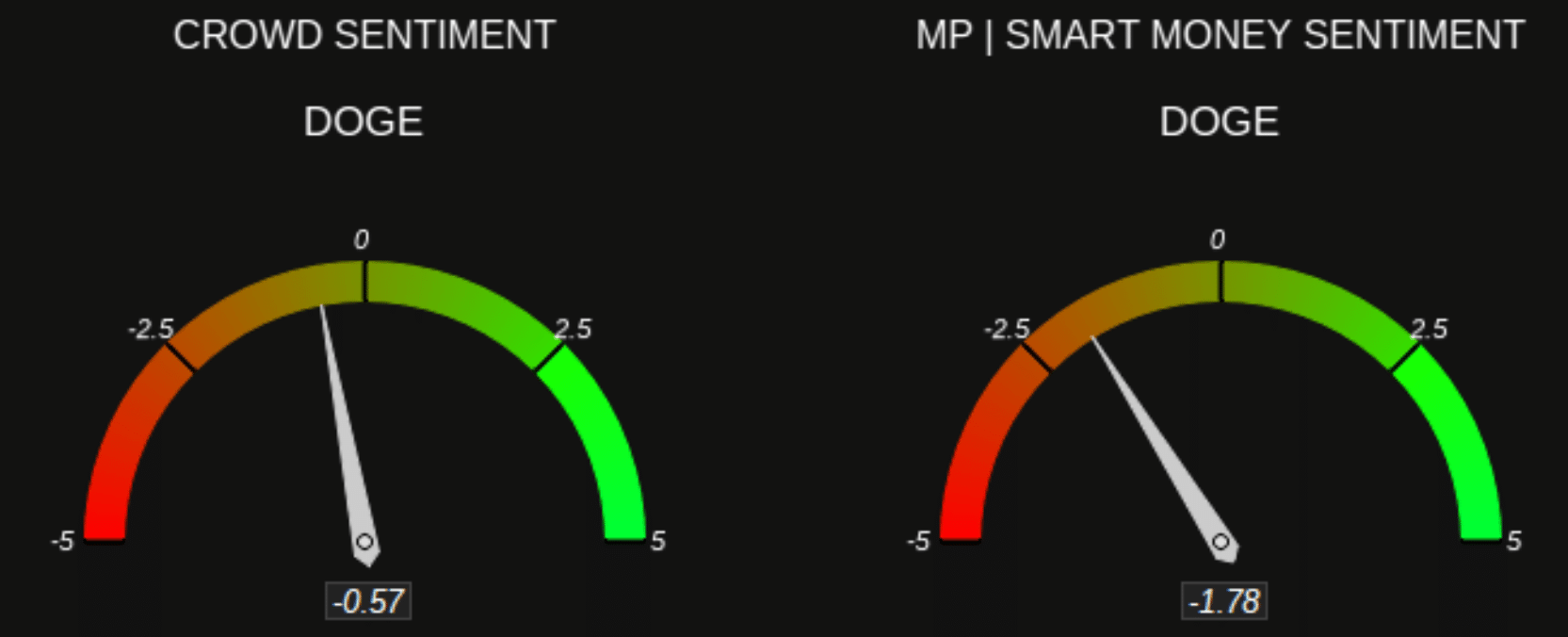

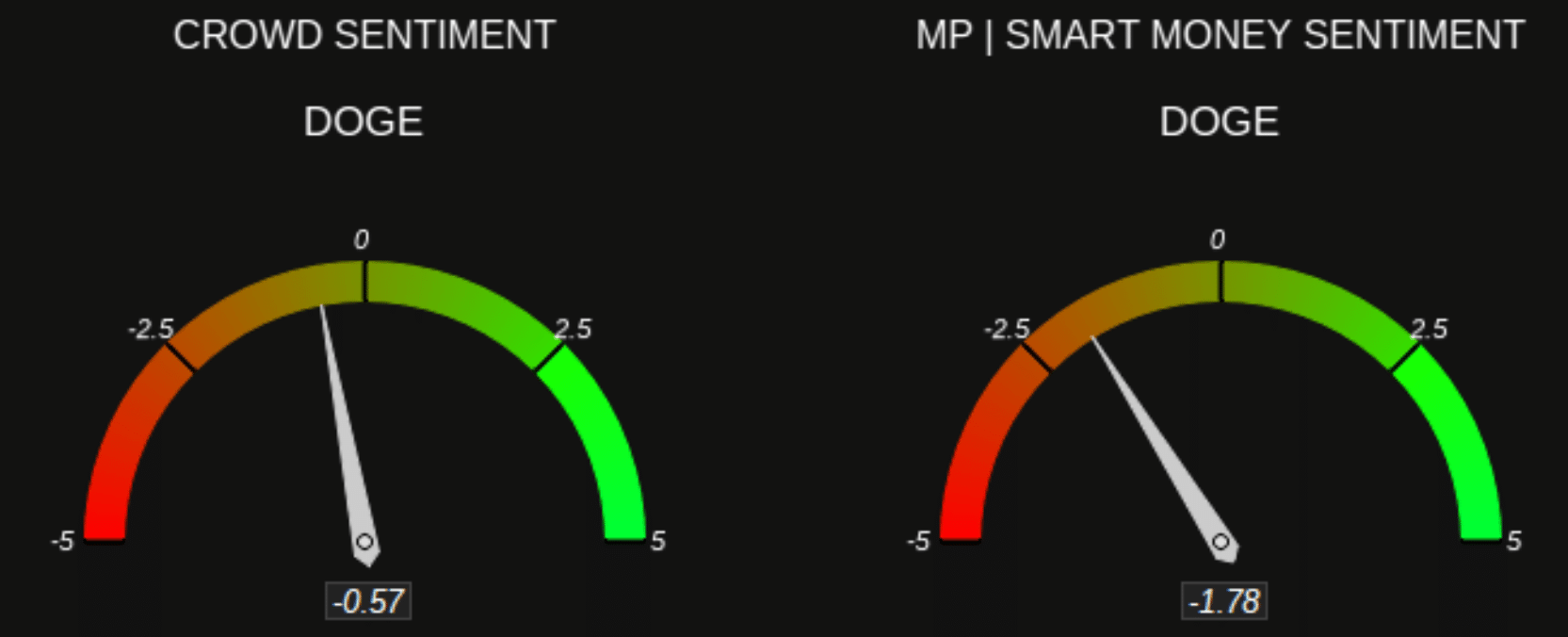

These bearish signs have dampened market sentiment around Dogecoin, as reflected by Market Profhit. Both the public and smart money sentiment on DOGE are bearish, indicating that traders expect further declines.

Source: Markt Profhit

Read Dogecoin [DOGE] Price prediction 2024-2025

If market sentiment remains gloomy, it could hinder buying activity, resulting in more declines for DOGE.