- The US CPI in July was softer than expected, at 2.9%, versus an estimated 3.0%.

- The US government’s $593 million BTC push could have spooked the markets.

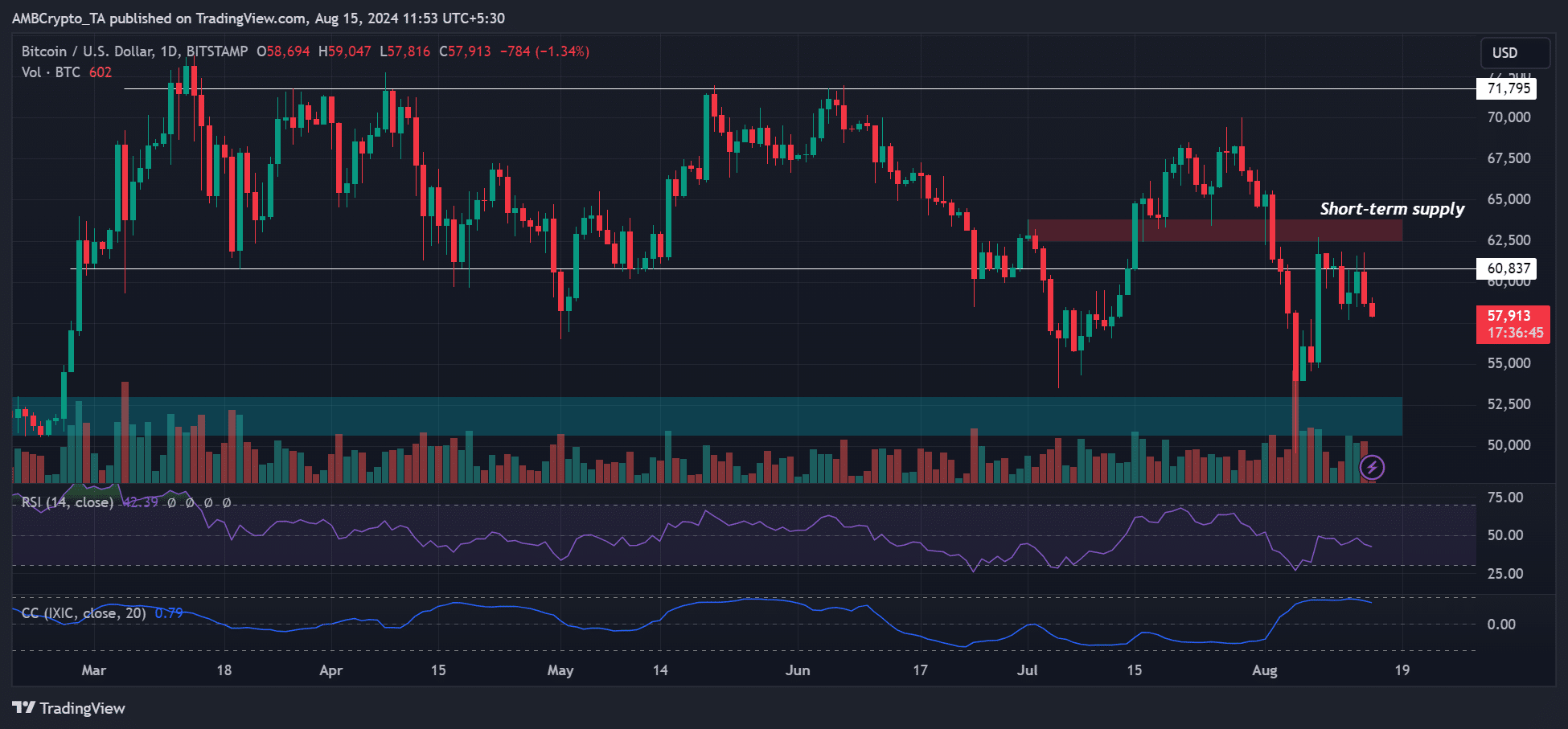

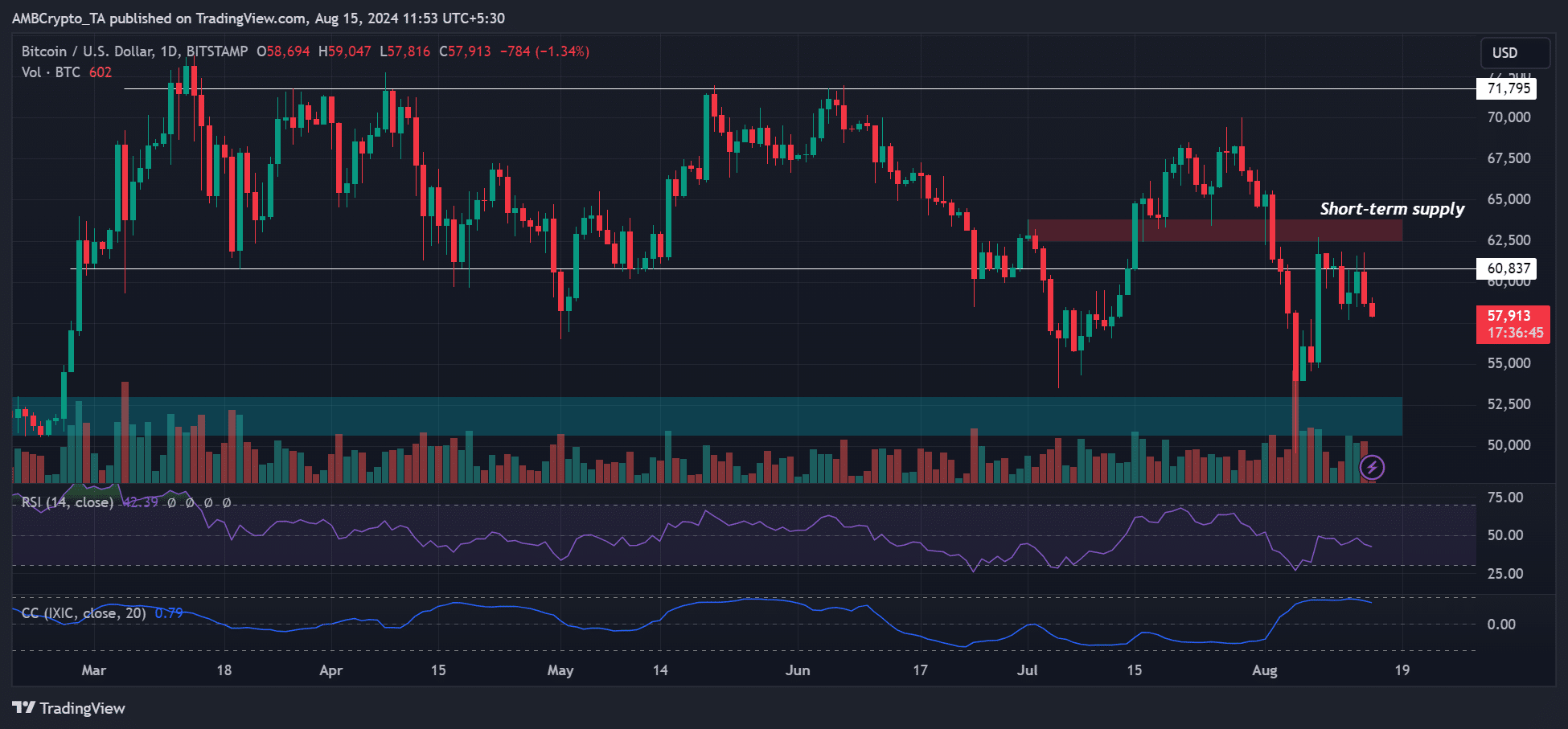

Bitcoin [BTC] failed to stay above $60,000 despite softer US CPI (consumer price index) in July factswhich came in at 2.9% year-on-year (year-over-year), versus the expected 3.0%.

The softer inflation data led to a slight rebound in the US stock market, including the tech-heavy Nasdaq Composite (IXIC).

However, BTC, which has a strong positive correlation with the Nasdaq Composite, moved in the opposite direction.

It lost 3%, dropping from $61.8K to $58.8K on August 14. At the time of writing, it remained weak above the $58k level.

Source: BTC/USD, TradingView

The softer CPI data is still bullish for BTC

Despite BTC’s sluggish intraday session on August 14, market insiders were still optimistic about the positive CPI print for BTC.

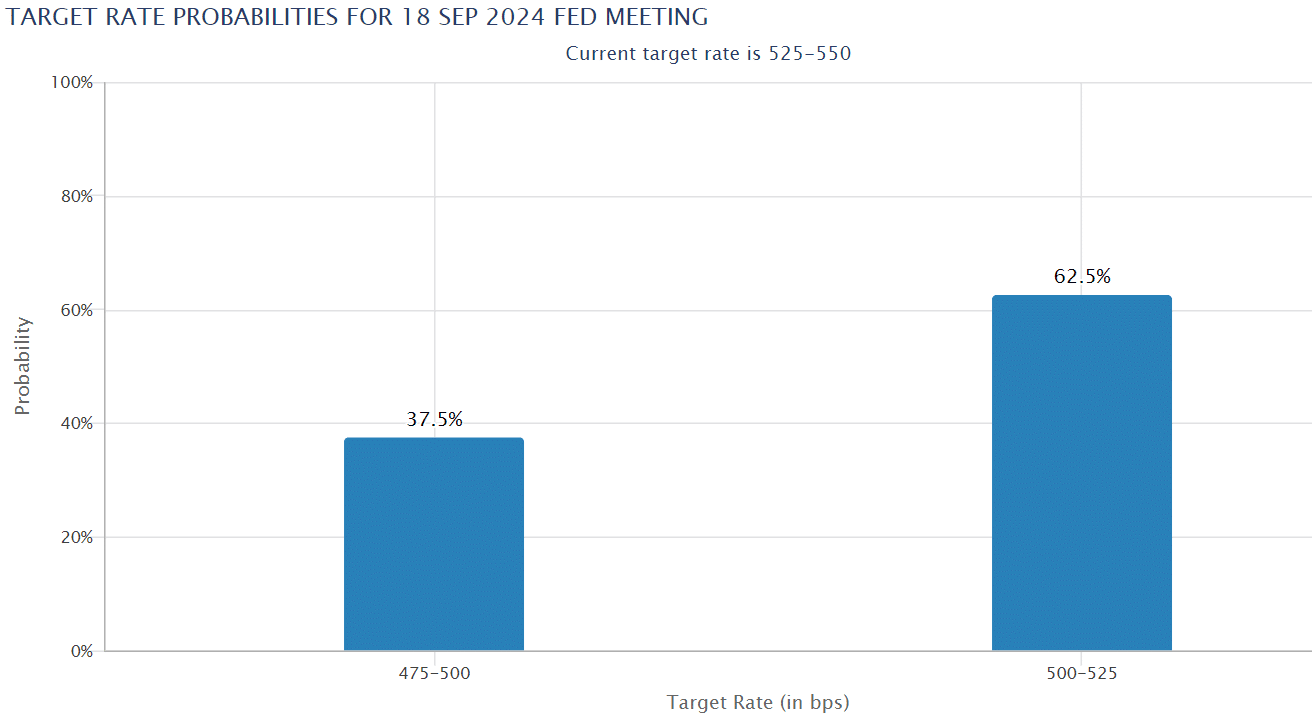

Eliezer Ndinga, VP, head of strategy and BD at digital asset manager 21Shares, told AMBCrypto that the softer CPI would increase the likelihood of a Fed rate cut in September and boost crypto markets.

“With inflation materializing as expected, the likelihood of a smaller 25 basis point rate cut from the Fed has increased, which could support risky assets.”

Bitwise CIO Matt Hougan echoed the same vision,

“The Fed will start cutting rates in September; 3% is the new baseline for inflation, not 2%. Both are bullish for Bitcoin.”

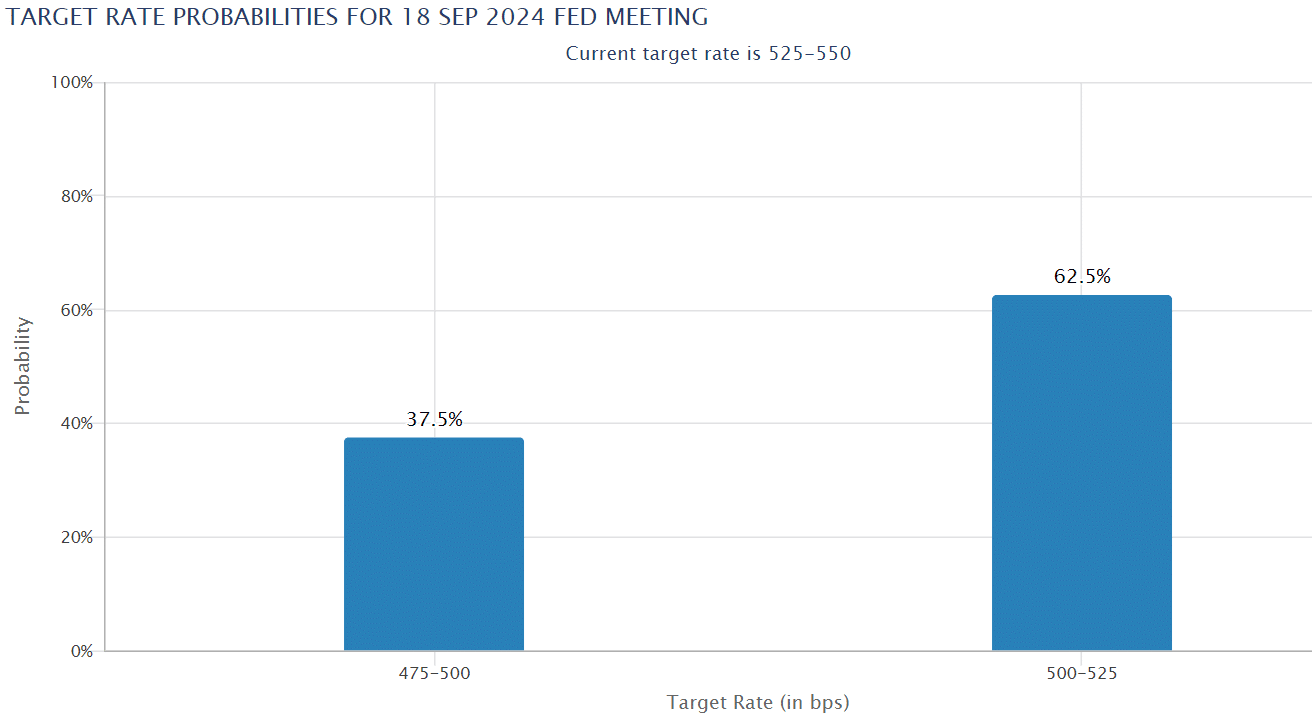

At the time of writing, these were the interest rate traders prices a 62% chance of a 25 basis point Fed rate cut in September.

Source: CME

$593 million BTC passes US Ghost market again?

Meanwhile, the US government on Thursday moved 10,000 BTC, worth more than $590 million, to another Coinbase Prime, according to Arkham facts.

Despite reportedly Since it was for custody purposes, a similar transfer by the US government spooked the markets about two weeks ago and dragged BTC lower.

As a result, FundStrat has Insights claimed that the actions of the US government could have hindered the expected recovery of the softer CPI figures.

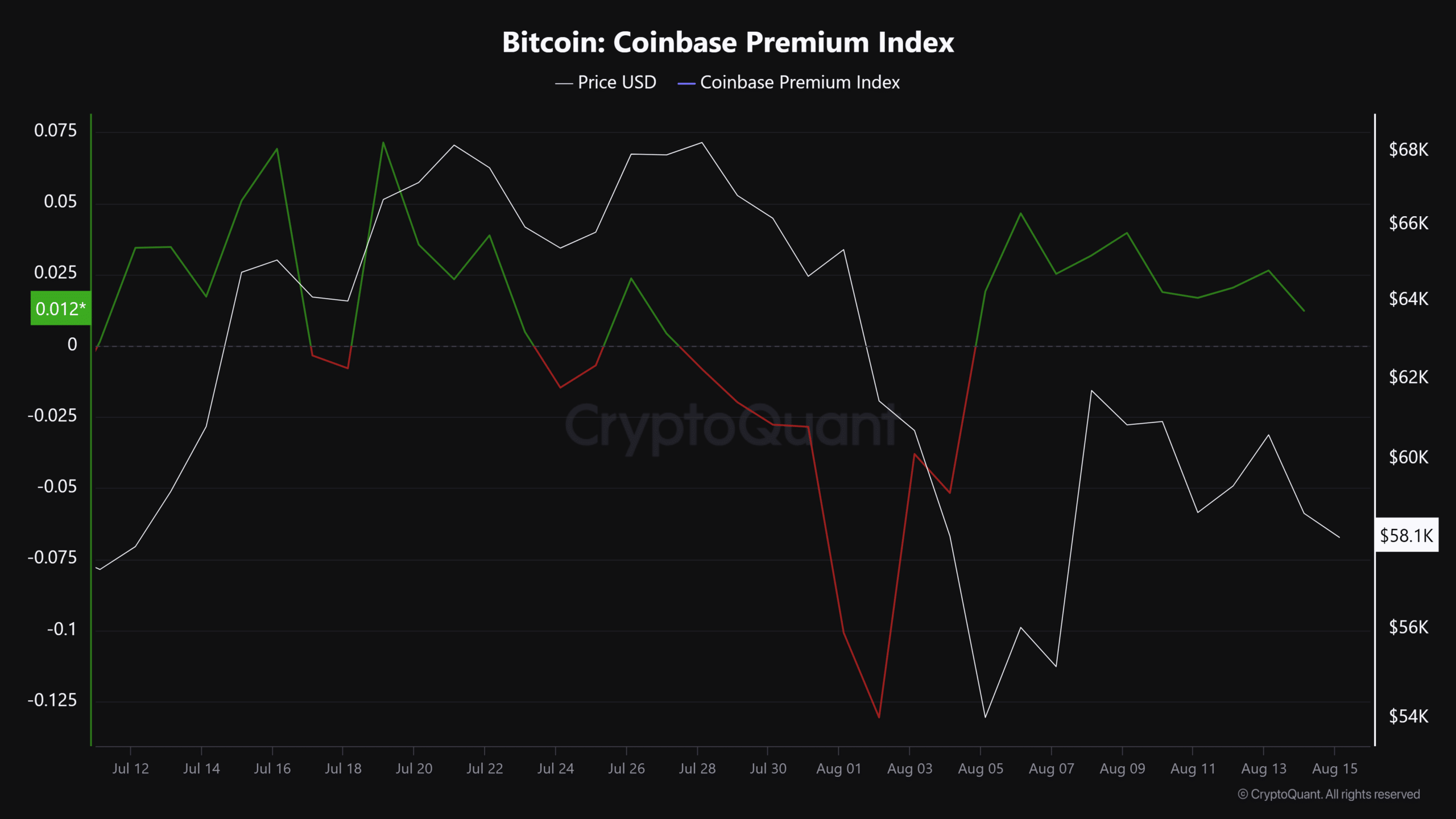

Meanwhile, the Coinbase Premium Index was still positive at the time of writing amid waning recovery momentum. It suggested there was still weak demand for the largest digital asset from US investors.

Source: CryptoQuant