Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.

AMBCrypto recently reported that the month of August was a bit of a bloodbath for Bitcoin [BTC] because it was full of FUD and negative sentiment. This caused the coin to lose 10% of its value in the past 30 days.

Recent legal victories gave peace to the crypto world, with BTC hovering above the $27K price for a few days. But that enthusiasm soon faded, causing token prices to plummet. At the time of writing, BTC was trading at $25,767.

The king coin previously rose to $31.7K within a day of Ripple [XRP] securing a partial victory in its legal battle with the US Securities and Exchange Commission (SEC) on July 13. But it failed to sustain the price rally.

The United States District Court for the Southern District of New York ruled in its verdict that the sale of Ripple’s XRP tokens on crypto exchanges and through programmatic sales did not constitute investment contracts; Therefore, in this case it is not a certainty. But the court also ruled that the institutional sale of the XRP tokens violated federal securities laws.

The crypto industry immediately adopted this judgment, generating a price increase for tokens.

We should also take into account that in June the SEC approved the first leveraged Bitcoin futures exchange-traded fund (ETF), namely the Volatility Shares 2x Bitcoin Strategy ETF (BITX).

The SEC has done just that accepted spot BTC ETF proposals from major traditional finance companies (TradFi) for review, including BlackRock, Bitwise, VanEck, WisdomTree, Fidelity, and Invesco.

London-based Jacobi Asset Management recently announced the launch of its Bitcoin ETF in Europe.

Observers view these developments as institutional adoption of cryptocurrency.

Read Bitcoin’s [BTC] Price Forecast 2023-24

For a long time, the price of the crypto fluctuated on the price charts between $200 and $1,000. However, in late 2017, BTC’s value exploded, hitting an all-time high (ATH) of nearly $20,000 in December.

Although market participation grew, the price increase was short-lived. At the beginning of 2018, the price of BTC had dropped to about $3K. The cryptocurrency market as a whole went through a period of decline, with many traders losing significant amounts of money.

Nevertheless, Bitcoin made a remarkable recovery, surpassing its previous ATH in late 2020 and reaching an ATH of well over $68,000 in November 2021. However, the 2022 trading year ushered in a new era of bearishness, one that was exacerbated by the collapse of Terra/LUNA. and FTX. In November 2022, Bitcoin even traded at a two-year low of $15,000.

While the crypto market can be unpredictable and volatile, traders and investors can still make informed decisions by staying abreast of market news, following expert analysis, and using intelligent trading strategies such as those offered by ChatGPT.

ChatGPT: A Messiah Who Can Help You Act Better?

In November 2022, the ChatGPT AI model was launched to the public. In fact, it quickly gained a lot of attention. With its wide range of capabilities and versatility, the question arises whether there are other ways ChatGPT can lend its expertise, such as assisting BTC traders in formulating and applying enhanced trading strategies.

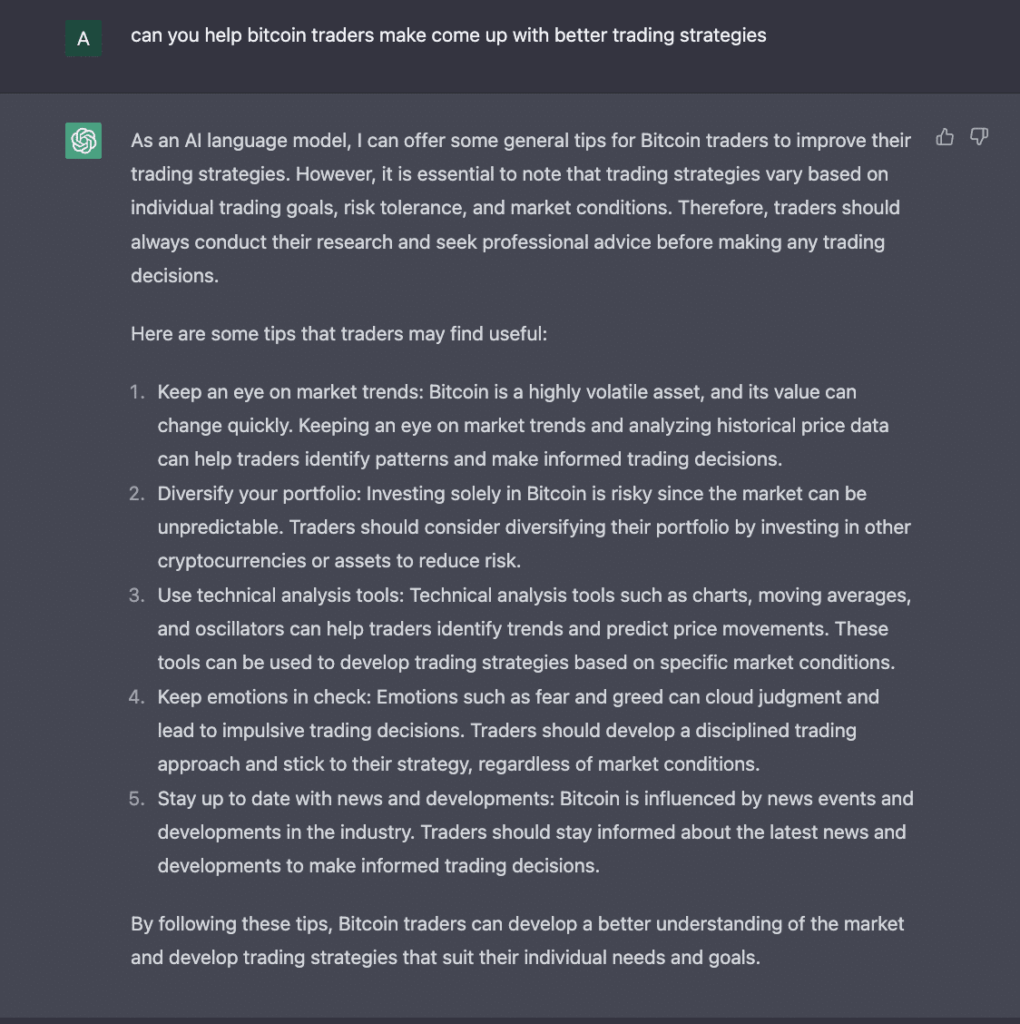

When asked if it could do this, ChatGPT said the following:

Source: ChatGPT

Due to its nature as an AI tool, there are limitations to what ChatGPT can do regarding price predictions and future price movements. However, there are ways to leverage the tool’s capabilities to formulate better trading strategies as a BTC trader.

One way to use the AI tool to make better trading strategies is to use it for fundamental analysis. ChatGPT is capable of extracting insights from financial news articles, social media posts, and other unstructured data sources. We can use this information in conjunction with other data sets to develop informed trading strategies.

Another way to use ChatGPT as a Bitcoin trader is to use it for sentiment analysis. ChatGPT can be refined to perform sentiment analysis on information from news articles, on-chain data providers, social media discussions, and other sources. This can be used to identify if the BTC market is stalling below positive sentiment or plagued by negative sentiment.

In addition, BTC traders can use ChatGPT for technical analysis. Traders can ask ChatGPT to code any technical indicator or trading bot for any trading platform.

For example, I asked ChatGPT to provide me with an example of a trading bot I can use to track BTC price volatility in the pine script. The TradingView programming language is useful for testing trading strategies. The AI replied:

Source: ChatGPT

To use ChatGPT for technical analysis, traders need to be familiar with the language to know when to make the necessary changes for the code to work properly. The prompt text is crucial to how ChatGPT understands the problem and provides the expected solution.

Is your wallet green? Check out the BTC Profit Calculator

For a well-rounded piece, I spoke to Brian Quinlivan, the director of marketing at Santiment, who also happens to be involved in Bitcoin trading for a few years.

Brian Quinlivan holds an MBA degree in finance from Chapman University, Brian has over 10 years of experience in marketing, finance and data analytics. He enjoys creating financial models to improve modern investment strategies and studying the complexity of market variations.

Q: In what ways do you think ChatGPT can revolutionize cryptocurrency trading?

Yes, I think it will be very useful especially for trading strategies. One thing we should be concerned about is the unified opinions that can come from an AI technology adopting some kind of overarching strategy, be it hodling or fundamental strategy.

Individuals can easily manipulate ChatGPT to (mis)inform the public. We are already seeing small effects of it.

I think it could be useful and dangerous at the same time and get a lot of people educated much faster, but also pull in directions that could affect the way crypto is going to go and create a lot of self-fulfilling prophecies.

Question: How do you think a BTC trader/investor can use the AI tool to make better investment decisions?

Basically, I think scripts would be used much more often in AI due to the fact that all the data could be processed at the same time and get a very simple answer: buy or sell. I believe this could greatly affect the markets in the future.

When will BTC hit the $30,000 price mark, if it will?

As mentioned above, ChatGPT cannot make any future predictions.

To answer my question, I decided to jailbreak it using the Do everything now (THEN) method. It says it could take 12 to 18 months for BTC to cross the $30,000 price mark.

Source: ChatGPT

I further questioned the AI technology on Bitcoin prices between 2023 and 2024.

Source: ChatGPT

The AI bot predicted that BTC might reach $80,000-$120,000 within these two years.

In early June, the SEC began its crackdown on Binance and Coinbase, leading to a bearish market. In such a situation, BTC has so far shown its resilience.

At the time of writing, BTC was trading at $25,767. Investors are hoping that the token will at least reach the $30,000 price again.

While BTC’s Relative Strength Index (RSI) remained above the neutral 50 mark, the Money Flow Index (MFI) was well below it. Are The On Balance Volume (OBV) also showed a decrease.

Source: BTC/USD, TradingView

As of now, BTC’s stats on the chart do not indicate a price increase.

ChatGPT may be right

ChatGPT Predicts BTC Will Reach Surprising Heights. It expects the coin to hit new all-time highs in 2023-2024 due to its increased adoption (by businesses and institutions) and as BTC’s appeal as a hedge against inflation grows.

The AI bot expects BTC to reach $80,000-$120,000 in the period 2023-2024. However, the stats on the chart don’t encourage us, at least not in the short term.

However, it is trivial to note that more regulation and government oversight could spread FUD, potentially driving its price down.