- Volume peaks confirm a stronger sales pressure during the price decrease.

- The Death Cross and Fibonacci levels indicate more decreases in the store.

Bitcoin’s [BTC] Price continued his downward process and traded at $ 82,499 from the moment of press, after breaking under crucial support levels.

The cryptocurrency is now confronted with increasing bearish pressure, with technical indicators that suggest a long -term correction.

As an addition to the technical care, the well-known analyst Ali hit lists tweeted that Bitcoin has seen a crossover between the 50-day and 100-day advanced averages on the Daily Chart.

Source: X

This suggests constant shifts in Momentum that traders must keep a close eye on.

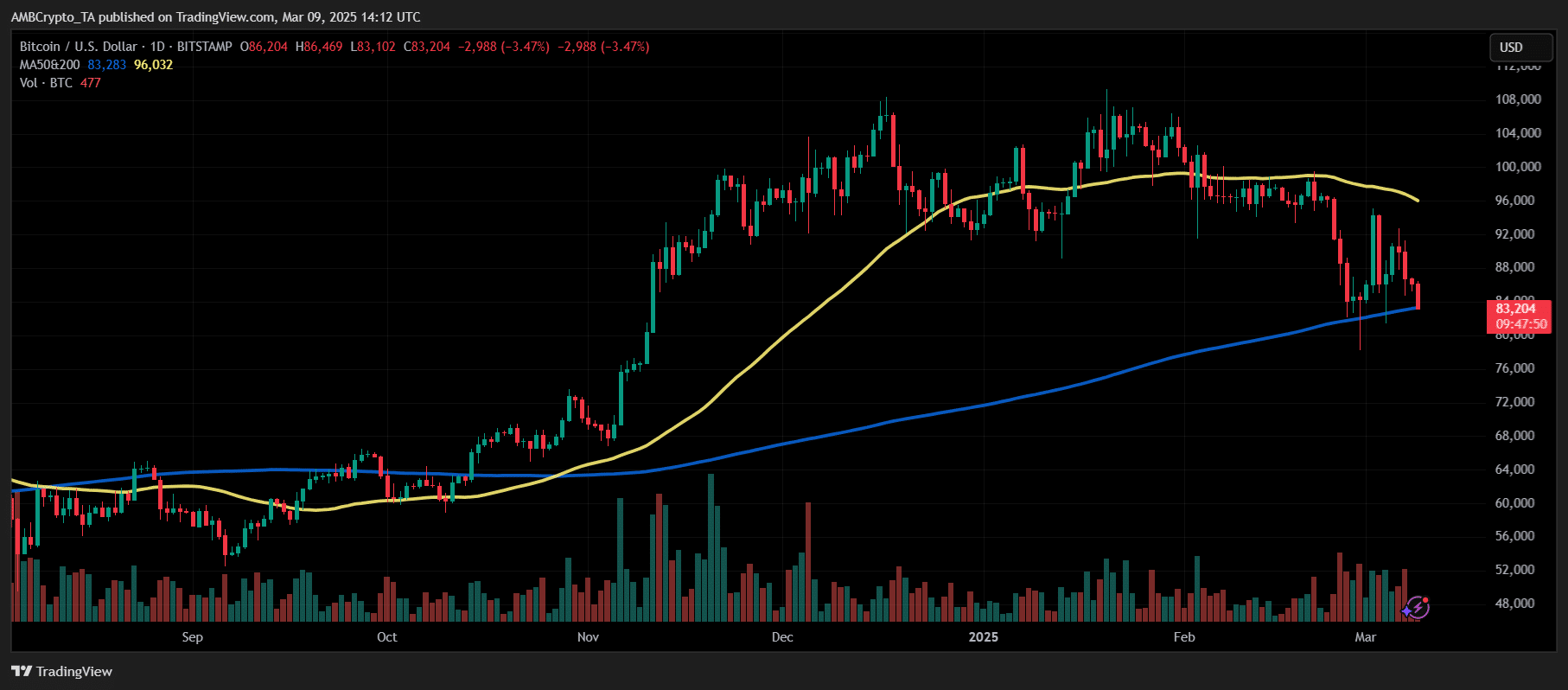

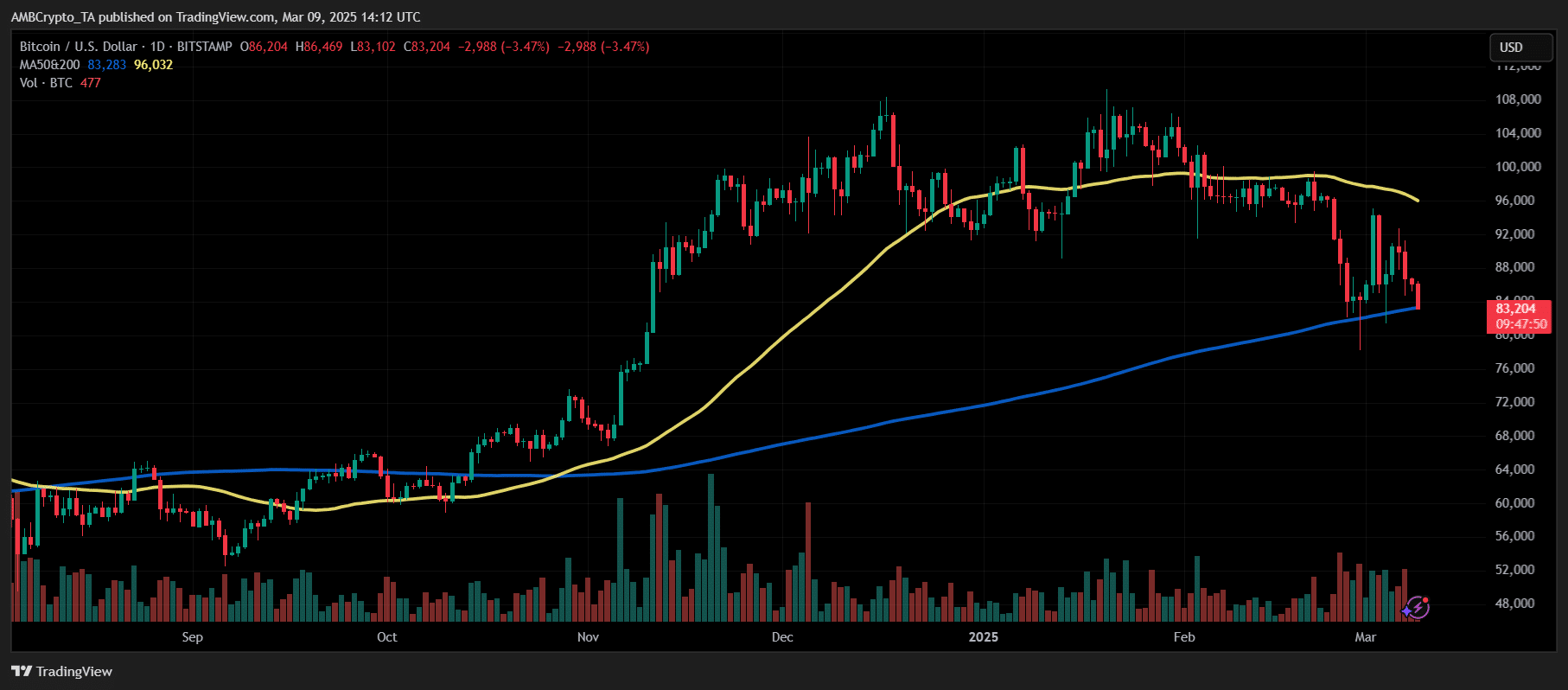

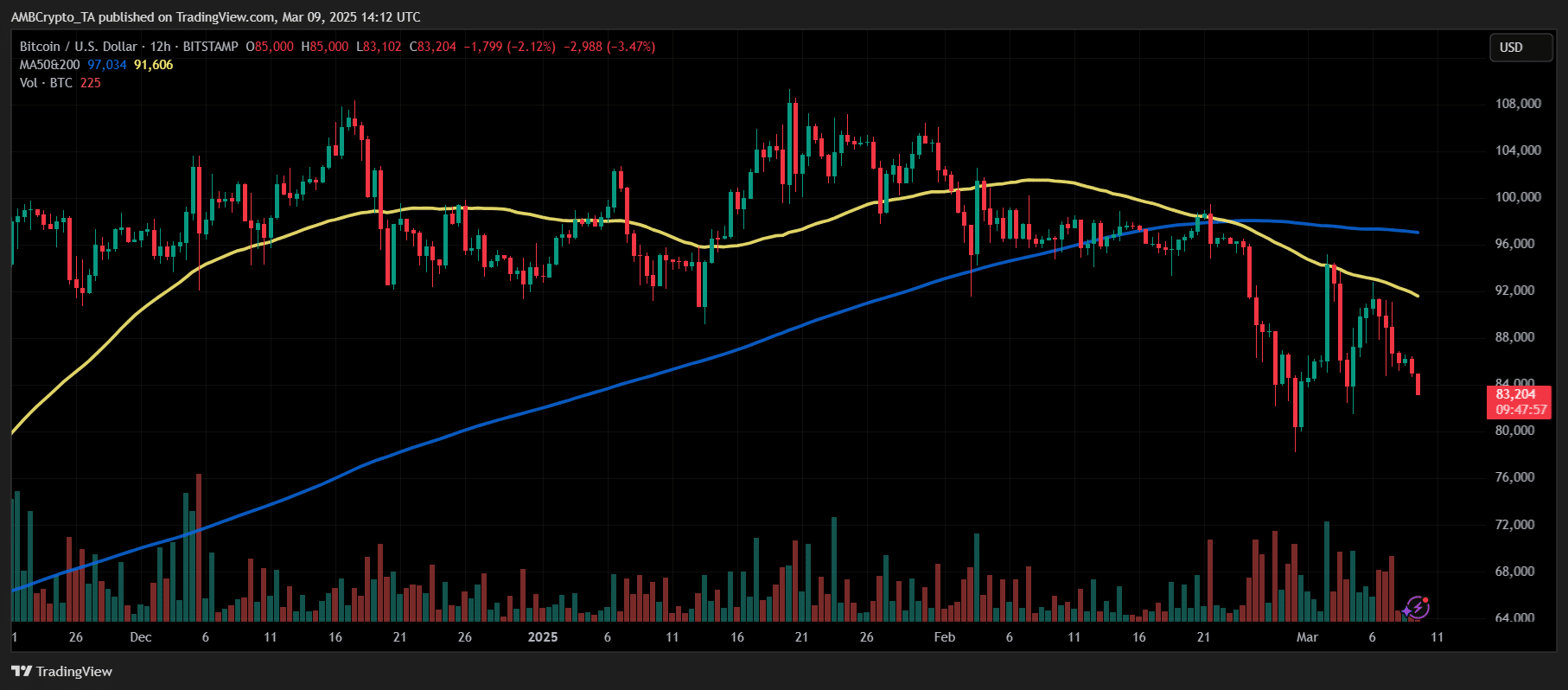

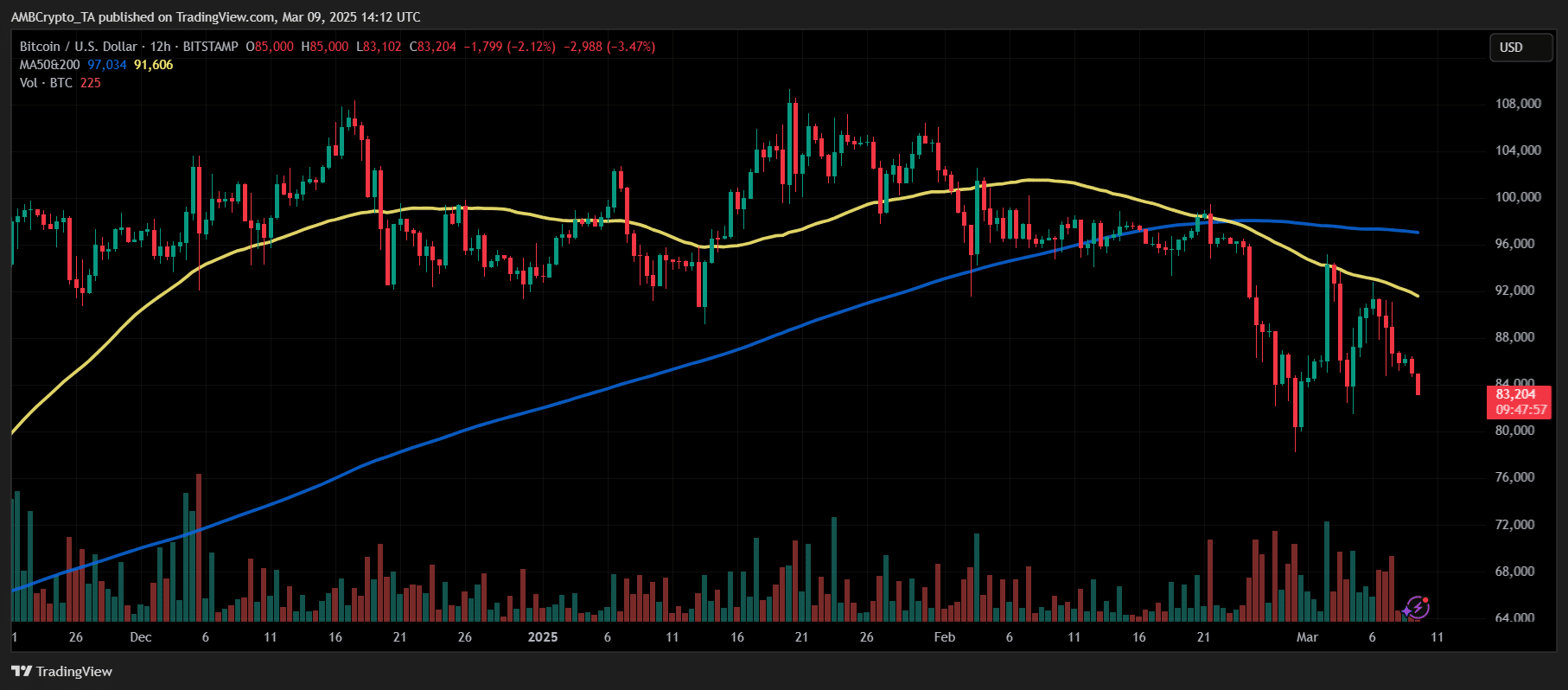

Death Cross confirms Beerarish Trend

A death cross-a well-known Beerarish signal-werd confirmed in February when Bitcoin’s 50-period (MA) on the 200-period MA fell on both daily and 12 hours of timetables.

Source: TradingView

Historically, this crossover preceded longer periods of downward price action.

Source: TradingView

Bitcoin’s 50-Period Mon was $ 97,041 on the press, while the 200 period was Mon $ 91,631. The reinforced strong resistance levels above the price.

BTC still has to show signs of reversing the trend, which remain under these key levels.

Fibonacci -levels suggest further decreases

Bitcoin previously failed to keep a movement above the 50% Fibonacci retracement level at $ 85,723. It now tested the Retracement level of 23.6% at $ 82,902, an important short -term support.

A decisive break under this zone can lead to a deeper correction to $ 80,380, which marks the 0% Fibonacci racement of recent highlights.

Source: TradingView

The most recent rejection of BTC near $ 88.181, in accordance with the 61.8% Fibonacci level, suggests that Bullish attempts have been weak, so that the downward pressure further validated.

RSI is approaching over -sold territory

The relative strength index (RSI) was 40.70 at the time of the press, which showed a weak momentum but did not enter any sold -over circumstances (<30).

Source: TradingView

Previous RSI departments at 33.79 and 16.73 indicate that Bitcoin has experienced historically deeper corrections before significant rebounds.

A drop under 30 RSI would suggest over -sold circumstances, which may indicate a short -term reputation.

Volume trends strengthen the sales pressure

Volume analysis shows that sales of activity peaks during downward movements, which confirms a market that is powered by Bearish sentiment.

However, if Bitcoin experiences a volume decrease during further price decrease, this may indicate the depletion of the seller, possibly on making an exemption.

Bitcoin tested $ 82,902 at the time of writing, the 23.6% Fibonacci retracement level, which serves as immediate support. Holding above this level is crucial to prevent further disadvantage.

A breakdown under $ 82,902 could push Bitcoin to $ 80,380, the 0% Fibonacci retracement level, which marks a critical support zone.

Main support and resistance levels to view

At the top, Bitcoin faces a strong resistance at $ 85,723, the 50% Fibonacci level. A decisive break above this resistance can shift the momentum and allow Bitcoin to test $ 88.181, the 61.8% Fibonacci retracement level.

However, if Bitcoin fails to reclaim $ 85,723, Beerarish can continue to exist, which increases the chance of further decreases. Traders must keep a close eye on these levels at these levels for confirming the continuation of the trend or reversal.

With the death cross still in the game and the 50/100-day advancing average crossover noticed by ali-hit lists, BTC remains in a Downtrend in the medium term unless there is a considerable purchasing pressure.

Traders must follow RSI levels and volume trends with important support to measure potential reversal signals.