- Bitcoin has risen in value by more than 4% in the past seven days.

- Most market indicators pointed to a speedy price correction.

Bitcoin [BTC] and Ethereum [ETH] showed bullish performance over the past seven days as their weekly charts were green. Here’s a detailed look at the top two coins to find out what the upcoming crypto week would look like.

Targeted by Bitcoin and Ethereum

According to CoinMakrtetCapThe price of BTC has risen by more than 3% in the past seven days. Similarly, the king of altcoins also witnessed a 2% increase in price.

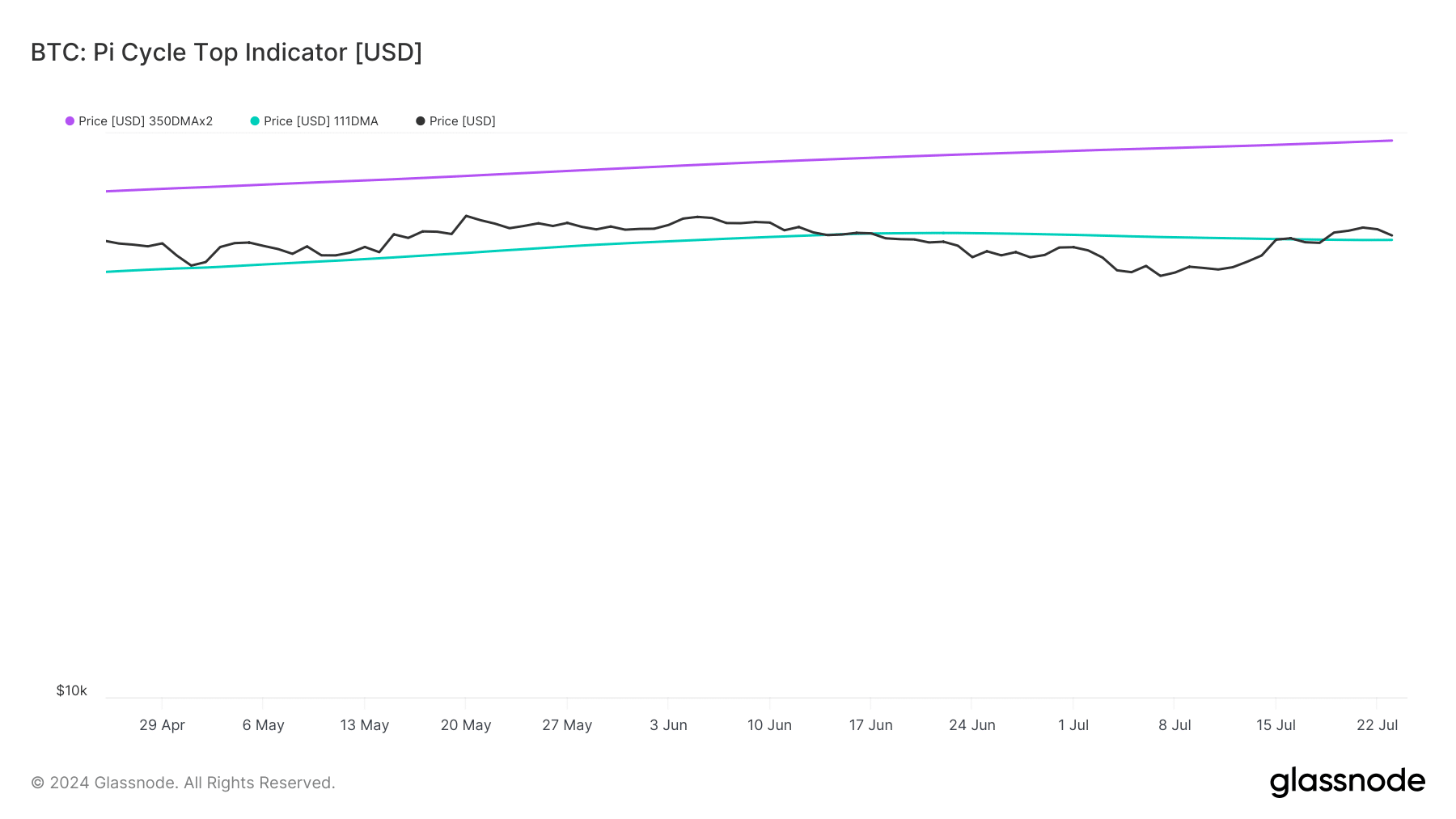

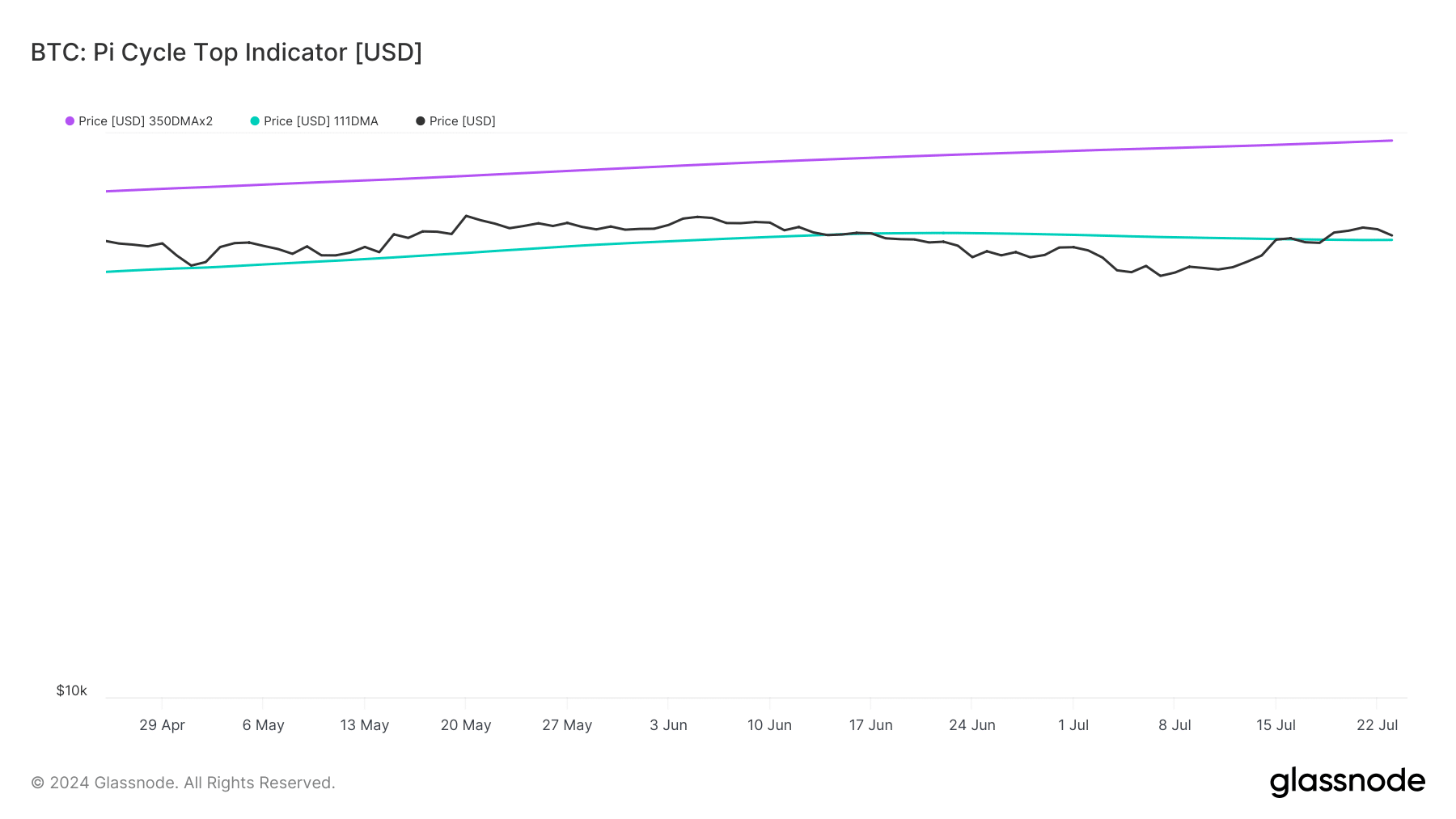

At the time of writing, BTC was trading at $64k, while ETH was trading at $3.5k. AMBCrypto’s analysis of Glassnode’s facts revealed that BTC was trading well below its market top. According to the data, BTC’s possible market top was around $97,000.

Source: Glassnode

Meanwhile, Ethereum’s price gained somewhat bearish momentum as the price reached the bottom of the market. According to the Pi cycle top indicator, the price of ETH could reach a market top of $5.2k.

If the coming week goes bullish, these two top tokens could achieve their goals.

What to expect from BTC and ETH

AMBCrypto next planned to look at the statistics of both coins to better understand whether the coming week will be bullish or bearish.

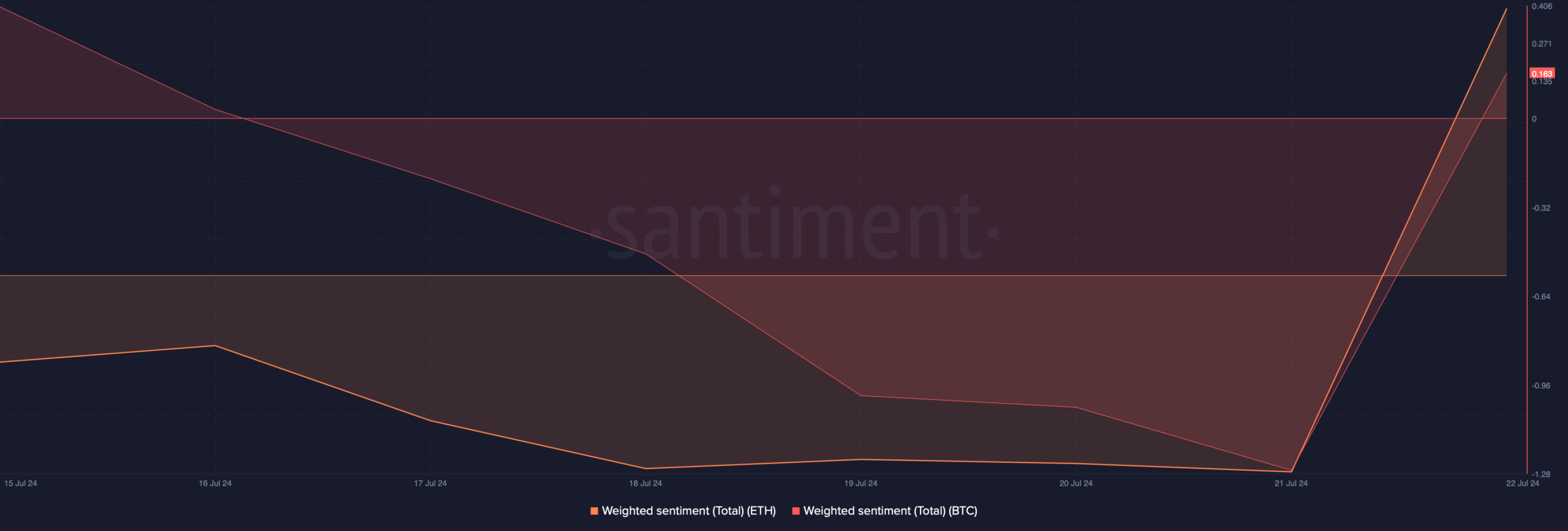

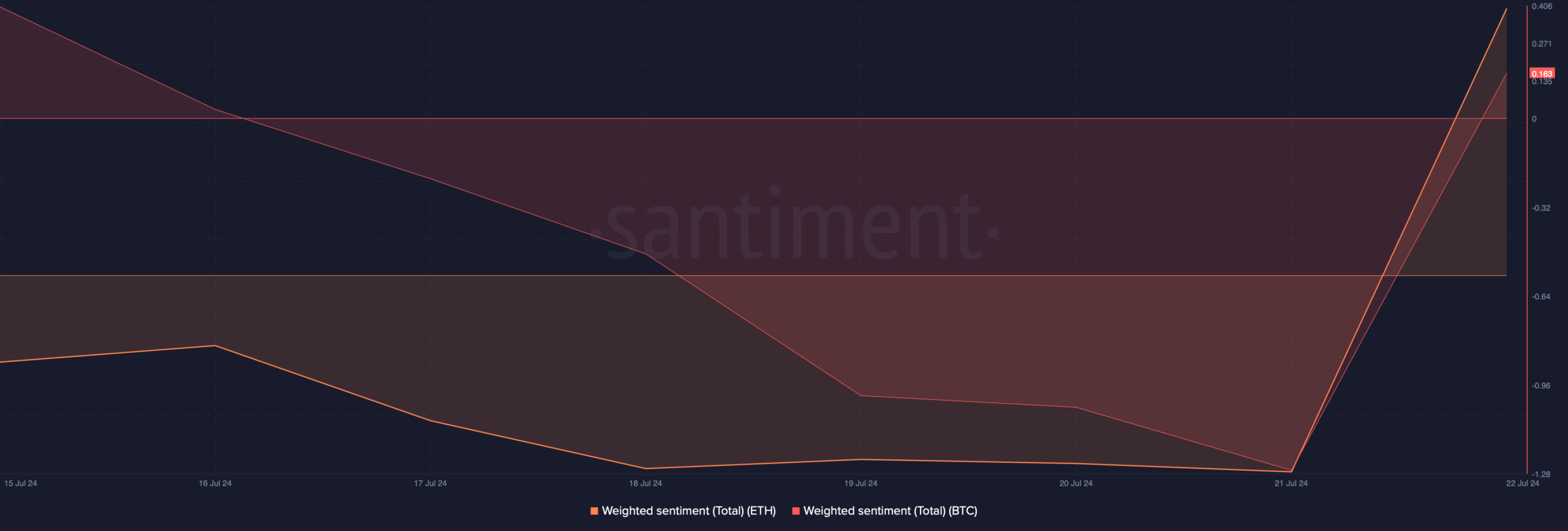

According to our analysis of Santiment’s data, sentiment around BTC and ETH turned bullish. The weighted sentiments of both tokens moved into the positive zone, meaning that bullish sentiments were dominant in the market.

Source: Santiment

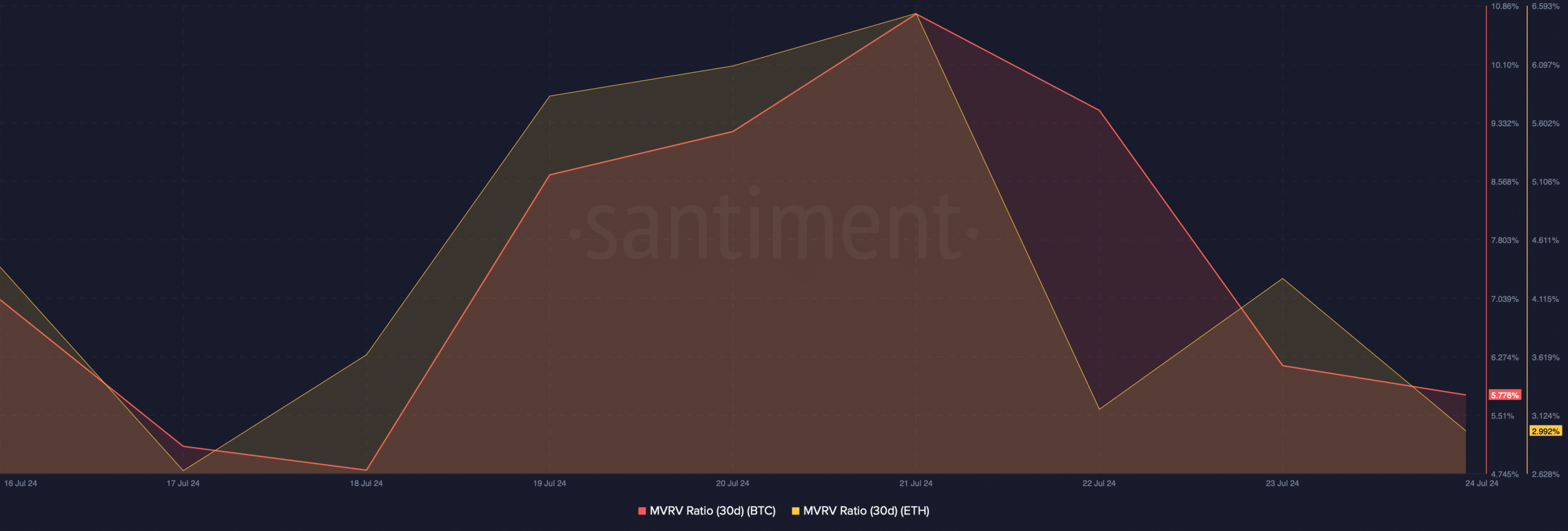

Another bullish signal was the MVRV ratio, which registered an increase over the past seven days. It indicates that the chance of a bull rally is high.

Source: Santiment

Let’s take a look at the daily charts of BTC and ETH to better understand what to expect from them in the coming days.

BTC and ETH price chart analysis

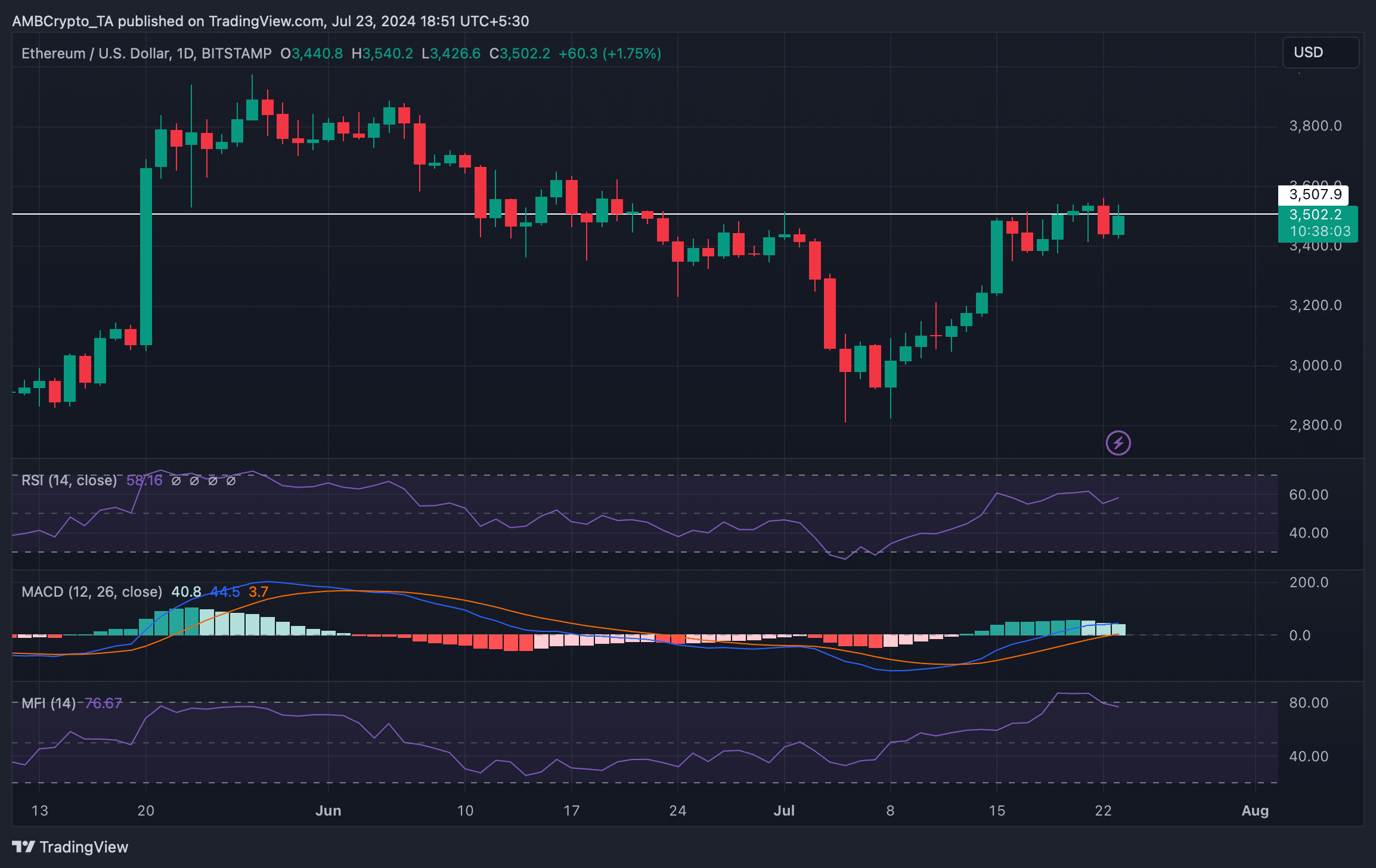

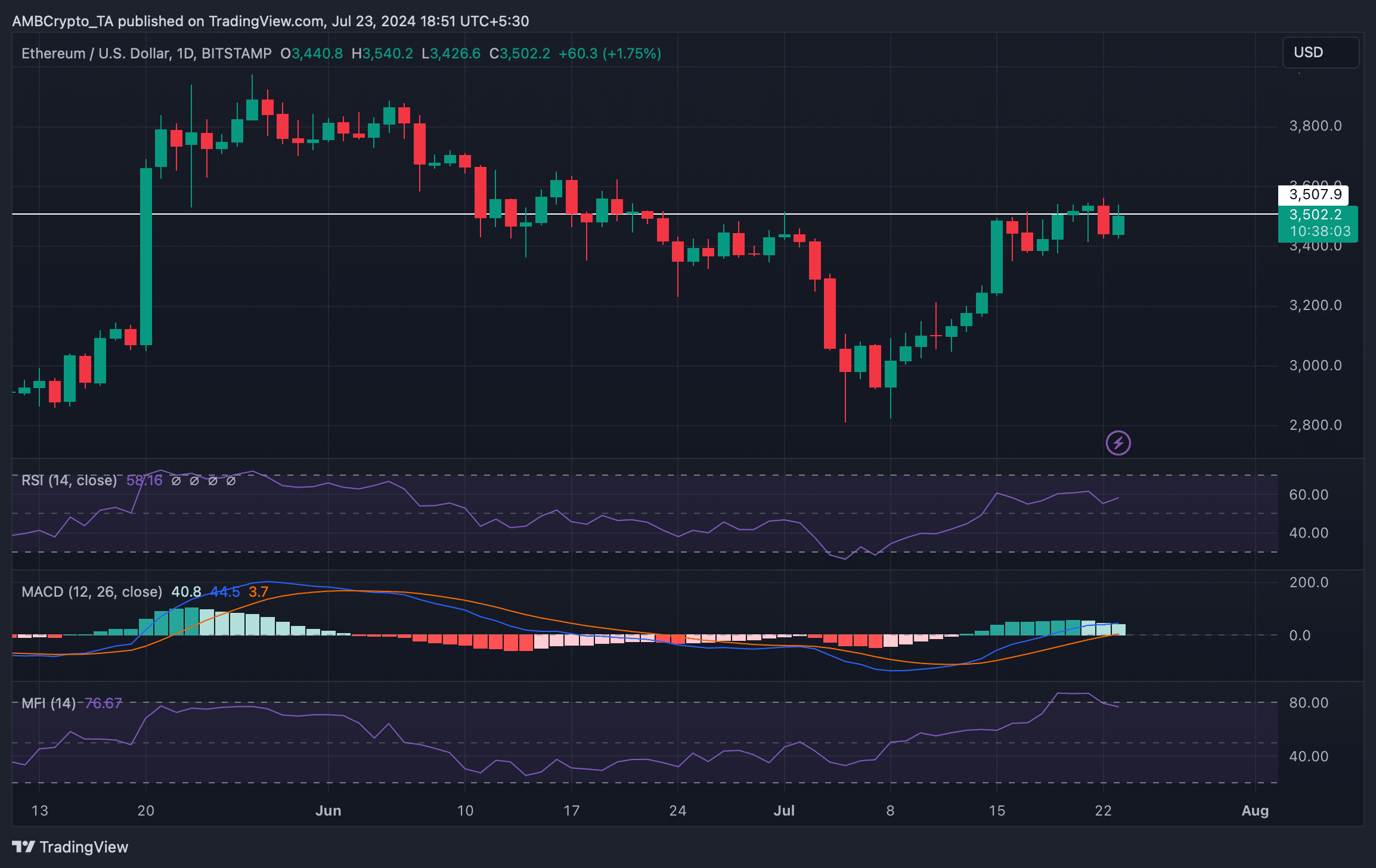

According to our analysis, the MACD showed a bullish advantage in the market for ETH. However, the rest of the market indicators were bearish.

For example, the Relative Strength Index (RSI) and the Money Flow Index (MFI) were both on the verge of entering overbought territory. This could increase selling pressure on ETH and in turn lower the price of the coin.

Source: TradingView

Read Bitcoins [BTC] Price prediction 2024-25

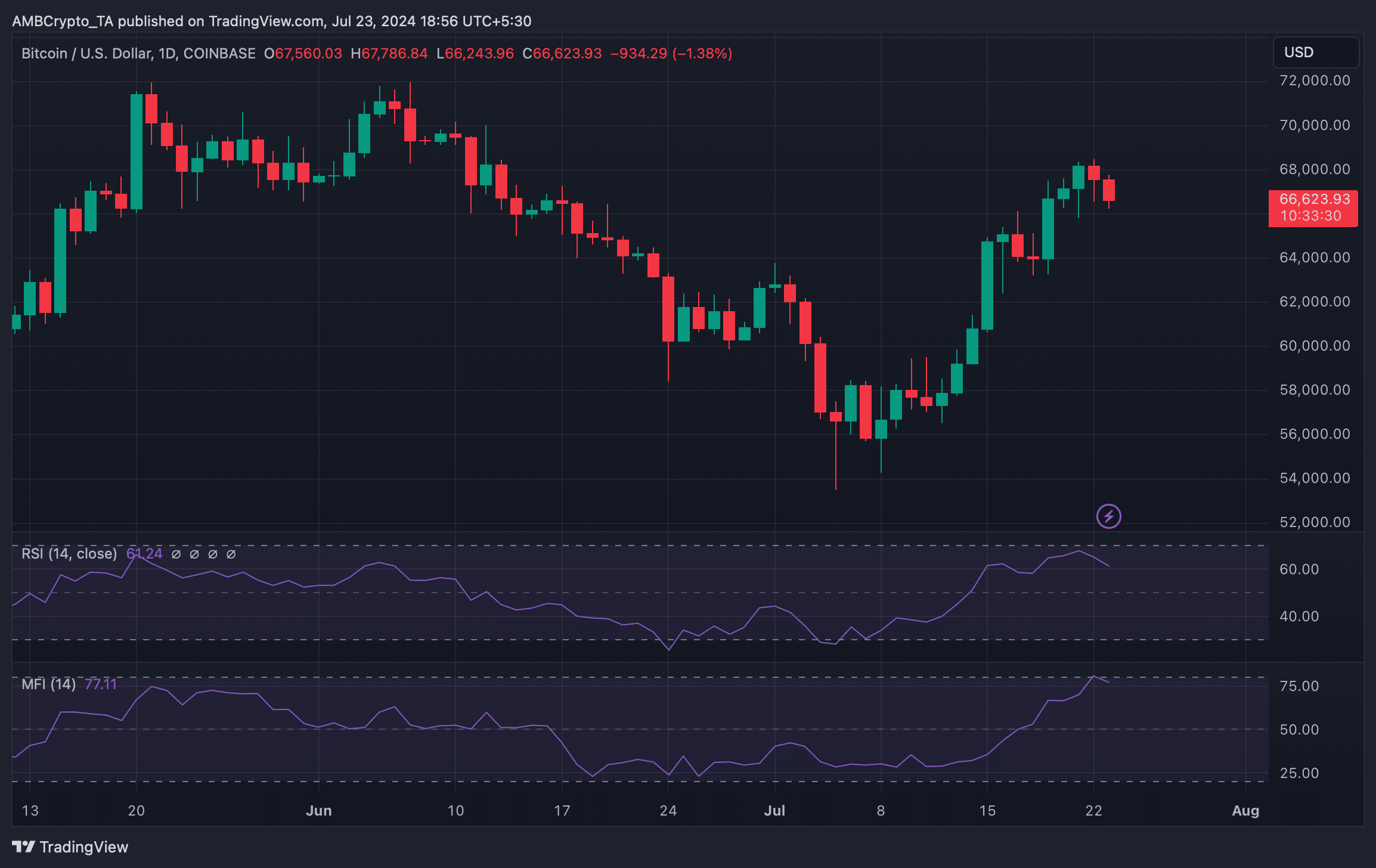

A similar situation was also noticed in the charts of BTC. Both BTC’s Relative Strength Index (RSI) and Money Flow Index (MFI) registered a decline.

This meant that the coming week could be bearish for top cryptos like ETH and BTC.

Source: TradingView