- The crypto market capitalization has fallen by more than 4% in the past two days.

- BTC and ETH could fall below key support levels.

The cryptocurrency market is currently experiencing one of its most challenging periods, marked by significant declines in key assets such as Bitcoin [BTC] and ether [ETH]. This recent trend raises uncertainties about the upcoming crypto week.

What the current market says

The cryptocurrency market is currently facing significant turbulence, with a notable drop in overall market capitalization over the past 48 hours.

According to data from CoinMarketCapthe market capitalization has declined by more than 4%, largely due to the decline of major cryptocurrencies such as Bitcoin and Ethereum.

Detailed analysis showed that BTC had suffered a sharp decline of over 26%, while Ethereum saw a steeper decline of over 30%.

These dramatic declines are a major contributor to the overall market decline. Moreover, BTC maintains a dominance of over 55% in the market, while Ethereum dominates over 16%.

Furthermore, given the recent declines and continued high volatility, the upcoming crypto week is filled with uncertainties.

At the time of writing, Bitcoin was trading around $50,800, down over 12%. Ethereum was trading at around $2,260 and down more than 15%.

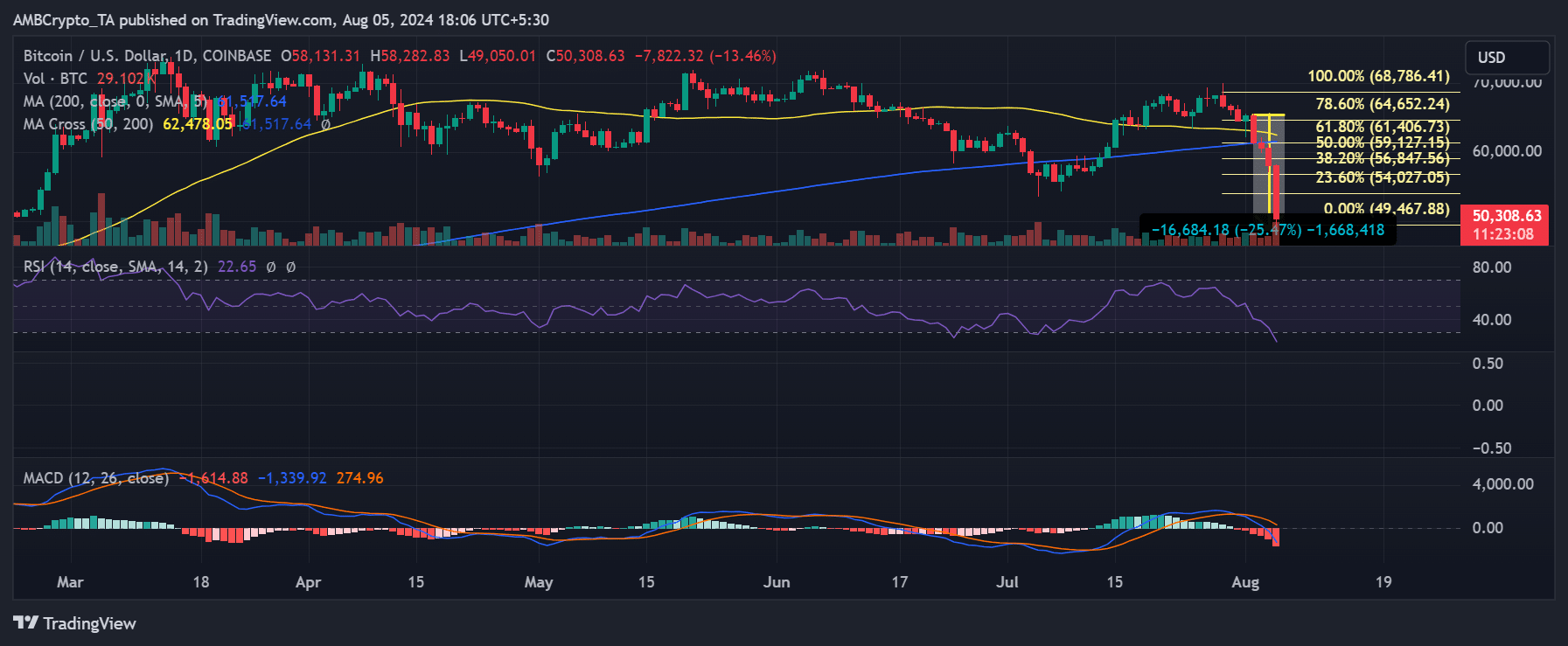

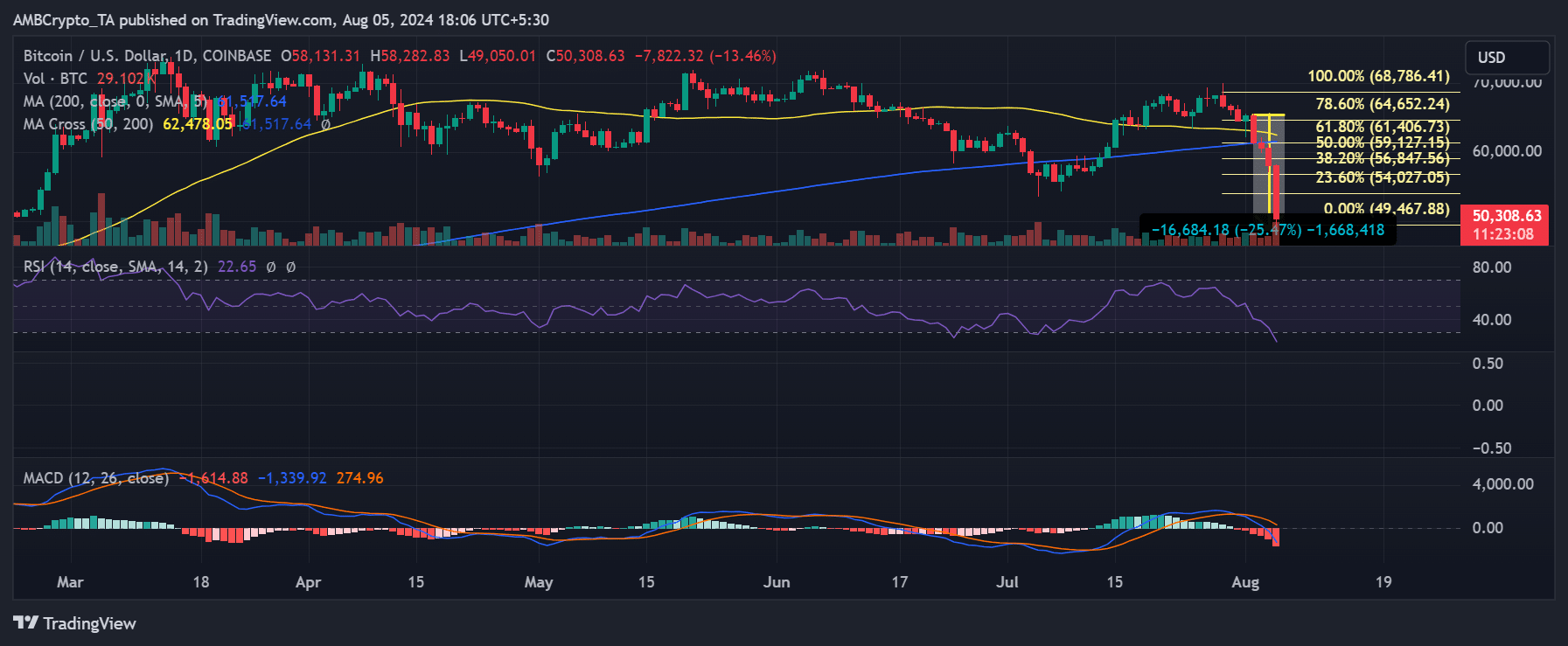

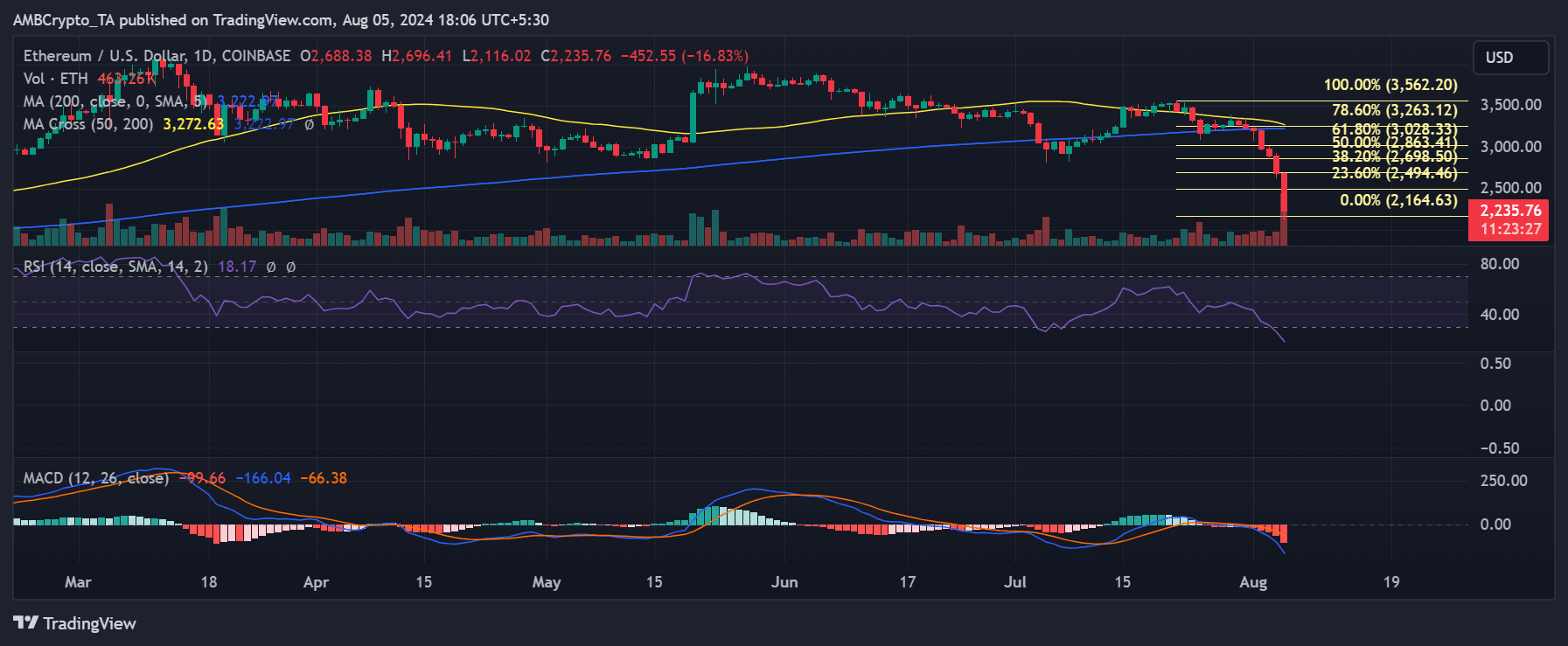

Using the Fibonacci retracement tool we can analyze the potential price movements for the coming week and assess the likelihood of further declines.

Crypto week ahead for Bitcoin

Current analysis shows that Bitcoin’s price is just below the 23.6% Fibonacci retracement level, which could act as resistance if the price tries to recover. The next major support level is at the 0% retracement level, around $49,467.88.

Source: TradingView

If the price remains above the 23.6% level, it could test higher Fibonacci retracement levels such as the 38.2% level at $56,847.56 or the 50% level at $59,127.13. Conversely, if the price continues to decline, it could find support near the 0% level at $49,467.88.

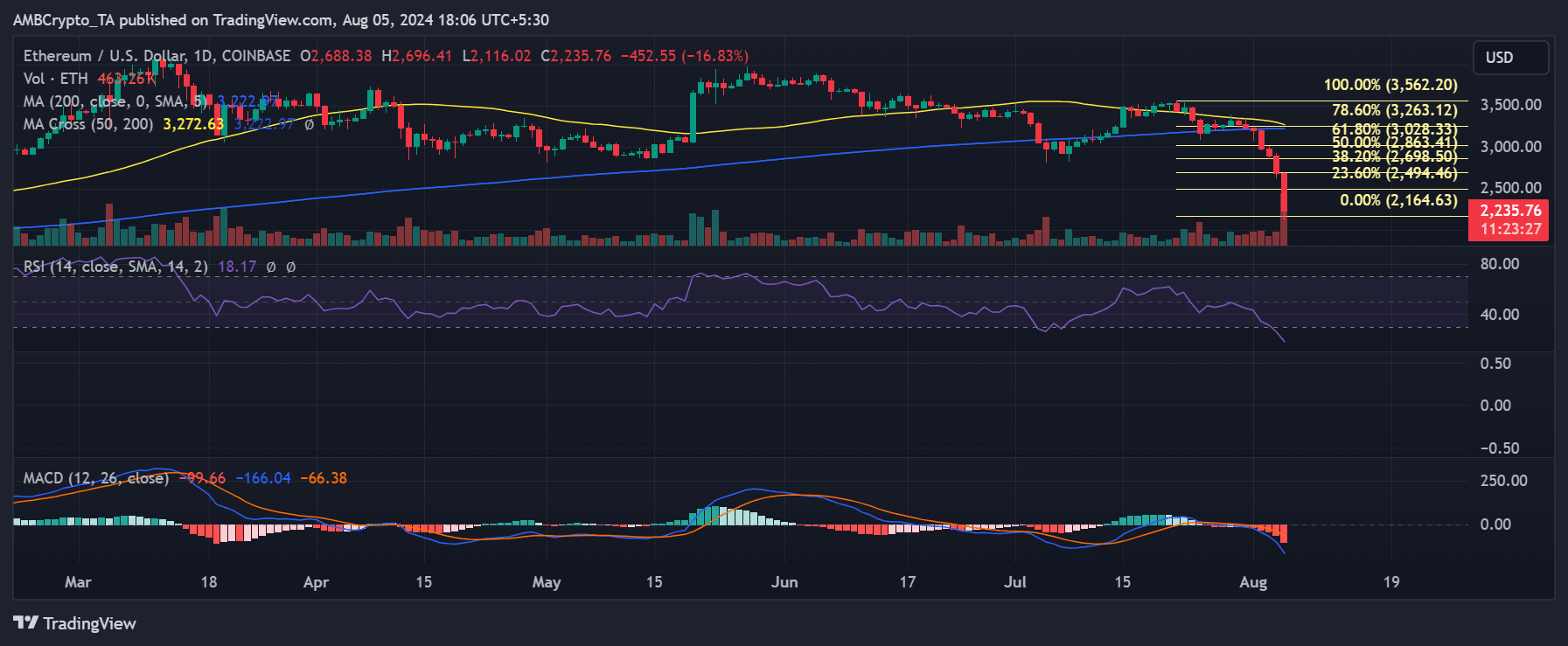

What about Ethereum

Analysis shows that the current Ethereum price is just above the 0% Fibonacci retracement level. If the price falls below this level, it could indicate further downside potential.

Source: TradimgView

Conversely, suppose the price remains above the 0% level. In that case, it could attempt a recovery to higher Fibonacci levels, with immediate resistance at the 23.6% ($2,494.46) retracement level.

This level could act as a key resistance point if the price rises.