- BTC’s rise towards $70,000 stagnated ahead of earnings season and US economic data.

- Analysts are evaluating whether BTC will break the psychological level of $70,000 this week.

After an impressive run towards $70,000, Bitcoin [BTC] faltered and fell below $67K during Monday, October 21, US hours.

The cooldown at the start of the week reflected nervousness in the US stock market, which fell for key companies ahead of this week’s earnings season.

But BTC could remain tied by the weekend, which QCP Capital predicted could change after the market gets a clearer Fed rate path.

The trading company said,

“Expect some sideways action until Thursday’s PMI data, which could provide clues about the Fed’s rate path.”

For context, the PMI (Purchasing Manager’s Index) is a key indicator of the state of the US economy and could be a gauge for the Fed’s interest rate decision in November.

Crypto Week Ahead: Will BTC Hit a New ATH?

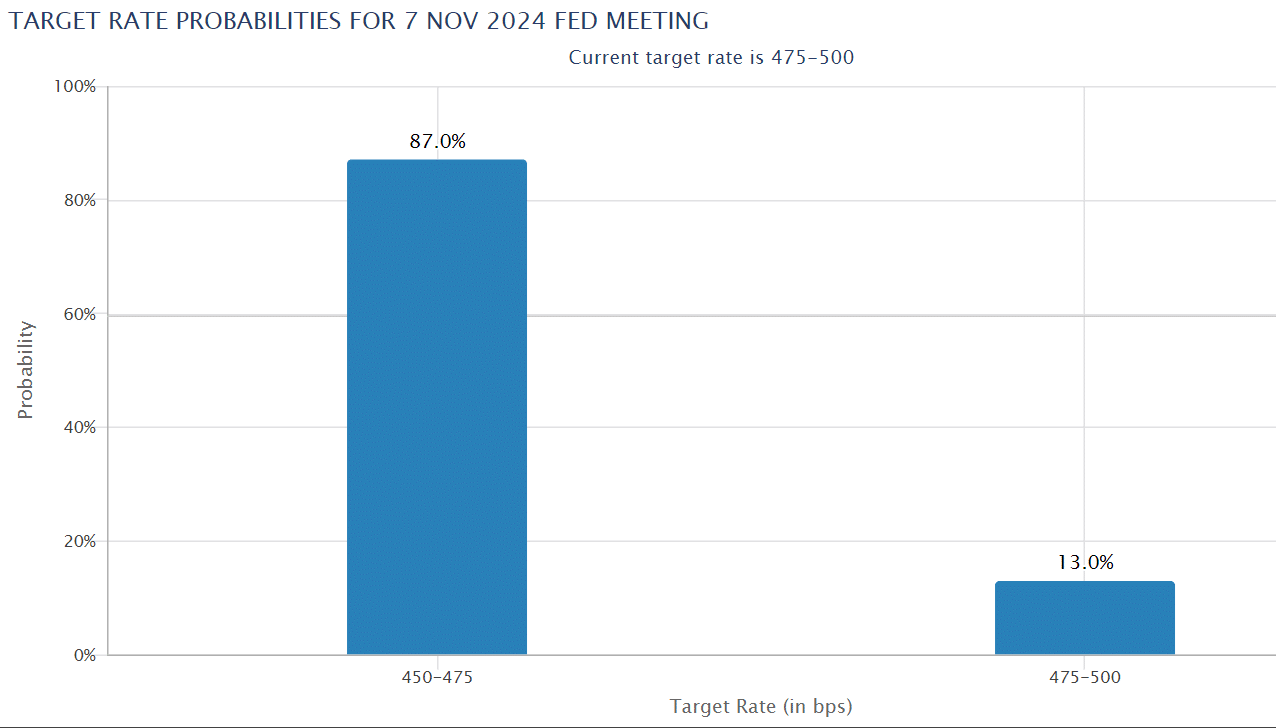

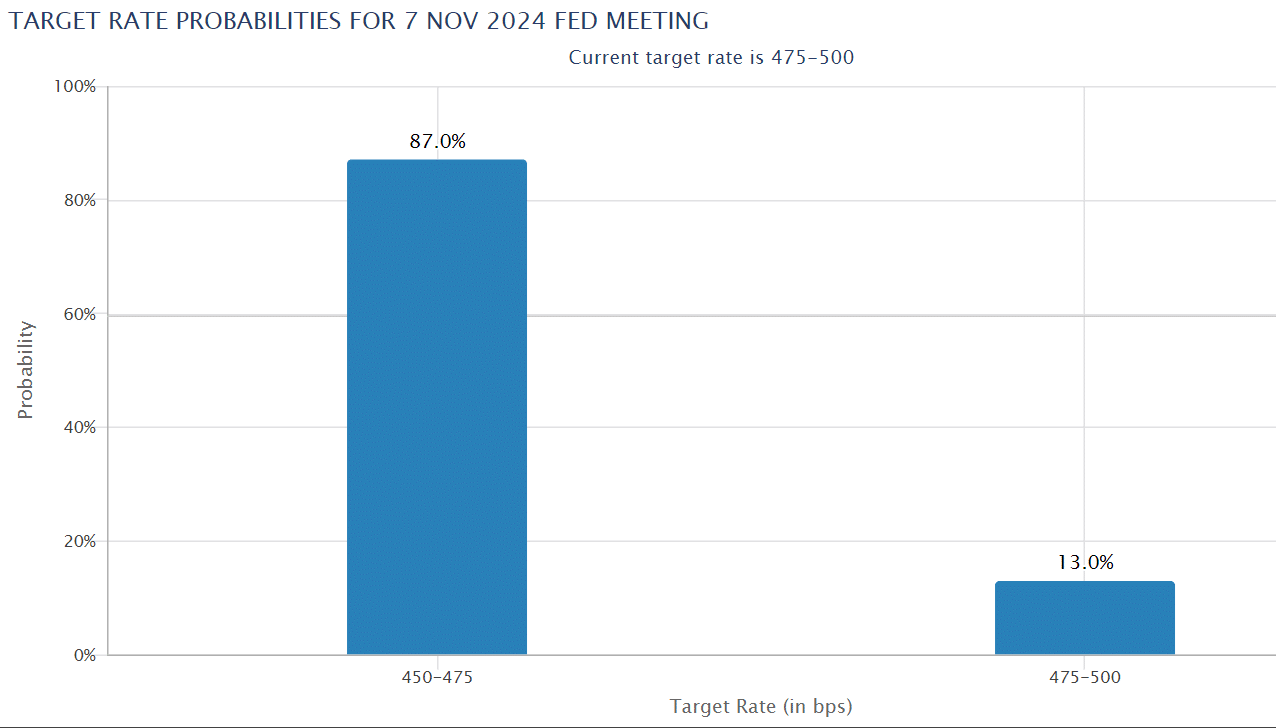

At the time of writing, the markets were prices a Fed rate cut of 25 basis points (bp) at the November meeting. How Thursday’s PMI data will tip the balance and impact BTC remains to be seen.

Source: CME FedWatch

That being said, the US elections were also a key factor in BTC’s price action. We asked Maria Carola, CEO of crypto exchange StealthEX, about her BTC prospects as the US elections approach.

Carola told AMBCrypto that the increasing risk of Donald Trump’s victory had driven BTC’s recent price surge towards $70,000. However, she believed that BTC could reach new ATH in November, but not this week.

“The odds of reaching a new all-time high (ATH) this week remain low… In November, Bitcoin is likely to surpass the ATH, setting off steady growth toward the next big milestone of $100,000 per coin.”

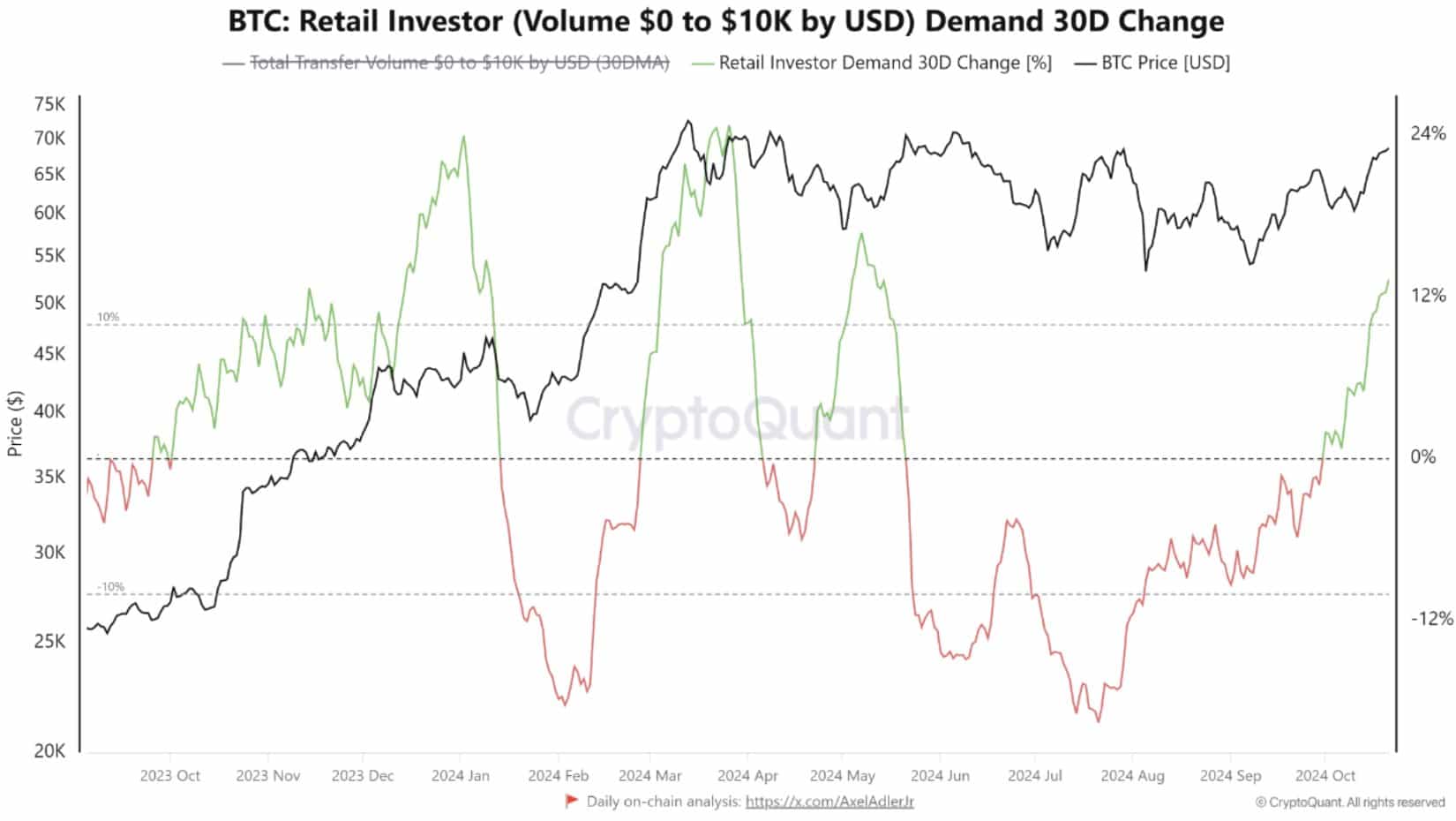

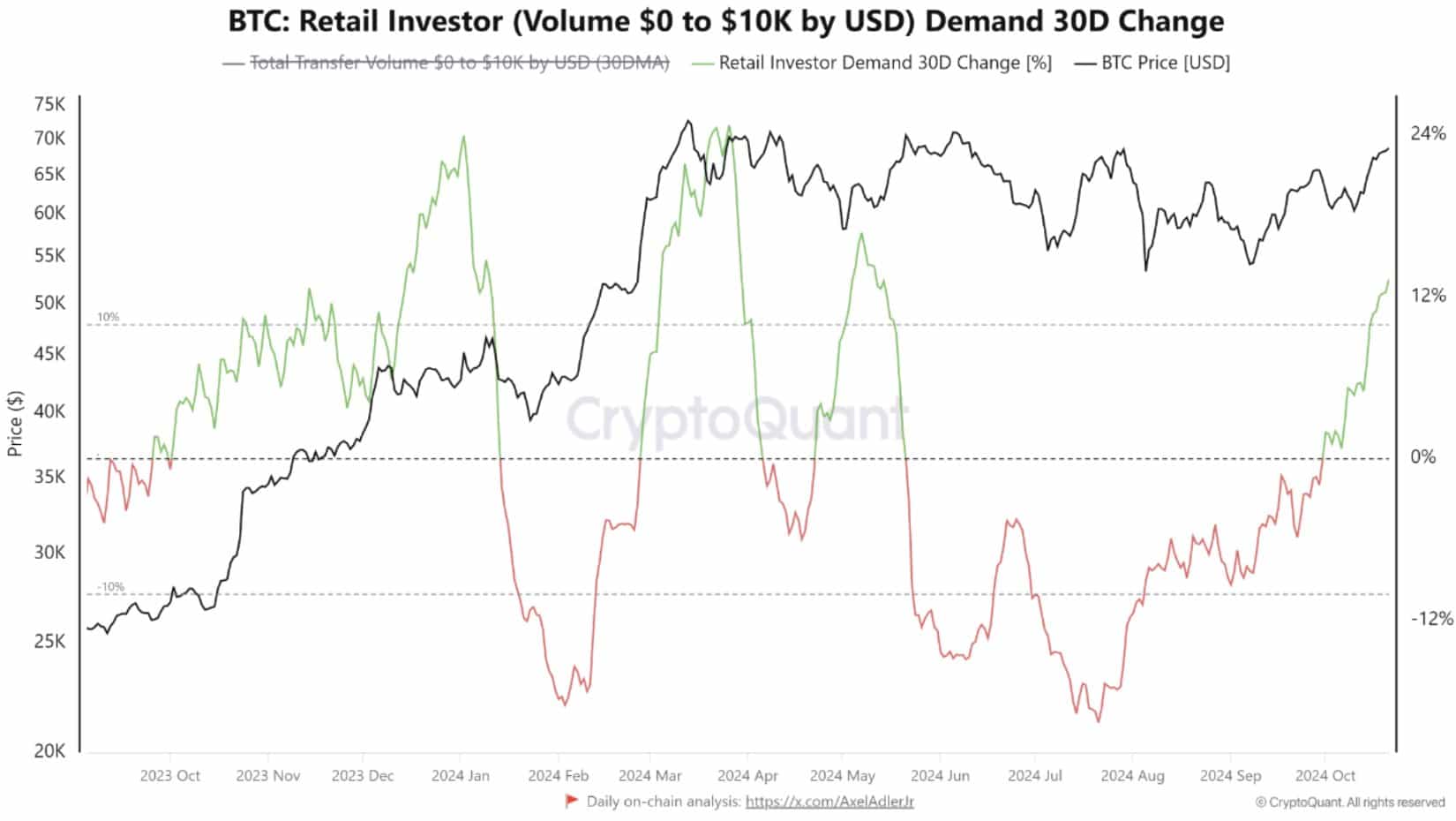

In the meantime, the recent pump towards $70,000 has seen renewed retail interest in BTC.

According to CryptoQuantthis trend mirrored a similar trend in March, just before BTC hit a new ATH.

“Over the past 30 days, retail demand has grown by approximately 13%, highlighting a scenario not seen until March, when we were close to the last all-time high.”

Source: CryptoQuant

Will renewed retail interest propel the rally seen in March?

QCP Capital said more retail players could get in if BTC breaks the $70,000 resistance.

“Both are approaching key resistance – $70,000 for #BTC and $2800 for ETH – which could generate strong retail interest.”