- Bitcoin’s recovery sparked a rally in crypto stocks.

- Amid its growing popularity, the Minneapolis Fed president deemed BTC worthless.

After the “ToThe prospects seemed to dwindle after that Bitcoins [BTC] fell below the critical $60,000 mark last week, but the king coin has now made a remarkable comeback.

On October 14, BTC reached a high of $66,500, its highest price since July.

This price increase catalyzed a double-digit rally for publicly traded crypto-linked companies in the US

CleanSpark (CLSK)– a Bitcoin mining company recorded the highest profit of 12.72% per Google Finance. This was closely followed by Coinbase (COIN), which valued with 11.32%.

Other notable winners were LM Funding America (LMFA) increased by 10.94%, TeraWulf (WULF) an increase of 6.65%, and Marathon Digital Holdings (MARA) increase of 5.60%.

At the time of writing, Bitcoin was trading at $65,657, up 9.04% in the past month and over 144% in the past year.

Why is BTC going up?

The rally in crypto stocks comes as Bitcoin benefits from increased investor interest, fueled in part by anticipation surrounding the upcoming US presidential election.

It is notable that both the Republican and Democratic parties have adopted a pro-crypto stance.

This in turn has raised the possibility of further upside for Bitcoin regardless of whether Donald Trump or Vice President Kamala Harris secures the presidency.

Trump, who was previously skeptical about cryptocurrency, has rebranded himself as a pro-crypto candidate and even launched his crypto-related project, because reported by AMBCrypto.

On the other hand, Harris is increasingly positioning herself as a supporter of crypto. Her recent one proposal focused on cryptocurrency which plays a key role in promoting economic empowerment.

Questions arise about the value of BTC

Despite growing acceptance and support from the larger community, BTC continues to face skepticism from traditional financial leaders and institutions.

On October 14, Neel Tushar Kashkari, president of the Federal Reserve Bank of Minneapolis, said that Bitcoin is still worthless after 12 years.

Kashkari emphasized that despite the longevity of digital assets, crypto has not been able to establish itself as a viable currency.

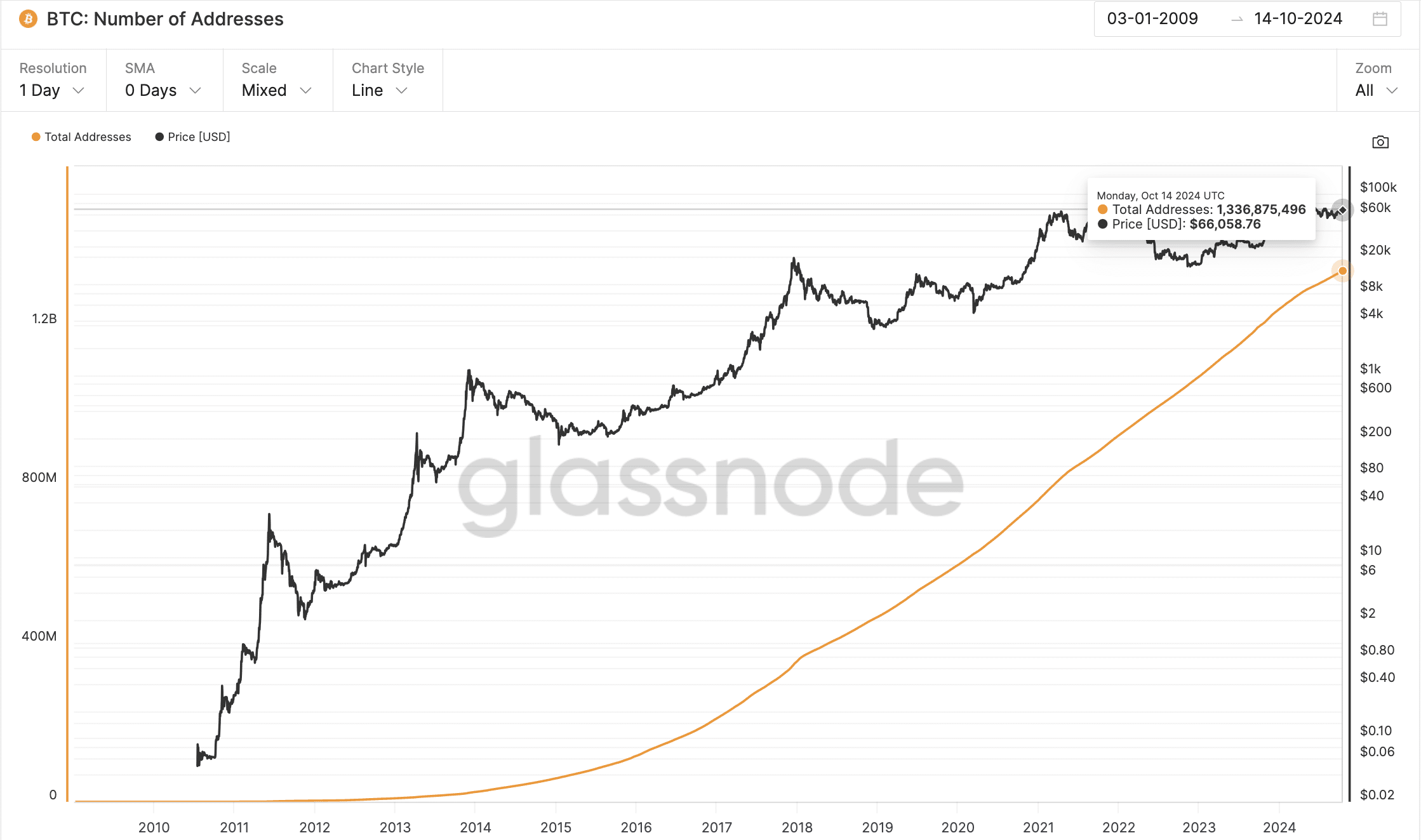

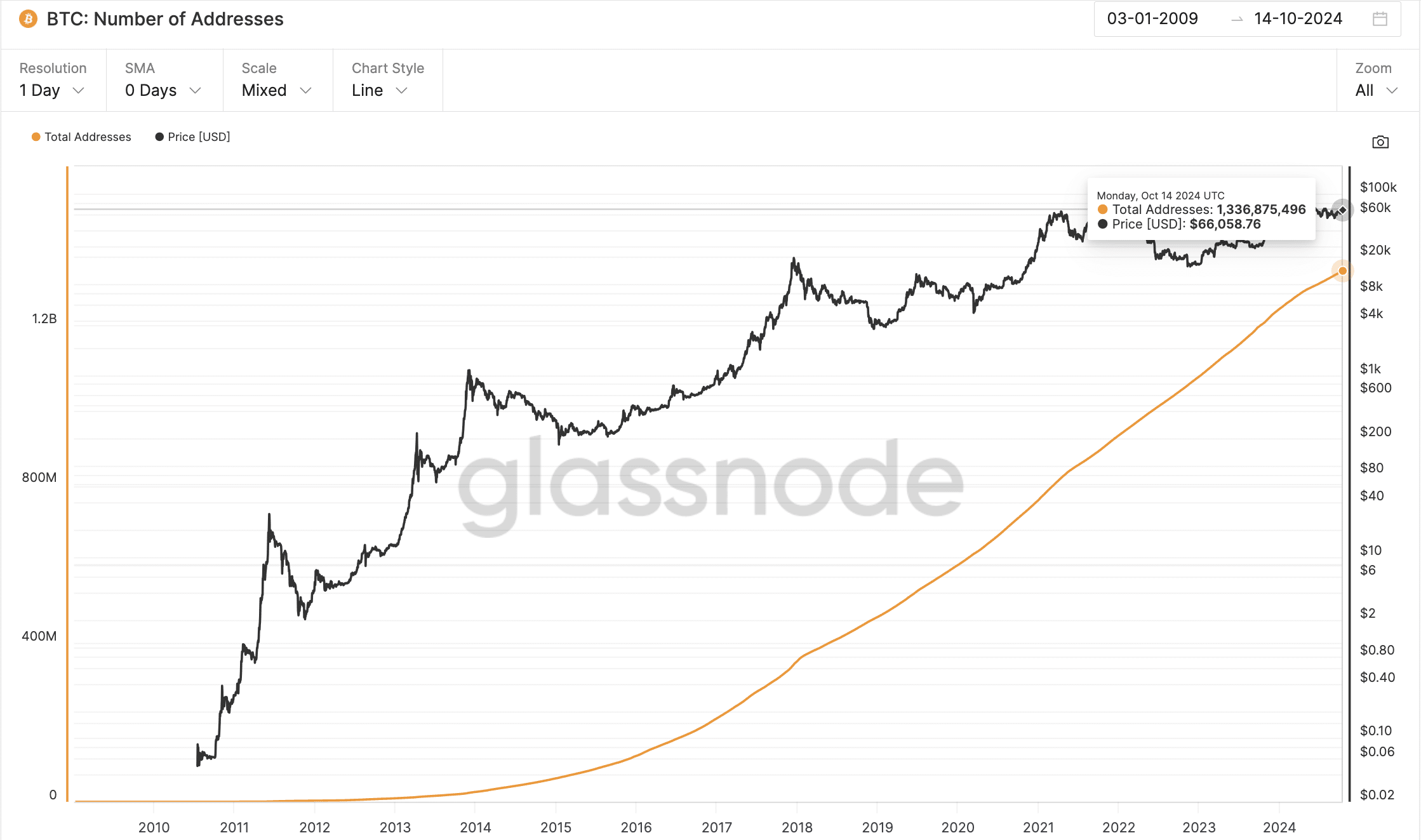

However, Bitcoin’s performance tells a different story: its $1.3 trillion market cap and 1.3 billion addresses, according to Glass junctionhighlight its widespread acceptance, market confidence and recognition as a valuable digital asset despite criticism.

Source: Glassnode