The winds of change are blowing through the crypto mining industry. The long-awaited halving in April 2024, which saw block rewards halved, has sent shockwaves through the ecosystem. Daily earnings for miners have fallen by more than 70% since the war halveforcing them to look for new ways to secure their profits.

Related reading

Enter Artificial Intelligence (AI). Buoyed by the success of projects like OpenAI’s ChatGPT, AI computing is experiencing rising demand. This, coupled with potentially higher profit margins compared to Bitcoin mining, makes AI an increasingly attractive option for miners.

AI: a beacon of hope in a volatile sea

Companies like Bit Digital are leading the way, with AI already contributing almost 30% of their revenue. Other industry players such as Hut 8 and Hive are also dipping their toes in the AI pool.

Adam Sullivan, CEO of Core Scientific, said:

“The shift to AI allows us to create a diversified business model with more predictable cash flows.”

This diversification is crucial in light of the volatile nature of Bitcoin prices. By integrating AI, miners aim to reduce their dependence on a single, often unpredictable revenue stream.

Mass exodus or miners’ metamorphosis?

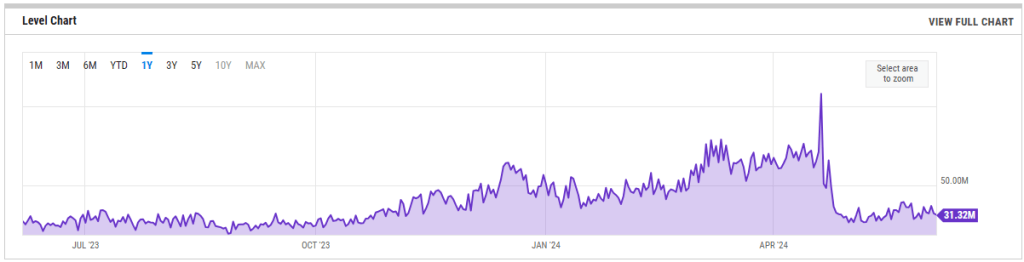

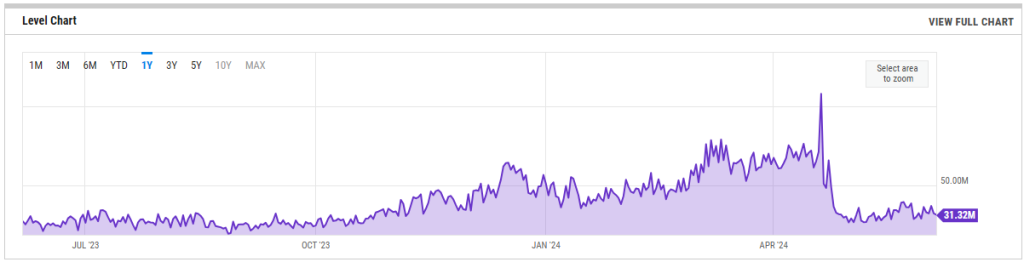

The impact of the halving is not limited to declining profits. Data points to a possible shakeout within the mining community. A recent report points to a significant drop in the Bitcoin network’s hashrate, a metric that reflects overall mining power. This could indicate a mass exodus of miners, especially those with less efficient facilities who are struggling to stay afloat after the pay cut.

Further confirmation of this theory is the recent flash in the Hash Ribbons metric. This indicator tracks the difference between the short- and long-term moving averages of hashrate, with peaks indicating low mining activity or miner capitulation.

Crypto hedge fund Capriole Investments interprets this as a potential “enticing Bitcoin buy signal,” suggesting the market may be reacting to a drop in the price. mining pressure.

Mining pressure refers to the pressure on crypto miners to sell their Bitcoin. Miners earn Bitcoin as a reward for securing the network and typically sell it to cover operational costs such as electricity and equipment. When pressure decreases, it often indicates that miners are less compelled to sell their Bitcoin.

Related reading

A silver lining for long-term bulls?

Meanwhile, some analysts claim that institutional investors are showing renewed interest in Bitcoin, causing them to ‘take risks’ in their approach. This could be a sign of growing confidence in the long-term prospects of the cryptocurrency.

Featured image from The Motley Fool, chart from TradingView