The most important digital assets analyst Jamie Coutts from Real Vision says that a bottom on the cryptomarkt can form after weeks.

Couts tells Are 33,800 followers on the social media platform X that, based on a metrician follows of the performance of Crypto assets for 365 days that the market is preparing for a bullish reversal.

“This month’s crypto-flush resulted in the highest 365-day new low (NL) lecture since mid-2024. Although it is not a definitive soil signal, this suggests that a soil forms. Focus on assets that surpassed last year and during this recent pullback. Their strength refers to what comes in the next stage of this cyclical bull market. “

He also shares the total 2 -graph – the market capitalization of all crypto -activa excluding Bitcoin (BTC) and Stablecoins – that shows a possible reversal that is formed in the daily period after a falling trend.

Total2 is appreciated at $ 1.24 trillion at the time of writing.

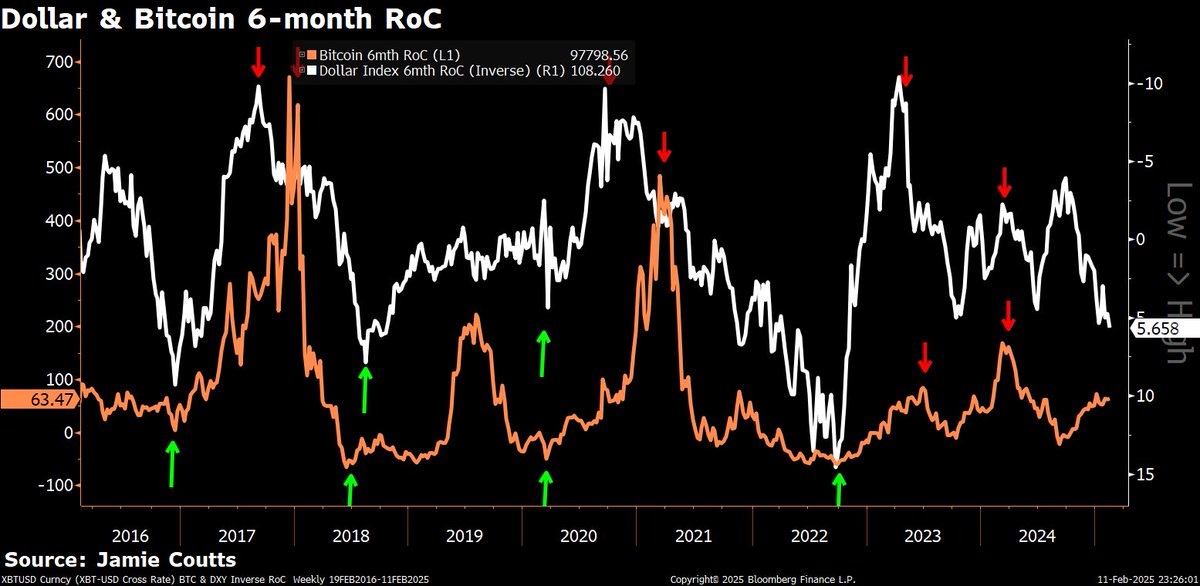

Next, coutts out Bitcoin can break his historically reverse correlation with the US Dollar Index (DXY), which travels the USD against a basket with other large foreign currencies, because more investors can treat the flagship Crypto Asset as a safe port assets comparable to gold.

“Bitcoin’s reverse correlation with the broken dollar? Since the September low, BTC has risen from $ 70,000 to $ 110,000 while the DXY climbed from 104 to 110. Is it ETFs (exhibition -related funds), MSTR (MicroSstrategy), Sovereigns? Hard to say. Perhaps Bitcoin is finally recognized as the Safe Harbor Asset that was intended. “

He too out That the acceptance of blockchain technology rises based on the metric of daily active addresses (DAAS) on smart contract platforms (SCPs).

“Liquidity always stimulates activity on the chain. But since 2022 that relationship has been weakened. Blockchain adoption is more resilient and less tied to liquidity cycles. Active addresses have tripled in the past year, while markets remain their usual schizophrenic themselves and debate where the liquidity goes. But here is the thing: the technology is the touch of escape speed. Zoom out. Both liquidity and blockchain use are in long-term uptrends. The only question that matters – they will be higher in one, three or five years. “

Finally, he to predict That 2025 will see an explosion of the acceptance of blockchain technology in different sectors.

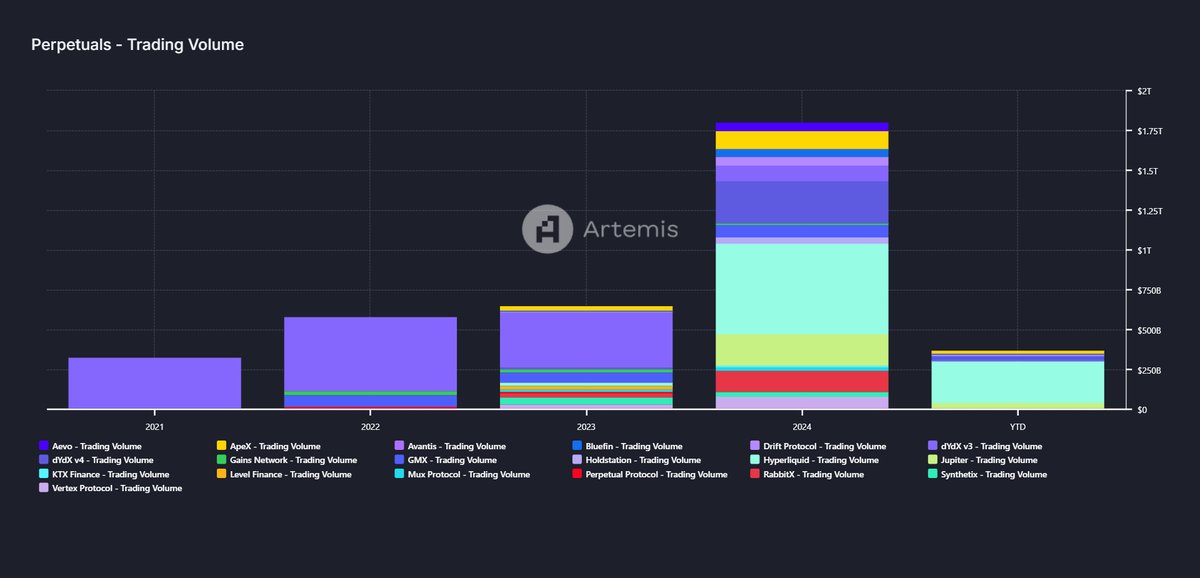

“In 2025 we will probably see Perps volumes of the chain of more than $ 4 trillion. What until RWAS (Real-World assets) massive land, shares, raw materials, bonds and KYC (know your customer) solutions so that settings can participate. Which chains and protocols do you think will benefit the most from what will happen? “

Don’t miss a beat – Subscribe to get e -mail notifications directly to your inbox

Check price promotion

Follow us on X” Facebook And Telegram

Surf the Daily Hodl -Mix

Generated image: midjourney