- Crypto liquidations reached nearly $300 million in just 24 hours, driven by Bitcoin’s sudden price surge.

- Short positions suffered the biggest losses, with more than $206 million liquidated as Bitcoin breached key resistance levels.

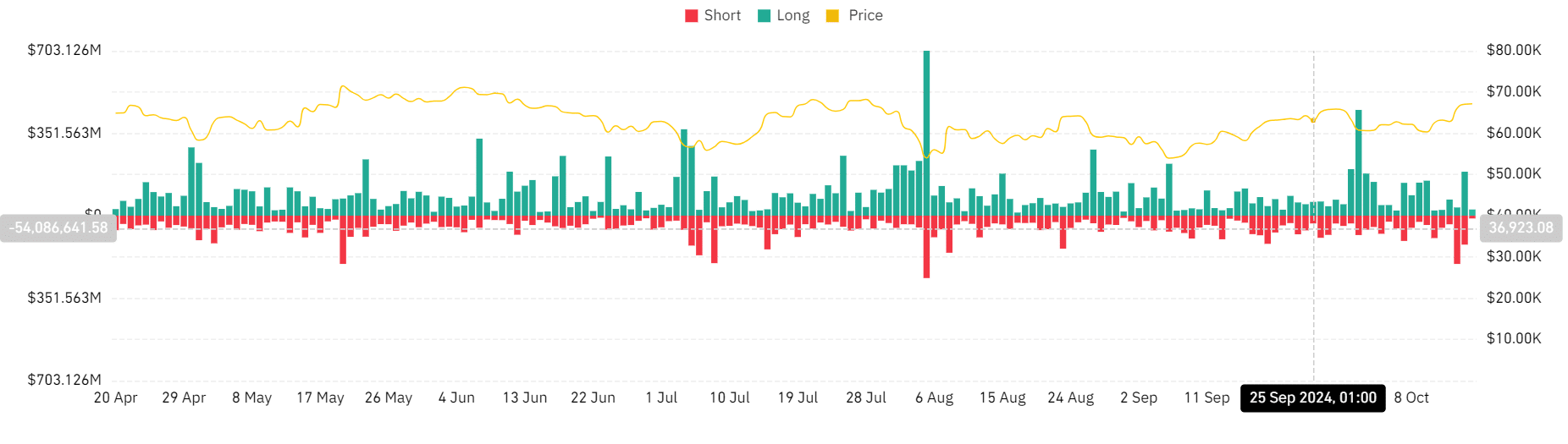

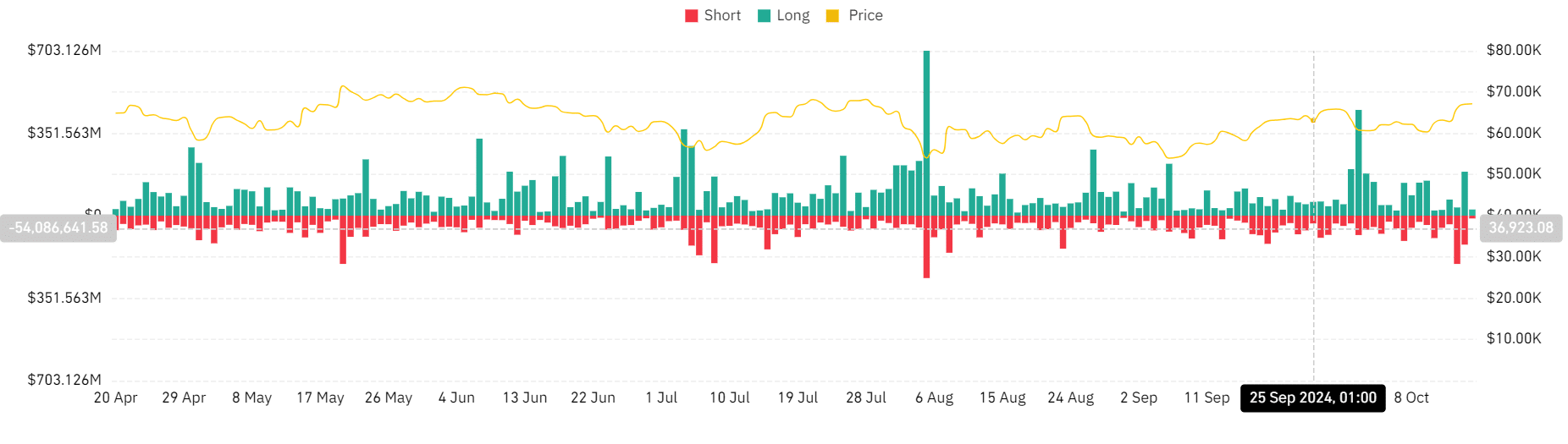

In recent days, both long and short positions have seen significant liquidations, with crypto liquidations reaching almost $300 million in just 24 hours.

The catalyst for this wave of liquidations was a sudden rise in the price of Bitcoin [BTC]which broke a key resistance level and caused a wave of forced liquidations across the market.

Crypto Liquidations Nearly $300 Million

Data from Mint glass revealed that crypto liquidations had risen to nearly $240 million as of October 14.

Short positions were hit the hardest, with about $206 million in liquidations, while long positions accounted for about $35 million.

However, the situation changed during the next trading session. The next day, liquidations of long positions rose to more than $187 million. Short positions remained under pressure, experiencing liquidations of more than $123 million.

This combined total represented the second-largest liquidation event of the month, trailing only the massive $500 million liquidation that took place on October 1.

Source: Coinglass

At the time of writing, long positions continue to suffer, with over $25 million in liquidations already in the current trading session.

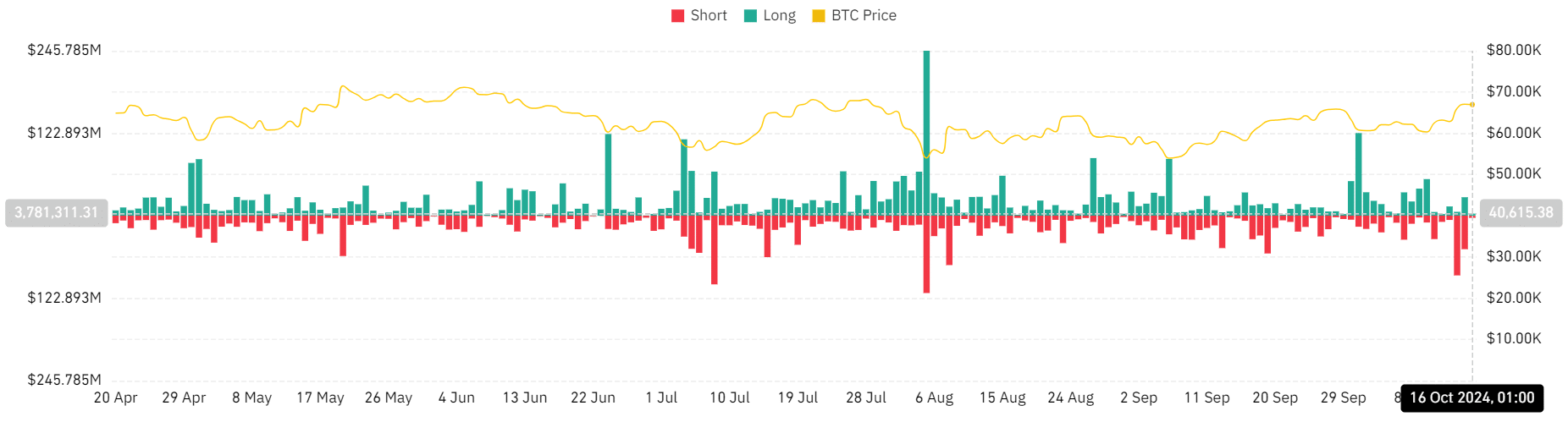

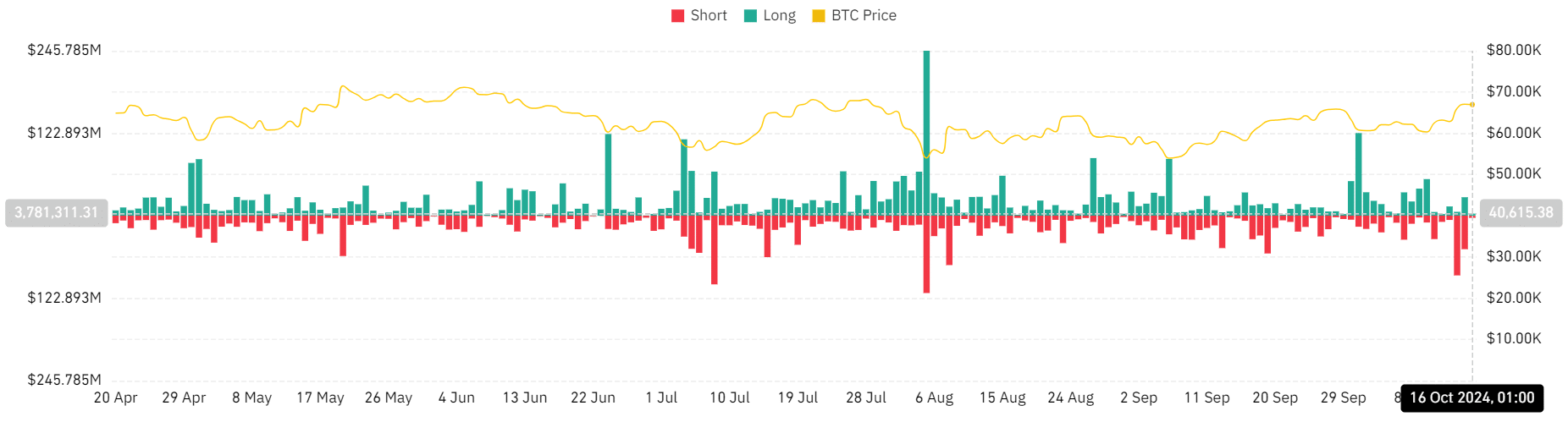

Bitcoin liquidations show strong consistency

Bitcoin’s rapid price movement caused the recent wave of crypto liquidations. After a long period of minimal price action, Bitcoin rose, leading to a series of liquidations, especially for short positions.

AMBCrypto’s analysis of the liquidation chart showed that on October 14, Bitcoin liquidations totaled more than $94 million. Short positions bore the brunt, accounting for $89 million.

In the next session, short liquidations fell to almost $50 million, while long liquidations rose to $27 million.

Source: Coinglass

This pattern suggests that Bitcoin’s recent price surge has had a disproportionate impact on short traders as momentum continues to build.

Bitcoin price trends

Looking at the price chart of Bitcoin, the price rose by more than 5% on October 14. This had a major impact on the short positions, where more than $200 million in liquidations took place.

Read Bitcoin’s [BTC] Price forecast 2024-25

The next day, Bitcoin continued its upward momentum, gaining 1%. This time, it was the long positions that took most of the brunt of the liquidation market.

At the time of writing, Bitcoin was trading in the $67,000 price range, showing a slight increase and further adding to the complexity of the crypto liquidation trend.