- Amid US inflation data, dInvestment products in digital assets register an inflow.

- Bitcoin inflows accounted for 93% of all recorded inflows.

Digital asset investment products recorded inflows last week after three consecutive weeks of outflows, according to a new report report by CoinShares, a digital asset investment company.

Source: CoinShares

The report found that digital asset investment product inflows totaled $29 million last week, with Bitcoin [BTC] investment products accounted for the bulk of the $27 million inflow. This marked a turnaround from the previous three weeks, when digital asset investment products saw outflows totaling $135 million.

According to Coinshares, last week’s inflow could be due to the recent US inflation data. For July 2023 it was 3.2%, slightly lower than expected.

The digital asset investment firm further found that, regionally, most of the “activity was in Canada,” contributing to total inflows of $24 million in the week under review.

This sudden growth in Canadian investor inflows coincided with a period when Ethereum’s [ETH] Coinbase Premium Index (CPI) slipped into negative territory.

The CPI metric measures the difference between an asset’s price on Coinbase and its price on Binance. When an asset’s CPI is positive, there is strong buying pressure among institutional investors on Coinbase. Conversely, a negative CPI suggests less accumulation activity by institutional investors in the stock market.

According to recent findings shared by CryptoQuant’s pseudonymous analyst ‘Greatest Trader’, institutional investors in the US are starting to shun the leading altcoin.

Bitcoin is king, still

In the previous week, BTC recorded its largest weekly outflow since March. The tide turned last week, when the king coin registered inflows totaling $27 million. This represented 93% of all recorded total inflows.

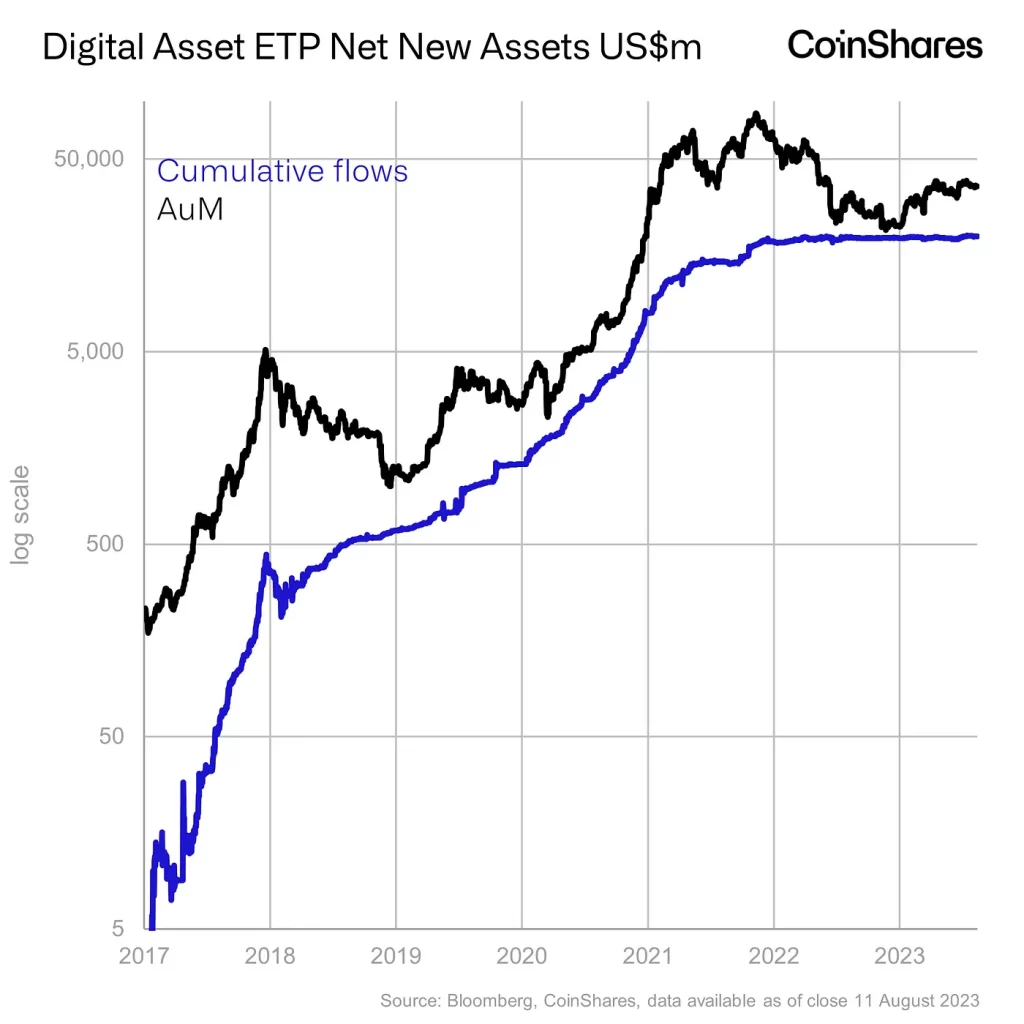

The report said this brought inflows to $456 million to date, with assets under management (AuM) of $24.43 billion.

According to Coinshares:

“These data suggest that sentiment for Bitcoin and the broader crypto market remains supportive despite seasonally low volumes.”

After 14 weeks of sequential outflows, Short Bitcoin products experienced no outflows last week, suggesting that short traders continued to hold their hands. However, outflows resumed last week and amounted to $2.7 million. This made it the only asset class to register an outflow during the week under review.

Source: CoinShares

Ethereum made many smile

According to the report, the leading altcoin ETH saw $2.5 million inflows last week. Other altcoins like Uniswap [UNI] and Solana [SOL] benefited from the improved sentiment with inflows of $700,000 and $400,000 respectively.

Ripple’s XRP recorded its 16th week of inflows. According to the report:

“XRP saw inflows of $0.5 million and is now on a 16-week inflow, representing 12% of assets under management (AuM). XRP’s AuM is up 127% since the start of the year.”