- Bitcoin was oversold and extremely unbalanced, but an immediate price increase is not guaranteed.

- A defense of the $50,000 support zone and some stabilization could convince investors to make a bid despite the risky conditions.

The crypto market was in a state of disarray as the price of Bitcoin rose [BTC] was just above the $60k level a day before press time. It has since hit a low of $49,000 and further losses could occur during the New York trading session, sending participants into panic.

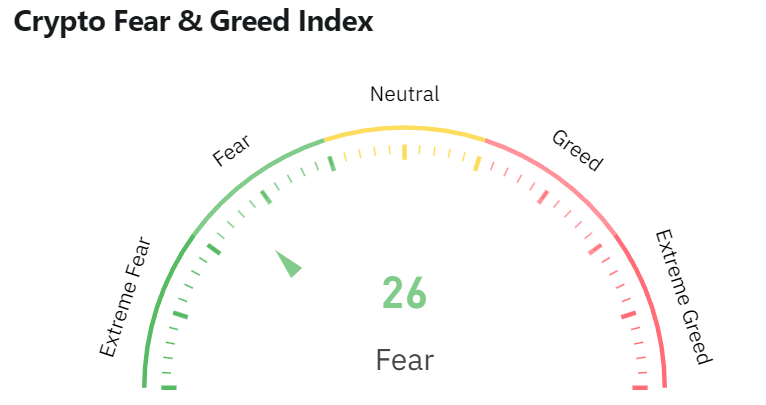

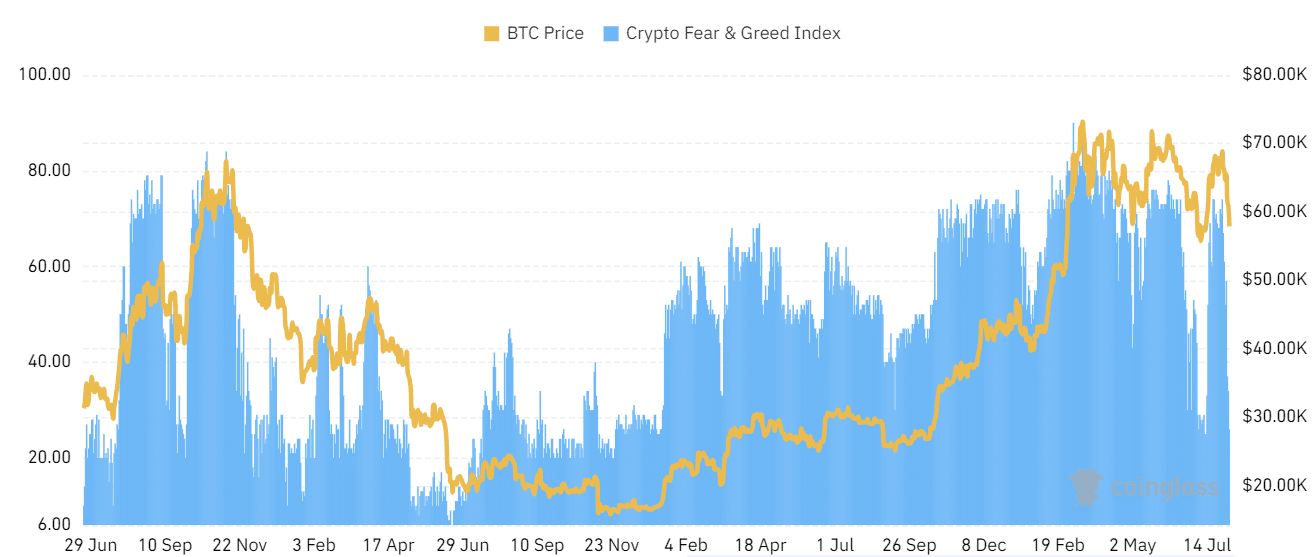

The cryptocurrency Fear and Greed Index was at 31 years old and showed fear in the market. In general, anxious times are good for buying opportunities. Will Monday be one of those moments again?

The Fear and Greed Index plummets after crypto prices spread alarm

Since July 29, the altcoin market cap has fallen by $163 billion, or 28%. This measures the top 125 altcoins excluding Ethereum [ETH] and of course Bitcoin.

The two giants have not fared well either, losing 37.85% and 30% respectively at their lowest levels.

At the time of writing, the index was showing ‘fear’ with a reading of 26. This was not the norm for crypto in 2024, with fear readings on some days over the past two months.

The most recent example was on July 13, when the index dropped to 25. Bitcoin’s price was $57.8k at the time, rising to $68.8k just two weeks later.

If history repeats itself, Bitcoin could hold the $50,000 support and climb higher.

Will the late short sellers be punished for their mistimed trades?

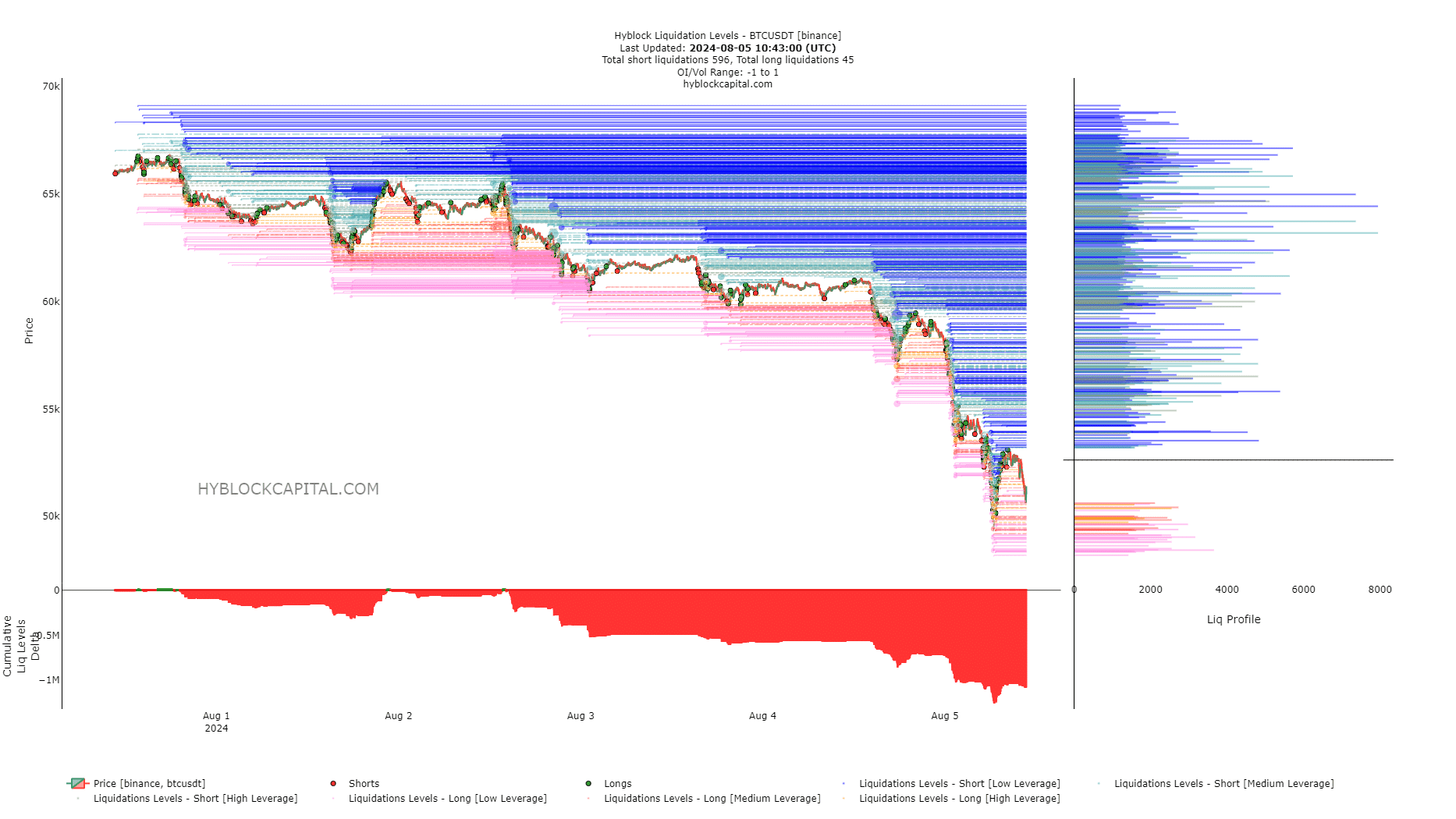

The daily RSI stood at 23, reflecting oversold conditions. The cumulative delta of the liquidation levels in the chart above was increasingly in favor of the short positions.

Read Bitcoin’s [BTC] Price forecast 2024-25

This imbalance can be wiped out by a sharp rise in prices.

With sentiment and fear ruling the market, strong buying pressure may not materialize for another 24 to 48 hours. If so, the $53.9k and $55.7k levels would be the near-term resistances to watch.