- LTC formed a bearish flag at the time of writing, indicating a further plunge despite the recent plunge.

- Long-term holders were liquidating their positions.

Litecoin [LTC] was one of the major cryptocurrencies hit hard by the market crash on December 3. This was because it lost 11.17% of its value, according to data from CoinMarketCap.

Although market prices are starting to recover, this may not be the same for LTC.

Analyst Ali Martinez announced this prediction. According to Martinez, LTC was facing intense sales pressure. This sell-off was one of the reasons why the price fell from $72 to $65 at the time of writing.

However, that might not be the end of a torrid season for Litecoin, Martinez said.

In his post on X (formerly Twitter), the analyst shared a three-day chart showing LTC forming a bear flag. As a result of the formation, Martinez noted that the coin could fall to $38.

After the recent dip, the outlook is positive #Litecoin seems challenging. If the selling pressure continues, $LTC could see a drop to $38, potentially confirming a bear flag formation. pic.twitter.com/Y21U6eR5tw

— Ali (@ali_charts) January 3, 2024

There is no trace of bulls in the photo

A drop to $38 would mean LTC would lose 1.71x its press-time value. However, the prediction would only come true if sellers continue to drive price action further.

If this happens, the Litecoin candlestick pattern could extend downwards while confirming the bearish flag formation.

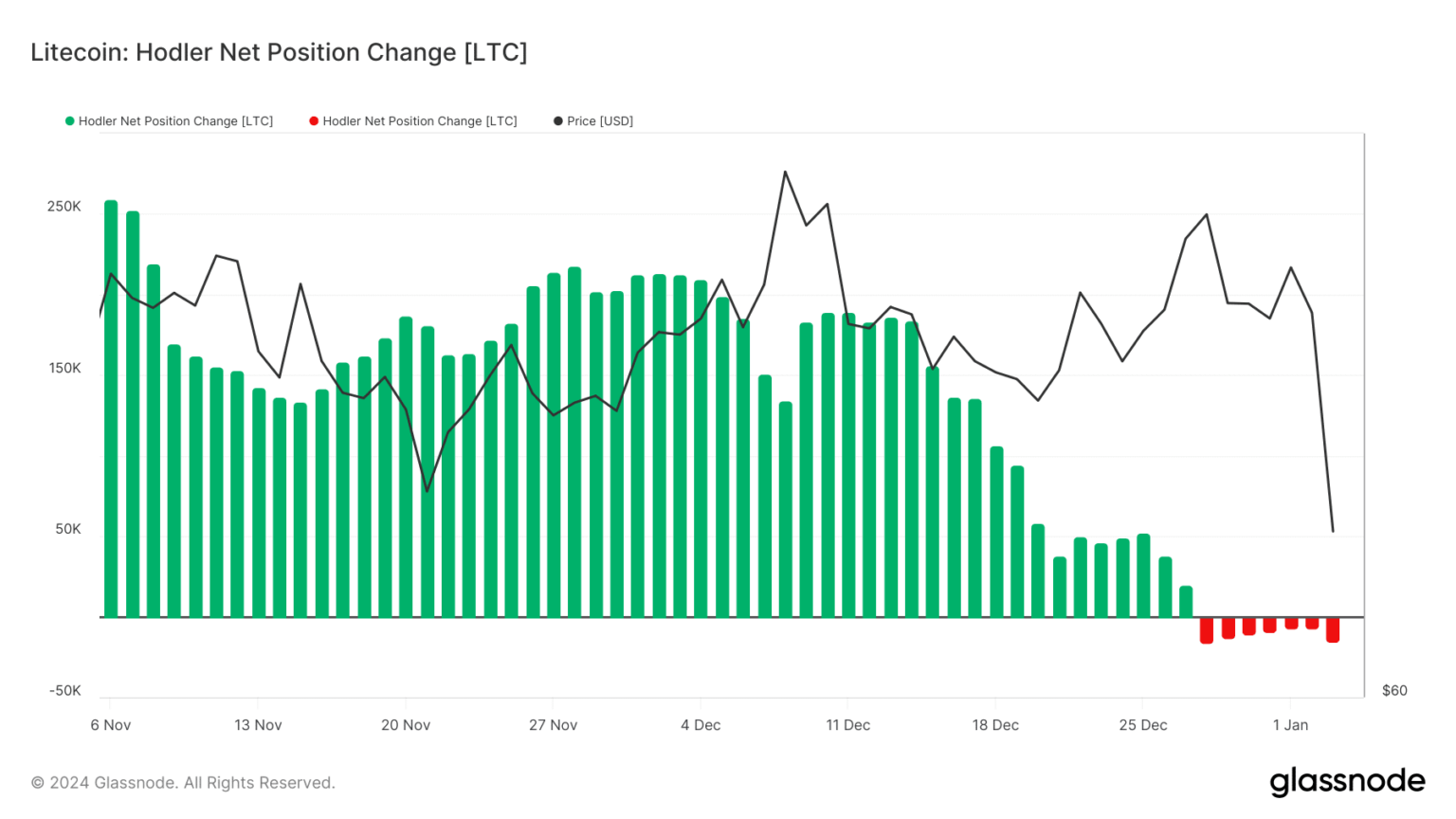

The projection was also validated by the Hodler Net Position Change. The measure shows the monthly position change of long-term investors. When Litecoin HODLers build a new position, the net change is positive.

According to AMBCrypto’s analysis of the metric, the net change turned negative on December 28, 2023. This has remained the same since then. This drop indicated that Litecoin HODLers were cashing out rather than accumulating.

Source: Glassnode

In addition to on-chain data, AMBCrypto continued to evaluate the technical condition of LTC. At the time of writing, the sharp decline indicated by the red candlestick confirmed the heavy selling pressure.

LTC remains the autumn man

A look at the MACD also indicated that momentum was bearish. Signals from the MACD validated the thesis as the 12-day EMA (blue) had crossed below the 26-day EMA (orange).

This view suggested that LTC would continue to oscillate downward. Additionally, the 50 EMA (yellow) had formed a death cross over the 20 EMA (cyan). This supports the point where LTC went down.

But what are the next goals for Litecoin? According to the 0.236 Fibonacci retracement, LTC could fall to $63.72 in a short time.

Source: TradingView

Is your portfolio green? View the LTC Profit Calculator

However, it seems like traders aren’t giving up on Litecoin just yet. AMBCrypto signed this inference compared to the financing rate, which at the time of writing was 0.01%.

This positive reading suggests that there are more traders with bullish beliefs than those on the bearish side.