- Bitcoin is down 22.5% from its peak, with current small gains insufficient for a recovery.

- Recent data on the futures market indicates bearish sentiment, potentially paving the way for future bullish trends.

Bitcoin in recent weeks [BTC] has registered a significant drop in value, falling 22.5% from its all-time high above $73,000 in March.

Although assets have struggled to recover this week after the ‘Red Monday’ it hasn’t been enough. Currently, BTC is up 0.6% over the past 24 hours, but the asset is still down 11% on the 7-day chart.

The sentiment on the futures market

ShayanBTC, an analyst from CryptoQuant, shared this insights on the Quicktake platform, highlighting the impact of perpetual markets and long squeeze events on Bitcoin’s price.

According to Shayan, the main cause of Bitcoin’s recent price decline can be attributed to increased selling activity in these markets. This was further reflected in the sharp decline in financing rates, a crucial indicator of market sentiment.

Funding rates have recently turned negative, indicating bearish sentiment dominated by short sellers. This shift suggests that the futures market is cooling down, potentially paving the way for a more stable bullish trend in the future.

Shayan especially noted:

“Financing rates have now turned negative, reflecting overall bearish sentiment and the dominance of short sellers. However, this can also be seen as a positive sign as it indicates that the futures market is no longer overheated. This scenario could create the conditions for a more sustainable bullish trend in the coming months, provided no drastic changes occur.”

Bitcoin recovery on the horizon?

Despite the bleak short-term outlook, there are indicators that point to a possible path to recovery.

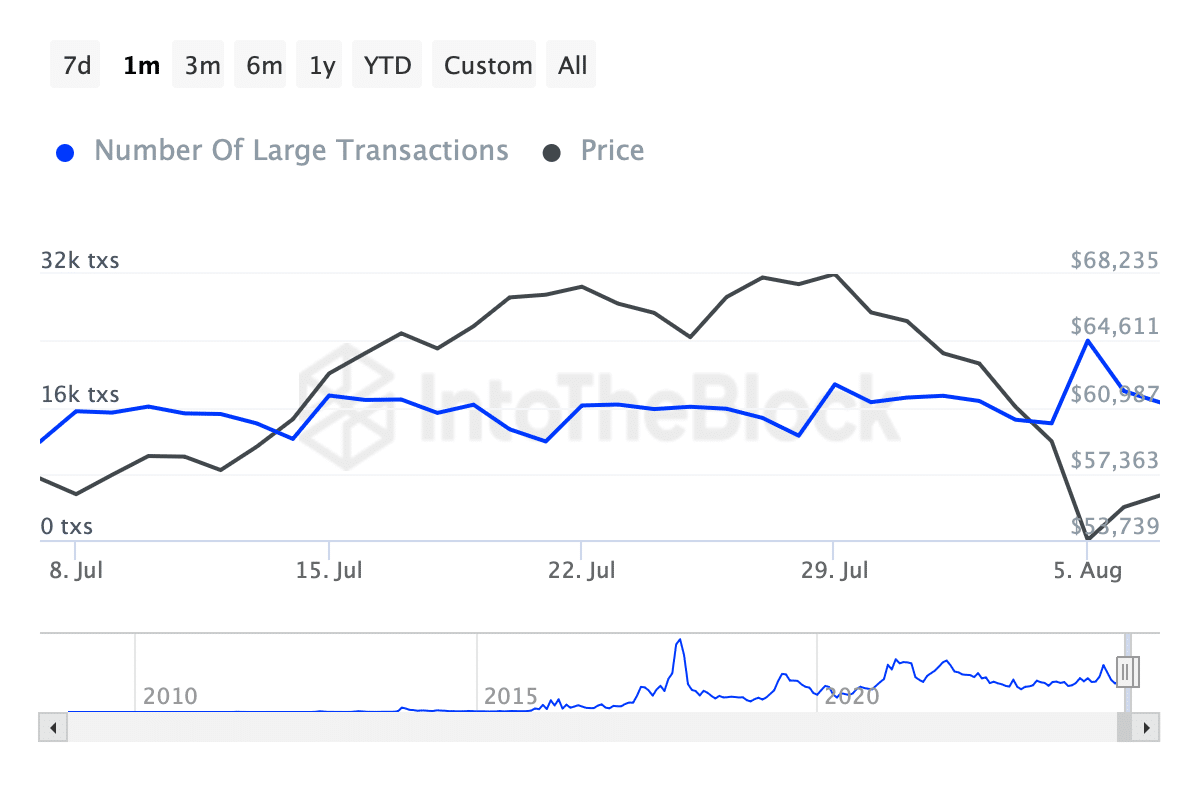

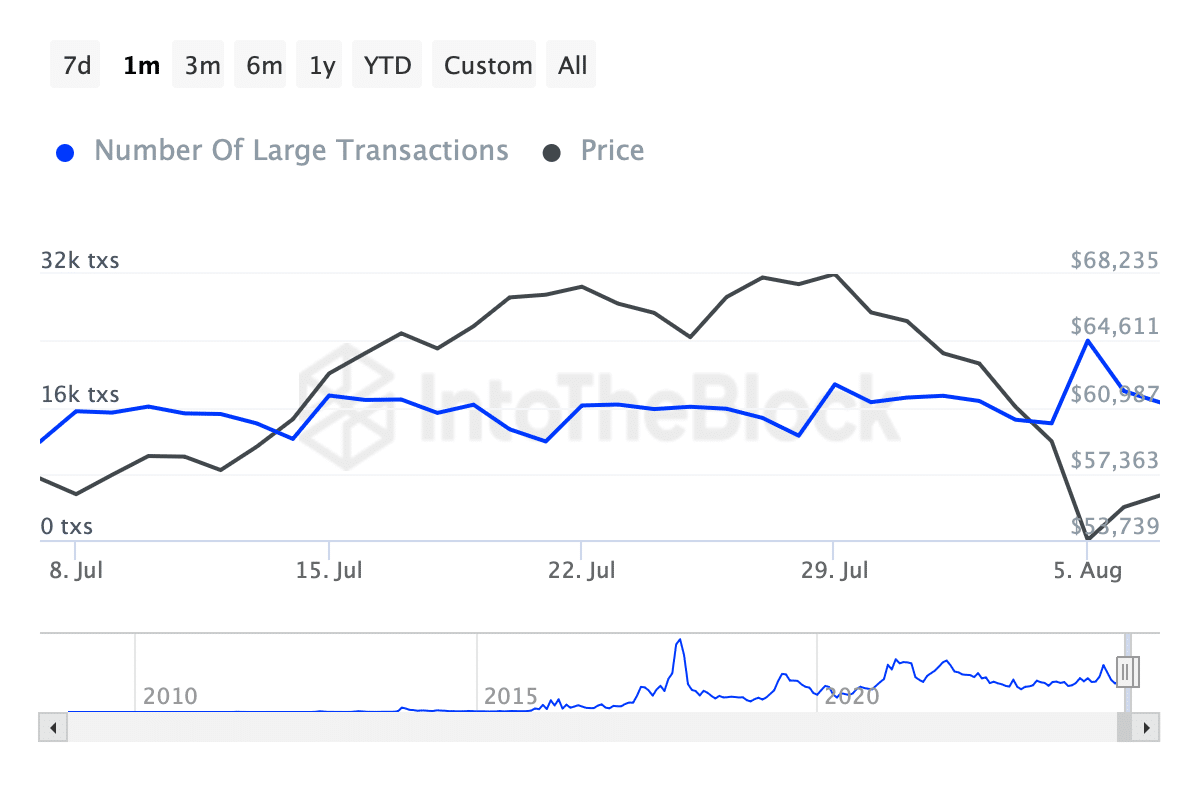

Facts from IntoTheBlock shows an increase in large Bitcoin transactions (over $100,000), which peaked from under 16,000 to over 23,000 transactions on August 5, before reaching around 16,560 today.

Source: IntoTheBlock

This fluctuation in whale activity could indicate renewed interest from major investors, potentially indicating a strategic accumulation of assets at lower prices.

Is your portfolio green? Check out the BTC profit calculator

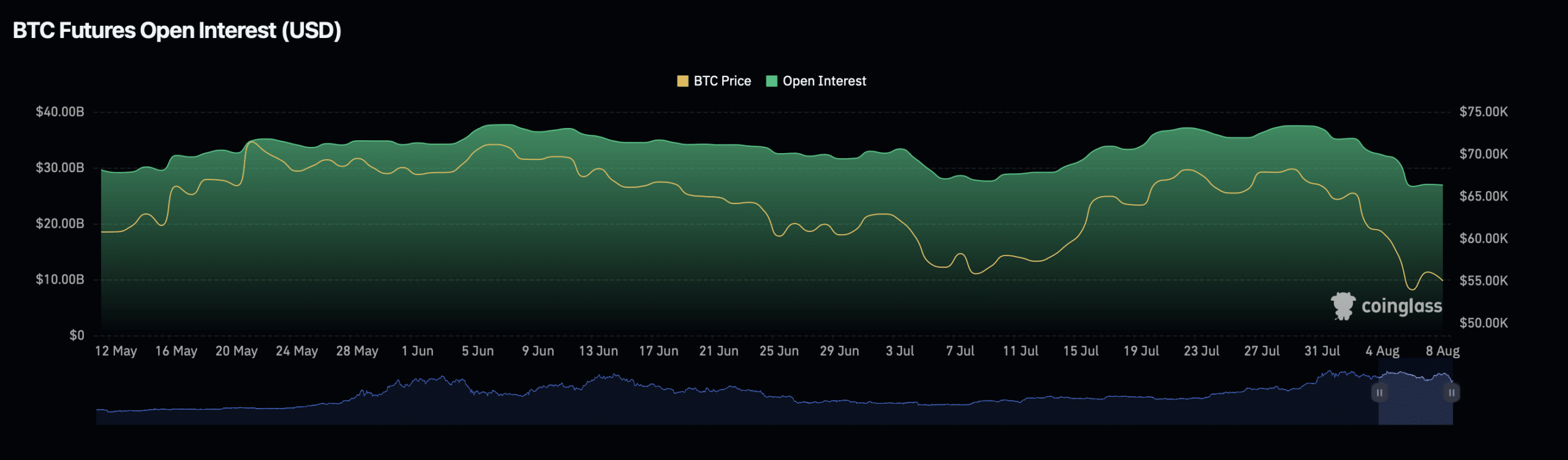

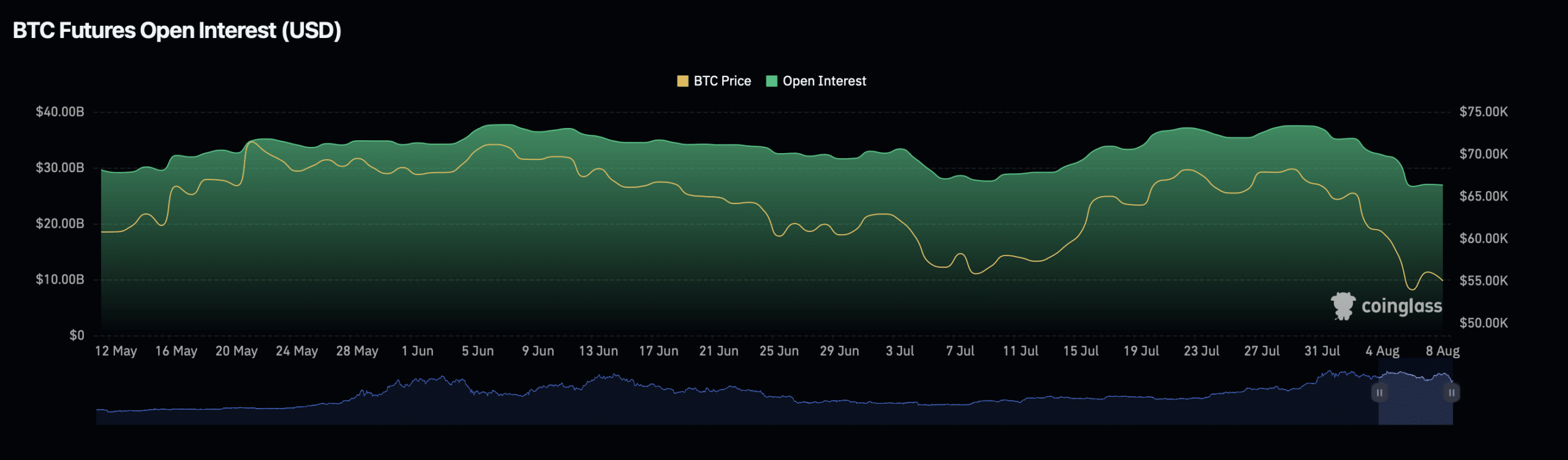

Moreover, Bitcoin’s overt interest has dropped slightly reject of 0.2% in the last day, which amounts to approximately $27.56 billion. This coincides with a 7% decline in open interest volume, which now stands at $76.14 billion.

Source: Coinglass

These shifts in open interest figures could signal a cooling of leveraged positions, potentially reducing the risk of further prolonged pressure and helping to stabilize the market.