- The price of Bitcoin has risen by more than 10% in the past seven days.

- Most metrics were bullish, but a few suggested otherwise.

Bitcoin [BTC] recently managed to break above the $60,000 mark, sparking excitement among investors. However, this uptrend could be just the beginning as a bullish pattern has appeared on the crypto’s price chart.

Bitcoin: A Bullish Breakout

AMBCrypto’s take on CoinMarketCap’s facts revealed that the price of BTC rose by double digits last week. To be precise, its value increased by more than 10%.

At the time of writing, BTC was trading at $63,370.18 with a market cap of over $1.25 trillion.

In the meantime, World of Charts, a popular crypto analyst, recently posted tweet shows an interesting development.

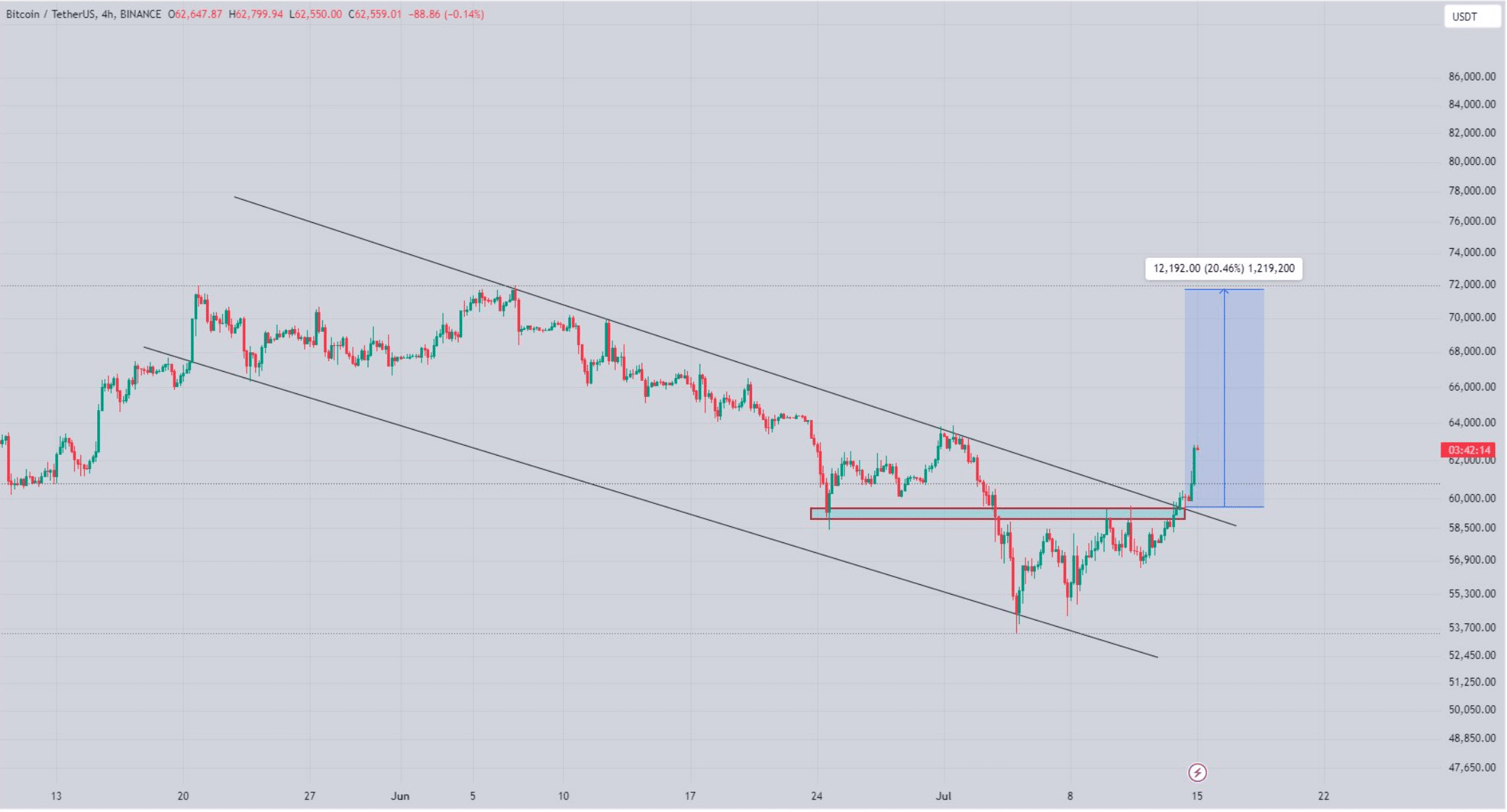

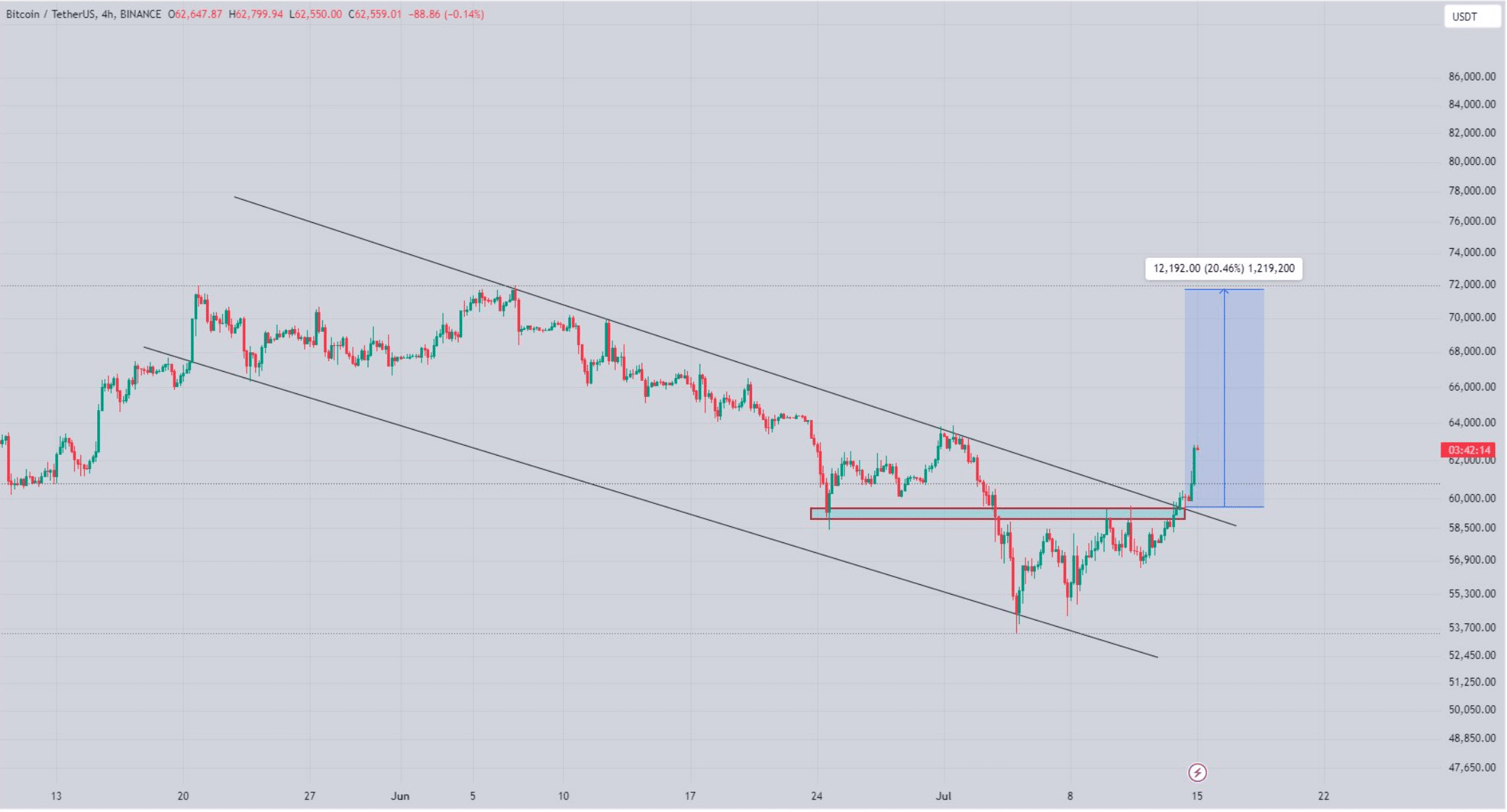

According to the tweet, a bullish descending channel emerged on Bitcoin’s chart. The price of the king of crypto has been consolidating within the pattern since May, only to break out a few days ago.

So far, BTC is up more than 5% since the outbreak. But if the trend continues, the coin’s price could see a 20% increase in the coming days or weeks.

Source:

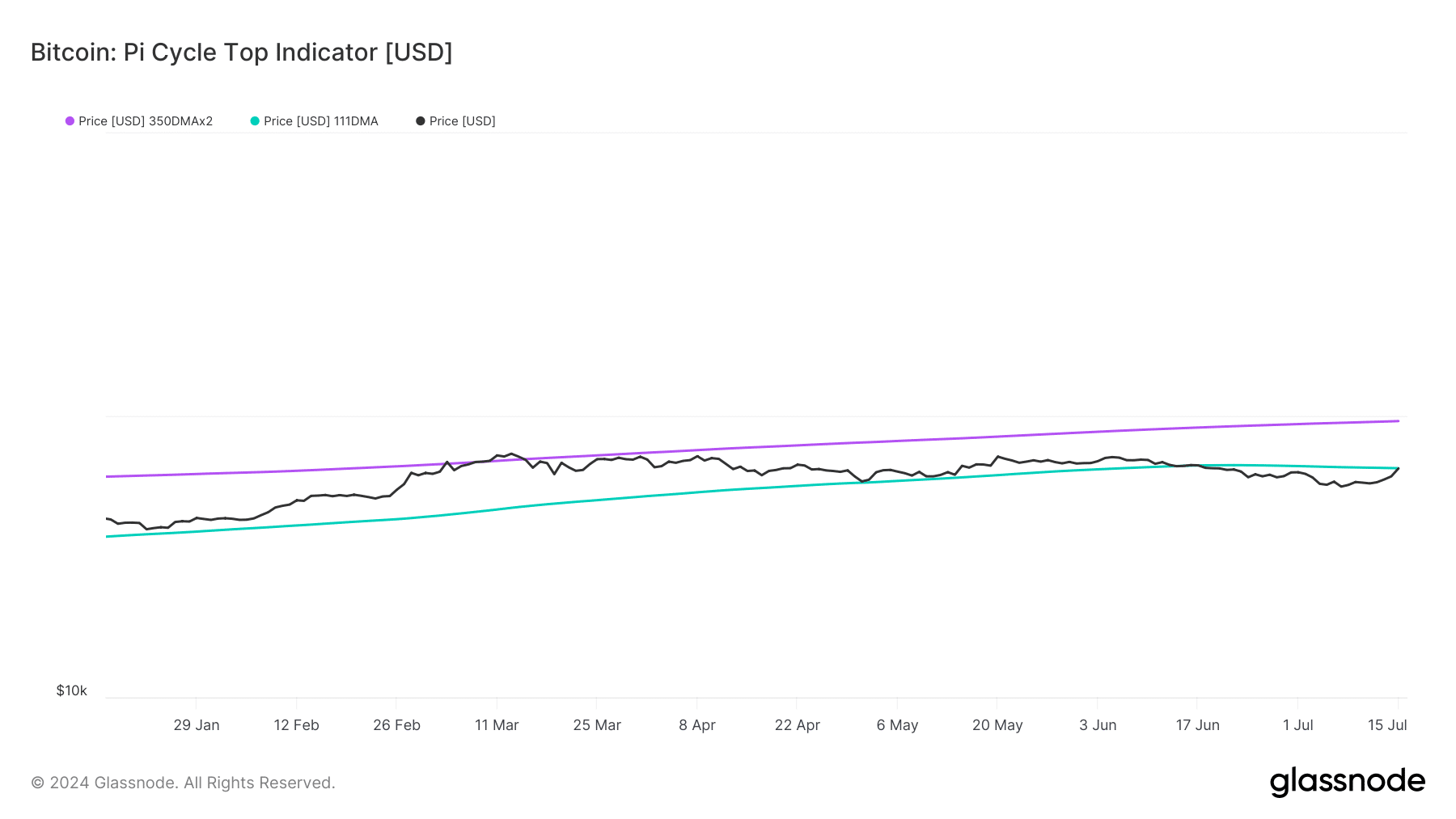

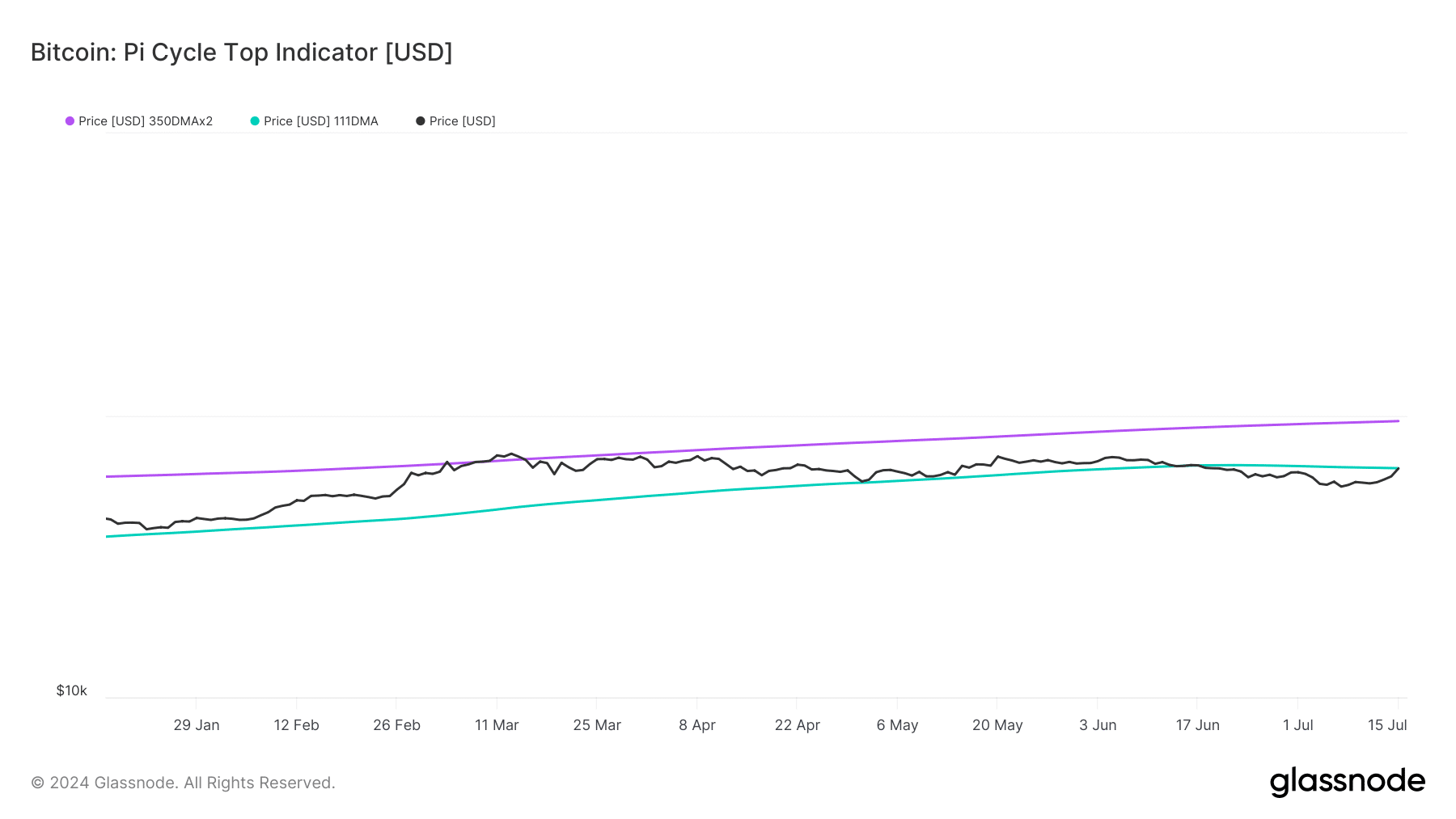

AMBCrypto’s look at Glassnode’s data pointed to yet another positive sign. The price of BTC has been below the possible market bottom of $64,000 for several weeks, according to the Pi Cycle Top indicator.

At the time of writing, it was quickly approaching that point. If the trend continues, Bitcoin might as well reach its possible market top of $95,000 in the coming months.

Source: Glassnode

Will BTC’s Bull Rally Continue?

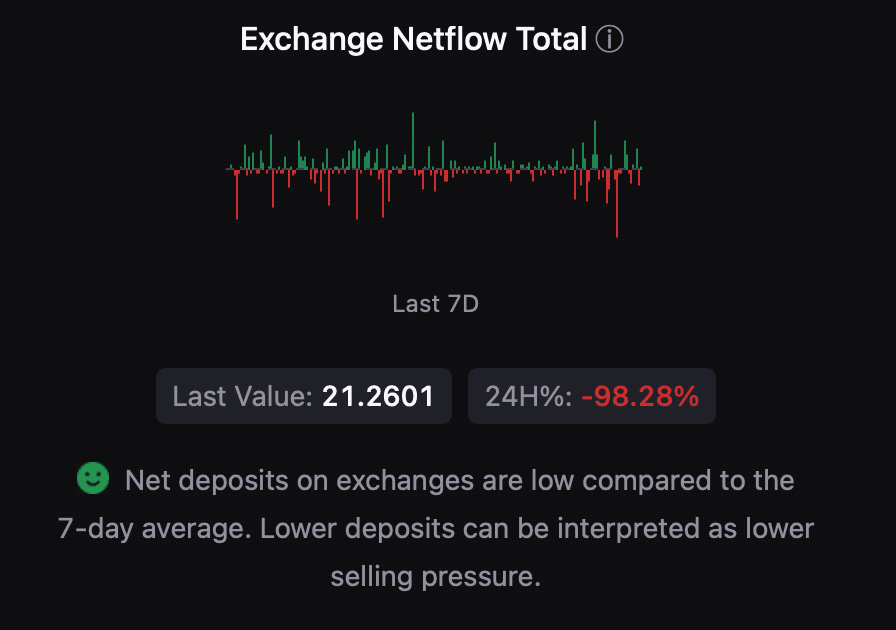

AMBCrypto then looked at CryptoQuant’s facts to find out what statistics suggested as to a continued price increase.

We found that the net deposits of BTC on the exchanges were low compared to the average of the past seven days, indicating that buying pressure is increasing.

The Coinbase Premium was also green, meaning buying sentiment among US investors was strong.

Apart from that, Bitcoin’s funding rate was also high. This suggested that long position traders were dominant and willing to pay short position traders.

Source: CryptoQuant

However, not everything was bullish. At the time of writing: BTCs fear and greed index had a value of 71%, meaning the market was in a “greed” phase.

When the metric reaches this level, it indicates that there are chances of a price correction.

Read Bitcoin (BTC) price prediction 2024-25

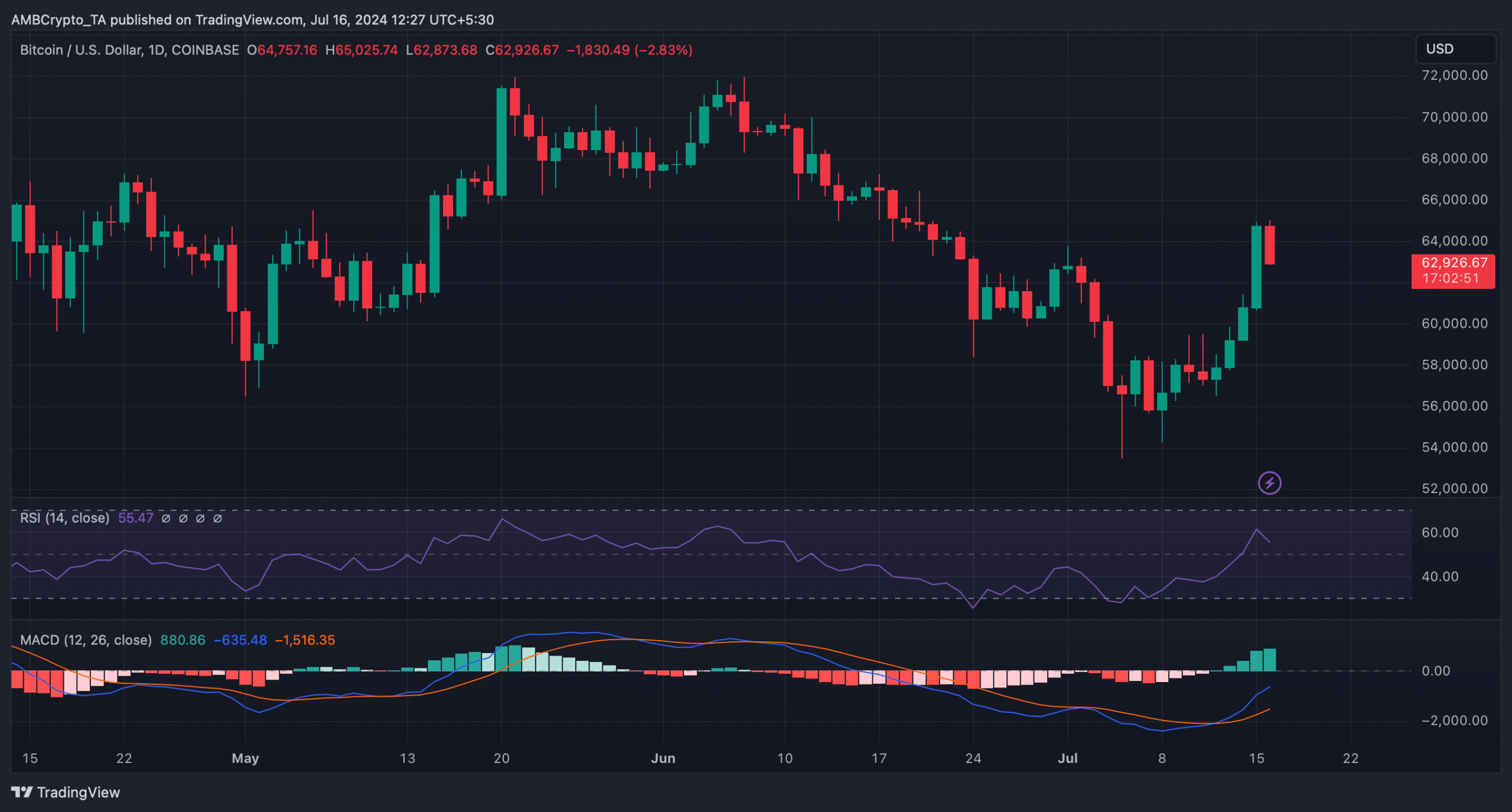

That’s why AMBCrypto checked BTC’s daily chart to better understand what to expect.

We found that after a sharp rise, the Relative Strength Index (RSI) was trending down, meaning bears could soon take over. Nevertheless, the MACD showed a bullish edge in the market.

Source: TradingView