- There is a decrease in the number of addresses with ADA.

- This meant that small holders were selling to whales at a loss.

Cardano [ADA] has experienced a drop in the total number of addresses with the coin over the past three days, Santiment noted in a after on social media platform

📈 #Cardano‘s market value today stands at +7%, despite the majority of #crypto dropped on Wednesday. Total $ADA The number of addresses has shrunk, which is a good sign. Falling wallets are usually a sign that small holders are capitulating and selling to whales at a loss. https://t.co/7NeeZ6pRph pic.twitter.com/FAsL2AEj9N

— Santiment (@santimentfeed) December 6, 2023

According to the data provider, this decline indicates a decline in coin ownership by retail investors, indicating a shift in the dynamics of ADA ownership.

Santiment said:

“Normally, a declining wallet is a sign that small farmers are capitulating and selling to whales at a loss.”

Most Cardano holders continue to make losses

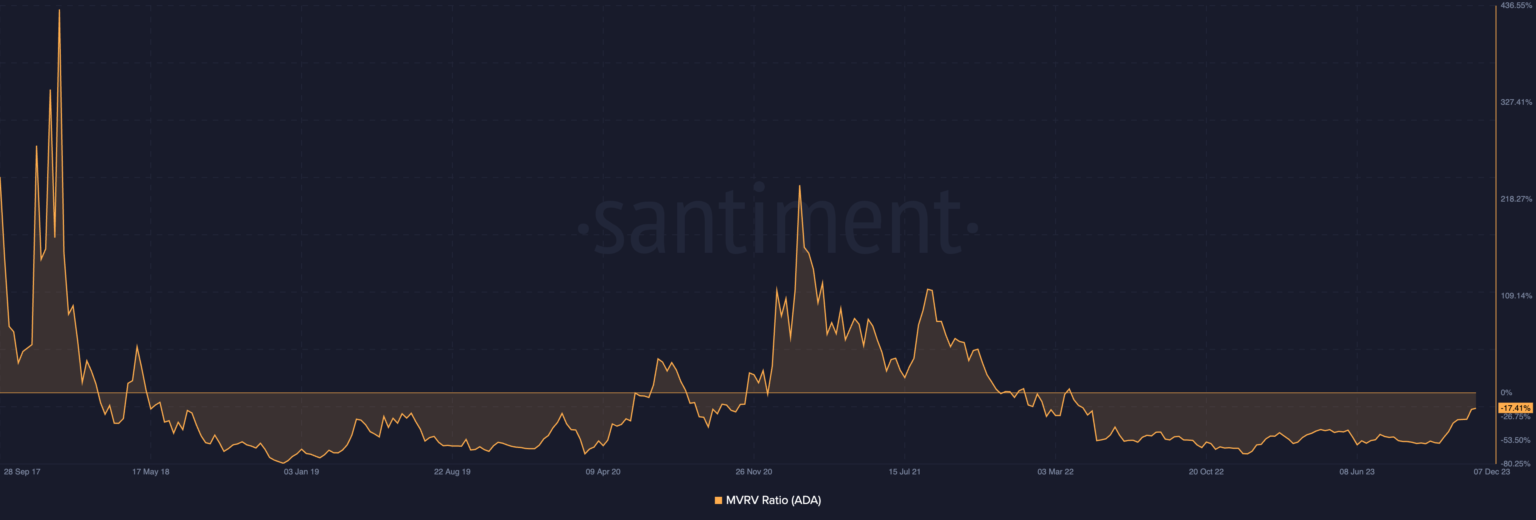

Although ADA’s value has risen by double digits over the past month, many of its holders remain underwater. An assessment of the altcoin’s market value to realized value (MVRV) ratio found that the metric has been less than one since March 2022.

The MVRV ratio tracks the ratio between the current market price of an asset and the average price of each acquired coin or token of that asset.

A positive MVRV ratio above one indicates that an asset is overvalued, and selling at the current price would result in a profit for investors.

Conversely, a negative MVRV value indicates that the asset in question is undervalued. If holders were to sell at the asset’s current price, they would realize losses.

Although there was an upward trend in ADA’s MVRV ratio, it remains below one and continues to show only negative values.

At the time of writing, ADA’s MVRV ratio was -17.41%. This meant that investors who bought the asset in the past held the coin at an average loss of 17.41%.

The bullish sentiment remains

While most ADA investors are holding the currency below their cost basis, open interest in futures has nearly doubled since November 1. At the time of writing, ADA’s $206 million open interest has grown 63% since then.

It is trite that a steady increase in an asset’s open interest means investors are taking more trading positions. It is often taken as a bullish signal.

Is your portfolio green? look at the ADA Profit Calculator

Likewise, the currency’s funding rates on the exchanges have been positive since the end of October.

A combination of positive funding rates and rising open interest underlines the bullish sentiment in the ADA market. This is despite the low profits recorded on transactions involving the currency.