- Bollinger bands seem to squeeze on Ada’s 12-hour graph, which indicates a potential upward rally.

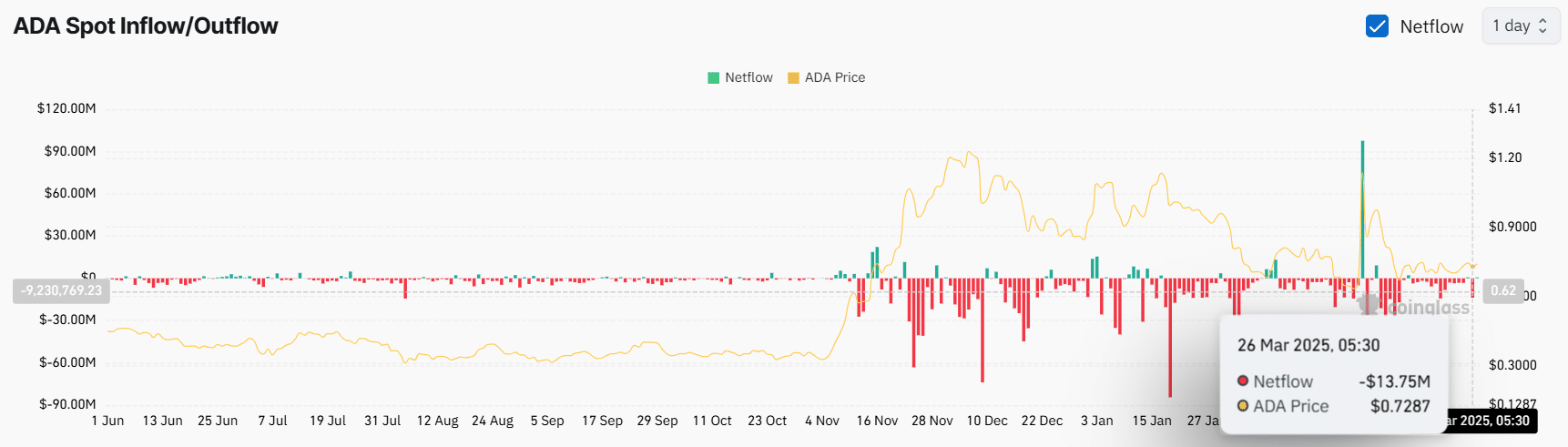

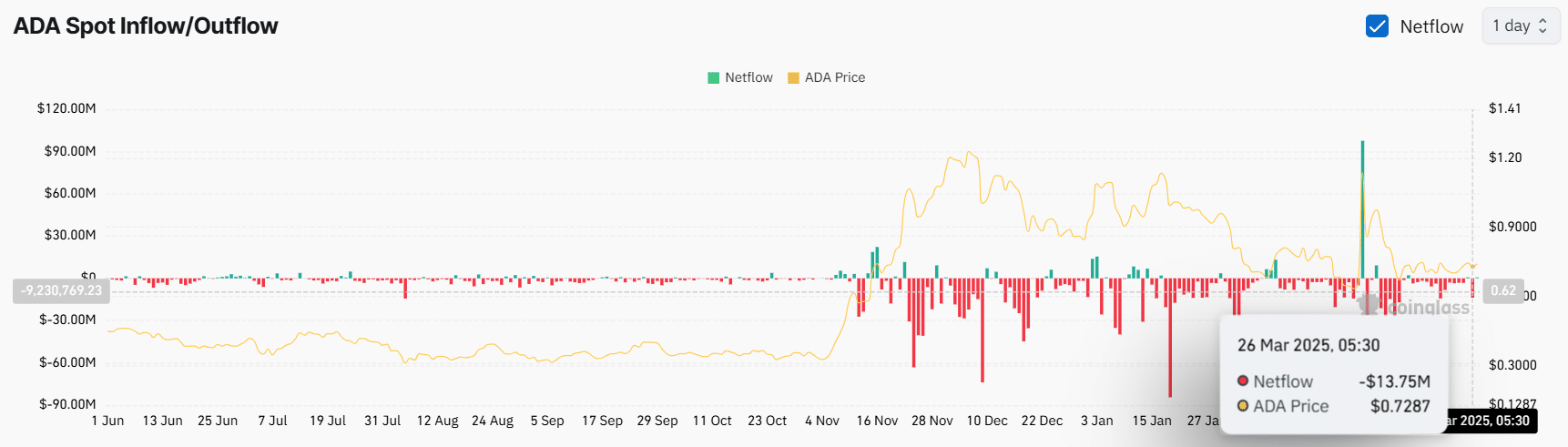

- The statistics on the chain revealed that stock markets had witnessed an outflow of $ 13.80 million in ADA tokens.

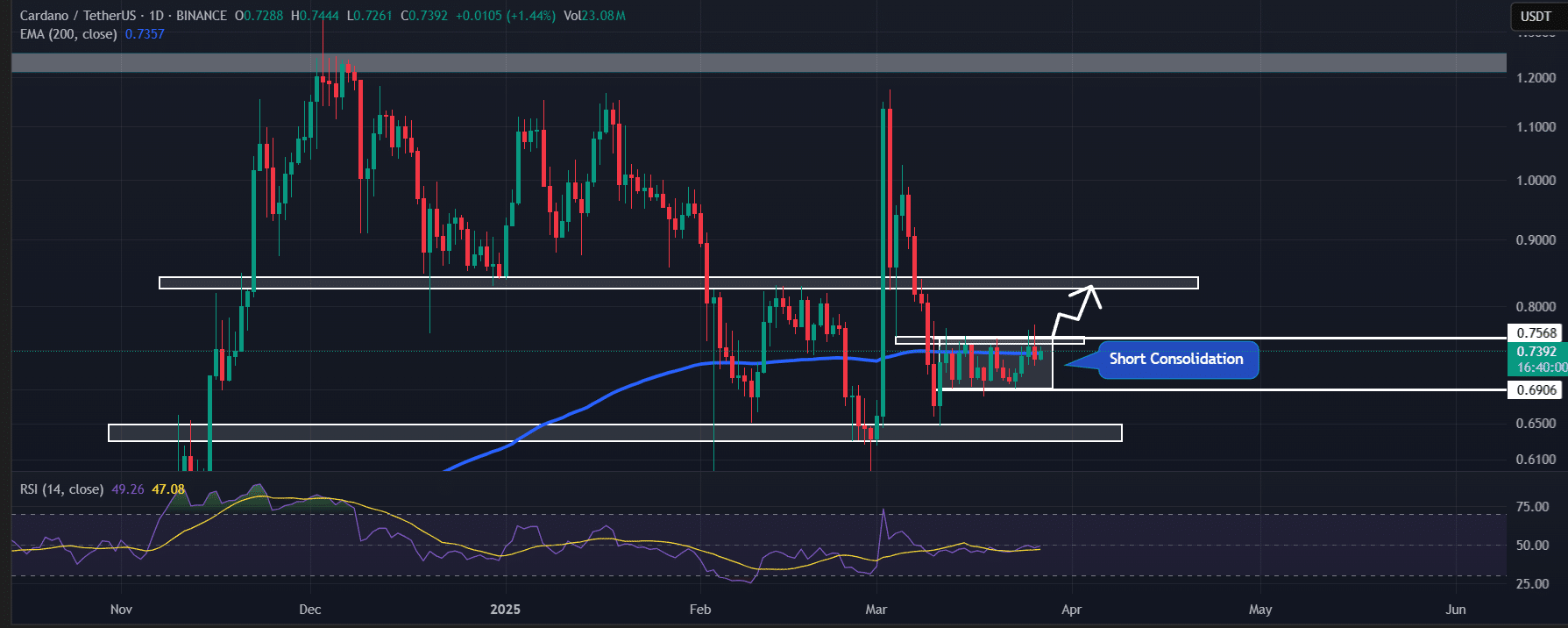

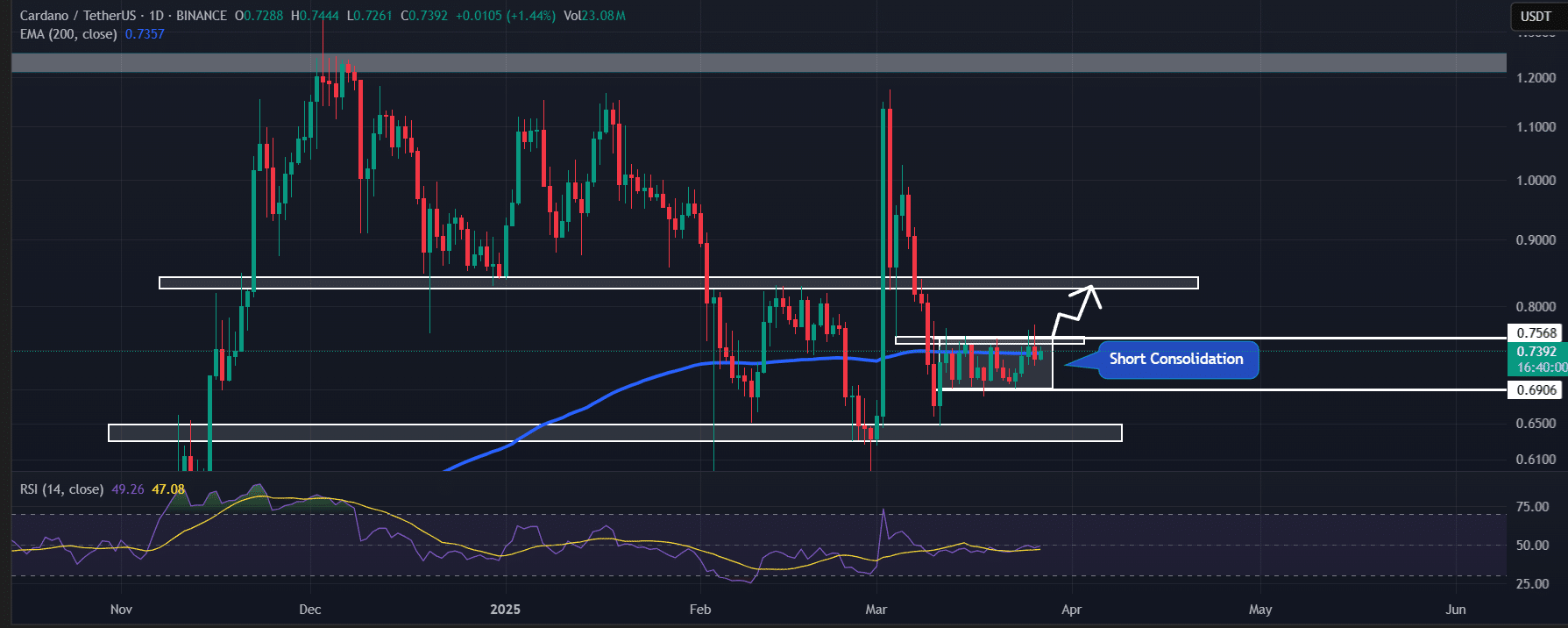

Cardano [ADA] has been stuck in tight consolidation for more than a week and is struggling to get up.

At the time of writing, the crypto market sentiment seemed to improve, giving him hope that Ada could break and resume his upward rally.

Cardano’s technical analysis and price promotion

According to Ambcrypto’s technical analysis, ADA is consolidating between $ 0.69 and $ 0.75 within a tight reach.

As the market recovers, it has actively hit the upper limit of consolidation, a level where reversations took place earlier.

Source: TradingView

In the meantime, the 200-day exponential advancing average (EMA) also acts as a resistance level, which limits the upward movement of ADA.

Moreover, a prominent crypto analyst Share a message on X (formerly Twitter) and expressed their opinion about Ada using a technical indicator called the Bollinger bands.

In the post, the analyst noted that the Bollinger bands limit on the 12-hour graph of Ada, which indicates a potential peak in the coming days.

Ada’s price momentum

At the time of the press, Ada traded in the vicinity of $ 0.74 and reflected a price fall of 1.5% in the last 24 hours.

In the same period, trade volume fell by 10%, with reduced trader and investors participation in the midst of price consolidation.

Ada’s relative strength index (RSI) stood on 47 and signaled neither overbought nor over -sold circumstances. Market sentiment can now influence the price direction.

If Ada breaks past the 200-day EMA and its consolidation range and a daily candle above $ 0.76 is closed, it could rise by 13% to reach $ 0.85.

Such a breakout can also create opportunities for further upward momentum.

Bullish on-chain statistics

Despite the price fall and continuous struggles, whales and long-term holders have collected the token, as reported by the on-chain analysis company Coinglass.

Data from Spot -entry/outflow showed that exchanges have witnessed the last 24 hours of an outflow of a considerable value of $ 13.75 million in ADA -Tokens, which points to potential accumulation by holders.

Source: Coinglass

In the meantime, intraday traders are also following a similar trend.

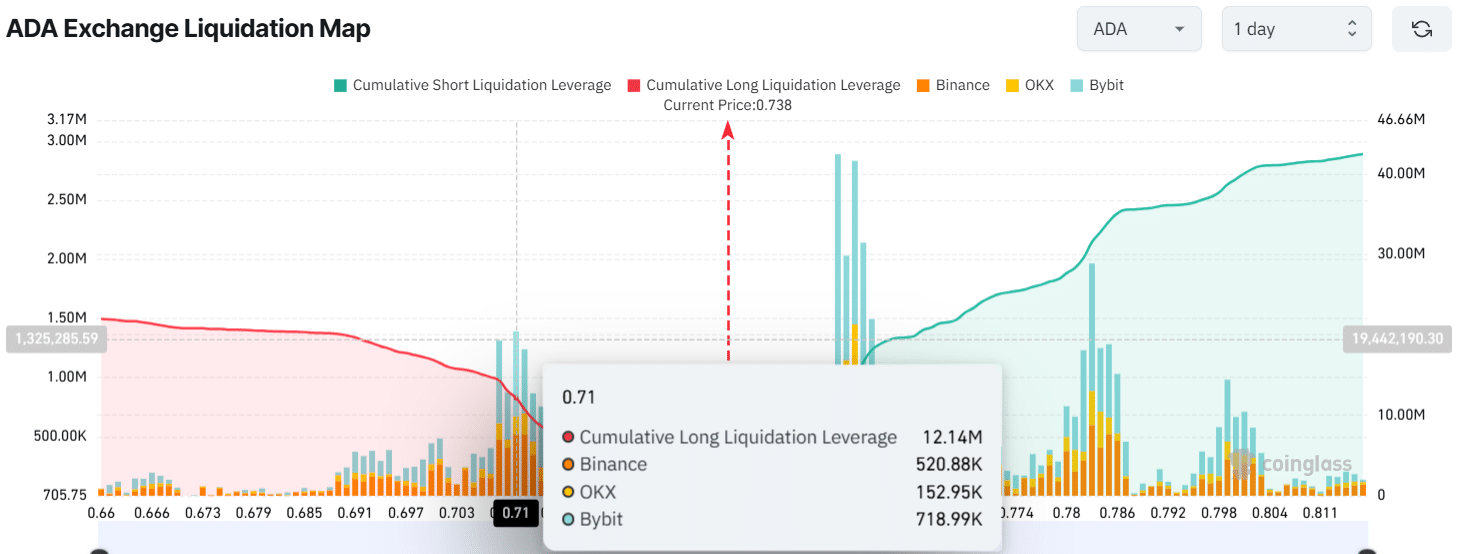

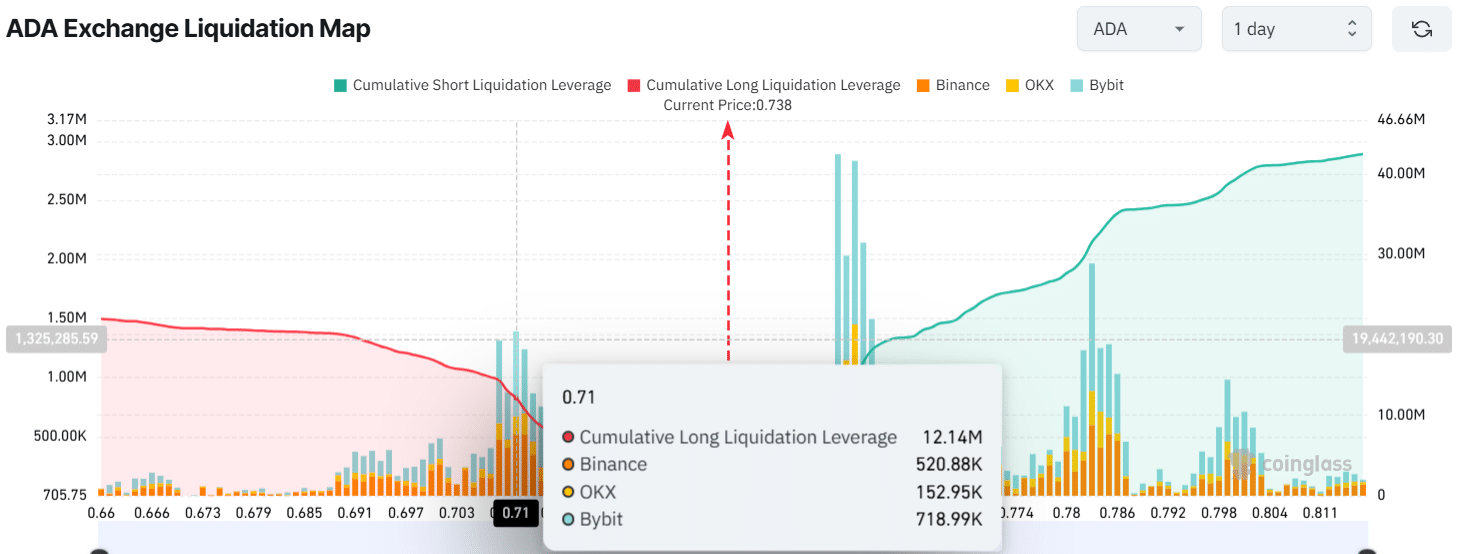

Coinglass data shows that traders are currently being used too much for $ 0.71 at the bottom, with $ 12.15 million in long positions.

On the other hand, the level of $ 0.753 is another livered zone, where traders for $ 9 million have held in short positions.

Source: Coinglasss

The over-levels suggest that bulls actively dominate and probably float to end the long-term consolidation.