- Uniswap rose more than 8% after retesting a key support level.

- A 520% increase in active addresses indicates growing network adoption

Uniswap [UNI] has shown significant strength after successfully defending the $8.75 support level and subsequently posted an impressive 8% gain.

The altcoin’s recent price action suggests bulls are regaining control of the market momentum.

A technical breakout indicates bullish momentum

Uniswap has moved on from the ascending triangle pattern, a trading pattern that historically precedes a bullish run.

Since the outbreak of the consolidation phase, UNI has tested the $8.75 support level several times in the past week. This strengthens the support level as a key demand zone for the altcoin.

Source: Tradingview

The successful defense of this level indicates Uniswap’s strong buyer presence.

Uniswap statistics send positive signals

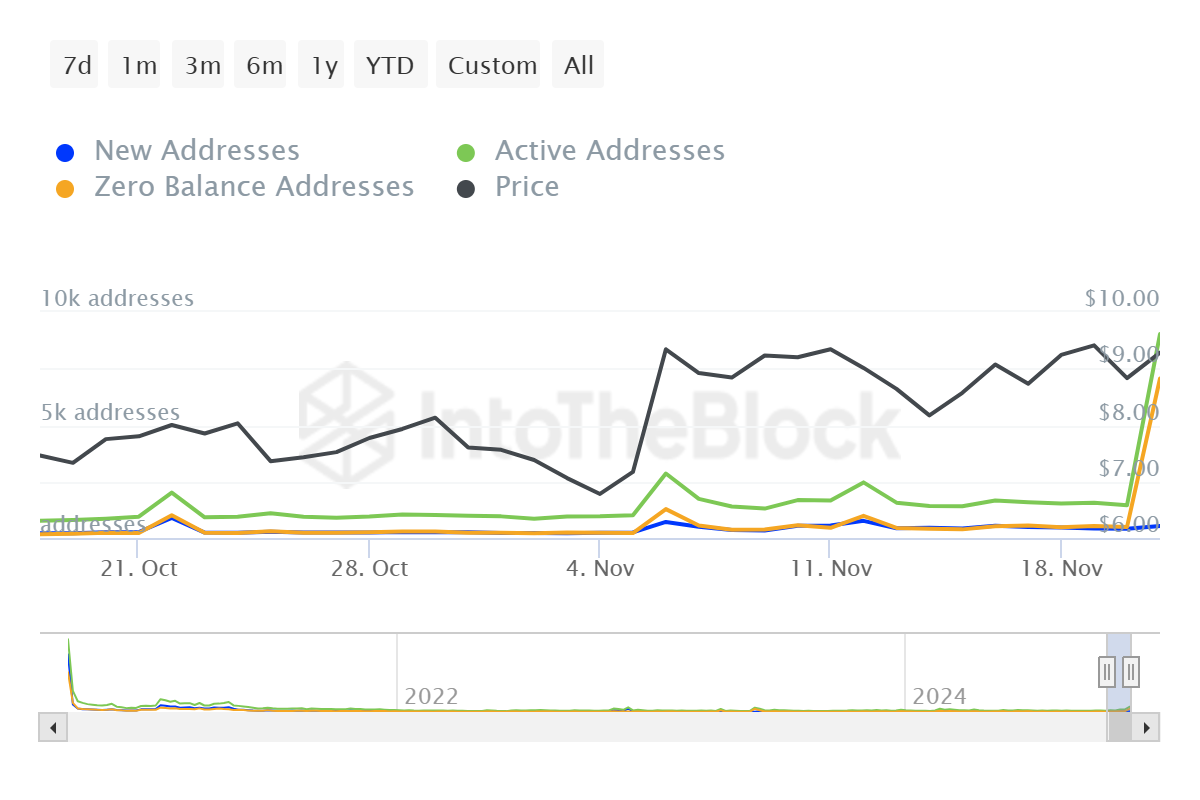

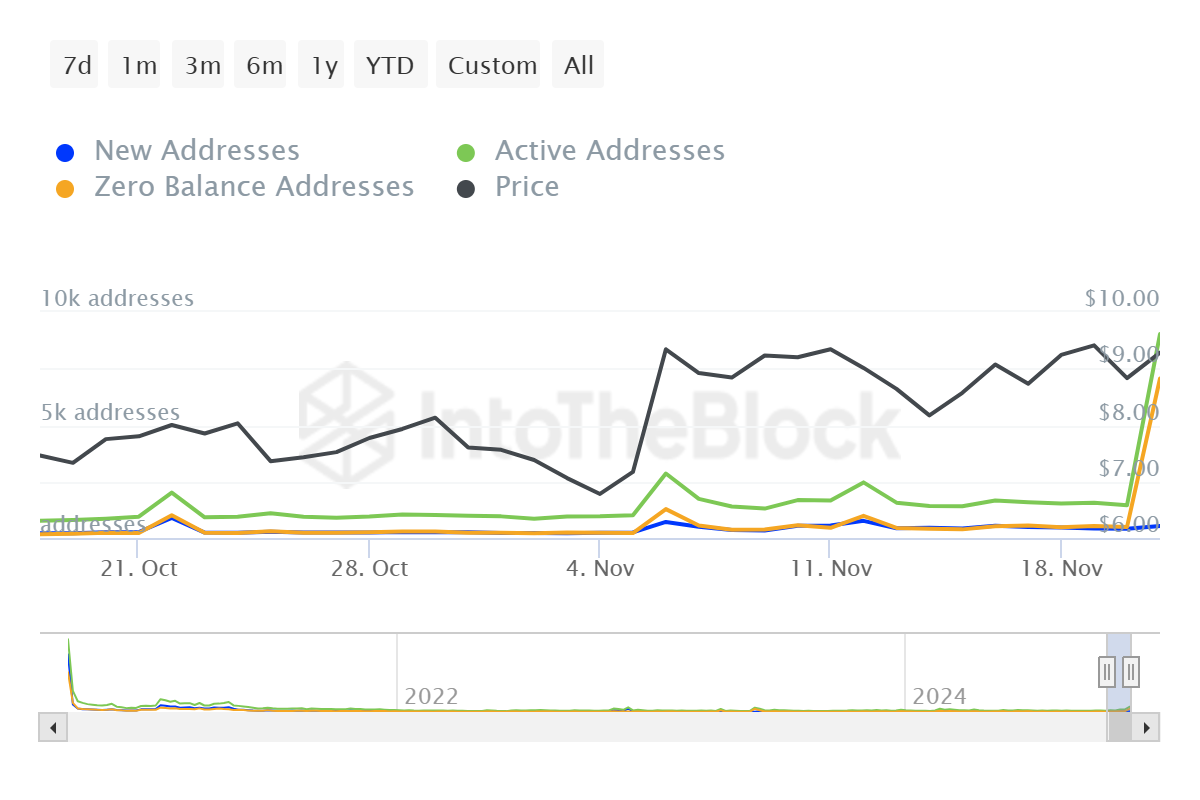

AMBCrypto analysis of the on-chain data reveals a substantial increase in network activity. Active Uniswap addresses have increased by 520% in the last 24 hours alone, indicating a significant increase in user engagement.

Source: IntoTheBlock

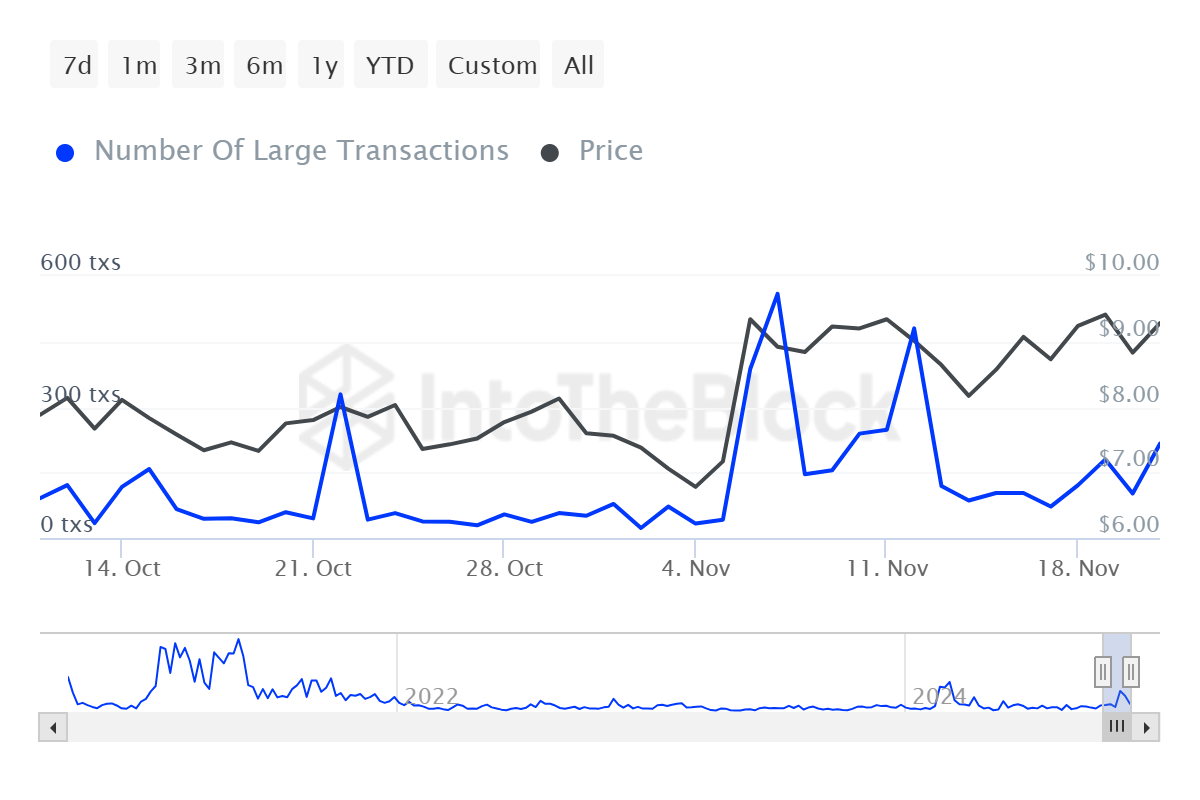

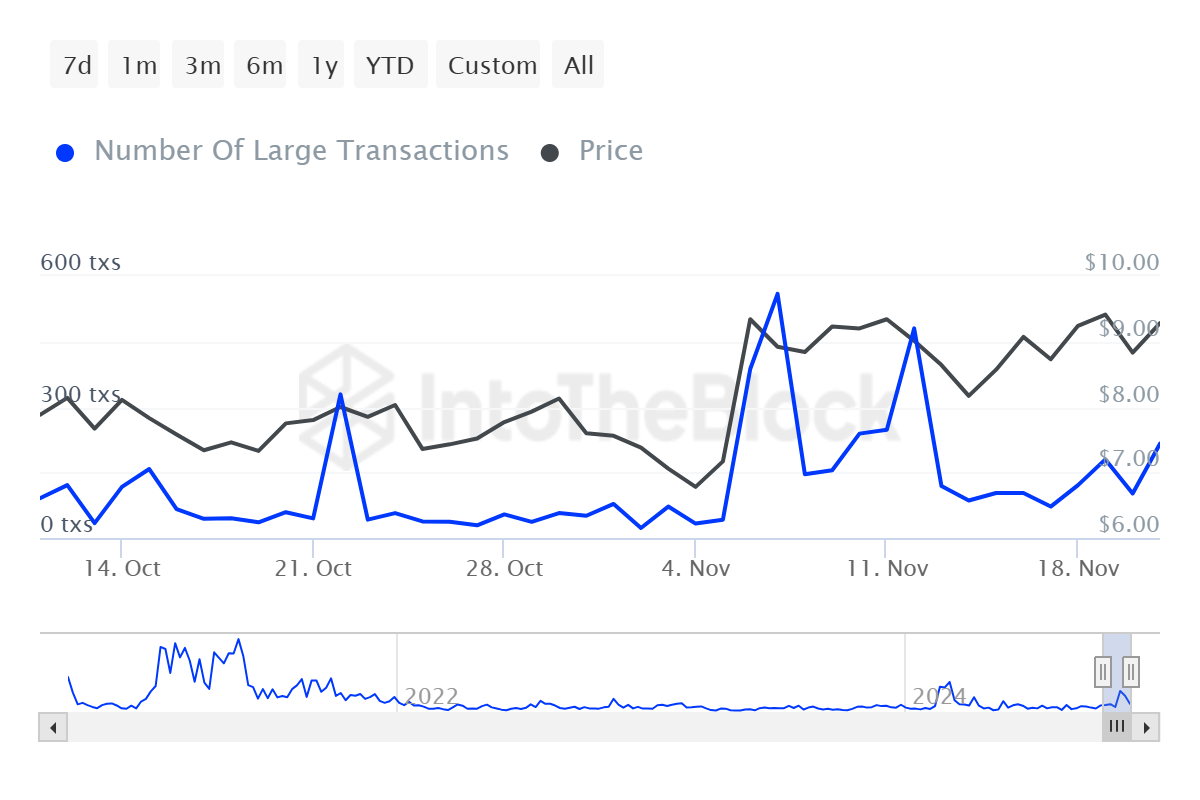

This rapid increase in large transactions coincides with a 143% increase in large transactions, indicating growing whale interest in UNI.

Source: IntoTheBlock

Source: IntoTheBlock

The significant increase in both active addresses and high transaction volume indicates growing institutional interest.

This increase in network participation often precedes sustained price movements, as increased trading activity typically leads to higher price discoveries.

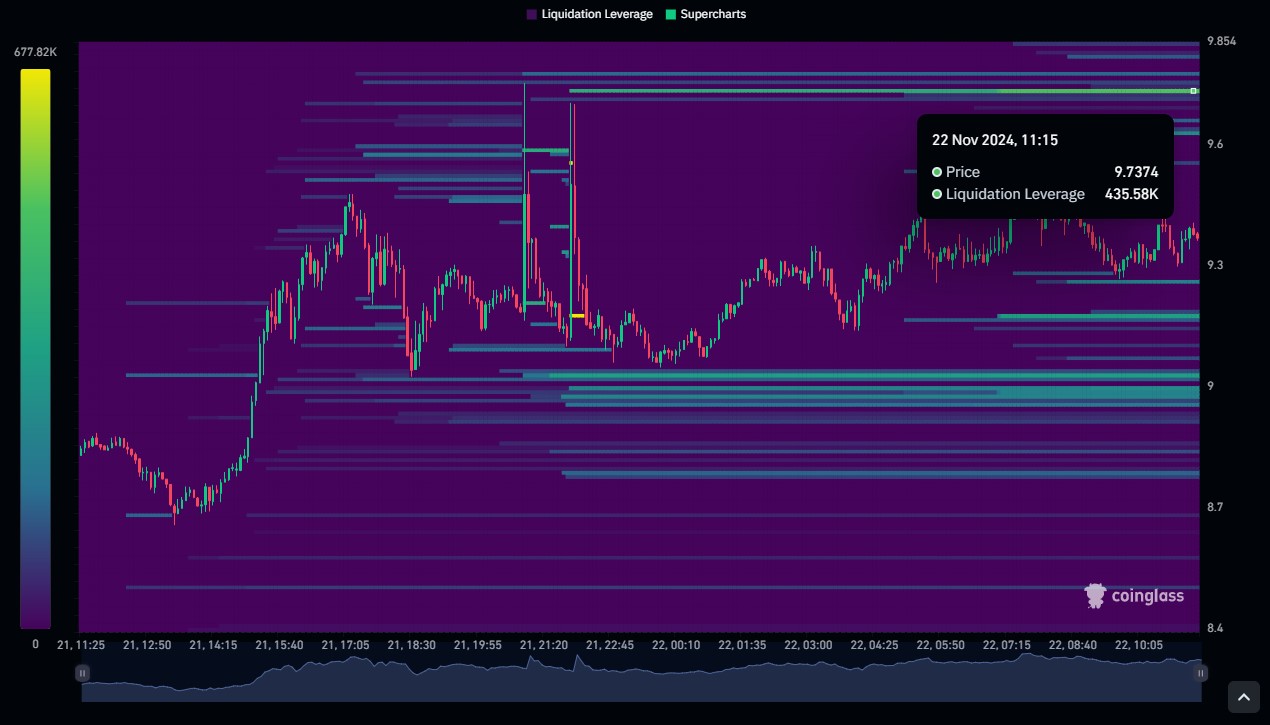

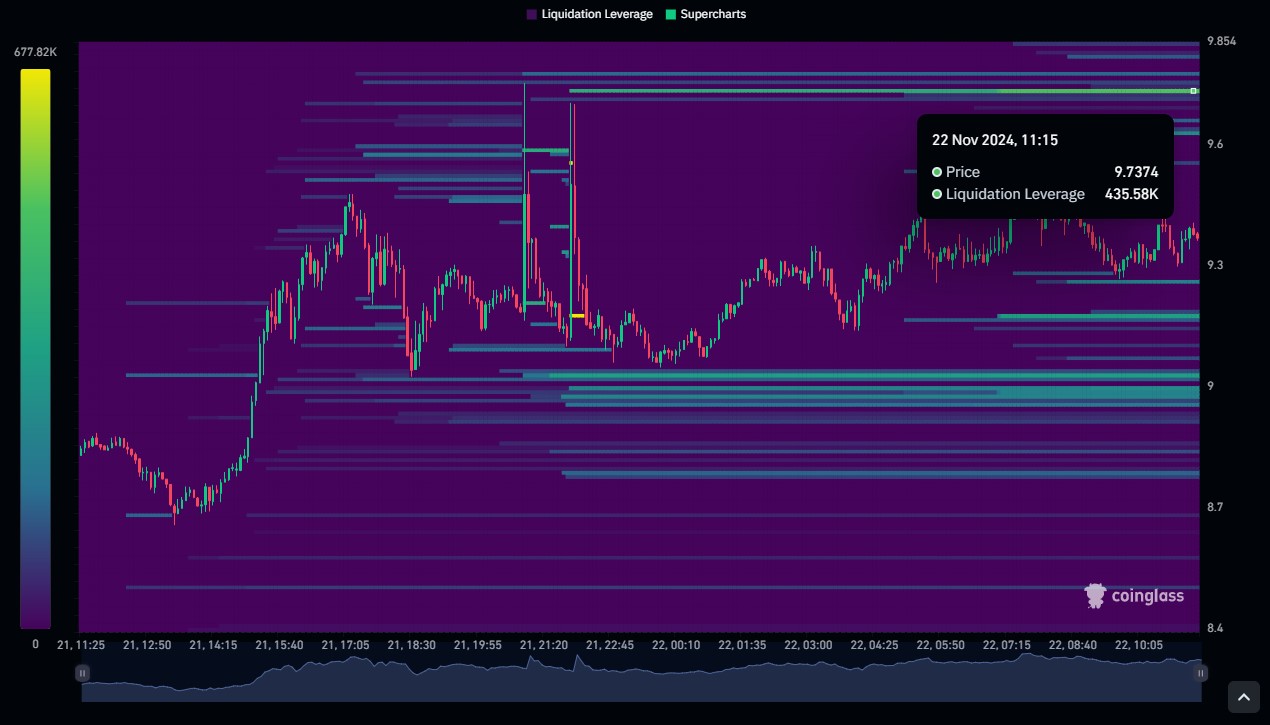

Critical liquidation level ahead

Coinglass’ liquidation heat map data report reveals a significant cluster of positions around the $9.73 price level, worth approximately 430,000 UNI in liquidations.

The liquidation pool can act as a price magnet to push UNI prices higher in favor of the long position takers. This further adds to the likelihood of a potential bullish run from Uniswap.

Source: Coinglass

Realistic or not, here is UNI’s market cap in BTC terms

Both Uniswap’s technical and on-chain metrics paint a bullish picture. However, the resistance level at $9.73 remains crucial.

A successful break above this level could trigger a cascade of liquidations, potentially fueling further upside momentum.