- The price of LINK has fallen by more than 7% in the past week.

- Market indicators pointed to some slow days.

After days of continued setbacks, Chain link [LINK] finally showed signs of recovery. This was the case when the token managed to break a bullish pattern that could lead to LINK reaching new highs in the coming weeks or months.

Chainlink’s bullish breakout

CoinMarketCaps facts revealed that the price had fallen by more than 7% in the past week. In the last 24 hours, the token also witnessed a price decline of 1.3%.

At the time of writing, LINK was trading at $14.27 with a market cap of over $8.37 billion.

The price drop caused several investors to suffer losses. According to IntoTheBlock’s factsonly 46% of Chainlink investors had a profit. However, there were chances of a trend reversal.

AMBCrypto reported rather that LINK has been consolidating within a bullish wedge pattern since April. The better news was that the token finally managed to break out of the pattern.

World Of Charts, a popular crypto analyst, recently posted a tweet to draw attention to this outbreak. If LINK tests this pattern, investors could soon witness a 42% surge in LINK, which could see it reach $22 in the coming weeks.

Source:

Will LINK reach $22?

As the bullish breakout raised hopes for a price increase, AMBCrypto planned to analyze its on-chain data.

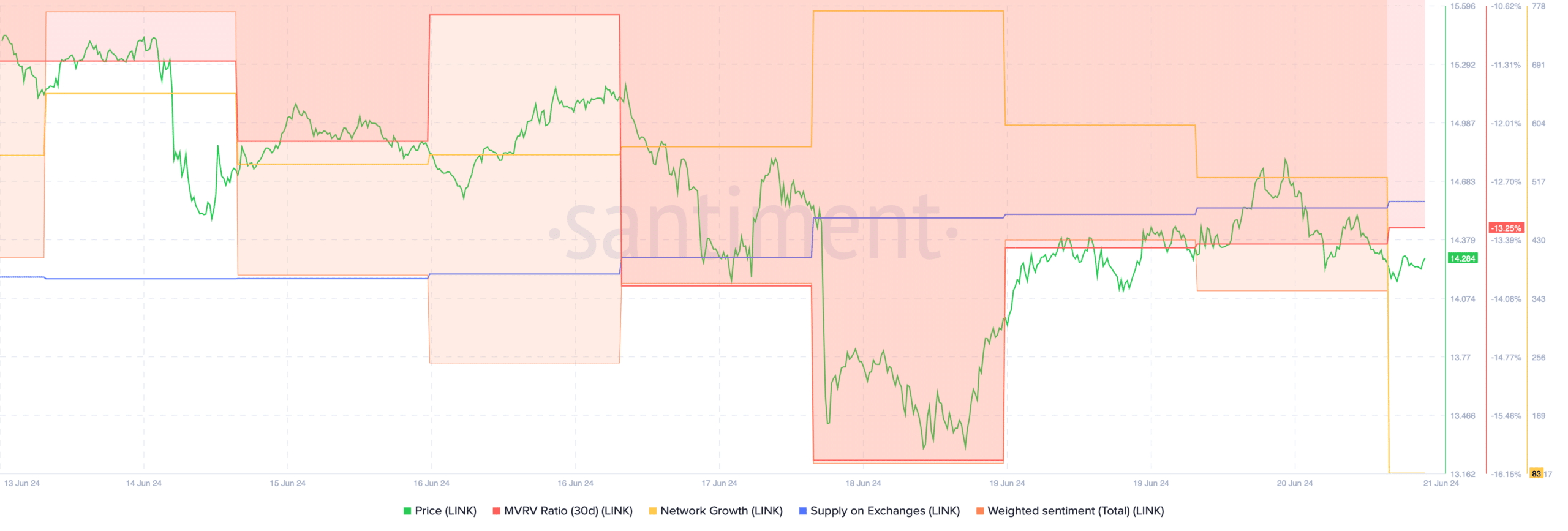

Our analysis of Santiment’s data showed that LINK’s MVRV ratio improved after the June 18 plummet.

Similarly, LINK’s weighted sentiment also improved after a dip, meaning bearish sentiment around the token decreased. Network growth has increased recently.

This meant that more addresses were created to transfer the token.

Nevertheless, investors were still considering selling Chainlink. This seemed to be the case as there was a slight increase in LINK offerings on the exchanges.

Source: Santiment

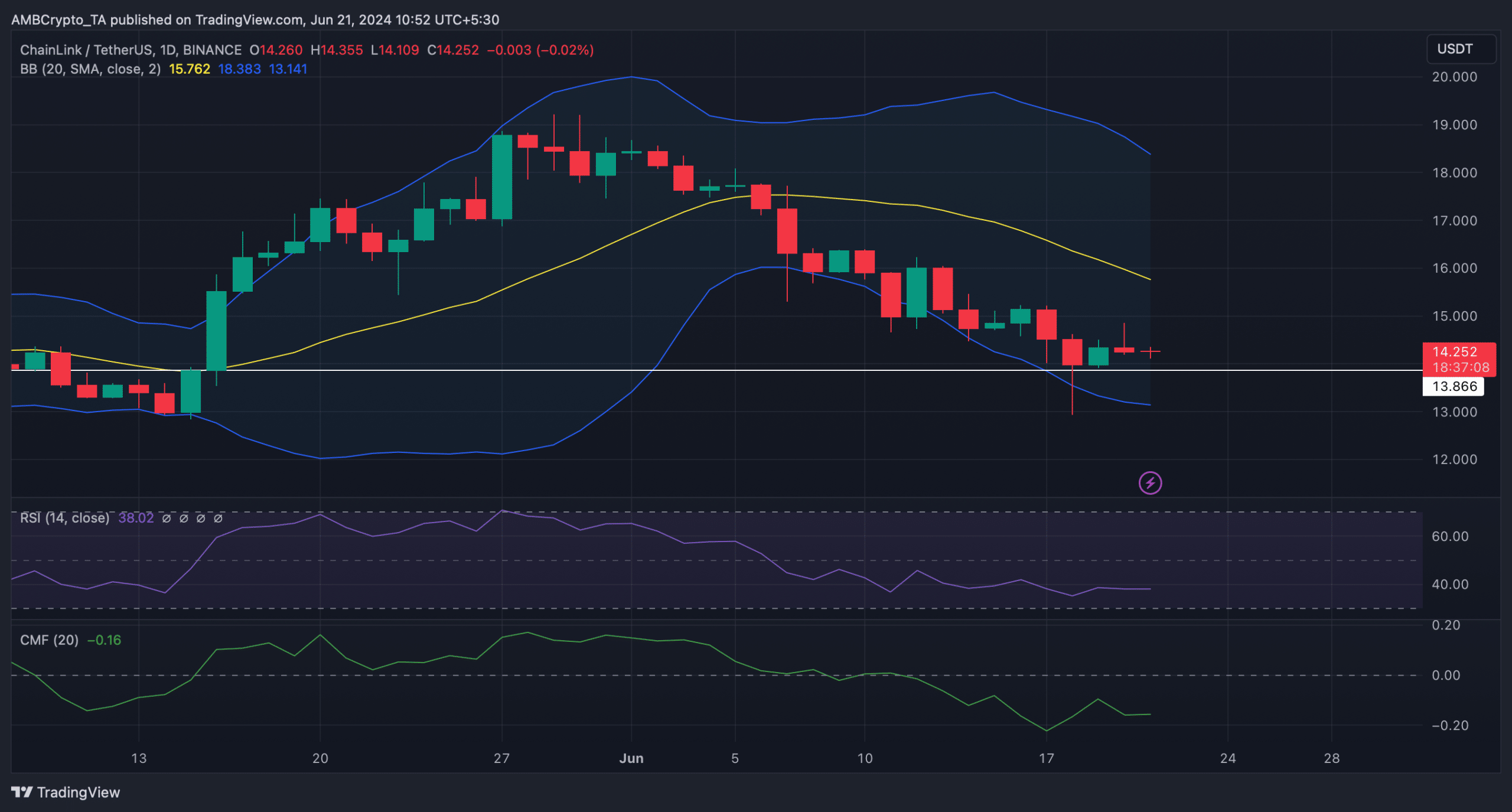

As selling pressure increased, AMBCryopto then analyzed Chainlink’s daily chart to better understand what to expect from the token in the coming days.

According to our analysis, there were chances of a price increase because LINK’s price had reached the lower limit of the Bollinger Bands.

However, the rest of the indicators pointed to a slow few days. For example, both LINK’s Relative Strength Index (RSI) and Chaikin Money Flow (CMF) moved sideways below their respective neutral marks.

Source: TradingView

Realistic or not, here it is LINK market cap in BTCs conditions

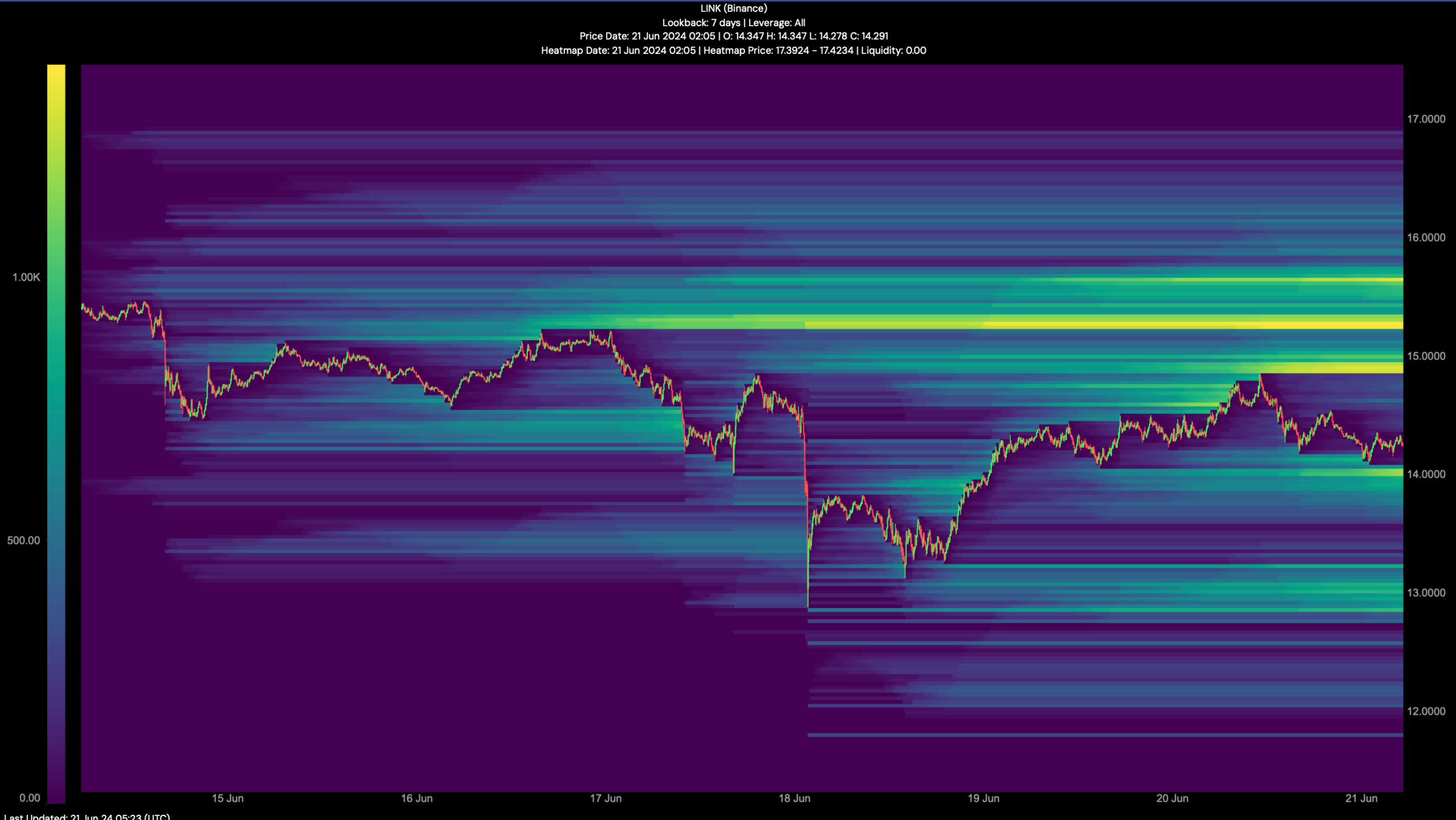

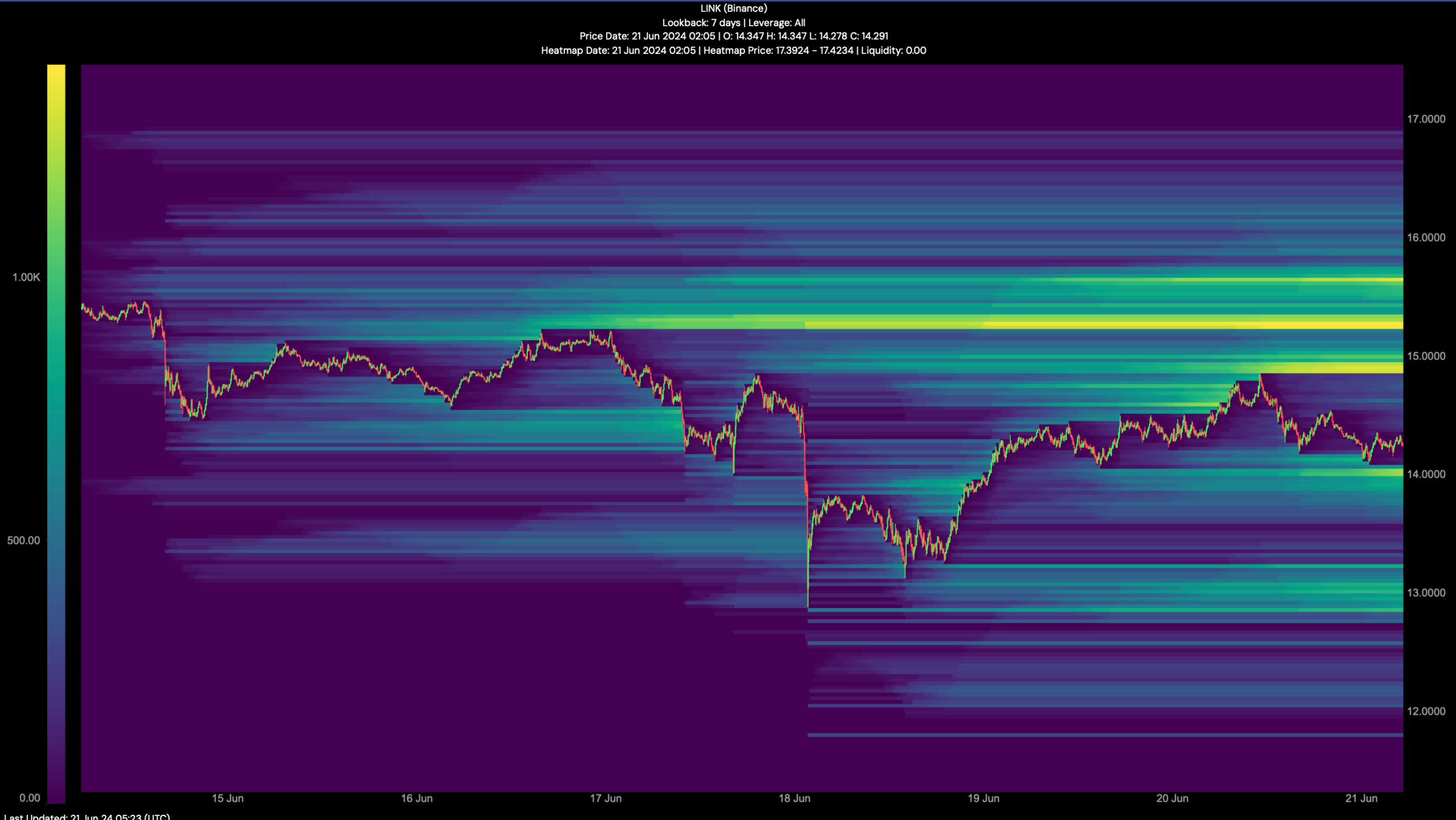

If LINK turns bullish, it may need to move above a few critical zones before eyeing $22. Hyblock Capital’s data showed that LINK’s liquidation would rise sharply, near $14.8.

In general, high liquidation results in short-term price corrections. LINK will face new resistance around $15 and a breakout above would open doors for LINK to climb towards $22.

Source: Hyblock Capital