Bitcoin has seen a decline over the past day, pushing the asset’s price below $67,000. Here you can see the historical support level that the asset could reach next.

Bitcoin is now not far from the price realized by the short-term holder

As analyst James Van Straten noted in a after at

The “Realized Price” here refers to an on-chain metric that tracks the cost basis of the average investor in the BTC market. This indicator is based on the ‘Realized Cap’ model for the cryptocurrency.

Related reading

When the spot price of the asset is higher than the realized price, it means that the investors are currently making some net unrealized gains. On the other hand, the value of the coin below the benchmark suggests the dominance of losses in the market.

In the context of the current topic, the Realized Price of a specific sector segment is of interest: the Short-Term Holders (STHs). The STHs include all investors who purchased their coins in the last 155 days.

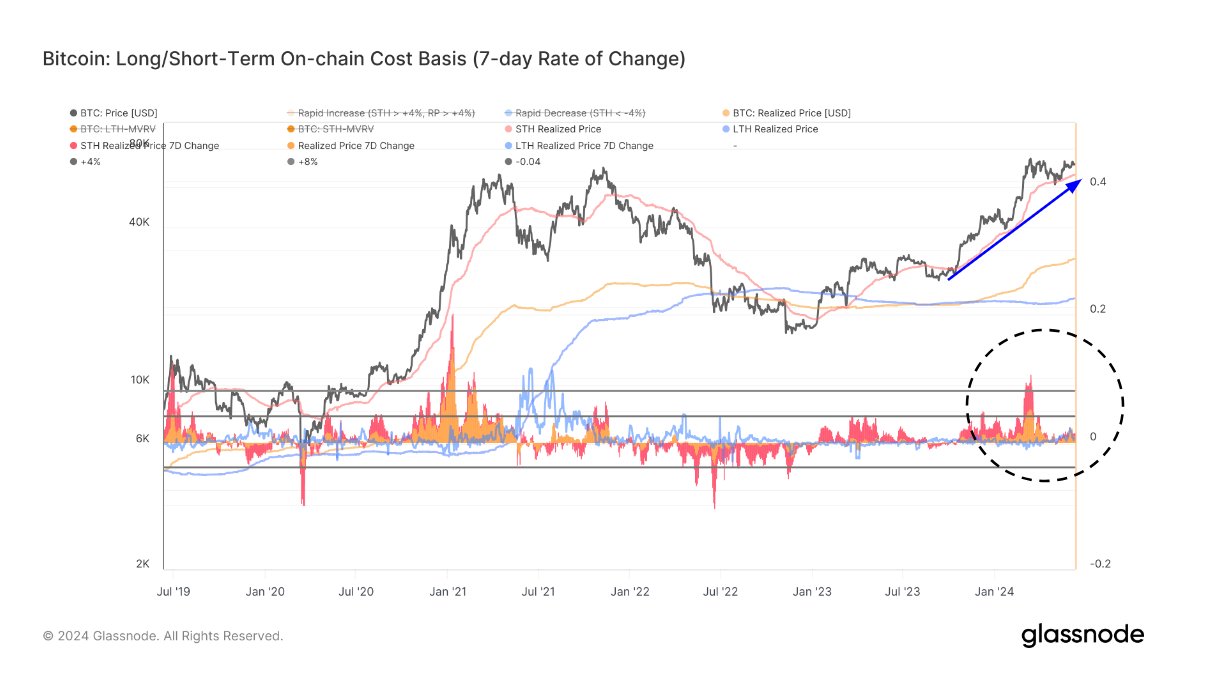

Here is a chart showing the trend in the realized price of the Bitcoin STHs over the past few years:

As shown in the chart above, the Bitcoin STH Realized Price rose rapidly during the rally towards the all-time high price (ATH) earlier this year. This trend obviously makes sense, as the STHs represent the new investors in the market, who would have had to buy at higher prices as assets rose, pushing the cohort average up.

Since BTC’s consolidation phase after the March ATH, the indicator’s uptrend has slowed, but its value is nevertheless increasing. After the latest increase, the statistic has approached $64,000.

What significance does the realized price of the STHs have? Historically, this indicator has taken turns as a key support and resistance line for the cryptocurrency.

During bullish periods, this metric can facilitate bottom formations for the cryptocurrency, keeping it above itself, while bearish trends generally witness the line acting as a barrier that prevents the coin from escaping above. Transitions above this level generally reflect a flip trend for the coin.

This apparent pattern has likely held because the STHs, being relatively inexperienced hands, can be quite reactive. Cost basis is an important level for any investor, but this cohort in particular is more likely to panic if their cost basis is retested.

When market sentiment is bullish, STHs might decide to buy more when the price falls to their average cost basis, believing that the pullback is just a ‘dip’ opportunity. However, in bearish phases, they may respond to such a retest by panic selling instead.

Related reading

The chart shows that Bitcoin found support around this line during the crash in late April/early May, possibly implying that bullish sentiment is still dominant.

With BTC seeing a drop below $67,000 over the past day and the STH Realized Price hitting $64,000, it will be interesting to see how a potential retest would go this time.

BTC price

At the time of writing, Bitcoin is trading around $66,800, down more than 3% in the past week.

Featured image from Dall-E, Glassnode.com, chart from TradingView.com