- Standard Chartered added another 20% to its previous Bitcoin forecast.

- On-chain data showed that BTC was closer to the bottom than the top of the market.

such as Clockwork, Bitcoin [BTC] has been subject to numerous price forecasts, the latest of which comes from Standard Chartered, the leading international financial institution. In a report shared by Reuters on July 10, the bank declared a bullish prediction for Bitcoin, suggesting it could hit $50,000 by the end of 2023.

Read Bitcoins [BTC] Price prediction 2023-2024

However, the bone of contention, which had sparked debate in the crypto community, was the institution’s $120,000 forecast for 2024. Standard Chartered FX analyst Geoff Kendrick said the decision to raise the projection by 20% was due to Bitcoin miner decisions.

BTC is skyrocketing and miners are changing

In defense of his opinion, Kendrick noted that BTC’s recent jump could force miners to hoard more of the Bitcoin supply. Usually, when this happens, the demand for Bitcoin increases, leading to an increase in price.

Also, miners’ earnings will likely only increase through transaction fees, rather than the combination of block rewards and transaction fees. Kendrick, who predicted a $100,000 hit the same year earlier, said:

“Increased miner profitability per BTC (bitcoin) mined means they can sell less while maintaining cash inflows, net BTC supply decreases and BTC prices rise.”

In May, Bitcoin miners recorded a huge increase in fees generated. However, the condition at the time of writing was nowhere near the hike mentioned. And according to Glassnode, miner fees have dropped to 1.66%.

This suggested that mining fees went extinct because the king coin could reach its total supply of 21 million. And when this happens, as Kendrick pointed out, demand would skyrocket and BTC price would skyrocket.

Close to the bottom

Kendrick also said miners’ market approach could change when the price hits $50,000. According to him, if the price reaches the milestone, miners, who recently sold 100% of their new coins, would lower the sales rate.

He said,

“However, if the price hits $50,000, they would probably only sell 20-30%. selling from 328,500 to a range of 65,700-98,550 – a reduction in the net BTC supply of about 250,000 bitcoins per year.”

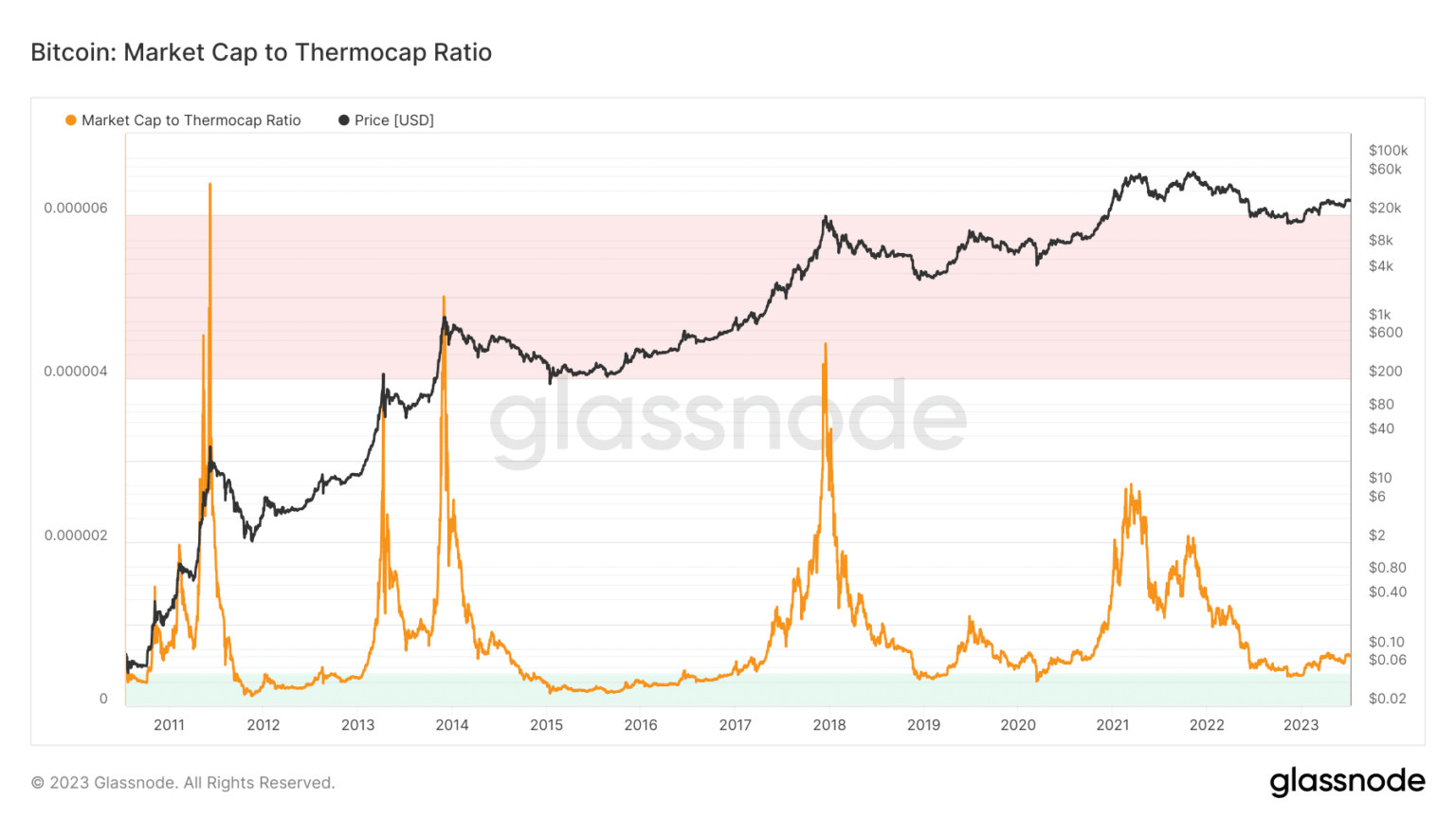

You may need to evaluate the status of a few other metrics. In doing so, one of the go-to metrics is Bitcoin Market cap to Thermocap ratio. Calculated as the ratio of adjusted supply to increasing supply, the Market Cap to Thermocap Ratio shows whether the price of BTC is trading at a premium to miners’ security spending.

At the time of writing, the statistic had risen slightly to 0.00000063. But it was still at a very low point. Historically, a high value of this metric indicates a BTC market peak. So the state at the time of writing is signaling a bottom in the local market.

Of whales the Bitcoin Market Cap to Thermocap Ratio, which is constantly accumulating, shows that the coin still has huge potential to rise. However, this was no guarantee that the $50,000 or $120,000 forecast would be met.

Source: Glassnode

BTC price action

This year, BTC has shown signs of suppressing bear expectations. And on a Year-To-Date (YTD) basis, the coin has gained more than 70%. On the technical side, BTC has been experiencing significant selling pressure lately.

Take for example, when the price reached $30,900 on July 6, several participants took the opportunity to grab a profit. This led to a plunge below $30,000. However, increased demand at $29,992 could neutralize seller dominance and push the price back up.

Moreso, the Awesome Oscillator (AO) had risen to 218.85. This positive reading indicates that the fast moving average was much higher than the slow moving average. So this indicates that the slight downtrend may not dominate for long.

![Bitcoin [BTC] Price action](https://statics.ambcrypto.com/wp-content/uploads/2023/07/BTCUSD_2023-07-11_10-43-59.png)

Source: TradingView

Retail is also getting ready

When analyzing other on-chain data, Santiment showed that the supply distribution has been impressive. This was because whales were not the only ones involved in accumulation. Judging by the address balance of the 0 to 10 retail cohort, accumulation also increased.

Usually, this suggests that market participants consider the $30,000 BTC to be a good buying opportunity. So the wider sentiment was that the coin price probably wouldn’t outperform it.

Source: Sentiment

In addition, the Z-score of market value to realized value (MVRV) was 0.70. Typically, the MVRV Z-Score evaluates whether BTC is undervalued or overvalued. It does this by comparing the market value with the realized value.

When it is significantly higher, and in the red zone, the Z-Score indicates that’s a market top. But at the time of writing, the MVRV Z-Score was only slightly above the green range.

This often suggests a significantly lower market value than realized value. As such, Bitcoin’s value could be considered undervalued and a significant rally could be possible in the long run.

Source: Glassnode

Realistic or not, here it is BTC’s market cap in ETH terms

In conclusion, the likelihood of Bitcoin reaching $120,000 in 2024 or $50,000 in 2023 is something that can be debated. But from the analyzed on-chain data, a rally remains visibly possible. But when exactly it will happen cannot be determined.

Nevertheless, Standard Chartered’s forecast may have some historical support. Aside from the miner action mentioned, the price of BTC usually shoots up after every halving. So this could be a point to look at.